The precious metal (credit card) market is hitting a boiling point, and I think it is time to exit some of my positions.

For years, my favorite credit card issuer has been American Express. While Amex is not without its faults, they have consistently offered high introductory bonuses, high referral bonuses, high spending category bonuses, and high (enough) retention and upgrade bonuses that have collectively kept me fully engaged. However, my Amex card portfolio has gotten outrageously expensive. Amex is finally pricing me out on some of my cards. As such, I am planning to downsize considerably, and in this post, I wanted to share my strategy as it relates to downsizing, which doesn’t necessarily mean cancelling (immediately).

Amex Bonvoy Brilliant downgraded

I took the first step on this path earlier this month, and this was a long time coming. At the end of 2025, I was just 38 nights short of Marriott Lifetime Platinum status. As soon as the elite nights posted this year from my Amex Bonvoy Brilliant and Amex Bonvoy Business cards, I reached Lifetime Platinum with Marriott. I no longer need to chase my “free breakfast” status with Marriott. That’s awesome.

The only thing that made me happier than getting off the Marriott hamster wheel was downgrading my Bonvoy Brilliant card. I used my monthly dining benefit right away at the beginning of the month. Then, by mid-month, I pulled up Amex chat and asked to downgrade to the $95 Bonvoy Amex card. That card is no longer available to new applicants, but it still exists (for what it’s worth, the $95 Bonvoy Amex card offers an annual 35K Free Night Certificate, which I consider a solid deal for $95).

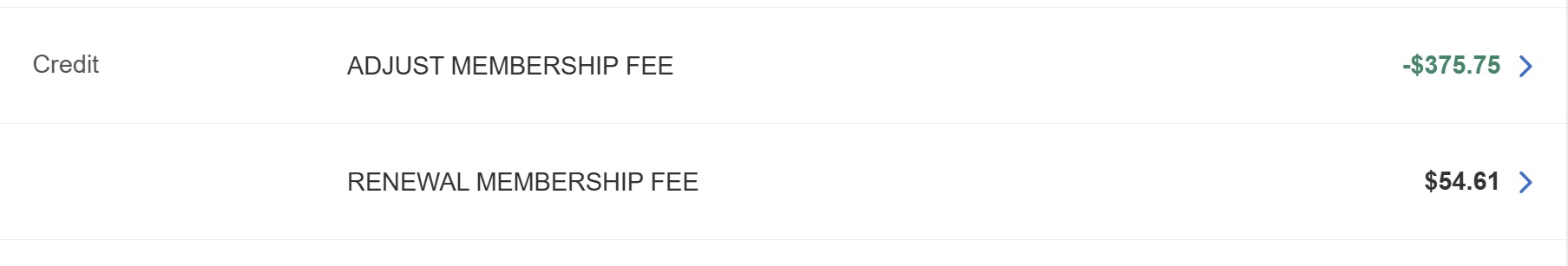

The reason for downgrading rather than cancelling is that my anniversary date is in August. If I cancelled now, I wouldn’t get anything back; I would be out the entire $650 annual fee. However, by product changing, I got an automatic statement credit for ~7/12 of the Bonvoy Brilliant’s annual fee (a refund of $375.75) and was charged $54.61 (7/12 of the $95 annual fee on the Bonvoy Amex). I was excited to get that back and be done with this very expensive card.

Next downgrades: The Business American Express Platinum Cards®

My wife and I have a few Business Platinum cards between us, thanks to a few years of Amex offering cardholders the opportunity to expand their membership with additional cards.

We were the beneficiaries of good timing in that the new Platinum card benefits launched in September 2025, and we had several Business Platinum cards renew at the $695 price point while still getting access to the new benefits (like the twice-annual $300 Fine Hotels + Resorts® / Hotel Collection credits that can be earned once between January and June and once between July and December). Since the card has those credits each year, plus the airline incidental credits, the quarterly $50 Hilton credits, and up to $150 in credits for qualifying Dell purchases, I figured that we’d keep all of our Business Platinum cards for another year under that old annual fee and cancel at next renewal, when we would be faced with the new $895 annual fee.

However, I did the math and realized that keeping these cards for a full year just didn’t make much sense. I’ve already used the airline incidental credits for 2026, and I realized that I could use the January to June FHR credits, the credit for up to $150 in Dell purchases, and the first-quarter Hilton credits right away, also. That’s a total of $700 in credits that can be used right at the beginning of the year. Again, that’s:

- Up to $200 airline incidental credit for your chosen airline (used in January)

- Up to $300 in statement credits for Fine Hotels + Resorts® / Hotel Collection bookings from January to June

- Up to $150 in statement credits for qualifying Dell purchases

- Up to $50 in statement credits for Hilton purchases

I have used or will soon use all of those credits. If I then downgraded these cards, I would get back ~$400 to $500 on each one (it varies by anniversary date and downgrade date) and get charged ~$70 of the Business Green card’s annual fee (again, depending on exact timing of each) for a net refund of somewhere between ~$330-$420 on each card. If I instead kept these cards for the full year, I wouldn’t see that net refund, and in exchange for letting Amex keep that $330 to $430, I would receive the July-December $300 FHR credit and 2 or 3 more $50 Hilton quarterly credits. That’s not a very good trade.

Thanks to being able to unlock $650 in benefits early in the year, I’ll gladly let our existing Business Platinum cards go very soon and be happy with the net refunds. While I find the consumer Platinum cards compelling even after the refresh, the Business Platinum card has just gotten too expensive to keep, and the upside of downgrading is that I’ll end up getting quite a bit of money refunded over a few cards.

Are the Gold cards the next to melt?

For years, my wife and I have held an Amex Gold card (we’ve actually both had one over the past couple of years, which really isn’t necessary). I’ve long regretted having cancelled my Citi Prestige card years ago (I’m jealous of the fact that Greg earns 5x dining on that card!), so I’ve held firm to the Gold card’s 4x dining and U.S. Supermarkets (on up to $25K in eligible purchases, then 1x). I’ve run the numbers and kept it based on math in the past, but I’ve finally decided that it just won’t be worth keeping a Gold card any longer.

With the increased annual fee on the Gold card — now $325 since late 2024 — and coupons that I don’t need, Amex has finally priced me out. With the Bilt Obsidian set to offer 3x and an even more valuable set of transfer partners (including programs like Hyatt and Alaska that I value more highly than many Amex partners) for just a $95 annual fee, the time has arrived for me to chop our Gold cards.

To be clear, despite all of the (deserved) blowback that Bilt has received recently, I’m still bullish on the Obsidian card. Forget about mortgage or rent, I’m just looking at it as a 3x grocery card (we will select the grocery option). I doubt I’ll use the hotel coupons, and I don’t imagine that we’re going to worry about paying mortgage or rent at all with the Obsidian. I’ll just be happy to have my wife hold on to that card and use it at the grocery store. She’ll probably use the $200 Bilt Cash from the welcome bonus to buy the newly-announced point accelerator and be happy with 4x grocery and 3x travel for the first $5,000 in purchases that she makes in those categories. Then, I anticipate that I’ll probably use future-earned Bilt Cash on this card to unlock further point accelerators, just to keep things simple. We’ll probably be able to earn 4x on our annual grocery spend for the $95 annual fee without any of the mental gymnastics of using the Gold card’s coupons. She can transfer to Hyatt or Alaska, and then we can combine points for free on that end (Hyatt allows one free points transfer in or out of your account every 30 days; both of us have Hawaiian credit cards that enable free transfers of Alaska Atmos points, and we’ll keep at least one of those cards).

Both of our Gold cards will go. My main questions are whether to downgrade or outright cancel, and when? Trutfully, I should have more carefully considered this at the time of renewal because the consumer Green card’s annual fee creates less upside in a downgrade.

My wife’s Gold card renewed at the end of October, so if she downgraded to a Green card now, I would expect her to get back ~$189.50 (about 7/12 of the Gold Card’s $325 annual fee) and be charged about $87.50 (7/12 of the Green card’s $150 annual fee). That makes for a net refund of just over $100 (give or take, depending on the exact timing).

If she instead kept the card until next renewal, during the months between February and October, she could earn or use $90 in monthly Uber credits, $90 in monthly dining credits, $63 in Dunkin credits, and another $50 in Resy credits for the second half of the year. For her, the choice is to downgrade and end up with a net $100 in her pocket or keep the card until renewal and end up with $293 in credits. I bet we’ll miss on a couple of those credits, but even if we “only” got $200 of the credits, that still seems like it is probably enough of a deal over the $100 we could get back by downgrading.

Since my renewal is in July, I’d only get about $135 back, and I would have to pay about $62.50 for the Green card (assuming I downgrade in early February, which would be my likely plan). That’s a net refund of just over $70. If I keep the card until renewal in July instead, I could get the July $50 Resy credit and also 5 more months of $10 Uber credits, $10 monthly dining credits, and $7 monthly Dunkin credits. Keeping the card would cost me the chance for a net $70 refund, but in exchange, I would end up with $185 in credits.

Or, taken on the whole, my wife and I could downgrade now/soon and end up with about $170 in net annual fee refunds or keep the cards and end up with up to $478 in credits. That’s enough to keep the Gold cards until next renewal. Then we’ll cancel.

Truthfully, the mistake here was in renewing at all. While the card comes with more in credits than the cost of its annual fee, I don’t like having to think about the credits each month. But, at this point, given that the difference in cost between the Gold card and the only downgrade option (the Green card) isn’t very much, it makes more sense to keep the Gold cards to renewal. But I won’t keep them beyond that.

What about consumer Platinum cards?

The biggest question mark for us is what to do about our consumer Platinum cards.

As you’ll hear Greg and I discuss on this weekend’s podcast, we both find it very easy to justify the first Platinum card’s new $895 annual fee. In exchange for that, we get:

- Up to $600 per year in statement credits for prepaid FHR/Hotel Collection bookings

- Up to $400 per year in Resy credits ($100 per quarter)

- Up to $200 per year in airline incidental benefits

- Up to $200 per year in Uber credits (broken up in monthly increments)

- Up to $300 per year in statement credits for lululemon purchases ($75 per quarter)

- Centurion Lounge access

- Escape Lounge and Plaza Premium lounge access for cardholder + 2 guests

- Some elite statuses

- Up to $209 in CLEAR membership fee reimbursement

- Various other small stuff (including 10 Delta SkyClub passes, though we fly Delta so rarely that those don’t matter to us)

To be clear, I don’t value any of the above at face value, and I hate the coupon craze overall, but it cumulatively hits far more than $900 for me for the first card. And since we frequently travel as a family of four, having two Platinum cards has been very convenient for Escape Lounges. I could add my wife as a Platinum-level authorized user if that were all that really mattered to me, but rather than pay $195 for an authorized user card, we can pay $895 and get all of the rest for a second time (including the CLEAR reimbursement). While Greg found the numbers a little bit harder to justify for the second Platinum card, I find the first two pretty easy keepers given the current benefits.

After that, subsequent consumer Platinum cards don’t help us with more lounge access, CLEAR credit, or included elite status. I’m on the fence about additional Platinum cards. Even if we assume that I’ll only use the FHR/Hotel Collection credit once and that I only value that one use at $200, I think they are close. If it were possible to “buy” the Platinum card’s coupon credits, I think I would conservatively pay:

- $200 for the FHR/Hotel collection credits

- $250 for the Resy credits

- $150 for the airline fee credits

- $100 for the Uber credits

- $150 for the lululemon credits

At those prices, I would feel like there is still substantial upside room. The total above comes to $850. While that’s $45 short of the annual fee on the card, it is close enough that I might consider keeping a third consumer Platinum (my wife and I currently both have the Schwab Platinum and a plain vanilla consumer Platinum). I’m being pretty conservative on the prices I’d be willing to pay for those coupon credits, and I think there is a good chance that I’ll probably either use both FHR/Hotel Collection credits or end up getting more value out of the other benefits to put me over the edge on keeping a third Platinum. We’ll see. I definitely do not feel the same pressure to downgrade or cancel on the consumer side, though I do find the annual fees to be eye-watering.

Bottom line

After recently downgrading my Bonvoy Brilliant card, it is time to melt down some Platinum and Gold in my household, with our Business Platinum and consumer Gold cards heading for the exits. The Amex points parade has slowed a bit, but the real story is that Amex has simply priced me out. I admit that I was a bit surprised when I realized that the Business Platinum cards didn’t even pencil out to keep until next renewal, but I am glad to rid myself of some of the coupon craze while putting a few bucks back in my pocket.

I am planning to cancel my Business Platinum as well but concerned about AMEX clawing back the bonus points. Card was opened 12/2024 and renewal fee posted in Jan.2026. Do you think they will claw back my bonus points? Points posted in April 2025.

Thanks for this post and your most recent podcast – I’ve been inspired to prune my Amex Platinum collection. I do have a timing question. If I downgrade from a Platinum to a Green to obtain the prorated annual fee, how long do I then need to retain the Green to avoid a clawback of the annual fee adjustment? In other words, do I just need to retain the Green until the next annual fee posts (which may vary dramatically, depending on when I downgrade during my cardmember year) or do I need to keep the Green open for a full year after the downgrade?

I can’t really for the life of me imagine walking away from Amex gold for bilt obsidian. Other than the different transfer partners, there’s no upside.

I’m far happier with the idea of $95 and no need to mess with monthly coupons (apart from turning on the points accelerators) than $325 and monthly and semi-annual coupons that I have to try to use. And with the accelerators, it’s the same 4x on up to $25K so long as I remember to activate them, which seems like far less hassle to me than remembering to use 3 different monthly coupons and two semi-annual ones.

If I lived in an area where I was always using Uber eats and GrubHub and Dunkin, it might be closer, but I don’t, so the main upside is that I don’t have to make sure I use monthly coupons to avoid coming out far behind. As it stands, I don’t really need a monthly $10 Five guys gift card and I would almost never stop at Dunkin’ if not for the monthly credit, so it just doesn’t make sense to me to prepay for those things and lock myself into using them monthly versus $95 for the same rate of return for grocery. To be clear, I would be sacrificing on dining, but I have enough cards I’m going to keep anyway that offer 3x on dining that the marginal benefit of 4x dining is not worth the coupons for me.

But as it stands, Bilt has transfer partners I like better and eliminates some of my coupon fatigue. The fact that I spent more than 2 cumulative months of last year outside the United States, and an entire month abroad the previous year, where I just wasn’t able to use the monthly Gold card credits, really exacerbates the coupon problem for me. There are times when I simply can’t use those coupons, and then there are times when it requires more effort then I’m willing to put into it unless I’m getting significantly more value than the cost. For me, the Gold card doesn’t provide that anymore.

Again, I fully recognize that there are situations where my feelings would be different. I would feel very differently if I lived in a city where I was using Uber eats and GrubHub weekly and where there was a Dunkin in my office building, but that’s not my situation.

How about the CapitalOne Savor card? I know C1 cards are sometimes hard to get. Took me a couple years. But so much relieve to finally able to drop the Gold and I get groceries points abroad without foreign fee.

I downsized from 9 to 4 total Amex card. Plat will be my next victim at the end of the year, unless there is a big ret offer.

I am wondering why downgrading from business plat to green instead of blue? The benefits are almost the same between these two cards but blue is a no fee card.

Thanks for breaking this all down. I have an Amex Gold consumer card with AF coming due, and a decision to make on which Bilt card to transfer to. Most likely I will get the Bilt Obsidian and cancel Amex Gold.

I also am a newly minted Marriott LTP so don’t need Brilliant Plat status/EQNs anymore. Knowing this was about to happen this year, I had previously called AMEX about a retention offer, and they offered up a 50k FNC with $1.5k spend in 3 months! First time that has EVER happened, but don’t underestimate the power of retention offers in your decisions, either. AMEX had dismal/no spend offers on their cards last quarter 2025 but their retention offers were pretty great for our family.

planning to cancel my Amex BusPlat in a few days after a couple of years (No realistic retention). While I “can make it profitable” the effort is not worth it right now. I’ll keep my Brilliant (Nowhere near lifetime Plat. Only 2 years. Lifetime Gold – 2 more years) and Aspire, and other Amex Marriotts.

Think I will get the Green card soon and just skip the coupon thing.

Do you worry about getting in Amex pop-up prison by canceling your gold cards and/or excess business platinum cards? I’m in a similar situation where I have amassed quite a collection of high fee Amex cards via NLL offers and renewals are starting to come due. I’m initially thinking I’ll play the retention offer / downgrade and hope for an upgrade offer game but I really would like to avoid pop-up prison and I’m worried outright canceling will get me in there.

No one knows how pop-up jail works. No reason to keep paying Amex annual fee $.

What’s everyone’s obsession with downgrading cards?

I’m right there with you on the Bonvoy Brilliant not really making sense anymore. 85k FNC is nice but it’s harder and harder to use, I use the $25/month credit but it’s a pain. $650/year and I have to put work into extracting what I’d call $800 of value.

But when the next renewal comes around I’m just going to cancel. Why would I downgrade to paying $95 a year for a certificate that’s going to be a pain to use? If the stars align I just put a bunch of work into doubling my $95 over the course of a year.

Getting the prorated refund is the point. I used the $25 monthly credit 5 times and the 85K cert and got a net ~$320 back, effectively paying about $330 for that 85K cert + $125 in dining credits. Keeping the card to next anniversary would have meant no refund (essentially a $330 cost) for 7 months of $25 credits. I like 85K certs, but we have 3 Ritz cards, which are a far better deal.

Downgrading doesn’t lock me into keeping the $95 card, it just locked in the net $320 refund.

That said, I certainly may keep the downgraded card. I would put absolutely zero effort into using a 35K cert to far better value than $95 – I have plenty of one night stay situations where hotels are $200-$300 but can be booked with a 35K cert. I kept wishing I had more of them last year. At the very least, they come in very handy for a JFK airport hotel the night before a flight. Cash rates there often climb over $400 for the properties closest to the airport, and I’ve used 35K certs. I wouldn’t have to try at all to get good value out of it.

To be clear, that doesn’t mean that it should matter to you or that you should be able to use them more easily. Maybe they just don’t fit your needs. Everybody’s situation will naturally be different, so it shouldn’t be a surprise that your own needs might differ from the next person’s.

Ah I see what you’re saying. Two things I learned:

1. Prorated refunds available for downgrades only

2. If you’ve already received a 85k cert you can keep it even if you downgrade midyear

This is great info, I’ll join you in downgrading and analyzing the $95 card next anniversary!

In addition to the proration of the annual fee for downgrades, Amex is pretty generous with upgrade offers. Tim has spoken about downgrading seven or so Platinum cards and then getting upgrade offers on all of them within six months. It’s a way to keep the points parade going of you’re out of new cards to apply for.

I’m going to be a nervous nelly and ask this — what if Bilt 2.0 goes the way of Mesa? So many folks signing up, getting excited abt 2.0

Take the SUB and cash out $ while you can. Nothing to be nervous about.

Given Ankur’s quick Bilt 2.0 maybe you and the other bloggers should NOT be going for the new cards and see if there is a BACO (Bilt Always Chickens Out) trade to be had here?

I was looking at doing exactly the same thing with my Amex Business Platinum so thanks for reminding me.

Just a curiosity what did you buy in January from Dell – the pickings are *$(% poor.

What would be the advantage anyway of renewing a third personal platinum even if the coupons cover the fee? I get having 2 for lounge access etc for a couple (I do that), but unless your kid is old enough to have their own credit card for lounge access, I’m missing something. We have a third personal card for the SUB, but absent a compelling reason, I was not going to renew it.

Idk, I can pretty organically use the Amex Gold card coupon book, BUT I’m just drowning in Amex points to the point I don’t think I can get much transfer value out of them reliably. Maybe 1.4 cpp consistently, for flights I’d have otherwise bought?

Anyways it’s to the point I’m just trying to offload to cashback. Aven is 6% on groceries for $10k, the BOA CCRs will do $10k a year on restaurants…

“Amex has priced me out” No, you priced yourself out grabbing a half dozen high fee cards with all their associated coupons.