Over the last few weeks, Bilt has remade its credit card portfolio and rewards program, which it now calls “Bilt 2.0.” One of the most central features is the ability to pay rent or mortgage for free in the Bilt app, then earn rewards based on the amount of those payments when using Bilt credit cards for other purchases.

Unfortunately, like much of Bilt 2.0, there have been some issues.

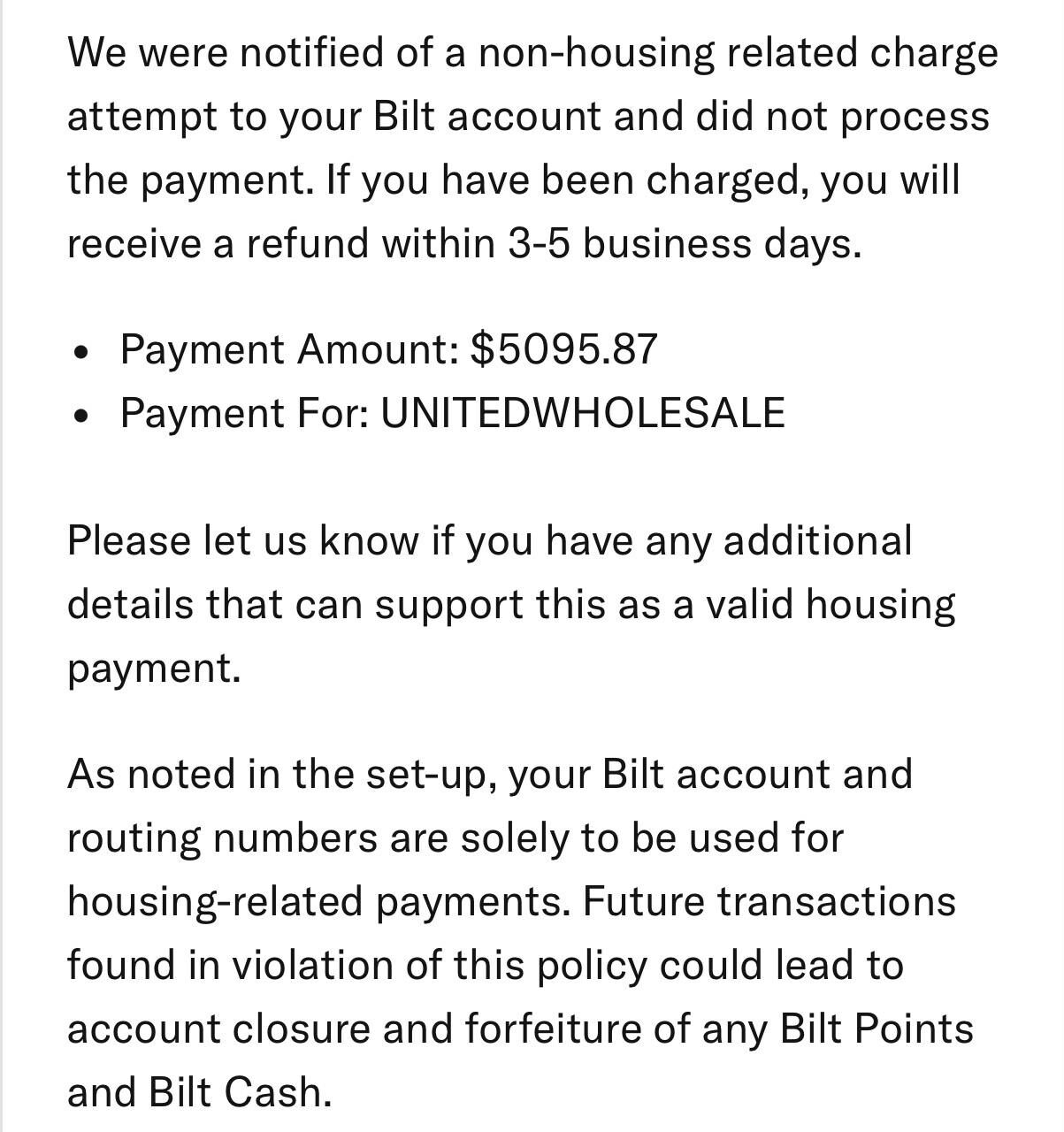

The most common problem seems to be that Bilt’s new payment system sometimes identifies mortgage (and even rent) payments as unrelated to housing, resulting in payment refusals. The most bizarre cancellations involve United Wholesale Mortgage (UWM), a company with which Bilt launched a partnership last year.

We’ve seen numerous examples of this from readers, our Facebook group and on reddit (other examples here and here). One person posted the message that they received from Bilt:

We’ve also received scattered reports that the mortgage provider has not received rent payments, even though funds were deducted from the Bilt member’s checking account. However, I think it’s too early to say whether or not this is simply a timing issue or a technical glitch. If Bilt needs to send a paper check to the provider, I imagine that it would take some time to arrive.

Quick Thoughts

It remains anything but smooth sailing for Bilt as it continues implementing Bilt 2.0. I’m not surprised to see some kinks in the new mortgage payment system, but I’m surprised to see declines when the payment is going to the mortgage provider with which Bilt has a partnership.

If it were me and my mortgage, I would probably give it a couple of months for things to settle down before moving my monthly payment to Bilt…and I’d even consider making a double payment in the first month to ensure the Bilt payment arrives when I want it to. But I certainly wouldn’t be wading into these waters right now.

For those who have already jumped in, make sure you give it plenty of time to arrive and keep a close eye on the first payment so you don’t end up saddled with penalties or late fees.

The potential points value is incredible. Bilt itself thus far has failed to impress. Don’t need to be a beta tester. Definitely waiting a month or two before considering paying my mortgage through these folks.

But if it works… and they keep the program the same (by the same, I mean as they modified it after launch with the ability to earn $50 in Bilt cash for every 25k points earned, which quite frankly changes the ballgame), it’s quite the ability to earn points on unbonused spend.

Until then… enjoying those 1:1 Rakuten transfers on 2/15 and 5/15.

I would still be willing to take the plunge at some point, but only if they do a remarkable job turning around this mess. I am willing to keep spreadsheets to track of coupons and bonus spend for all my cards. But I have no desire to do business with a company if there is a fairly high possibility they are going to mess up my account, especially if said company doesn’t get high marks for customer service. It is just too frustrating to deal with a company like that and it isn’t worth the points.

One thing I discovered on the $50 for 25k points is that it’s specifically $50 for 25k *qualifying points* so just base earn and rent I believe. I’m not sure if/how the accelerator will count, but as of now any of the 3x bonus earns (TPG, mobile) and the SUB do not count.

I’m sure all the comments to this post will be mature and insightful.

Is there anything this company is doing well right now? Anything?

If you believe that “any publicity is good publicity”, then yes, it’s definitely getting publicity!

Ahh yes, a double mortgage payment, exactly what american’s can afford right now.

I would humbly suggest that nobody rely on Built to pay any housing costs until they get their ship together.

Missing rent or mortgage payments can have costs other than just a late fee. IMHO not worth the marginal amount points to just wait a month or 2 and see if they can get it sorted. If anybody seriously thinks that an extra 1-2k points is worth the risk right now they need to maybe rethink some things

I worked at UWM for a long time. They are a “move fast and break things” mortgage company. Very interesting culture, I suggest checking out the WSJ expose. Sounds very similar to BILT. Not a compliment.

IME UWM rarely holds a mortgage very long – I’ve had 3 mortgages with them, and all have been transferred to other services within 2 years. Sounds like it’s probably for the best!

I’m not using Bilt to pay my mortgage until this gets resolved. Fortunately, the point accelerator gives me close to the same number of points I’d get as a result of using Bilt to pay the mortgage so I don’t feel like I’m missing out on much.