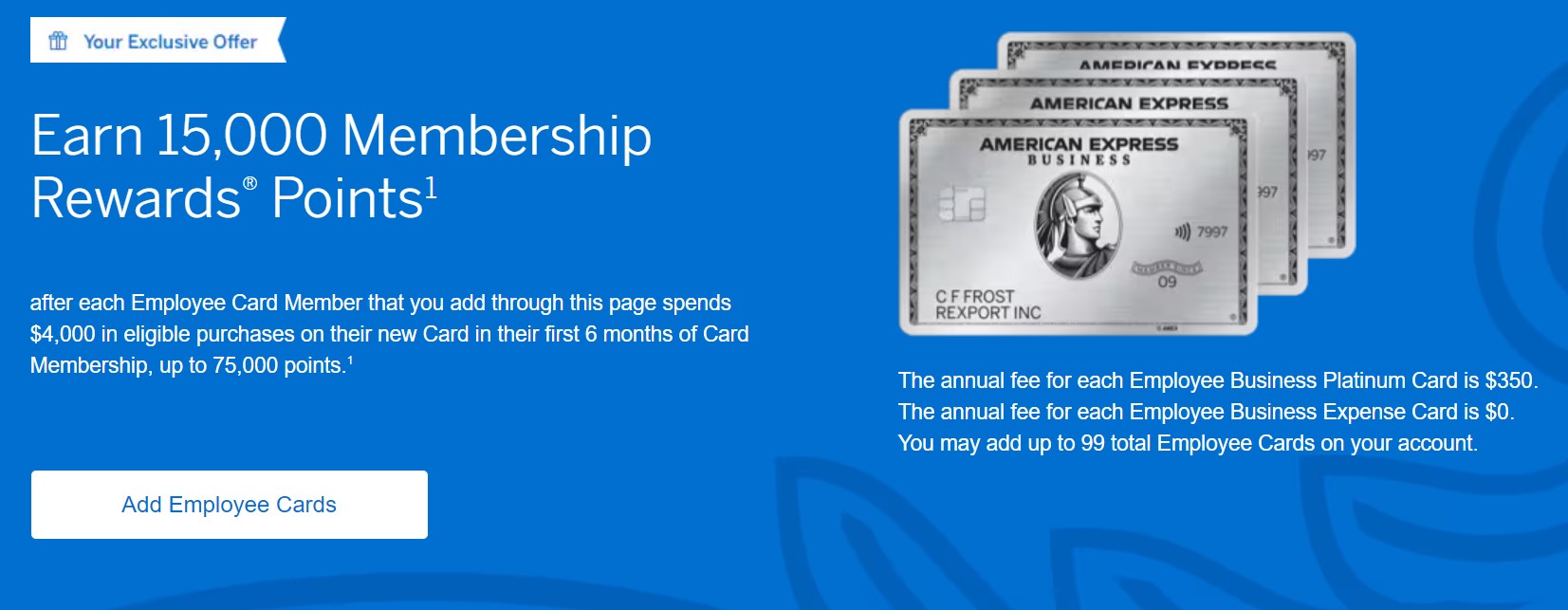

American Express has brought back another promotion for adding employee/authorized user cards to Business Green, Business Gold and Business Platinum accounts: 15,000 Membership Rewards points after $4K in purchases in the first 6 months on each employee card (up to 75,000 bonus points total).

This promo comes and goes periodically, with a new round of folks targeted every few months or so.

Employee card offers have come and gone over the last couple of years in various permutations, but this offer matches the best that we’ve seen. It’s worth noting that even folks with new business cards can add employee cards and the spend on those employee cards will count as minimum spend towards the welcome offer…effectively allowing for a double dip.

The Deal

- Get 15,000 Membership Rewards points after $4K spend in the first 6 months for each employee card added to a Business Platinum, Business Gold or Blue Business Plus card from American Express (up to 5 employee cards or 75,000 bonus points max)

- Promotion is targeted (see links below to find out if your card is targeted and to register)

Direct Link to Offer (Business Platinum cardholders)

Direct Link to Offer (Business Gold cardholders)

Direct Link to Offer (Business Green cardholders)

You must log-in to find out if you’re targeted. If the offer then shows as expired when you try to add cards or you get the following screen, it’s no soup for you:

Terms and Conditions

- The maximum points you can earn through this offer is 75,000 Membership Rewards® points.

- Employee Card Members can be added at different times but must be added by 8/26/2025 at 11:59 ET to be eligible for this offer.

- Purchases made by other Employee Card Members on your Account will not count toward an Employee Card Member’s Threshold Amount.

- Purchases made by eligible Employee Card Members will not be combined to satisfy the Threshold Amount. Your purchases as the Basic Card Member will not count toward an Employee Card Member’s Threshold Amount.

- Eligible purchases do NOT include fees or interest charges, purchases of traveler’s checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments or purchases of other cash equivalents. Your Card Account must not be past due or canceled at the time of fulfillment of any offers.

Quick Thoughts

The terms indicate that you can only get the bonus for the first five additional cardholders you add and spend $4K (we’ve seen offers in the past where the bonus is extended to up to 99 authorized user cards). This is a great deal, but it’s especially useful when meeting minimum spend on a new card.

Let’s say that you sign-up for a Business Gold card with the referral bonus of 200,000 Membership Rewards points after $15K in spend (this is what’s listed on our best offers page). Instead of spending directly on the card, you could add four authorized user cards (I’d actually go ahead and do five, but just for sake of argument let’s say four). The spend on those authorized user cards will count towards the $15K minimum spend. After meeting the $4k on each card you’d end up with 216K from the Gold (200K from the welcome offer and 16k points from the $16,000 in spend). You’d also get the 15K bonus on each of the four employee cards for an additional 60k total. All told, you’d have 276,000 Membership Rewards after $16,000 in spend. Wowza.

In the past, Amex has been fairly loosey-goosey about what it allows for authorized users and whether or not they make any attempt to verify that it is an actual person…there’s some pretty crazy stories out there. Of course, your mileage (and your tolerance for that sort of thing) may vary.

Is it maximum 75k per account or each card type, ie 75k for biz gold, 75k for biz platinum etc.

Does the AU on the Business Gold get their own top two 4X categories? I’d like to have four 4X categories between the two cards.

I have been targeted in the past and was targeted again recently for 15k MR / $4k spend on my BBP and 7kMR / $4 spend on my Biz Platinum but this time it seems the interface for the offers only allows me to take the offer on the specific card rather than being able to choose other cards (such as my Biz Gold card).

Be careful. When I did this last year and added 5 AUs 5 months later (after receiving the main card SUB), it went smooothly and I received my additional 75K bonus spend pts. However, when I went to cancel the card after my annual fees posted (within 30 days cancellation grace period), the retention rep warned me that if I canceled my main card prior to the 1 year receiving said bonus AU spend pts, Amex has the right to take away all those points and shut down my cards and withhold my amex pts I have accumilated due to “If Amex determine if you are gaming the system..” policy. Amex inserted that fine print when you agree to the AU spend bonus. The Rep was cordial about it and I decided it was not worth canceling my card until at least that 1 year period from when I I accepted the AU bonus pts. This is how Amex use this strategy to hold on to the user until after annual fees are past the 30 days charge posting.

Does this make the AU ineligble in the future for getting a SUB on their own amex biz card?

No, employee cards and AU cards don’t have bearing on bonus earning at Chase and Amex. I don’t want to speak to other banks that I’m not sure about. Personal AU cards do count towards your 5/24 status. I’ve seen DPs of Chase manually removing them, but I wouldn’t count on it.

One could theoretically meet $9.9K of spend with the Global entry credit ĺot applies to each employee card – this could be great for those with large extended families (my DW she has 8 siblings)

You need a SSN for each card correct?

Yes, so I don’t know about the loosey-goosey part

Yes, but since they are employee cards, not AU cards, they don’t mess with your personal credit report or your Chase 5/24. So you can just use your own name and SSN for all of them without issue.

thank you

Not when you first submit the request. You just need a name. It says you do need to provide more information within 60 days of receiving the card.

Does it have to be the AU cards with the annual fee or can it be the free ones?

Free ones work.

DP:

I got many immediate family and myself AU cards for multiple accounts over multiple years but for the last 3/4 months every application is turned down and recon/customer service tells me only ONE AU card per person per account is now being enforced.

Getting 40 AU cards in my name for a long closed Biz Plat might have set something off, but Customer Service assured me in advance that that was explicitly allowed at the time.

30 plus year history with Amex, btw

No dice across three Biz cards. I have a lesser offer of 7000 points for $4K spend on the Biz Platinum in my AMEX Offers tab. Not too keen on that since the return won’t be high enough to justify moving spend from a 3X or 4X category on another card.

I upgraded my AMEX Biz Gold to AMEX biz Platinum last week (thanks Nick for the heads up!), just activated my card today. How long does it take to show up in the list of eligible cards? I only see my 2 existing BBP, not my old AMEX Biz Gold or my new AMEX Biz Plat.

I will give it a day or 2 to see if the new AMEX Biz Plat shows up in the drop down list of eligible cards.

I have been in this situation for a few months – my biz plats show in the drop down, but the biz gold that I’ve had for almost 3 months does not

AMEX requires a legitimate social security to add an AU – looks to me they don’t allow fictitious AU’s?! AMEX also specifies on my offer that the points can only be earned by adding an AU/AF card, not the business/no AF card.

With needing a social security number to activate the card how do you approach family and friends to get the socials?

If I signed up for a sole prop with 1 employee (me) can I still take advantage of this offer?

As long as you’re targeted, for sure.

How can you tell you’re targeted? I see the 15k after clicking the link above. After it asks me to log in, I don’t see it anymore. Also, can I make a $4k tax payment on an employee card and have that count for my Biz Gold SUB?

My offer states there’s a 95 annual fee for the first 5 employee cards and 95 each additional card. Is that what you have as well?