NOTICE: This post references card features that have changed, expired, or are not currently available

A reddit user named ShadowRegent today flagged an announcement in the fine print on the Merrill Lynch web page that outlines the benefits of Preferred Rewards for Wealth Management indicating that program will end on or after November 12, 2021. To be clear, Preferred Rewards for Wealth Management is a slightly different program than the Preferred Rewards program that readers likely know due to credit card bonuses offered to those with money on deposit with Bank of America / Merrill Edge or Merrill Lynch (See: Bank of America cards: Awesome with Platinum Honors status for more on Preferred Rewards). The potential wrinkle is this footnote goes on to say that clients currently enrolled in Preferred Rewards for Wealth Management will be transitioned to the “new” Bank of America Preferred Rewards program which will feature two new tiers for those with balances of $1,000,000 or more. I don’t think there is any major cause for alarm here at this point, but there are clearly some sort of changes in the works.

The fine print in question here reads as follows. Bold is mine to highlight the important part in the first paragraph (I’m including the rest here for completeness).

1 As of November 12, 2021, or such later date as we may provide you notice of, the Preferred Rewards for Wealth Management program will be discontinued. If you are enrolled in the program on that day, your enrollment will be automatically transferred to the new Bank of America Preferred Rewards program. The new program will be expanded by adding two new tiers for clients with a qualifying balance of $1,000,000 or more. If your three month combined average daily balance is below $1,000,000 on the third business day of the month in which Preferred Rewards for Wealth Management discontinues, you will transition to the Preferred Rewards Platinum Honors tier. To enroll in the Preferred Rewards for Wealth Management program you must have an active, eligible Bank of America® personal checking account and maintain a qualifying three-month combined average daily balance of at least $250,000 in your combined qualifying Bank of America deposit accounts (such as checking, savings, certificate of deposit) and/or your qualifying Merrill investment accounts (such as Cash Management Accounts, 529 Plans). The qualifying balance is calculated based on your average daily balance for a three calendar month period. Refer to the Preferred Rewards for Wealth Management Addendum to the Personal Schedule of Fees for details on accounts that qualify towards the three-month combined average daily balance calculation and receive program benefits.

Certain credit cards are eligible to receive the Preferred Rewards or Preferred Rewards for Wealth Management bonus. Enrolled Preferred Rewards members can receive a Preferred Rewards bonus of 25% for the Gold tier, 50% for the Platinum tier, or 75% for the Platinum Honors tier based on their Program tier and type of card and Preferred Rewards for Wealth Management clients can receive a bonus of 75% based on their enrollment and type of card. If your product receives the 10% customer bonus, the Preferred Rewards or Preferred Rewards for Wealth Management bonus will replace the 10% customer bonus. The Preferred Rewards or Preferred Rewards for Wealth Management bonus for eligible cash rewards credit cards will be applied after all base and bonus cash rewards have been calculated on a purchase. For example, a $100 purchase that earns 3% ($3.00) will actually earn $3.75, $4.50 or $5.25 based on your tier or program when the purchase posts to your account. For all other eligible card types, a purchase that earns 100 base points will actually earn 125, 150 or 175 points based on your tier or program when the purchase posts to your account. The Preferred Rewards or Preferred Rewards for Wealth Management bonus is not applied to any account opening bonus, if applicable. The Preferred Rewards or Preferred Rewards for Wealth Management bonus also does not apply to the bonus earn for certain programs. This information can be found in the Program Rules associated with those credit cards. Other terms and conditions apply. Please refer to your card’s Program Rules for details about how you will receive the Preferred Rewards or Preferred Rewards for Wealth Management bonus. Program Rules are mailed upon account opening and are accessible through the rewards redemption site via Online Banking or by calling the number on the back of your card. View a complete list of ineligible cards.

The key point of concern here is that this clearly indicates that we will see a “new” Bank of America Preferred Rewards program and it will feature two new tiers that require far more in account balances than the current combined $100K required for top-tier Platinum Honors status. While a hundred grand is no small requirement, it isn’t out of reach for many who are able to meet the requirements with long-held IRA accounts and the sort. On the other hand, a million dollars would be a significantly higher hurdle.

The natural fear with this is that $100K may not be enough to get the 75% credit card rewards earning bonus in the new program. I can’t say with certainty that fear isn’t well-placed, but on the other hand I don’t think it is time to panic yet. The Preferred Rewards for Wealth Management program currently requires $250K or more invested/on deposit (and doesn’t come with measurably better benefits than Bank of America Preferred Rewards). The first paragraph above indicates that those who do not meet the $1m tier will be automatically transitioned to Platinum Honors status (since their $250K or more would exceed the $100K requirement for Platinum Honors). The second paragraph goes on to detail the benefits of Platinum Honors status including the 75% credit card rewards bonus. My instinct is that they probably wouldn’t have gone on to detail those benefits if they don’t expect to offer them to these wealth management customers when they transition to Preferred Rewards as we credit card enthusiasts know it.

Of course the question is what benefits will they offer to those with a million bucks or more. Currently, the Preferred Rewards for Wealth Management program doesn’t over many meaningful benefits over the Platinum Honors level of Preferred Rewards (see this addendum for details). The wealth Management program adds waived fees for stuff like cashier’s checks and insufficient funds/overdrafts (are many of their customers with $250K on deposit over drafting often enough to care about this?) and 2 free outgoing wire transfers per month (my HSBC Premier account, which only requires monthly direct deposits of $5K or more, offers unlimited free outgoing wire transfers). Looking over the benefits they are currently offering the Wealth Management customers, I just don’t see much above and beyond what they give Platinum Honors members anyway so maybe the addition of tiers will add more not-very-useful benefits like the ones they currently provide (or benefits like rate reductions in wealth management fees or mortgages or auto loans, etc). I’m not yet convinced that they see credit card rewards as the key component of their wealth management program, so I’m not immediately worried about any changes to the current status quo for those of us riding the Platinum Honors train to 2.625% back everywhere.

Of course, I could be wrong. They could completely revamp the program and change the requirements / benefits. If they do, I would guess that current customers who have Platinum Honors whenever the new program launches will likely maintain their benefits for some amount of time before being affected by any changes. Maybe it’s just wishful thinking, but I imagine there being some notice about a change for the worse.

We will have to keep our eyes peeled and ears to the ground for any additional details in the coming months. Hopefully this is a non-event.

New card coming on Nov 22 and confirmation of new diamond ($1m) and diamond honors ($10m) tiers but scant details yet.

https://www.advisorhub.com/project-thunder-week-7-merrill-touts-new-bank-of-america-rewards-program-for-high-net-worth-customers/

‘Bank of America is adding two new “preferred rewards” tiers: “Diamond” for individuals with assets of at least $1 million and “Diamond Honors” for accounts with $10 million or more in their bank or brokerage accounts.

[…]

The weekly update did not include details of the new benefits for the Diamond-tier customers. The highest tier of the rewards program had previously started at $100,000 and offered better rates on banking products such as interest “boosters” on savings accounts, lower loan rates and no-fee ATM transactions, according to a company website.

A new “Premium Rewards Elite” credit card would also be rolling out on November 22, according to the memo, which did not address whether Merrill brokers would be incentivized to sell the product.’

Maybe they are going to just change the base earnings to 2.5% to match Fidelity (Fidelity Visa) rewards plus program at the 1million + level? https://www.fidelity.com/rewards/overview

Ive been platinum honors for a while, and never really use my premium rewards card. I’ll be downgrading before AF hits. 2.62% on everything sounds great, but I almost always am working towards a signup bonus, and even when not there’s so many categories with 3x to 5x on other cards that I rarely need to settle for 2.62%. So no big loss to me if they nerf the program.

Here’s the one benefit I really want:. A free safety deposit box. I think Citi does, or used to do that.

That absolutely makes sense. You’re not going to beat the return when spending toward a signup bonus. Personally, I prefer to MS new bonuses whenever possible because otherwise I find it tedious to track when I’ve hit the requirement. So I’m usually not actually using my new cards as “everywhere else” cards, which is why I value 2.62% back. It also makes for a really easy go-to card for Player 2 as it may not be the best in every situation but it sure beats those times when you find that P2 used an airline credit card for 1x. Finally, I’m not yet at the point where I have so many points that I don’t want to accumulate more, but as the drought in my travel continues and I continue to earn more points, I have become more interested in supplementing that points stash with cash back.

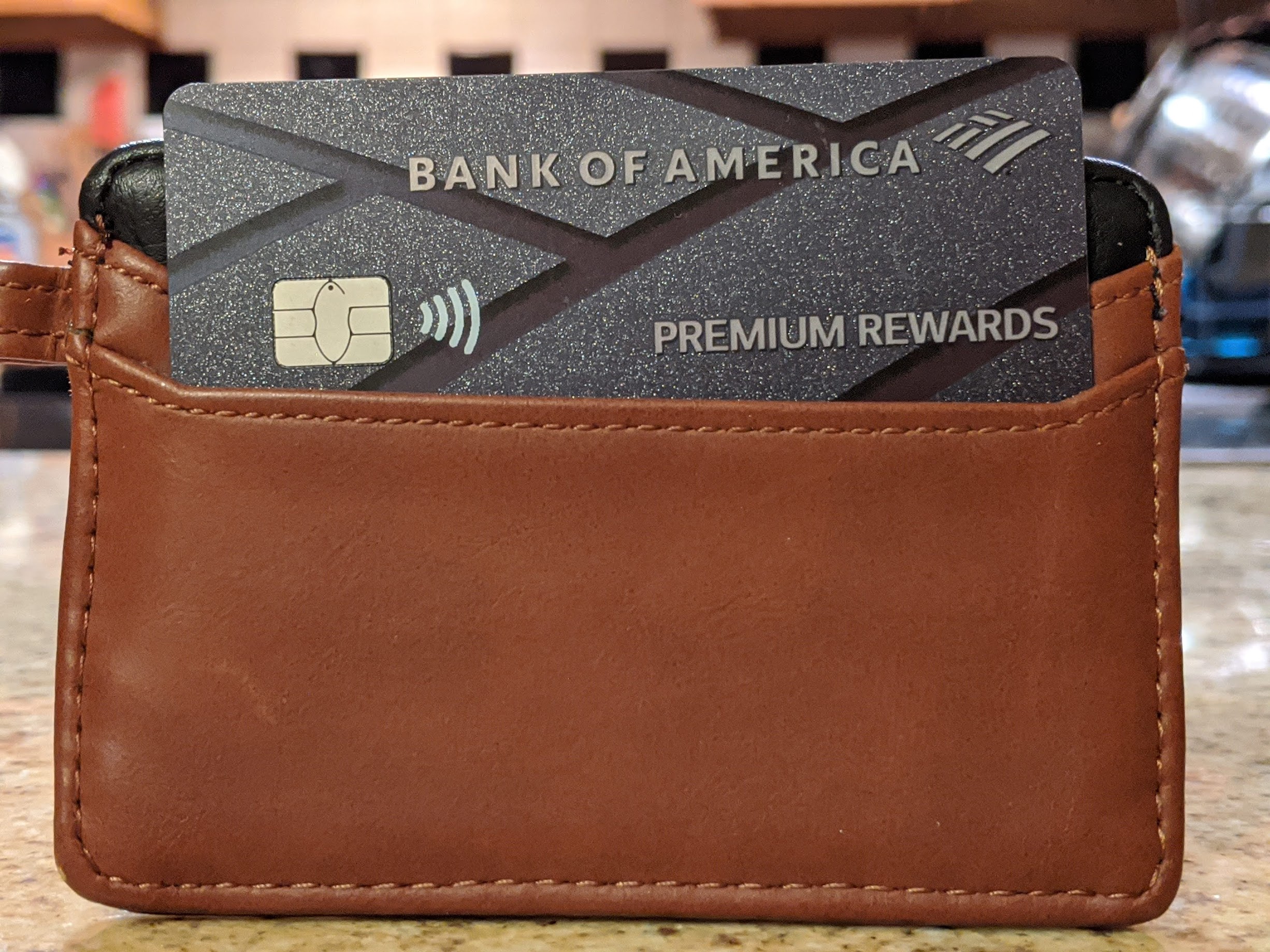

In my case, I have a large monthly insurance bill that goes on the Premium Rewards card and that alone yields a few hundred bucks a year, so I’m very happy with Premium Rewards for that.

The good news is that if you’re downgrading you don’t necessarily need to lose 2.625% cash back if they let you downgrade to the Unlimited Cash Rewards since it also has that earn rate. We’ve also had a number of reader reports of a retention offer of $100 back after spending $1500 in 3 months on the Premium Rewards card. Obviously not as good as a new signup bonus, but between that $100 and the $39.xx you’d ordinarily earn on $1500 spend it comes out to about 9.3% back on that $1500. Worth seeing if you can get it.

BofA Platinum Honors already comes with a free safe deposit box.

Oh damn, you’re right! I never saw it listed as a benefit, but it’s buried there under the waived service fees. Thanks for the heads up.

Nick – you write great posts – but would be easier to follow if you inserted more paragraph breaks

They’ve been heavily promoting the Preferred Rewards bonus with the new Unlimited Cash card. I’d be very surprised to see them cut the benefits so soon after the launch of a new card.

I think the worst case scenario is that they change the tiers and make it harder to qualify.

[…] Read more @ frequentmiler.com […]

[…] Read more […]

Nick, I was going to arrange the Platinum Honors deal but just haven’t gotten around to reviewing and setting up everything. Obviously, it’s not as quick and easy as signing up for a cc. I would be aggravated if I went through all the hoops and then have them downgrade the benefits. Do you and Greg have an educated guess on whether they will grandfather you into the existing benefits or apply the new levels (at some point).

My educated guess is that those who have Platinum Honors when the program changes would likely keep the 75% credit card bonus for at least a year. No real idea beyond that. However, if you haven’t yet set the ball in motion, I don’t think there is enough time. You need Platinum Honors is based on meeting the $100K daily balance for 3 straight months. If you started today, you wouldn’t hit your third month until sometime after the changes come into effect I think since it says November 12th. Even if you had deposited $100K today I’m not sure it would have happened fast enough to happen before, so maybe it’s better to hold off now until we see what happens I guess. Or you move in the money hoping that those working on qualifying will get the existing benefits.

I don’t know how much money she has, but IIRC, depositing $300k will get you the benefits in a month because they know your average will be over $100k. I vaguely remember something like that back when this program was new.

I can vouch for this is how it works. If you deposit $150k you can qualify in 2 months. I got mine in 2 months.

I deposited > $200k and it took about 3 months. I called and tried to explain to them the average balance and got the usual customer service ineptitude.

Deposited $300k+ August 16. Will ave 3 month balance calculation be $100k first week September $300/3 months?

[…] Read more […]