Following our recent Frequent Miler on the Air episode (The amazing 250K offer) and various posts about the latest and greatest Amex Platinum offers, a number of readers asked how Nick and I could get the Platinum card and bonus. Haven’t we each had the card before?

Most Amex welcome bonuses come with the following “lifetime rule” restriction:

Welcome offer not available to applicants who have or have had this Card.

They also throw in this catch-all allowing them to deny the welcome bonus for any reason:

We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

The Amex Popup

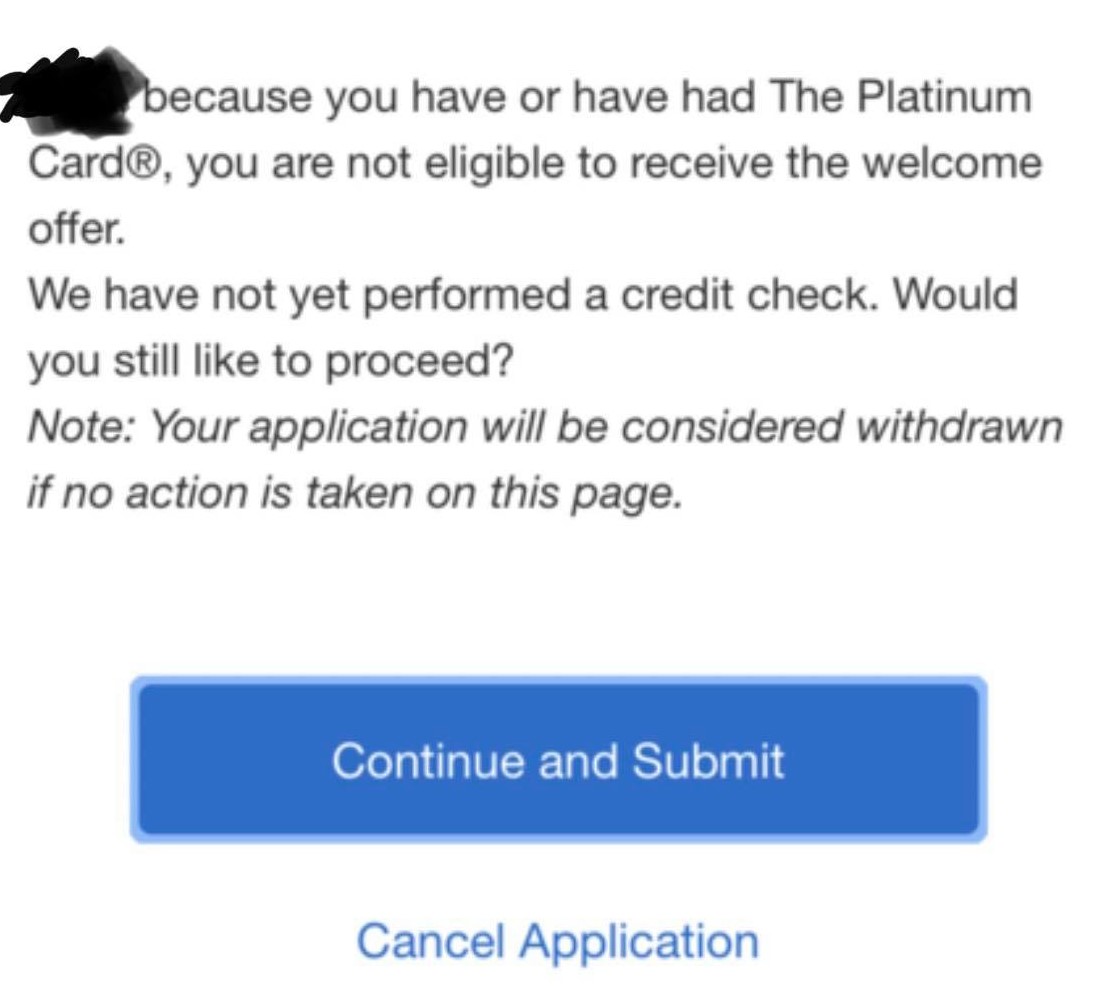

A few years ago, Amex introduced a popup warning box as part of their online card application process. If Amex deems that you are not qualified for the card’s welcome bonus, you are likely to see a popup stating something like this:

Because you have or have had the [card name], your are not eligible to receive this welcome offer.

We have not yet performed a credit check. Would you still like to proceed?

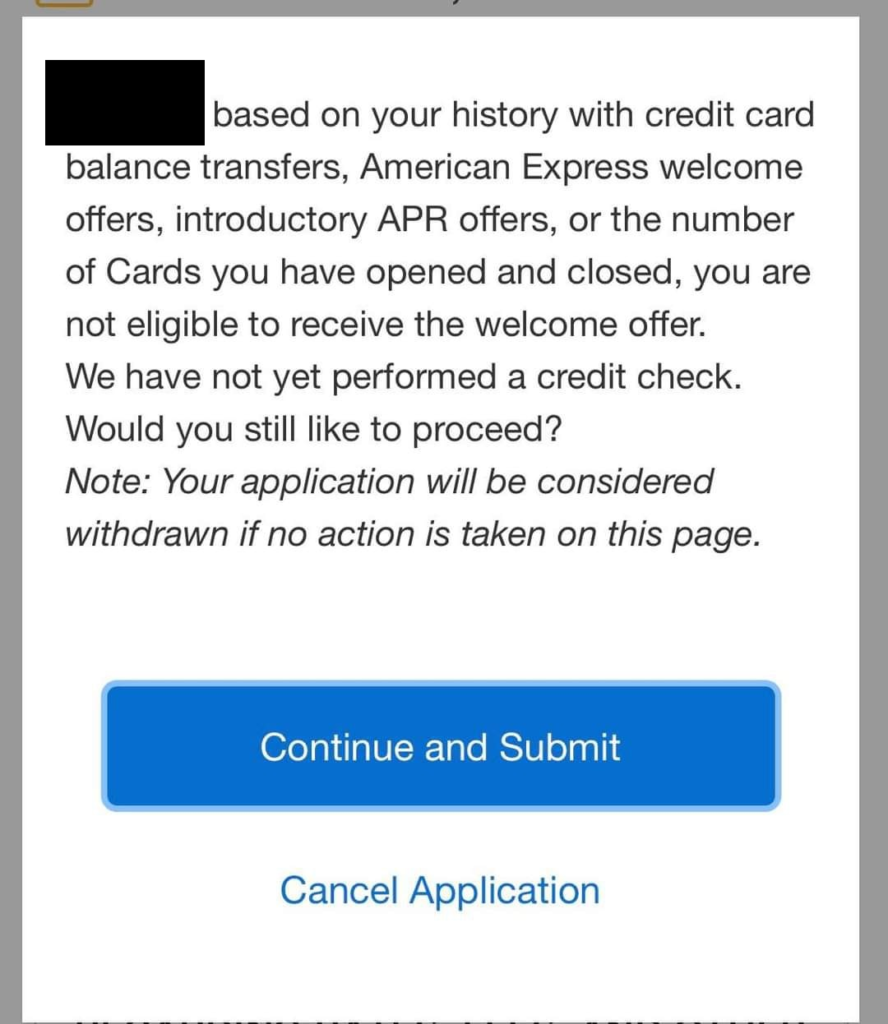

or this:

Based on your history with credit card balance transfers, American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive the welcome offer.

We have not yet performed a credit check. Would you still like to proceed?

If you proceed with the application, you are acknowledging that you want to get the card even though you won’t get a welcome bonus.

While it’s no fun getting a popup telling you that you can’t get in on an offer you want, this is much better than quietly approving your application without telling you that you won’t earn the bonus. The latter is what used to happen pre-popup.

Recently, I’ve seen some evidence that the popup is correct. That is, even if you strongly believe that you should qualify for the welcome bonus, if you blow through the popup you probably won’t receive the bonus.

Less well known is what happens if you don’t get a popup even though you’re technically not eligible for the welcome bonus. I’ve had success with that situation before, but I don’t know if it’s a sure thing. Anyway, I’ll get back to this later in the post…

Nick and Greg’s Platinum Eligibility

In Nick’s case, neither he nor his wife have had the Platinum Card from American Express before. It’s fine if they’ve had other versions of the Platinum card such as the Business Platinum, Morgan Stanley Platinum, or Schwab Platinum. Those are all considered to be separate products (see: Which is the best Amex Platinum card?). So, Nick and his wife are free to try to get one of the incredible Amex Platinum offers that are floating around (125K + 10X, 100K + 10X, etc.).

My situation is different. As I reported previously (See: My plan for maximizing the incredible Amex Platinum offer), my wife and I have had the Platinum Card before:

- Me: Last had card 5 years ago (I signed up for the Platinum card on 4/14/2014 and cancelled it on 5/14/2015).

- My Wife: Last had card 6 years ago (Signed up on 1/8/2013, and cancelled on 3/7/2014)

It’s generally believed that Amex “forgets” that you’ve had a card about 7 years after you cancel it. My wife and I haven’t been Platinum-free for that long, but I thought that there was a good chance that 5 years was long enough. I figured that if I didn’t get the popup warning, I’d be good to go. I applied for the 100K + 10X offer and was approved! No popup appeared.

Still, readers asked whether the lack of a popup proved that I was eligible. I decided that that was a great question. I had no way of answering that question in the broad sense, but I had a straightforward way of answering it for my specific situation. I could meet the terms of the offer to see what happens.

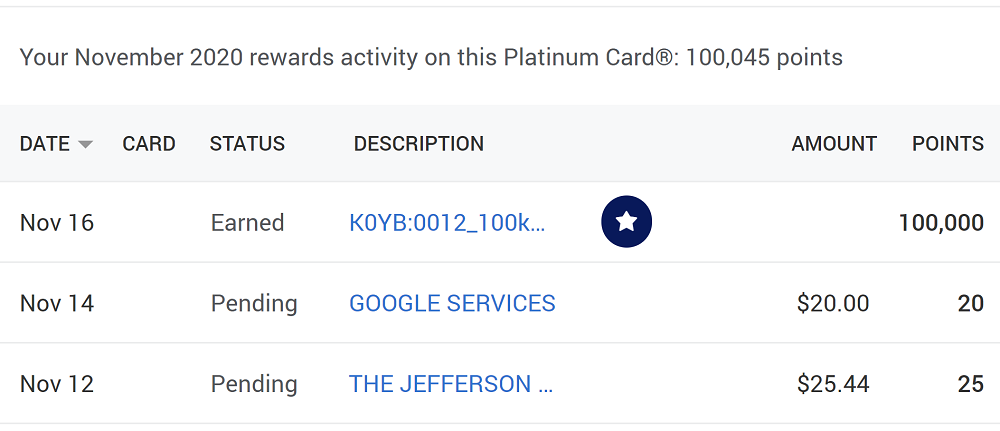

I paid a large bill (over $5K) with my new Platinum card in order to see whether I would earn the 100K bonus. Bingo! As soon as the charge changed from pending to actual, the 100K bonus appeared in my account! Ironically, I haven’t yet earned the standard 1X points from paying the bill, but the welcome offer hit immediately.

This proves that in my unique situation, at least, I was eligible for the bonus even though I had the same card 5 years ago.

Options for Bending the Lifetime Rule

There are two options I know of for getting an Amex welcome bonus even if you’ve had the card before: 1) Wait several years and then hope you don’t get a popup; or 2) Use an offer that has no lifetime language (sometimes you’ll see this referred to as “NLL”).

Wait several years and then hope you don’t get a popup

There has long been the belief that if you wait 7 years after closing or product changing away from a card, you’ll be eligible for a new welcome bonus. We now have some evidence that waiting 7 years isn’t necessary since I earned a bonus just 5 years later. We don’t know the shortest option, though. Is two years enough? Three? Four?

One approach is to simply give it a try. If you don’t see the popup warning, then go ahead an apply. If you do see the popup, then abort the application. We don’t have proof that you’ll be eligible for the welcome bonus without the popup, but we at least have some evidence that it’s possible.

If you get approved for the offer that includes 10X earnings at grocery stores and gas stations, a simple way of determining if your new card qualified for the offer is to make a small purchase at a US grocery or gas station. You should then see an extra 9 points per dollar credited to your account. I don’t know why I didn’t think of that approach before rushing to spend $5,000 :).

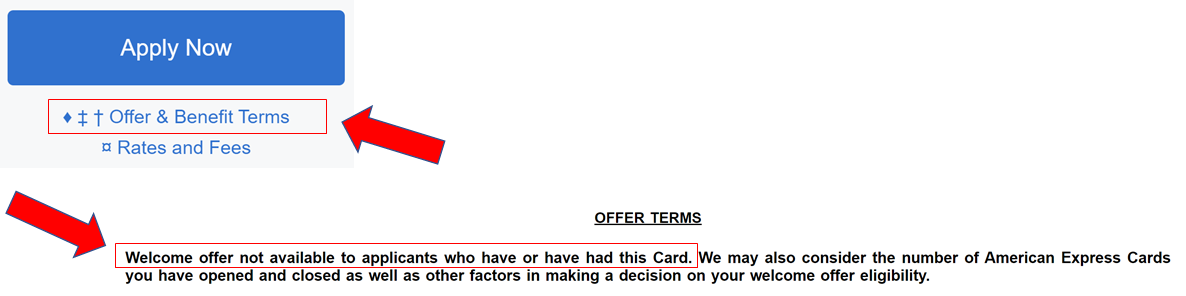

Use an offer that has no lifetime language

Some offers don’t include the no lifetime language. Usually this happens only with targeted offers such as those that you get in physical mailers, but occasionally you’ll see this with targeted online offers as well. When viewing online, click the link to see “Offer & Benefit Terms”. If the Offer Terms section doesn’t say something like “offer not available to applicants who have or have had this Card” then you’ve found one with No Lifetime Language.

Warning: Do not use a No Lifetime Language offer if it wasn’t meant for you. Amex has been known to shut down accounts and take away points from those who have abused such offers. I also recommend against doing this repeatedly even if the offer is meant for you. Amex doesn’t like people to repeatedly sign up for cards just for the welcome offer. If you do this repeatedly with the same card, it will be pretty obvious what you’re up to.

I have an open vanilla Amex Platinum (which Amex converted from a TD Ameritrade card) that I’ve had for about three years now.

Figured what the heck and applied for a second Platinum fully expecting to get a pop-up, but there was none.

Now to test the waters with some gas/grocery purchases to see if the 10x comes through.

Have there been data-points in the last year of bonuses being denied when no pop-up appears?

Cool. No, I haven’t heard of anyone not getting the bonus. Make sure to read this post to see how to know if you’re getting 10X: https://frequentmiler.com/yes-your-new-platinum-card-is-earning-10x-where-appropriate/

Thanks for the reply Greg!

Hopefully this is Amex karma to balance out the wife who has been in pop-up jail for the last two years.

Hey Greg, love your content and great articles! Any DPs on getting back in Amex good graces after Chapter 7 bankruptcy? P2 and I filed Chapter 7 about 15 years ago. Bankruptcy has fallen off both our reports. Both have high income and high credit scores. Between the two of us, we opened 12 cards last year. Obviously, hitting Chase pretty hard. We both applied for an Amex card. Our denial letter read, “we cannot approve your application because Amex cancelled your previous account”. Any insights/strategies/DPs? Are we locked out of Amex forever? Would we have any better luck applying for Amex business cards?

Sincerely,

Membership Rewards = 0

Ouch, that’s too bad. No, I don’t know of any datapoints that can help you. There must be a way back in, but I don’t know it.

Will rat team claw back points for gc’s purchased at supermarkets?????

They will might do so, especially if you exclusively buy gift cards. My guess is that if you mix in a gift card now and then with real grocery purchases that will be OK.

@Greg, when you applied for this current Plat offer did it contain the “Welcome offer not available to applicants who have or have had this card” language? Or NLL?

Yes

My 2nd statement posted a couple of days ago. I am well past the minimum spend requirement for the 100,000 points SUB, but my bonus has not posted. This is my first AmEx Platinum, so no problem with lifetime language. Any idea why it would not be posted yet?

Have you paid your statement balance? Amex seems to be going through a period of being unusually slow to post rewards and credits. This seems to happen every year. I wouldn’t worry. It will post eventually.

Thanks, Greg. It actually posted the next day after asking.

Dang it. Did not apply before due to I had it. Reread bending the rules, so decided to try….got the dreaded popup…..

DP: have had & cancelled both Green and Platinum very recently (2018-2019). Applied for both offers (100K and 45K MR) in November and both were approved with no pop up.

JT J – Did you get the bonus?

Yes – got the bonus pts on the Green. Haven’t spent enough on the Platinum yet but I do get 10X on grocery and gas, which is part of the welcome bonus.

I got my last platinum bonus in early 2014. tried to applied again today and got approved without popup. on the contrary my wife got popup even she never had this card before. she is in amex popup wall since long so I was kinda expecting it.

[…] Frequent Miler and the rest of the folks on BoardingArea already covered the deal, but the offer for most is only available to people opening the offer incognito. If you are having trouble getting the offer, I thought I would offer a direct link to it through my referral link. Yes I do get a referral bonus of 30,000 bonus points if you sign up, but I can only earn it twice a year. […]

What if you downgrade your card. Later, Amex offers you an upgrade offer, so you upgrade back to your original card. Then, you downgrade or cancel your card again. From which point does the “5 year” counter start?

I’d assume that it starts from the last date at which you downgraded, but who knows in practice

[…] Bending Amex’s Lifetime Rule […]

[…] interesting finding, maybe the “lifetime” is 5 years? Bending Amex’s Lifetime Rule. I tried numerous times to get the 125k offer to come up to apply for son without success. Oh well, […]

If you us a NLL offer you will most likely still get the pop up, no?

I did not get the pop-up and was approved a couple days ago for the 100K + 10X offer. I had the card before and canceled about 4 years ago. Is it advisable to online chat with an AMEX rep to confirm you will get the bonus? $5,000 is a fairly high spend amount for me – but doable.

I think a better approach is to make a purchase at a gas station and/or grocery and wait a few days to a week to see if the purchase earned 9X bonus points (1X regular points + 9X bonus)

Great idea! I was worried that chating with an agent would trigger more scrutiny on the bonus history.

Okay. P2 cancelled her personal platinum in 2018, but started an application 10 days ago for the 100K 10X platinum, did not get a pop-up, applied, and was instantly approved. She has received the card, spent on groceries, and today sees that she has gotten only 1X for those purchases. So now what to do? Is chatting going to help? She assumes trying to cancel the card now is not an option. Any other avenues of possible relief?

Thanks for any ideas.

RSD1952

The +9 doesn’t show up in-place. Have you checked P2’s membership rewards transactions?

Greg –

Thanks! The extra 9x have been added to P2’s account overnight. Sorry to have not waited longer before I bothered you with this.

And thanks for the great podcast – it’s what I do every Saturday morning before P2 gets up.

-RSD

I got the Platinum in mid November, no popup when I applied. I have been getting the 10x on gas and groceries, but I finished spending the $5K two weeks ago and no 100K bonus so far. Doesn’t look good.

@Joe, any updates? I am in that situation, too. Previously had a personal Platinum, closed > 5.5 years prior to applying for this offer in mid November. No pop-up, completed the spend requirement about 10 days ago. The 10x on gas and groceries have been posting like clockwork since November, but no 100k bonus yet.

Update: the bonus posted yesterday, about 2 weeks after meeting the spend requirement.

I guess I should deactivate the popup blocker before applying for my next Amex card.

No, you’ll get it despite the blocker b/c of the way they coded the website. I did and I am religious about blockers (ad and popup) plus I use Brave to minimize even more ads and related nonsense.