NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

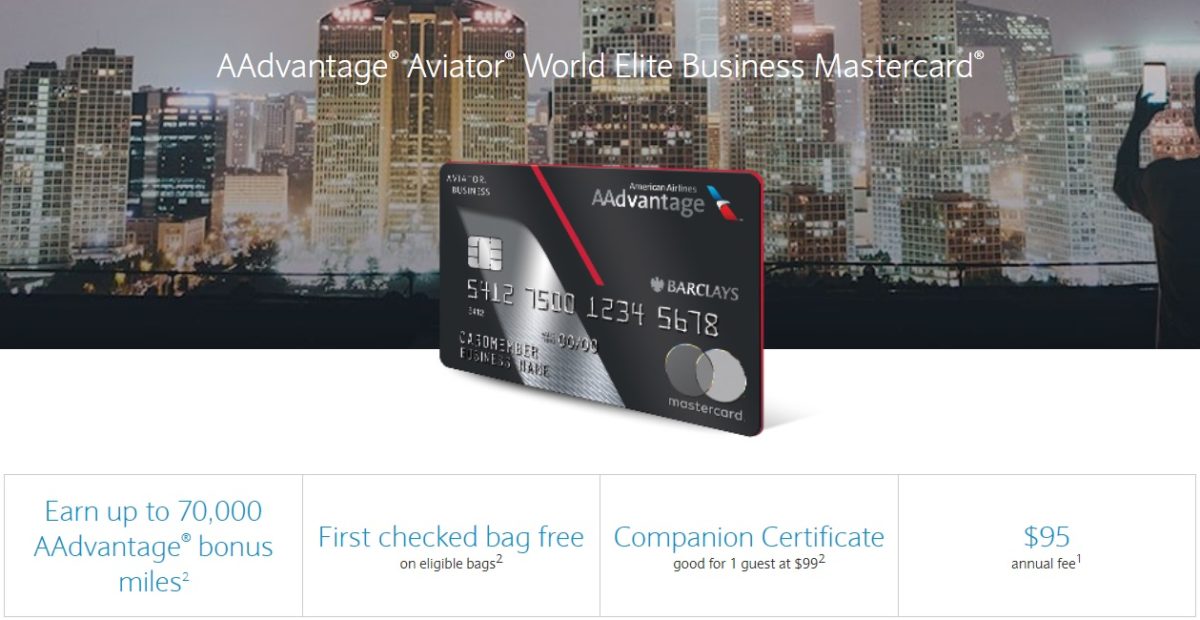

The AAdvantage Aviator Business Mastercard disappeared a few weeks or months ago from the Barclays website. It returned yesterday with a welcome offer that’s not an all-time high, but is still a fairly strong offer.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $-95 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 2/6/23: 80K miles + a $95 statement credit after $2K spend in first 90 days. Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

Quick Thoughts

If you didn’t take AAdvantage of the Conservation International offer towards the end of last year and could do with boosting your American Airlines mileage balance, the return of this Business credit card could be a good way to do that.

The welcome offer has two elements to it. The bulk of the miles – 60,000 of them – are earned by spending $1,000 in the first 90 days of being a cardholder – a fairly easy spending requirement as things go. The other 10,000 bonus miles are earned by adding an employee card and having a purchase made on that card.

The card comes with a number of perks including a Companion Certificate where a guest can fly with you for $99 + taxes and fees, although you have to put $30,000 of spend on the card within your cardholder year in order to earn that certificate.

Remember that only base spending on an American Airlines credit card earns Loyalty Points in their new elite status program. That means that if you were to spend exactly $1,000 in order to earn the 60,000 bonus miles, you’d only earn 1,000 Loyalty Points, not 61,000 of them.

If you’re not concerned about your 5/24 status, applying for the personal Aviator Red card could be a better option. That card also offers 60,000 bonus miles as its welcome offer (albeit without the opportunity to earn the other 10,000 bonus miles for adding an employee card), but the personal card has its annual fee waived for the first year and you only need to make one purchase on the card in order to earn the bonus miles.

[…] 2022.3 Replace: This card is alive once more. The present provide is 70k. HT: FM. […]

[…] 2022.3 Update: This card is alive again. The current offer is 70k. HT: FM. […]

[…] 2022.3 Update: This card is alive again. The current offer is 70k. HT: FM. […]

I opened the Citi business advantage platinum on 4-2019. can I open the non business card and still get the bonus this month and then on 4-2023 open another Citi business and still get the bonus. Could I also open the Barclay and get that bonus? It’s not clear – can you please explain. thank you kindly!

Yes, you can open the personal card now even though you opened the business version in April 2019.

When it comes to opening another business AAdvantage card, you’ll likely have to wait a little longer. The rules state that you can’t earn another bonus if you’ve earned a bonus on that card in the last 48 months. Although you got the card in April 2019, if you didn’t complete the minimum spend requirement until 1-3 months later, you’d need to wait until that date before you’d be able to earn another bonus.

As for Barclays, you can get one of their cards as that’s completely separate to Citi.

This is a dream bank for AA points. This card worked All over the EU no hassles like 6 years ago WAY ahead of the others.On my 4th personal card spent $2 to get 60K then cancel in 11 months True Love it is.

Never been turned down by this bank as in very loyal to my 812 Fico.

Great card IF u like AA and FM makes no profit I think.This will be next card easy to do.

Recon #?

Thank you for your recent application. We’re in the process of reviewing the information you provided for your AAdvantage Aviator World Elite Business Mastercard application.

Please keep in mind it may take up to 10 business days to process your application. There is no need to reapply. Please feel free to check back as this page will display the most recent status updates.

[…] 2022.3 Update: This card is alive again. The current offer is 70k. HT: FM. […]

[…] 【2022.3 更新】此卡复活了!新的开卡奖励是70k。HT: FM. […]

Thoughts about whether relaunching this produce means Barclays will “forget” if you’ve had this card in the past? P2 was denied for a second one last year (closed first one a year before) although my app was approved after having card previously.

No idea, but I suspect it’s effectively a continuation of the old card rather than being regarded as a completely brand new product and so it’ll likely be harder to get approved if you’ve had the card before.

Is the SUB once in a lifetime?

I don’t think they have a hard and fast rule regarding these cards. If you’ve had it in the past it might be possible to get it, but they might also say no because you’ve had it before. The application process involves them shaking a magic 8 ball behind the scenes, so hopefully you get lucky if you apply.

T&C from Barclays’ site:

Bonus AAdvantage® Miles

You will receive 60,000 bonus AAdvantage® miles after spending $1,000 on Net Purchases within the first 90 days of your Account open date. This one-time bonus AAdvantage® miles offer is valid for new accounts only. Existing accounts, and previous cardmembers with accounts closed in the past 24 months may not be eligible for this offer.

So 24+ months IF u got any bonus from them,personal or Bus.Will they tell u before u apply the Heads Up is ???

Good Job

DoC has mentioned this point multiple times and I’ve seen it discussed a lot online…if you’re approved for the card, you will generally get the bonus. Not guaranteed obviously, but I personally have gotten the bonus on both personal and biz after having the cards previously.

How does Barclays feel about having more than one of these? Do you know of any data points?

The application page says it’s for new cardholders only, so if you currently have the card I doubt they’ll approve you for a new one.

I had Personal & Bus at same time .BUT Good luck.