Now that Bilt has “fixed” its overly complicated Bilt 2.0 rewards program by introducing a slightly less complex option (see details here), I decided to take a quick look at which option is better. The answer? It’s complicated.

Option 1 vs. 2

As a reminder, at the time of this writing, Bilt is planning to offer two options for Bilt 2.0 cardholders to earn points from housing payments (rent or mortgage):

- Option 1:

- Cards do not earn Bilt Cash from spend

- Housing payments earn points based on your everyday spend as a % of monthly rent/mortgage:

- <25%: Earn 250 points

- 25%: Earn 0.5x points

- 50%: Earn 0.75x points

- 75%: Earn 1x points

- 100%: Earn 1.25x points

- Option 2:

- Cards earn points + 4% back in Bilt Cash

- Bilt Cash unlocks points on housing payments

- Every $3 of Bilt Cash unlocks 100 Bilt points

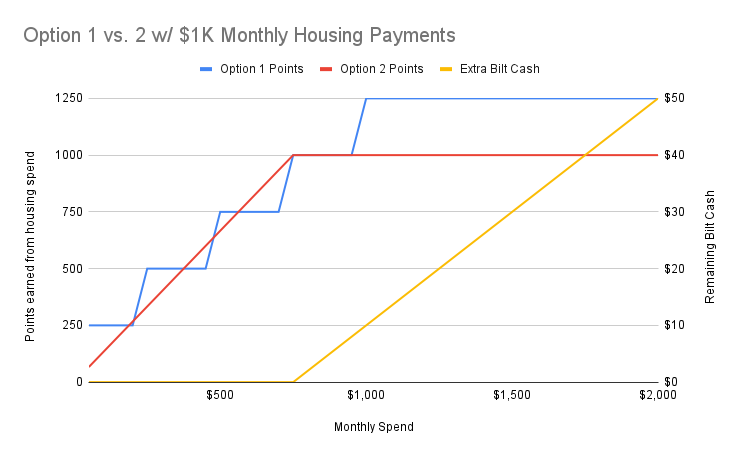

Modeling $1K Housing Payments

I created a spreadsheet to analyse the two options. I started with the assumption that a person has $1,000 in monthly housing payments. The following chart shows the number of points earned from housing payments with each option (left, vertical axis) based on monthly credit card spend for non-housing stuff. The blue line shows the points earned for housing payments with Option 1, and the red line shows the points earned for housing payments with Option 2. The yellow line shows the amount of Bilt Cash left over with Option 2, and available for other uses.

Note: The following charts do not include points earned from credit card spend. They only show points earned from making housing payments through Bilt. By doing it this way, this shows the difference in earning between options 1 and 2: it doesn’t matter which Bilt card you have.

Findings:

- When monthly spend is less than 75% of housing payments, neither option is clearly superior. Option 1 looks like steps because it is best right when you reach a target (e.g. when everyday spend reaches 25% or 50% of housing spend.

- When monthly spend exceeds housing payments, Option 1 is consistently 25% better than Option 2, but only if you don’t value left-over Bilt Cash.

- If you do value left-over Bilt Cash, it doesn’t take long for the value of that Bilt Cash to exceed the extra points earned with Option 1. For example, if you value Bilt Cash at 20% face value, and Bilt points at 1.5cpp, then 250 Bilt points = $3.75. So, at 20% of face value, you would value $20 Bilt Cash (20%=$4) more than the 250 Bilt points. You get $20 of Bilt Cash when your everyday spend exceeds your housing payments by 25%.

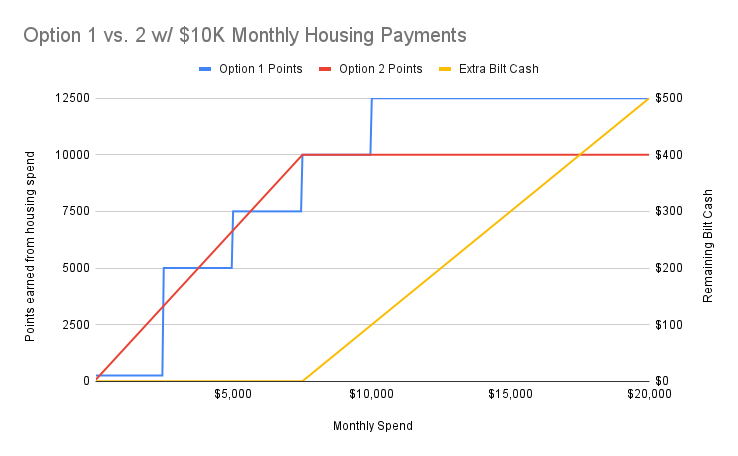

Modeling $10K Housing Payments

When I first modelled $1K in housing payments, I figured that the pattern would be the same for larger payments. That’s not true at the low-end of spend, though. Option 1 offers a minimum of 250 points each month. With my first analysis, that 250 point minimum had a large effect and made Option 1 look like a better option for those whose everyday spend is a tiny fraction of their housing spend. With $10K in housing payments, though, the 250K minimum is far less meaningful, and Option 2 looks better starting out of the gate. From this, we can add one more conclusion:

- If your housing payments are very high, and your everyday spend is low, Option 2 is a clear winner.

Conclusion

The good news is that it would be hard to make a catastrophically bad choice between Options 1 and 2. The worst mistake will, at most, cost you 25% your housing spend amount. For example, if your housing spend is $2,000, then picking the wrong option will, at most, cost you 500 Bilt points.

The one thing that the above analysis really clarifies for me is the decision to be made when your monthly everyday spend greatly exceeds your housing spend. In that case, you need to choose between earning more points (Option 1) or more leftover Bilt Cash (Option 2). Hopefully, we’ll get some clarity in the near future about how to value Bilt Cash, and then we’ll be able to analyse that choice better.

Spreadsheet

If you’re interested in checking out the Google Docs spreadsheet I used for this analysis, you’ll find it here. Let me know if I got any formulas wrong! Once you open the spreadsheet, you can optionally copy it to your own Google account by selecting File… Make a Copy.

I think you miss the 25% spend step on the $10k mortgage example

Exactly this. The used car (I mean, credit card) salesmen like TPG, FM, and the like were all pimps in this whole process and honestly, still are trying to “sell” the cards while playing both sides. It’s amazing how quickly they sold out to Blit and continually have done for the last couple years. Makes me wonder why anyone would click thru from any affiliate links for anything ever again, unless you were just a mindless idiot who couldn’t see what was really going on.

There’s an alternative way to look at this analysis that I haven’t seen mentioned yet.

It’s widely been touted that the Palladium earns “3.33x points per dollar spent” using the old set up (Option 2 here, and really it only earns 3.33x UP TO 75% of your rent). Using $1K rent scenario, that math works out as $750 regular spend x 2 points (1,500) plus $1,000 rent x 1 point (1,000) = 2,500 points / $750 spend = 3.33x points per dollar spent (again, note this ratio only applies UP TO 75% of your rent).

Option 1 here would actually result in a slightly worse ratio of points per $. Again, using the $1K rent scenario, $1,000 regular spend x 2 points (2,000) plus $1,000 rent x 1.25 points (1,250) = 3250 points / $1,000 spend = 3.25x points per dollar spent (also again, only applies UP TO 100% of your rent).

So Option 1 actually results in a slightly worse points per $$ ratio (3.25x vs 3.33), although admittedly the difference isn’t huge. Option 1 does result in more points when reaching your target spend, but conversely it requires slightly more dollars per point to get there, if you care about that.

This analysis is really only for people who can plan nearly exactly how many dollars they’re going to spend on the card per month.

Your chart of Option 2 – red line is wrong – I modeled the options for 7 scenarios and the 3rd dimension is the annual fee and 4th is the 95$ cards bonus categories.

The Red line will go at 45 deg angle till 750, then it will rise by 1000 and then again follow the 45 degree angle

Sorry I thought it was total points on Y axis – with housing points for Option 2 it will be flat till 750 then rise vertically to 1000 and stay there

I think Column “I” should be comparing Column “D” and “F” (Option 1 points and Option 2 max points) instead of column “D” and “G” (Option 1 points and Option 2 points) for a true comparison of which option gives the most points.

As Greg has said, I think the easiest way to understand the Palladium Card is that you get 3.3x Bilt points on all spend, IF you pay your rent or mortgage through the Bilt portal (which apparently can only be done through ACH now?).

Given that the Palladium card gives Gold status until the end of 2027, which gives 1:1 xfers from Rakuten to Bilt and enhanced xfer bonuses from Bilt to partners (Atmos, Hyatt, JAL, etc.), overall it seems like the Palladium is the best card out there for spending categories that aren’t already earning 4x or higher. It’s also a 2ndary way to earn valuable Atmos and Hyatt points for me.

Tempted to get the Blue card, buy a single banana each month, and earn my 250 points… That’s a hell of a return on spend.

I dont even think you need to buy the banana! Just set up autopay for rent/mortgage via their portal and you will have 3000 Bilt Points at the end of the year.

I believe the banana is a reference to the banana art Bilt was selling a few days ago, to mock the folks that used banana purchases to meet some spend requirements. OP is trying to stick it to Ankur by going back to buying bananas again.

I can’t actually believe we need a chart to figure out how to gain value on this new BILT 2.0 cards. It’s way too complicated for an average person to figure out, can’t recommend this card to anyone any longer personally. I’m out

My plan is go with the Palladium and Option Two. Not bother unlocking points on my $2K mortgage and built up on Bilt Cash for a few months to see if it has any real use. If Bilt Cash is a dud, I will use it towards unlocking my mortgage points, and then once the Bilt Cash is gone switch to Option 1.

I think there is something to be said of stability and consistency. I never thought i would go back to Amex BBP. No fee and no headaches. Will try and earn bilt points just not with the card.

Isn’t the real issue the value of Bilt Cash? You put a massive haircut on it. But Bilt says it’s 1:1 in their ecosystem on various credits. If true, then Bilt Cash is worth 100%, not 25%. If true, then using any amount of Bilt Cash to buy into housing at 3:1 makes no sense. If you forgo the brain damage, you’re looking at a 4% card for everyday spend (Bilt Cash) + [1-2.2%] in Bilt Points. That’s essentially a 5%+ return on everyday spend. If you overlay the rent/mortgage, you’re essentially converting 4% [Bilt] Cash into another currency (Bilt Points) but at a 3:1 transfer, which makes no sense. Ergo, forget the mortgage.

What am I missing?

I think Greg’s position of being very skeptical about Bilt cash given what has and hasn’t been revealed so far (and, well, *how* that has and hasn’t been revealed) is very reasonable, but *if* it turns out that it’s worth anything like face value instead of being another set of hard to use coupons then of course you’re right that it changes the math significantly.

Does this mean IF someone sells you $100 Bilt Cash, you’d pay $100 for it?

Not really my point. See Nick or Dav’s responses. They got it.

If and when Bilt Cash turns out to be valuable, we’ll obviously re-evaluate. At the moment, we know very little despite having asked extensive questions. If you can use $100 in Bilt Cash for a $100 restaurant tab or $100 Lyft or a $100 hotel booking, we’ll re-evaluate. However, I think it is far more likely that we’ll see things like being able to use a maximum of $10 per month on Lyft (which is not yet set, but that’s the closest thing we have to an example of what to expect). For all we know, maybe you’ll be able to use up to $15 in Bilt Cash on a restaurant tab of $150 or more at Restaurant X and up to $20 off on $175 at Restaurant Y, etc. Maybe you’ll be able to use $X toward a hotel booking, but only if you stay a minimum number of days or spend a minimum amount, etc. Those would all be 1:1 uses, but we would value $15 off of $150 at a restaurant much differently than $100 off $100. We’ve had no indication that Bilt has the limits and restrictions finalized. I wouldn’t make decisions today based on earning something with such ambiguous value. It can be used to earn rewards on rent/mortgage, and that is the extent to which we can value it so far.

That’s not to say that we know it won’t be valuable — we just don’t know yet, so it wouldn’t make sense to plan as though it will be. I could imagine that it might be really useful for unlocking a better transfer bonus or something, but that really depends on how much it costs, and I’m not sure that will work out to be net better than having just used it to earn rewards on rent/mortgage in the first place.

Fantastic expose’ Basically shows that Option 2 (or 1 whichever was added as an alternative) is the same wine in another bottle.

The more I look at this dumpster fire and the coupon kings, simplicity wins. My Venture X is due for renewal and it’s either that or go on a 1 year no-coupon diet and see if C1 will give me a repeat bonus (last SUB was 4 years ago).

Problem with vx is the transfer partners. I value bilt points at 2.2 cpp, and venture miles at 1.1 cpp

And that’s fine if your focus is on lodgings. And then, Citi also gets a bump up.

Hey Greg, could you model something in the middle like a $4,000 monthly housing payment?

https://www.maxmilespoints.com/bilt-calculator

This will help! But it doesn’t account for the point accelerator.

just use the slider

So have there been any clarification if the rent/mortgage payment has to be in full? For example, if my rent/mortgage is $2k and I only pay 50% ($1k) and my spending is more than $1k, will I get 1.25 points on the 1k points?

Gemini AI confirmed that my calculation below is accurate. So for non-bonus / non-SUB spend 4X is a winner