Miles for Family posted a few days ago about a really weird potential restriction on Cardless credit cards: according to Cardless terms, it is only possible to get one Cardless card…..ever. I can’t imagine that they really intend for this to be enforced as-written, but it’s worth being aware as we are expecting coming card offerings for in separate partnerships with Qatar Airways and Avianca LifeMiles. You may need to be strategic in terms of deciding which Cardless card is the right one for you if they do intend to enforce rules as-written.

A strange application limitation

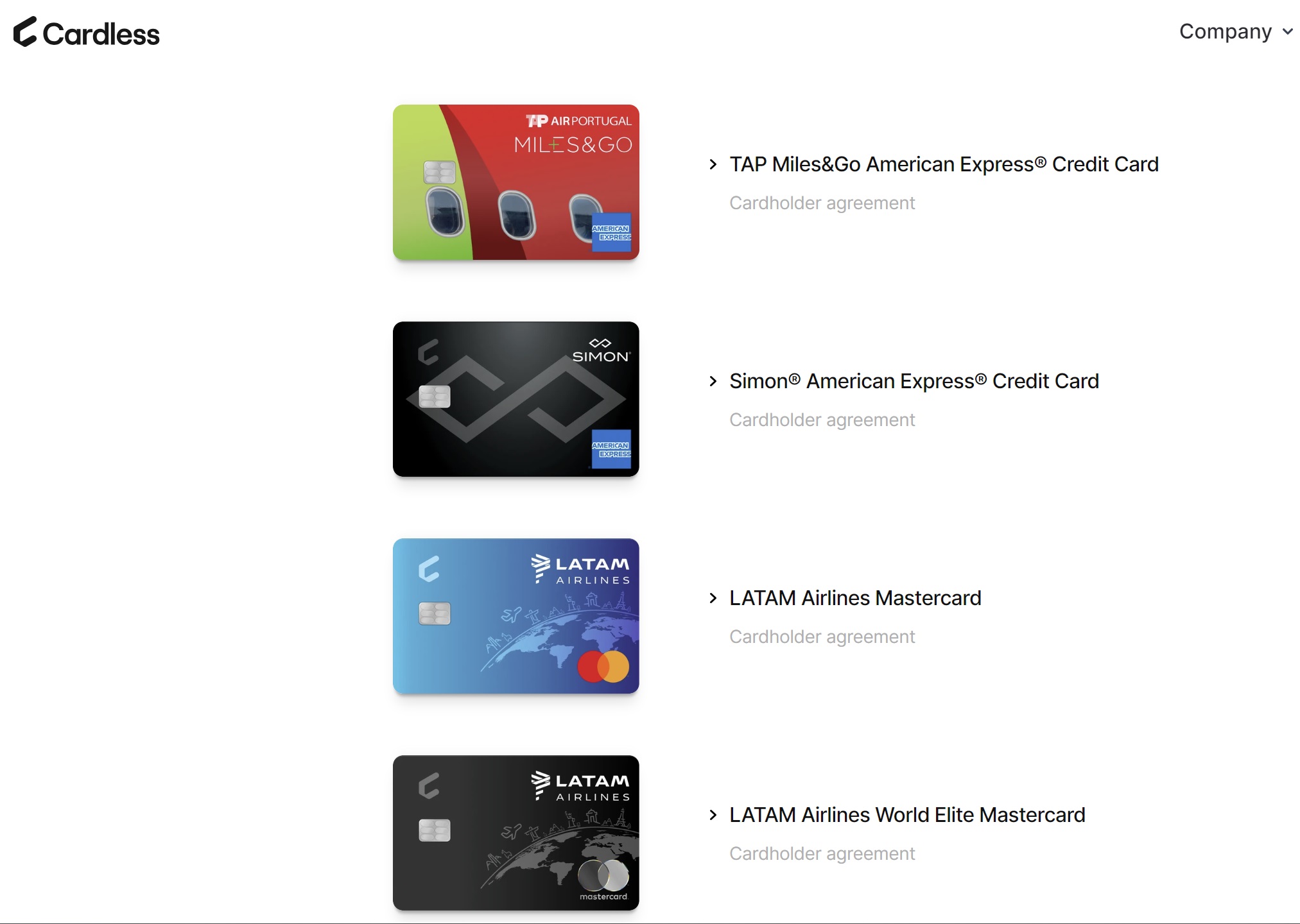

As a reminder, Cardless is a card issuer that has been best-known for some odd co-branded sports team cards, including an old Manchester United card, which was followed by a couple of random US sports team cards (there was a Miami Marlins card and a New Orleans Pelicans card) and a Simon Mall credit card. Then Cardless seemingly began to pivot away from those cards (which I believe are discontinued apart from the Simon one) to target foreign airline programs, with offerings coming out for a LATAM credit card and then a TAP Air Portugal card over the past year or two. Now we’re expecting the coming launch of Qatar Airways and Avianca LifeMiles cards.

I think that Cardless is smart to market to some of these foreign airline programs that have some foothold / popularity in the US. I have to imagine that foreign airlines are excited to potentially get a piece of the US credit card market.

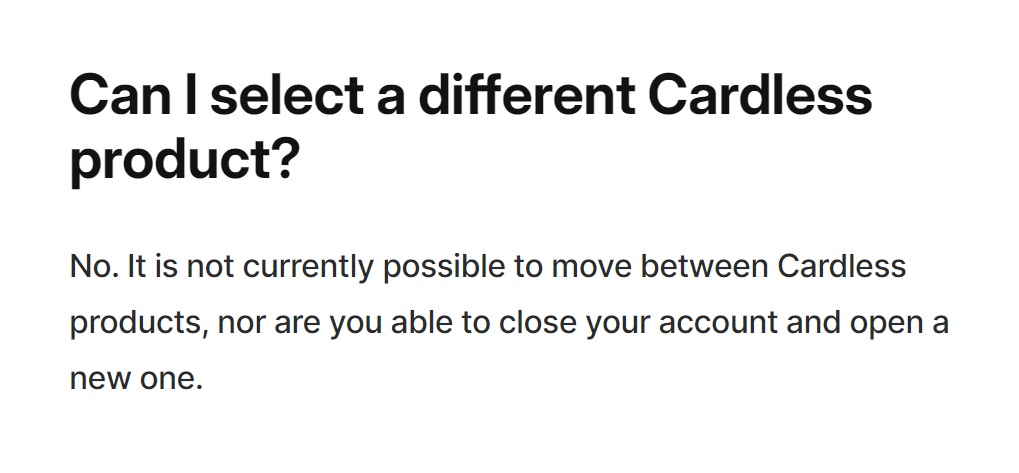

Given that Cardless is such a small issuer, I haven’t heard data points on getting multiple Cardless cards (frankly, I imagine that few people have found their offerings compelling enough as to want multiple of their products). However, Miles for Family found the following important note in the Cardless frequently asked questions:

It sounds like Cardless is saying that it is neither possible to product change nor to close a Cardless product and then open a different one. That seems like an odd restriction, particularly for a company focusing on airline products since a customer’s airline needs may obviously change over time (with a new job, relocation, etc). Do they really want to lock customers out of ever getting a different Cardless product?

It’s possible that this FAQ item is mainly intended to say that you can’t product change. However, without further clarification, I would say that it would be prudent to carefully consider which Cardless product is right for you. For instance, if you’re interested in the Qatar Avios card but you’re also an Avianca LifeMiles fan, you’ll need to consider whether you should wait for details on both cards to be released before you decide to go in one direction or another (or either of them at all if you’re concerned that a different co-branded offering could be even more appealing someday).

Never had a Cardless card before. Score is 810. I’m right at 5/24. Just denied for an Avianca card – Reason:

we are unable to provide credit to you on this occasion for one or several of the below reasons:

Anyone have an update on this?

Call them and ask them! How hard is that?

[…] up bonuses, earning categories, and card benefits. So what’s the problem? It’s been reported many times that Cardless has a “1 Card Rule” that […]

Disapproved for the Qatar card $99 AF due to the following reason:

Thank you for your recent application, which we are processing on behalf of our issuer, First Electronic Bank. Your request for a credit card was carefully considered, and we regret that we are unable to approve your application at this time, for the following reason(s):

Applicant already has an account with Cardless.

If you have any questions regarding this notice, you should contact:

First Electronic Bank ℅ Cardless, Inc.

350 Townsend St., #610

San Francisco, CA 94107

Confirming the rule is enforced

Cardless living up to its name: less cards!

I can’t believe this policy will fly, so to speak, with their airline clients. I mean, “Let us issue your card, for which many sports fans will not be eligible”.

The Cardless FAQ is correct, taken literally. I had a Pelican card and cannot get a TAP card due to the policy.

Why such a stupid policy exists is another question.

I’d guess that Cardless got burned by certain hobbyists with the various sports cards and this is the result.

No. They are not a charity.

Agreed. To prevent abuse, Amex has its lifetime rule. To prevent abuse, other card issuers have their rules. And, to prevent abuse, Cardless has this rule. We might not like it but we know why it’s there. Let’s not kid ourselves.

Except, they’re also blocking lots of completely normal business for themselves and their clients. You don’t have to be like us to want several cards for different purposes, especially over time. If I’m running an airline do I want to sign up with a company that limits the pool of potential applicants for my card so seriously? Sure, other companies have restrictions, but none nearly so stringent. I can see why Cardless (what a dumb name) wants to do this; I can’t see why potential clients would go along with it.

Did you read the rule?

This is nothing to do with abuse prevention. This is simply inane FROM THEIR POINT OF VIEW!

This restriction is 100% enforced. Even if your first(only) Cardless card has been closed, you will never be able to open another one. For “life” according to their support.

I tried to apply for a second card and as soon as you get to the phone number it doesn’t let you continue. In fact I emailed them and it was confirmed that is only one credit card per “life”, no matter if you cancelled the credit or not. Hope they change this rule.

They are an annoying issuer in other ways too. The application process required that I use an e-mail address that their vendor happened to know about, and if you don’t use one of those, they deny your application and make you wait several months to reapply.

Even one card seems like too many given the name of the company.

When I read that Nick, it seems like it’s saying no product changes with the card ajd no cycling of that card. I would suspect those terms apply to each unique card but again that’s just how I understood it on first read.