NOTICE: This post references card features that have changed, expired, or are not currently available

Note: As of October 13, 2015, the Target REDcard (REDbird) can only be loaded with cash in-store at Target. Gift cards and/or debit cards no longer work to load REDcard. For more info, see: Here is the REDbird memo, “Cash is the only tender guests can use”

Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

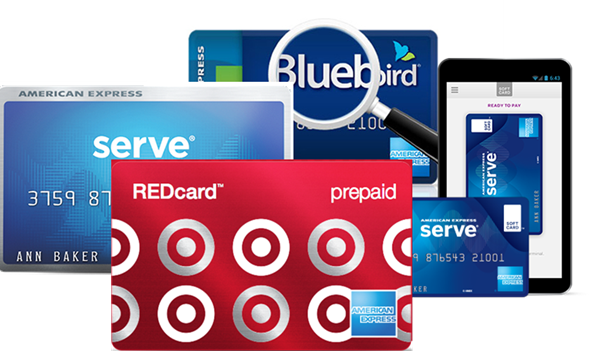

With the Arrival of REDcard, American Express now offers four variations of almost the same card: Bluebird, REDcard (AKA Redbird), Serve, and Serve with SoftCard (AKA SoftServe). Each of these is useful for manufacturing spend. And, each has its own pros and cons. Unfortunately, American Express allows each person to have only one. So, many people are now asking which is best.

To answer this question, I created a new page on my site (found under “Gift Cards”): The complete guide to Bluebird, REDcard, Serve, and SoftServe. On that page, you’ll find a complete comparison of the four products. Here, though, I’ll provide an excerpt of my recommendations:

For maximizing rewards:

- If you want to maximize credit card spend and savings opportunities regardless of the complexity involved, then get SoftServe (Serve with Softcard).

- If you want to maximize credit card spend and savings opportunities, but you do not have (and do not want to get) cell phone hardware and service required for SoftCard (details here), then get Serve.

- If you want the simplest possible option for earning credit card rewards with the lowest possible fees, get the Target Prepaid REDcard.

For convenience and shopping:

- If you frequently shop at Walmart, get Bluebird.

- If you frequently shop at Target, get REDcard.

- If you find yourself often in or near Walmart or Family Dollar, regardless of whether you actually shop at those locations, get Serve or SoftServe.

Further readings…

Above was just a small snippet from the much more complete guide: The complete guide to Bluebird, REDcard, Serve, and SoftServe. Please check it out!

Also consider reading these related posts:

- Bluebird takes flight and changes the game (this is from October 2012 so it’s a bit dated!)

- REDcard changes everything

- Earn miles automatically, with Serve.

How easy is it to transfer from a Bluebird to either a Redbird or Serve? I have more Targets around me than Walmarts. I also like the idea of the online loading of Serve.

Thank you!

Usually it is easy:

1. clear out all funds (and wait until transactions are complete)

2. Go to your online profile and click “close account”

3. sign up for new card

Some people do have trouble with #3 where they are told that they still have an open Bluebird account. If this happens to you, make sure to register Redbird or Serve with the exact same info (especially email address) as you used before.

Uh oh. So I cancelled my Bluebird and went onto the AMEX website to get info on applying for a Redcard. Come to find out that you can only buy the temporary ones in selected Targets. And, there aren’t any in California where I live! Does anyone have better info than that?! If not, I guess I’ll have to go with a Serve. Sheesh.

[…] Bluebird, Redbird, SoftServe… Which is best? […]

Thanks…have one more question – searched the Serve site and elsewhere (FT)…no luck.

The $1K/month credit card uploads for Serve…is that per calendar month or a rolling 30 day basis, etc.?

Flyertalk mentions calendar month – but not with respect to credit card uploads….

Would love it to be calendar month, you could time that better, lol.

It is calendar month

I’ve been debating between a Serve or Redbird. Goal is to build points, not for shopping. I do not live near a Walmart, although they are building a huge (claimed to be the biggest so far) one near me, scheduled to open in June 2015. I like the online loading feature of Serve, but not the $1K limit…so looks like I should go for Redbird (Target not too far from here) to do in-store loading with my credit cards – then in June, decide if I want to switch over to Serve….anything missing in my plan? Thanks so much! PS – I have CVS and Walgreens nearby, but those are cash loads only as I understand it.

It sounds like you have it right: go with REDbird now and then re-evaluate in June. Correct regarding CVS and Walgreens

Just curious: did you ever have anyone confirm what jiaoyi reported, namely that SoftServe’s daily limits are reverting back to the regular Serve ones? I was planning to close my Serve account and apply for SoftServe instead, but now that I read this, perhaps there is no longer any point in doing that…

No one else has reported this, so I’d say its unconfirmed at this point.

A heads up: SoftServe is dying.

I linked my serve card and softcard yesterday and tried to load $500 from my credit card. But none of them success.

So I call customer service today, they tell me that Serve can only load $200 daily from credit card no matter with or without softcard. And they are updating their website for the new policy now.

I want to get another confirm because I have never heard this before.

Can anyone confirm this? As of right now I still see the $500/day limits. See: https://www.serve.com/help/#use-your-account-in-softcard-18

Before I tried to reload my Softserve account using my Citi HHonors reserve card, I reduced the cash advance limit to $0. I had to upload pictures of my drivers license and the credit card to Serve first. When I tried the load, it wouldn’t work. So Citi HHonors reserve loads to Amex Serve will be treated as cash advances including any fee involved.

I went looking for AFT no luck, but I did see plenty of Redcards here in MN. I see ppl are experiencing problems with it, so I’ll just wait till they fix them..

I signed-up and loaded a temporary prepaid redcard thinking that the there was some value to the temporary card. I had no intention of closing my bluebird account. It seems like I may have misunderstood and made a mistake. Is there anyway to get funds off of this temporary card without registering it? One thought is that my wife registered her card, so I was thinking maybe I can be a sub-account or family account within her account, and that would not violate the “you can only choose one” rule. Any thoughts?

The only way to get funds off the temp card without registering it is to use it as a credit card for actual purchases. Alternatively, you might be able to find friends eager to try Redcard that will pay you for the card.

Darn. I am confused by various comments by people being excited about their ability to get multiple temporary cards.

Any idea if I can use my cc to load a redcard that’s registered to a different person? Serve doesn’t like it if I do but just wondering if redcard has similar restriction.

Yes, you can. Since the reload is done at Target, you can hand the Target cashier anyone’s Redbird card and pay with your credit card.

I think there may be substantial changes and clarifications of Redbird’s features by the time it’s available nationwide. So this subject of relative merits will need to be revisited more than once. 😉

That’s certainly possible.

Following is mesg about the reload card, which means that only cash can be used to reload red card in the store. Does it mean that reload with credit card is just an IT glitch which will be fixed at some time?

“Once you register your Card, you can continue to add money using Direct Deposit, linking a debit card or bank account, or by adding cash for free at any U.S. Target store.”

Amex uses the term “cash reload” to mean any type of reload at a store (regardless of how someone pays). They use the same terminology with Bluebird and Serve too even though we know we can load with debit cards.

Bought one of these on Friday 10-10 and wasn’t even able to buy merchandise at Target with it. They (AMEX? Target? whoever is behind the CS # on the back of the card) are being inundated with calls because their system is not recognizing the cards as paid and loaded with funds. Proceed with caution and the likely retention of your funds from 15-??? days. I’ve been told it will be 10 business days before I can expect the problem to be resolved (but was told 3 business days just 2 days ago, so there you go). One CSR said once it gets resolved, I’ll be issued a new TEMP card to register. And THEN I have to wait for the permanent card to arrive in the mail. Phht!

Yikes. Yes, you’re right, they’re experiencing huge technical issues right now.

Just an update…this AM I received a call from the Prepaid Resolution Team that my temp card was now activated (total of 5 business days since starting this process). AND I’ve successfully registered my account. Now waiting for the permanent card to arrive. Keeping fingers crossed that all is smooth from here on out.

Great!

Time will tell on the Redbird, thanks for doing the research. If CC loads at target are not a temporary glitch kind of thing, and CC companies code super targets as grocery, and CC companies don’t charge as cash advance…then this does change things for the better….I am waiting to see how it pans out, I am sortta forced to because TX is not included. I would hate to cancel BB and go through the trouble of getting family to procure RB for me, only to have them quit taking CC loads for the monthly limit.

Any data points on whether an Amex card would earn reward points from loading REDcard directly at Target?

My Amex clearly shows the Redcard reloads as purchases so I’m sure they will earn points.