| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

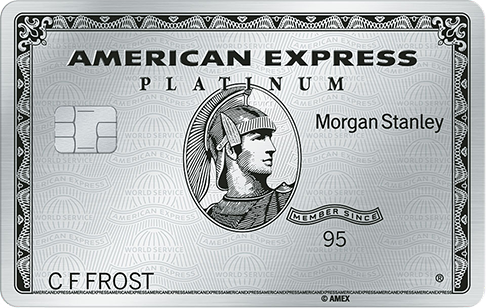

We’ve seen some incredible Platinum card offers over the past couple of years, but it isn’t often that we’ve seen the offer on either the Charles Schwab or Morgan Stanley co-branded Platinum cards eclipse the “standard” offer on the “vanilla” Amex Platinum card. That’s now the case again as the welcome offer on the Morgan Stanley Platinum card has been significantly increased to 125,000 points after $6,000 spend within the first three months. Apart from the offers Amex ran a couple of years ago that included additional points for dining or small business spend, this is the best that we’ve ever seen for this card.

The Morgan Stanley Blue Cash Preferred also has an increased (but much less attractive) welcome offer of $350 back in statement credits after $3k spend.

The Offer & Key Card Details

| Card Offer and Details |

|---|

80K points ⓘ Non-Affiliate 80kK after $6K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K points after 6k spend [Expired 11/8/23] FM Mini Review: In my opinion, this is the best of the consumer Amex Platinum cards when you need two cards thanks to Morgan Stanley offering one free authorized user. Unfortunately you do need to have a Morgan Stanley account to apply. Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X prepaid hotels booked with American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $500 after $100K cardmember year spend Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ 1 Free Authorized User ✦ Redeem points for 1 cent each into your Morgage Stanley account ✦ $695 Annual Engagement Bonus for Platinum CashPlus accounts See also: Amex Platinum Guide |

Quick Thoughts

The “standard” offer on the vanilla Platinum card has been 80K points after $8K in purchases within the first 3 months for some time now. It’s great to see the Morgan Stanley version again offering more.

Amex recently adopted “family” language for their Platinum cards, excluding folks who’ve already had any version of the card from receiving a welcome offer on the Schwab or regular Platinum. However, as of now, the Morgan Stanley card is the one Platinum card that’s unchanged, meaning that you can still get a welcome offer even if you have (or have had) the “vanilla” or the Schwab Platinum cards. Even some people who’ve previously had the Morgan Stanley Platinum and cancelled have reported luck getting another one.

The Morgan Stanley card is also the only Platinum card that offers one “full” authorized user (who receives perks like Centurion Lounge access and Delta SkyClub access when flying Delta) for free. Furthermore, it’s also possible to get an annual relationship bonus that helps mitigate the annual fee.

Note that you must have an investment relationship with Morgan Stanley in order to be approved for this card. Discretionary/Non-discretionary Advisory, Self-Directed Brokerage and AAA accounts are all fine.

Would opening a CD work?

https://www.morganstanley.com/what-we-do/wealth-management/cd-savings

Anyway I can open some sort of Morgan Stanley account by the day’s end and be eligible for this card to sign up by tonight?

Is there enough time to do so?

This is NLL offer!!! I already had one and applied again and was approved 😀

I’m not sure if this is mentioned below, but after you receive the card, you do not have to leave funds to avoid the monthly fee of $55. MS covers the af every year and you pay it back at $55/month = $660. So MS actually pays you $35 to keep the card. And, you can get a au card for free with all the same benefits. Such a deal!

I misspoke. You still have to pay the annual fee but with the annual bonus the net cost is $660.

But the annual bonus is taxed…

Just fyi, if you call in and try to set up a new account with Morgan Stanley, they will try to do a bait and switch on you.

I called in and told them I was interested in opening a Premier Cash Plus account.

The sales guy said it would require $2500 in deposits AND a balance of $25,000 to avoid fees.

I told him that the terms on the MS website said it was $2500 in deposits OR a balance of $10,000.

He said “this branch requires a balance of $25,000”

I asked him “what branch am I speaking to?”

He said “the virtual branch.”

I told him I wouldn’t be interested since the terms he was giving me were different from what was on the Morgan Stanley website.

Be careful.

I might be seeing this wrong, but it looks like they may be lowering the amount required to park funds: “Effective on or about October 9, 2023 the average daily BDP balance requirement for Premier CashPlus Brokerage accounts is changing from $25,000 to $10,000” see note 7 on pg 40: https://www.morganstanley.com/wealth/relationshipwithms/pdfs/important_account_information.pdf

If true might make it a bit more palatable to get the MS Plat

Do I have this correct? To get this card and get my annual fee refunded in the second year, I will have to get a Morgan Stanley account that costs $55 per month AND pay the $695 annual fee. After the first year, I will just have to pay the $55 per month Morgan Stanley fee which saves a slight bit of money, but I need a Morgan Stanley account to have this card anyway. (I know there are ways to make the account fee free, but they aren’t worth it over just having $25k in a high yield saving account.)

Thank to the FM team, I opened an Access Investing account in December right before that door was shut. I had been eyeing getting the MS platinum (and closing the Vanilla Platinum I opened during the 150K + 10X bonanza). Watched the offer drop from 100K to 80K to 60K, and then got nervous when the Platinum family language appeared in the Schwab and Vanilla platinum applications, that that ship may have sailed. So super happy to see the 125K offer without Platinum family language…jumped on it on Saturday and my card should be here tomorrow.

Long term I’ll probably cancel the Vanilla, though I’ve done very well with maxing out referrals the last two years, so that might be reason enough to keep double the Platinums, especially now that they raised the annual referral cap to 100K.

What is this about an AAA account? I don’t know if i’ve seen that referenced before. I’ve heard of the access investing and CashPlus, but what about AAA?

Am I correct in thinking that if I have never had the personal platinum card and signed up for the Morgan Stanly platinum I would no longer be able to earn a welcome bonus on the personal?

Yes, that’s correct. However, if you go in the reverse order (personal, then MS), you can get both.

Did I miss this already? Clicking on the link takes me only to a page with the more standard 80K offer …

It’s still there. Try clearing your cache or using a different browser.

I can’t get this offer to load no matter what. Tried different browsers, cleared cache, incognito.

All I get is the 80k offer.

what balance do you need in a AAA account? I have an account that was for college but I’ve emptied it now.

In case anyone was wondering, you can’t open a Morgan Stanley account apply for the card and then close the account, “American Express may cancel your Card Account and participation in this program, if you do not maintain an Eligible Morgan Stanley brokerage Account.”

P2 and I both have Personal Platinum cards that we opened in 2011. If we cancel both, can we get this (or the 150k referral) personal card? Do we have to wait for any period of time?

I don’t think you need to cancel the Personal plat to be eligible for the MS bonus.

Does anyone have a link to open a qualified account with morgan stanley? Been googling and going through their website but no idea how to open an account lol.

Same here

A CashPlus account will work but requires a $15 monthly fee. https://www.morganstanley.com/what-we-do/wealth-management/cashplus

How do you open a cashplus account? Do you need to call in?

If it is your first account, yes. You must call in and speak with the virtual account assistance team.

Did u open premier cash plus and got the MS Platinum after that? Did you confirm via chat that u will get 125k SUB? Just wanting to make sure we can get MS plat with premier cash plus and no need of opening platinum cash plus