NOTICE: This post references card features that have changed, expired, or are not currently available

Well, maybe you should have slept on the Cash app after all. While my experiences with the app have mostly been pretty good, it is always worth a second thought when the mainstream media picks up a story from a niche corner of our hobby. And so when I saw a Yahoo Finance report of potentially widespread fraud issues with the Cash app, I unlinked debit cards from our accounts. I’m not saying that I won’t use the app again, but rather that it seemed prudent to unlink our debit cards until we next need to load funds if enough people are experiencing issues to warrant a mainstream media report.

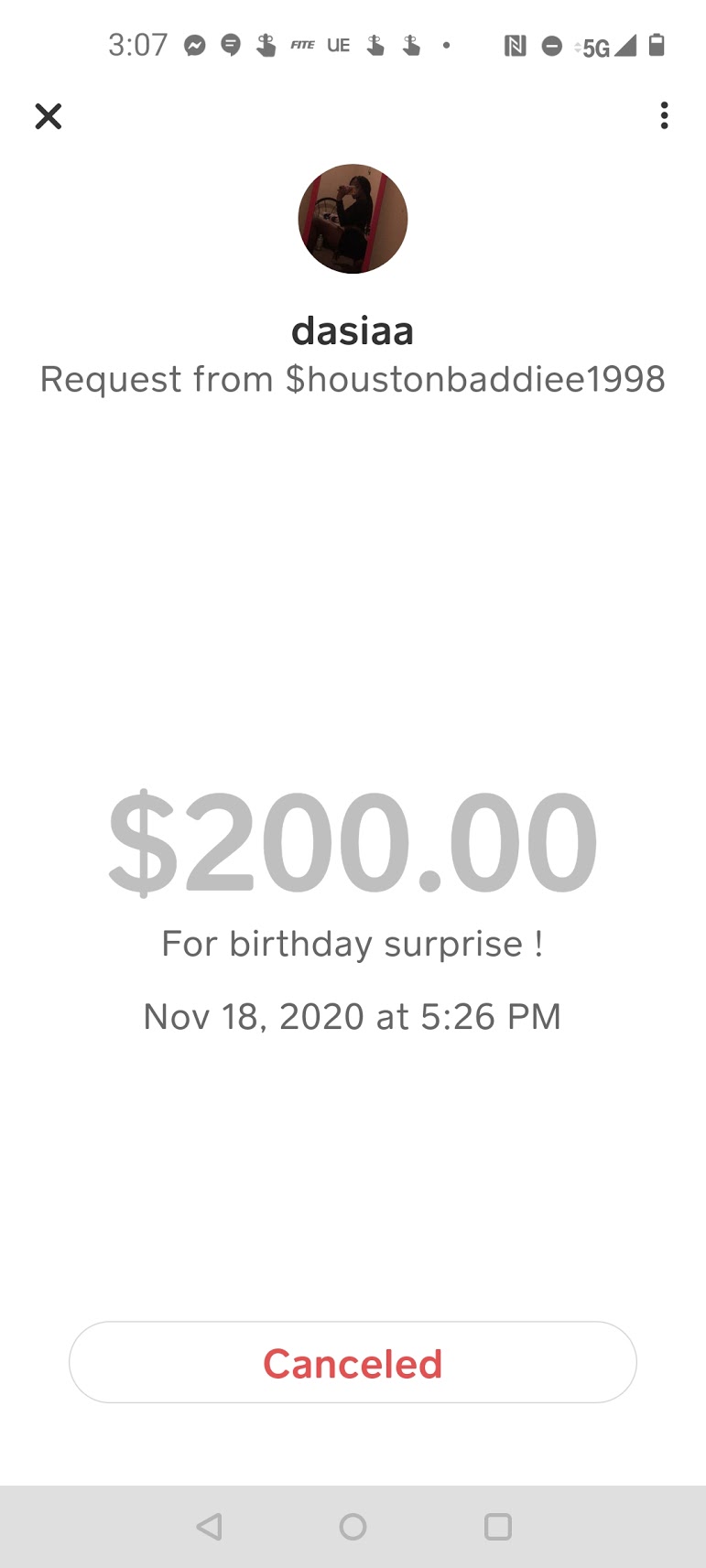

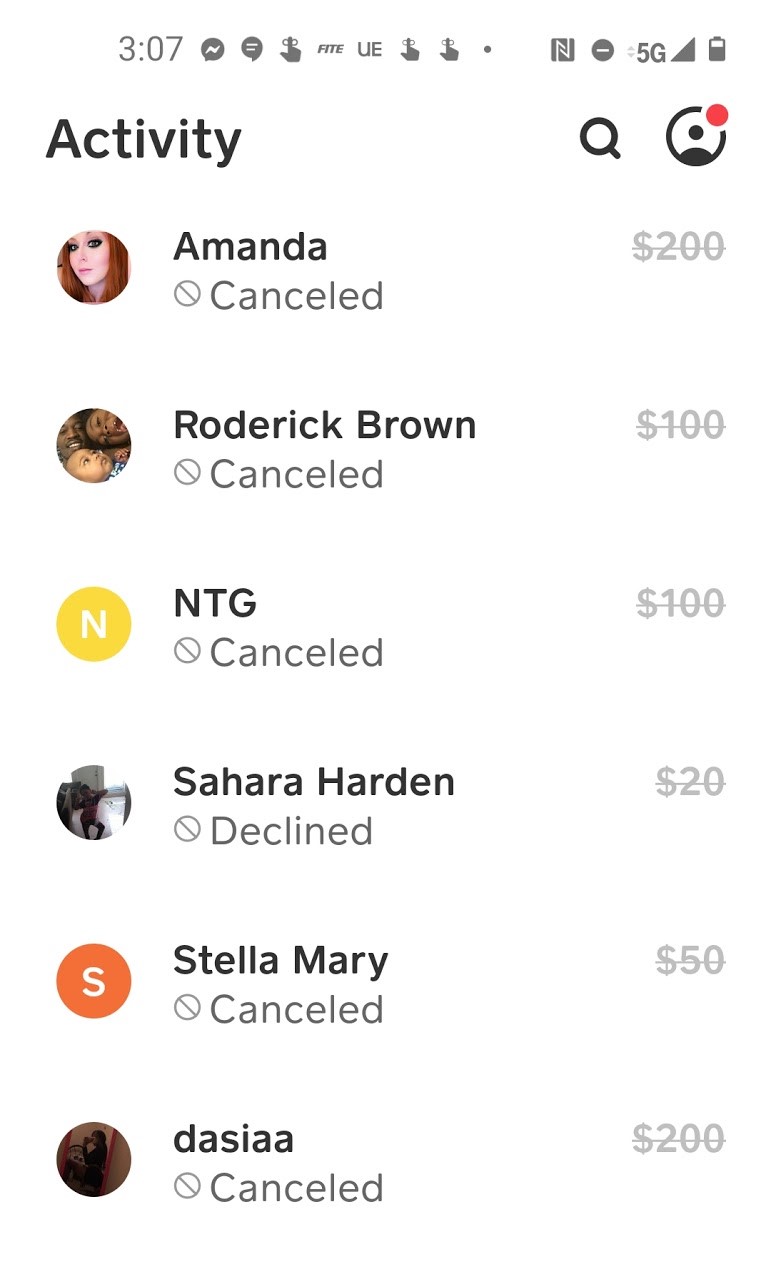

In my previous post about the Cash app, I had originally posted a picture of my Cash App card, which included my user name. Within a short time after the post published, the requests for cash starting coming. Some had reasons listed that made me admire the hustle – like “For birthday surprise!”

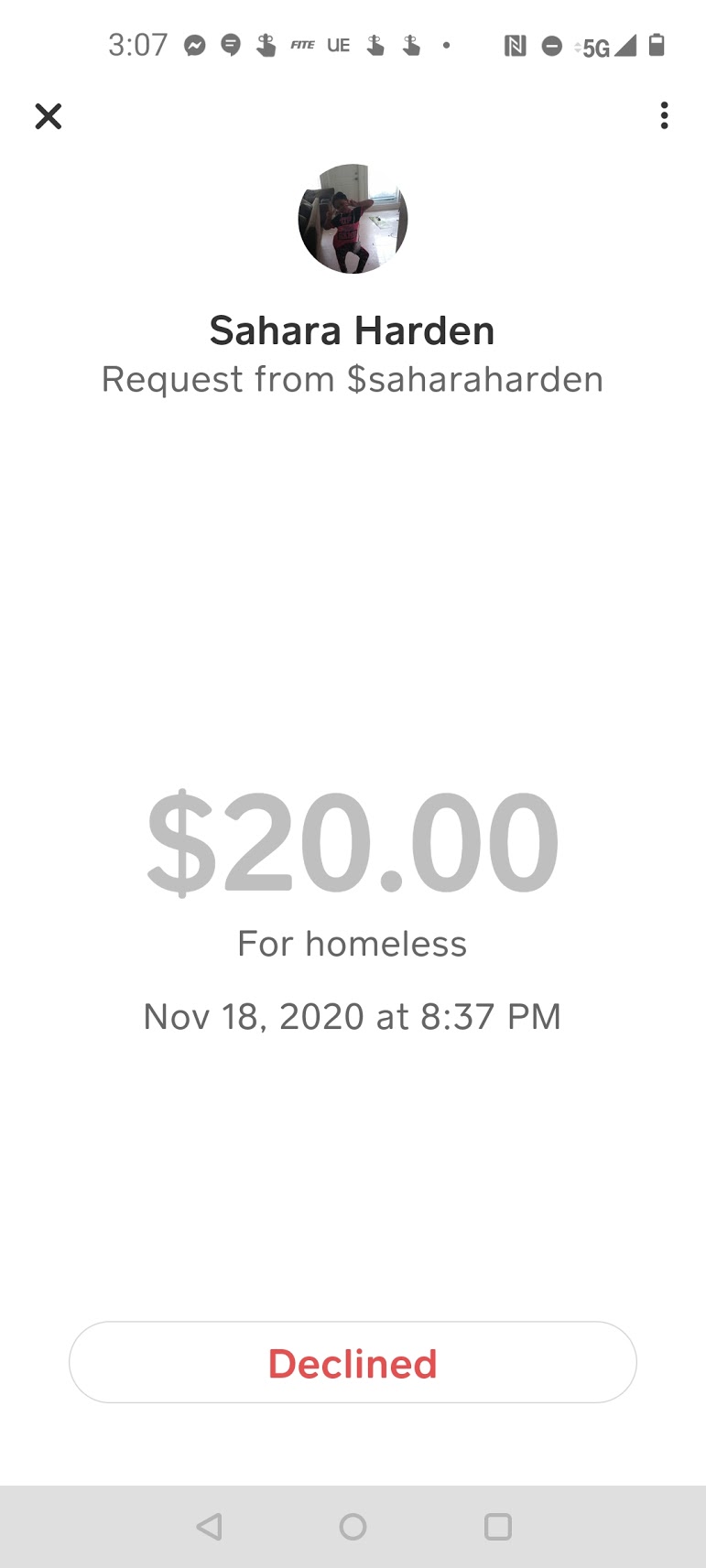

The amounts and stated purposes varied considerably throughout the day.

The amounts and stated purposes varied considerably throughout the day.

It didn’t take long for the volume of requests to get kind of ridiculous and I was marginally concerned that at some point I was accidentally going to accept one of them.

Thankfully, it died down on its own and I had no further issues since the few days following publication of that post.

However, some users haven’t been nearly as lucky.

Yahoo Finance reports that in some cases, people have awoken to hackers having drained their linked bank accounts to quickly flip stock or bitcoin and run off with the profits. It sounds like in some cases, it has been a fraudulent text message with a URL that looks legit getting clicked by the Cash app user and personal information then being phished. In other situations, it has been a matter of phony customer service phone numbers set up so that people would Google the Cash App and unwittingly call their non-existent customer service and hand over details to a scammer (Cash app does not have a phone number to call for customer service).

I am wholly unsurprised to read that attempts to contact customer service have been frustrating when not completely fruitless. I’ve had to contact customer service a few times when boosts did not post automatically. The exact process they lay out in the app for reporting a missing boost is impossible because some of the steps they list just aren’t options within the app (the instructions say to go to your activity and click a button that says to report a missing boost, but no such button actually existed the last few times I went to report an issue). Despite proactively explaining to customer service that there is no such button to click, in both cases I received a robotic customer service reply telling me that I needed to follow the impossible instructions to report a missing boost. And in both cases, I replied with full screen shots from the app showing them that the process they were telling me to do didn’t exist as an option in the menus. I did eventually get credited by customer service, but it was definitely frustrating that they were telling me to select menu items that just weren’t options in the menus that they designed and maintain.

And so I wasn’t surprised to hear that, for example, Cash app simply closed the account of one user who was temporarily credited by his bank for the fraudulent transfers only to have the credit from his bank later reversed since Cash app did not report the transfers as fraudulent (and had since closed his account). In some of the cases reported by Yahoo finance, people were out thousands — one business owner reported having lost $21,000.

All of this is to advise readers that if you use the Cash app, don’t link a bank account that has a lot of money in it. I imagine that few readers here are using the Cash app as a primary account and those with more experience would likely see it as logical that it wouldn’t be wise to link a debit card that has access to a lot of money to any electronic app. In fact, when SoFi Money splashed on the scene a couple of years ago with a high interest rate (at the time 1.85% APY, but much less now) and ATM fee reimbursements worldwide at most ATMs (this is now more limited for newer users), I lamented that I didn’t want both in the same account as the high interest makes me want to keep a lot of money there but I definitely don’t want a lot of money in the account attached to the debit card that I’m going to use in some shady alley ATM in a foreign land. I only want the amount of money I’ll reasonably need in an emergency in an account that is accessible with a debit card.

And thus this Yahoo article about the Cash app is a good reminder that this is true by extension any time your bank account is linked to a debit card. Keep a small disposable account that doesn’t have enough money in it as to be painful if lost that you can link to stuff like the Cash app

That’s not to say that accounts without a debit card are immune from being hacked and nor is it to blame the victims here who have been scammed out of money at a time when a lot of people can’t afford to lose any more. I feel for those folks and hope that Square (the parent company of the Cash app) does right by them. But I thought it was worth publishing this here as I know that some readers use the Cash app and as such I thought it was worth being aware of these issues and careful about the account(s) you link.

I personally believe the cash app is behind all the scams. Why are they so hard to get ahold of I was almost and just a few minutes ago and I try to get ahold of cash have to ask him if it was a scam there asking me for the pan to my card why the hell do they need the PIN to my card just to get logged in to talk to customer support. Yep y’all needs to be investing investigating cash at Big Time I’ll never use them again

They may have resolved one issue, but there are several others. I have been trying since April 19, 2022 to get 3 fraudulent charge taken off my account and the money back into my account. Only to be told to go to the App and fill out a claim form. However the App will not let you get to the claim form. So I reached out to support through the App and they are all bots, and they say the same steps. They have no real help. I reached out to the company through email and got more of the same. They had another bot responding as to hot to find the claim form on the dang App. And then they said,,, here it the kicker, you can also call the 1-800 number and we can help you complete the form for you! Lies again!!! That number directs you straight to the App and hangs up on you!!! I need help. I have even reported my card stolen and had it cut off because that is able to get done through the App but if you want money back they have nothing for you! This company is a JOKE. AND IT IS NOT FUNNY.

I’d be closing this app and possibly requesting new cards that were linked. Just delinking a card still leaves the info out their if there is ever a data breech

Cash app never helps get funds back and if you dispute through bank of lucky enough to have that be source of funds they then shut account down.

I signed up for CashApp a few months ago but thankfully didn’t add my bank account. I was immediately bombarded by phishing e-mails that continued for about a month and then died down. I don’t feel comfortable using CashApp.

I have a friend that was a victim to this. Thieves drained the bank account through Venmo and CashApp. Once they drained available cash from the linked accounts, they went into her bank account and started depositing a $4900 bad check once a day, and would Venmo/CashApp it out as soon as it preliminarily cleared. Rinse and repeated for several days. She didn’t get coverage from either app or the bank itself. She lost over $25k and is in the process of declaring bankruptcy.

Do not reuse passwords, setup MFA, setup bank activity alerts and security features, and look at your bank accounts often.

You can turn off incoming money requests, or restrict them to contacts only (although I would assume that requires you to upload all your contacts to Cash App which doesn’t seem like a good idea either)

The problem with jumping on that mainstream media train is that you are implying that phishing is a CashApp specific problem. It isn’t.

It appears that all the reported issues (including your blunder of putting out your cash app name) had the victim’s cooperation. Either handing out credentials because of a text message telling them to do so, or for not configuring 2FA which would probably have prevented money from being transferred out even after credentials are compromised.

Is Square to blame for not having more gullible-proof features enabled by default? You bet! Should there be additional safeguards? Absolutely! Would it prevent gullible people from sending money to scammers? Probably not.

FWIW: if you take a look at the settings in your CashApp, you can disable money requests from strangers.

Thanks for the heads up.

Have two Cash app accounts (circa 5 years). Linked accounts at the time were secondary accounts ( a Credit union and JPMC DDA) not our primary accounts but over time that changed.

Both previously Cash linked to those accounts, until five minutes ago). Over the years had become primary banking accounts (with overdraft protection connected to CLs north of 6 figures).

But as other have pointed out – the boost have become almost worthless – haven’t added money in almost 8-9 months.

It was absolutely great, though, while it lasted. I made $100’s if not $1,000’s on the coffee boost, USPS boost, grocery boost, etc. And I know other people did A LOT better. (Sbux). Now, I wouldn’t fault anyone for not messing with Cash App at all, except that a lot of people like to receive and pay through it.

Exactly why I never linked my bank account to CashApp. I refuse to provide my bank account login and password to ANY third party. People look at me like I’m crazy when I also tell them I’ve NEVER owned a debit card.

Then how did you fund the Cash app if you didn’t link a bank account and have never owned a debit card? (and by the way, not to burst your bubble, but the Cash app card *is* a debit card lol)

My Cash App account is funded only with money that people send me to pay for merch from my business. No bubble has been burst as the Cash App card got cut up and tossed in the trash when they sent it to me. I send funds in my account via the app to pay debts owed to others. No bank account – no debit card. No worries!

And all the good boosts are gone. No more 10% off groceries, $1 off coffee, etc. it’s like 5% off Burger King and things like that. Not worth it till they make the boosts attractive again.