NOTICE: This post references card features that have changed, expired, or are not currently available

Last year, I put a renewed focus on bank account bonuses. In my case, that was both a function of spending more time at home than I had in the past decade and also because I realized I had been leaving easy wins on the table. Still, I surprised myself at how lucrative those bonuses became: by year’s end, my wife and I had banked $4,680 in bank account bonuses. We don’t expect 2021 to be quite as lucrative, but neither will we sleep on bank account bonuses. We’re still not traveling at this point and aren’t sure when we’ll be ready to do so, but we intend to make up for lost time when that day comes. Raking in some easy wins now will take the sting out of things like award taxes and fees and other expenses when the time comes or put us in good position to buy miles or points on sale to get outsized value when we travel.

$1525 that should be on the way

In my post about the bonuses we earned last year, I noted that we still had $1525 on the way set to post in 2021 (note that I updated that from the original since our bonuses from First Tech posted after we followed up with the name and email address of the person who referred us). In early January, my $400 PNC Checking account bonus posted to that account, kicking off our 2021 bonuses. Update: Since publishing this post, the $500 Bank of America business checking bonus has posted as well.

We’re still waiting on a $225 bonus from Merrill Edge that should have posted about 3 months ago and Merrill hasn’t responded to emails or secure messages about it much to my disappointment. I’ll continue to pursue this because we met the requirements correctly, but I have to say that I’m awfully disappointed in customer service on this one. For the most part, I don’t need much customer service for a self-directed brokerage account. However, I’m disappointed not to get any.

I’m still expecting $400 from P2’s Santander account. I expect those bonuses will likely post as expected and in the near future. With the PNC bonus, that will bring us to $1300 in 2021 even without the bonus Merrill Edge owes us, which surely isn’t a bad way to kick off the year (and I do expect to eventually get that $225 from Merrill Edge!).

A 2021 roadmap: A plan to add $2100 or more

Here are the bonuses I have in mind to go after in 2021:

PNC Virtual Performance Checking (P2): $400 bonus

The bonus here requires $5,000 in direct deposits within 60 days of account opening. I had opened this account for myself last year and the bonus posted about a month after meeting the direct deposit requirement. In my case, I met the requirement through an ACH transfer (sending some of that money back out within a couple of days to meet a requirement elsewhere; see Doctor of Credit’s resource for what works). I expect this to be an easy $400 win for P2 as well and since this is scheduled to end on 2/1/21, this account is on our immediate to-do list. The PNC account has an early termination fee of $25 if closed within the first 6 months, so we’ll plan to keep this around through at least the end of June. PNC has a pretty smooth app interface, but this account has some shortcomings (you can only transfer out $2K per day), so I don’t imagine we’ll keep this for much longer than necessary.

Note that the $400 bonus requires a PNC branch in your state. If you don’t live in a state with a branch, you’ll only get a $200 bonus.

TD Bank Beyond Checking (P1 + P2): $300 each = $600 total

The TD Bank Beyond checking account requires direct deposits of $2500 or more within 60 days to get the $300 bonus. More of a pain is that it requires either an average daily balance of $2500 or $5K in monthly direct deposits to keep it fee-free. We currently have $20K of savings tied up in the Bank of America business checking account bonus. Once I receive the bonus from Bank of America, we’ll open these TD accounts and “direct deposit” $2500 each and just leave the money there for the required six months ($5K between the two of us) to keep it fee-free. Note that this offer is also regional. Assuming we get on this soon, we would be free to close these accounts in July or August.

Citibank account package (P2): $400

Citi is currently offering a bonus of only $300 when you open a checking and savings account and deposit $15K within 30 days and leave the money for at least 60 days. In the past, we’ve seen the ability to get $400 from this combination. I could have sworn we saw a $600 offer last year, but I can’t find confirmation of that offer, so I’m listing it at $400 because we will wait around for at least that much of a bonus to pop up to open this account and tie up the money.

Bank of America business checking (P2): $500

I am waiting for the $500 to post from the Bank of America business checking account offer. I had found that offer targeted to me within my online login. I hope to see my wife get targeted for this during the latter half of this year. If not, she might take a swing at applying for it anyway, but I’ll hope to see it pop up in her account. With any luck, we’ll get the Citibank account package above (which has no early termination fee) within the first or second quarter of this year and then find this offer around Q3 so that we will be able to close the TD Bank accounts to use the money tied up there and in the Citi account above to trigger a $500 bonus with Bank of America. That’s counting on threading the needle a bit, though we have several months of wiggle room.

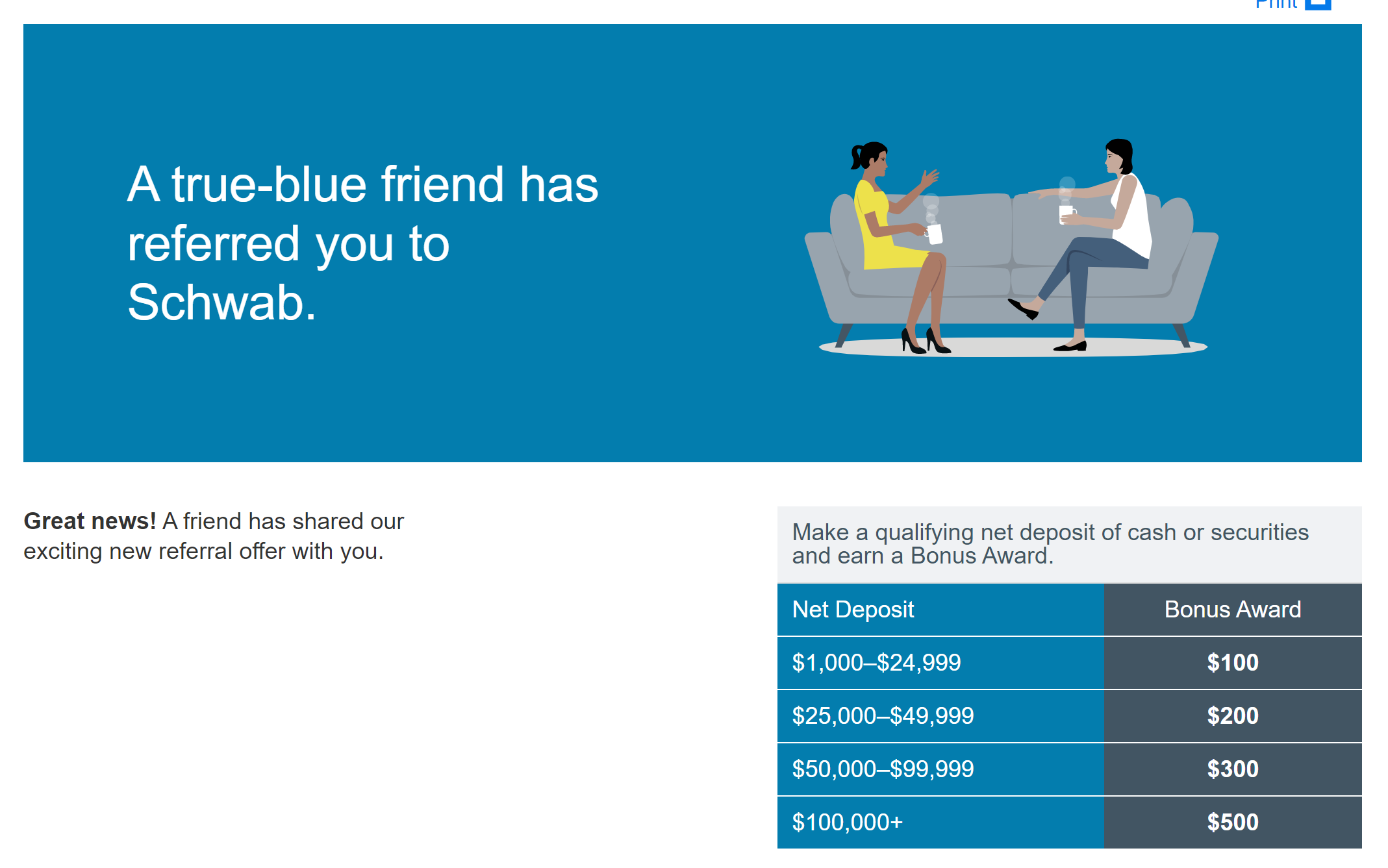

Schwab investor checking (P1 and P2): $100 bonus each = $200 total

The Schwab checking account has long been a must-have for travelers because of the fact that the debit card refunds all ATM fees (even internationally) and charges no foreign transaction fees. I am grandfathered in to the same sort of deal with SoFi Money, but ever since they started limiting that for new accounts I’ve been waiting for the other shoe to drop. I know I can count on Schwab long term, so it is long overdue for us to get these accounts. We’ll just put $1K each in the account for the $100 bonus and add to it when we’re going to travel and need ATM access. I am partly interesting in getting this open to create a relationship in case the day comes where we’d like the Schwab Platinum card to cash out Membership Rewards points at a value of 1.25c each.

Possible bonus: PNC Business checking $400 offer

This last one is a bonus play if the stars align, but not a definite: PNC has in the past offered a business checking account with a $400 bonus when you deposit $10K and leave it for 3 statement cycles. At the moment, the offer is $200 for depositing $5K and leaving it for 3 statement cycles (and doing 20 debit card transactions per month). If the stars align and the $400 offer comes around at the right time, I’ll jump on it (possibly for both of us if our money isn’t tied up in one of the other bonuses above and/or possibly in place of the Citi offer), but I don’t know how often they bump this one up. They are currently offering a $500 bonus that requires $30K on deposit, but that’s not in the cards with our other bonus plans. Note that I am not counting this offer in my 2021 roadmap total above or totals below because I’m just not as confident that we’ll make this one happen.

Bottom line

The road map above should be pretty do-able by shuffling around savings each month and it will sure beat the return in a savings account given current interest rates. Note that several of the accounts require direct deposits, but I’ve noted before that Doctor of Credit maintains an excellent resource about what works. In most cases, we’ll meet direct deposit requirements just by shuffling the same money from place to place before paying the bills with it at the end of the month. Some of the bonuses above require money on deposit for some time, but thankfully we have emergency savings socked away. Rather than leaving that money in an account out of sight and out of mind, we’ll put that money to work for us by taking advantage of new account bonuses being offered. Together with the $1525 that we expect to post this year for accounts opened last year, we hope to follow the plan to earn a total of $3825 in checking/savings account bonuses in 2021 (not counting that last PNC account bonus above). That won’t be quite as lucrative a year as 2020, but it’s still a great windfall for a little bookkeeping effort. With any luck, we’ll see something totally unexpected pop up like that NorthOne bonus last year that put $600 in our pockets with only a $50 deposit each (long since expired) so that we can juice that a bit more. I won’t stop collecting points any time soon, but I’m glad to use this time when I’m not preoccupied with award searching and booking to bring in some extra savings to cover the award taxes and fees and other travel expenses when we inevitably make up for lost time.

Nick, Capital one $400 bonus deposited for P1&P2 in 2/22. Acct opened early December. Cha-Ching. Ty FM and DoC.

Glad to hear it!

Hi Nick, great article. Are you aware of anyone ever getting their credit card accounts shutdown for regularly churning checking/saving accounts bonuses at the same bank? I am mostly concerned about Chase or Citi, where bank bonuses can be churned every 1-2 yrs, but curious about any other banks as well. Thanks!

Does the Schwab account have a maintenance fee? And/Or a requirement to waive it?

OMG, hilarious…kind of a PITA. I finally got the PNC Virtual Wallet Performance Select checking set up and added a couple external accounts to ACH transfer money in. Once I did I tried to send $5K and it wouldn’t allow me, so I changed it to $2K…ok, so good so far, THEN to confirm, system asked me to verify my license plate on a car I owned 11 years ago!! Who knows this!? (Literally like 4-5 cars back), so I couldnt answer and it then locked my account to transfers. Had to call and speak to 3 reps to lift the hold. Now find out you can ONLY ACH TRANSFER MAX 2K/day from any or multiple accounts. So, according to the PNC rep I have to go back 3 difft days and make transfers. Not sure this $400 worth it…but trying to stay patient…ugh. Keep you posted, LOL. Making ACH from BOA…according to DOC and Reddit, qualifies for $5K deposit…hope this is the case. Thx. Nick

P2 and I already started $3,400 worth of bonuses to be earned in the first half of 2021 with just three accounts each: $700 for Citi Priority ($50k required for 3 months), Citi Personal Wealth Management ($50k required for 3 months and can be IRAs) and E*Trade $500 ($100k required for 6 months). The latter two are brokerage bonuses that are easy to do with an ACATS transfer of existing assets from another brokerage.

[…] bonuses. Having said that, if you can keep meticulous records this can be profitable, for example: Bank Account Bonus Goals for 2021. For a resources for this type of bonuses, check here: Best Bank Account Bonuses for January […]

I saw on a financial site that one brokerage states that it can take 270 days for the bonus to post and your account still has to be active. I would skip those.

I’ve done a couple lately. Marcus gave me $100 for $10K. Since I already had an account with Marcus and the money available that was simple transfer from bank to bank. $100 isn’t much (1% of $10K) but that is more than you can get in interest.

I created an account at Schwab for another bonus. Eventually Schwab will be taking over my TD accounts so this was fairly easy as well.

I am also doing a Cap One bonus.

In most cases I either screw up something and miss or get a reduced bonus or I lose interest.

I guess if bonuses get to $500 or more it gets some interest by me depending on the rules. I sure am not planning to more a lot of stocks around just to chase small $$$.

Couple of notes Nick-

Beware of wanting Merrill customer service. I signed up with a public offer that I saw on DOC. When I called them about a question about depositing my money, the rep told me the offer was a targeted offer, which meant I didn’t qualify. There was no such language in the T&C. He then proceeded to offer me the same deal but with double the length of leaving my money there (6 months v a year). I’m very unhappy with such “service”, but think there is a chance that he doesn’t know what he’s talking about, and that I’ll get the bonus after 6 months. If it’s the alternative, I’ll actively dissuade people from signing up with Merrill because of such practices. Any thoughts on whether I’d get the bonus as the original offer stated?

Nick— Merrill bonuses take 180 days to post from the date that you meet the requirement, and in my experience, the bonus will post around day 180-185. So if it hasn’t been that long, I would wait it out.

The current increased offer says 180 days. The offer under which we signed up was 90 days. We signed up for three total accounts and got the bonus on two of them after the 90 or so days.

Nick you’ve created a monster here. Ever since my very first recent HSBC $600 bonus, I’m hooked. I’m in line for $500 from Chase for checking and savings, and have my eye on $400 from Santander and another $300 for Chase business checking. I’m now off to investigate the ones still available in this article.

Just FYI there are way more than what Nick posted. Go to doctor of credit for main source on these bonuses

What is a P1 and a P2?

Player 1 and Player 2. Sorry for using confusing shorthand.

Is this worth it if you have to pay taxes on it?

If your boss offered to pay you an extra three or four thousand dollars this year to work for an extra hour each month, would you say no because you’ll be taxed on your income?

I don’t know about you, but I can’t remember the last time I turned down a raise because I’d have to pay tax on the extra income.

Short answer: Yes. Without question.

Definetly makes sense. Ive just been noticing all these tax forms coming in the mail and second guessing if it is worth it.

Got $500 on the Citi bonus w/15k in 2019, posted 2/2020. Not $600, but not $400 🙂

So I might not be totally crazy. Thanks for the confirmation!

once you are done with getting an account bonus and want to close out the account, can you transfer out the money online to another account and close the account online or do you have to go into a bank to do this?

You can do it online easily, basically for any bank.