NOTICE: This post references card features that have changed, expired, or are not currently available

Doctor of Credit reports that Chase’s 5/24 rule most likely does not apply to the Chase Marriott Rewards Premier Business Plus card. This is news because in recent months the 5/24 rule was expanded to include all almost all Chase co-branded cards. It’s important and timely news because this card is only available for new applications until February 12th. After that, the card will be re-branded as the Marriott Bonvoy Premier Plus Business card and will be nearly impossible to get. The only way you’ll be able to get it (to my knowledge) after Feb 12 is to product change from the old $45 Chase Marriott business card which hasn’t been available for ages.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

If you have a business, you are eligible to apply

You might not get approved for this card, but apparently 5/24 won’t stop you. The main prerequisite is that you have a business.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Are you eligible for the signup bonus? Probably not.

The offer terms for this card make it clear that the bonus is not available to you under a number of conditions. These terms are pretty clear so I’ve quoted them verbatim. Many readers have either signed up for the SPG Luxury Card or upgraded to the Luxury card recently and so we are ineligible for the signup bonus:

Eligibility for the new cardmember bonus: The bonus is not available to you if you:

- are a current cardmember of this business credit card;

- were a previous cardmember of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months;

- are a current cardmember, or were a previous cardmember within the last 30 days, of The Starwood Preferred Guest® Credit Card from American Express;

- are a current or previous cardmember of either The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card, and received a new cardmember bonus or upgrade bonus in the last 24 months; or

- applied and were approved for The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card within the last 90 days.

It’s important to note that even if you don’t qualify for the bonus, you may be able to open a new account without a bonus.

Downsides to opening the Marriott Biz card

There are a number of downsides to opening this card now:

- If you want to sign up for the Bonvoy Business from American Express card (previously SPG Business), you would have to cancel the Chase business card and wait 30 days. That’s a problem because the Bonvoy Business from American Express card will soon have a 100K welcome bonus. Of course, if you’ve ever had the SPG Business card, you won’t be able to qualify for the Bonvoy Business from American Express card anyway due to Amex’s lifetime rule.

- If you want to sign up for the Bonvoy Brilliant from American Express card (previously SPG Luxury), you would have to wait 91 days after acquiring this card and 24 months after receiving a signup bonus for this card. This may not be too much of an issue if you don’t qualify for the Marriott Biz signup bonus anyway.

- Getting this card may decrease your chances of getting other Chase cards since Chase is sensitive to the amount of credit they’ve extended to each person as well as the number of Chase cards an applicant has opened recently (not just due to 5/24).

Reasons to open the card (even without a bonus)

This is a rare situation where it may make sense to apply for a card even if you won’t qualify for the signup bonus:

- Lock in $99 annual fee (the Amex equivalent card’s fee is going up to $125)

- Last chance to get this card

- Annual 35K free night certificates upon card anniversary (e.g. you’ll get a cert every year except upon signup)

- Chase and Amex $95 Marriott cards are still fair game. The application rules for the $95 consumer cards don’t care about you having or signing up for the Chase Marriott business card.

- Doesn’t add to your 5/24 count. Business cards from Chase are often subject to 5/24 (except in this case), but they don’t add to your 5/24 count.

- Earn 4X at gas stations. Yes, there are better gas station bonuses out there, but this could be important if you care about the next two:

- Earn an additional 35K free night award with $60,000 or more spend per year. I wouldn’t do this, but maybe you would?

- Gold status with $35K account year spend. Gold status isn’t worth much though!

- 15 elite night credits each calendar year: Important only if this would be your only Marriott card.

My Take

Don’t apply if:

- You are planning to sign up for the Bonvoy Business from American Express card (previously SPG Business) once the 100K offer is available; or…

- You want to sign up for the Bonvoy Brilliant from American Express card (previously SPG Luxury) within the next 90 days. E.g. you don’t want to risk missing out on the 100K offer.

Otherwise, if you like the idea of spending $99 per year for a 35K free night certificate, then go for it. If I didn’t already have this card, I would sign up without question.

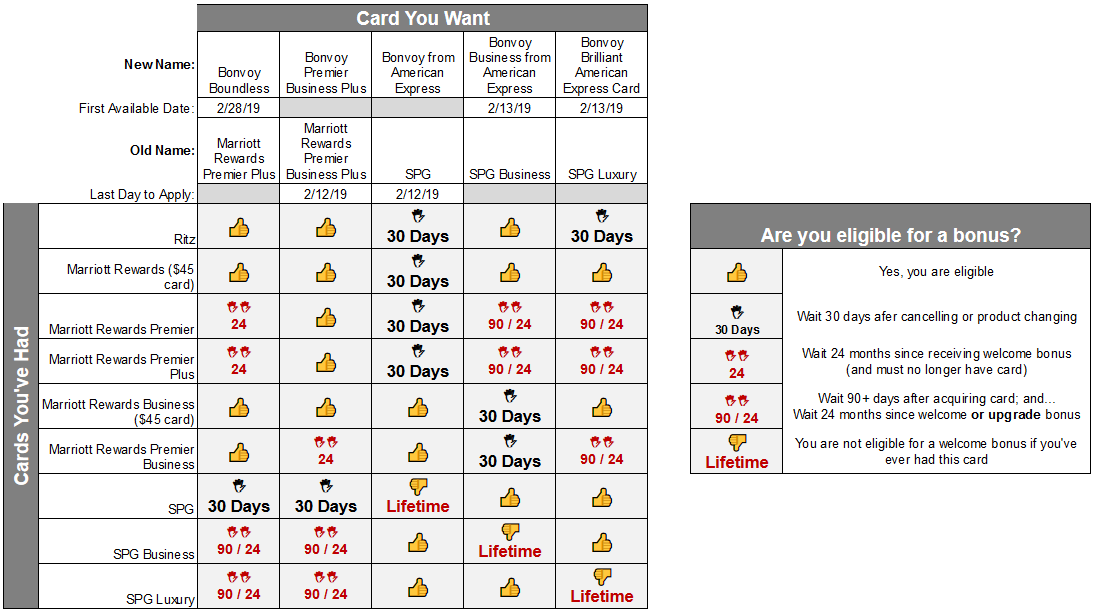

Chase / Amex Marriott Card Rules (for reference)

Greg, at the end of the article you say you would sign up for this card if you didn’t have it. Would you also sign up for this card if you had the SPG Business but not this one (meaning, you wouldn’t get the sign up bonus). Thanks

Yes, but that’s a tougher call. I’d only do so because I’m pretty sure I’ll have no trouble using the certs towards very good value

at what point is too many certs not helpful? Likely my number is going to be different than yours 🙂

Hard to say. For me, it would be the point at which I’d have to go out of my way to use the extra cert each year. Of course, I have no idea what point that is, but I’m sure I’m not there yet.

Hi Greg off topic, but anything you can do to make the email comments clickable in iPhone mail app? The link comes in and you have to copy and paste the link in to get to the comment. Not sure if you’ve seen or not. If there’s a better place to report this let me know!

Hmm. I didn’t know about that. I use the gmail app for email and the links are clickable there. Any other readers know if there’s a trick to making iPhone emails include clickable links?

Hmm, for me, none of these work: gmail from a desktop, gmail app in iOS, stock mail app in iOS.

Screenshot of gmail.com from desktop:

Screenshot of gmail iOS app:

Screenshot of mail iOS app:

Interestingly enough, the link appears clickable only in the stock iOS mail app, but when you click it, the email goes entirely blank. Screenshot:

Hopefully you can work with this information… it looks like the URL isn’t properly formatted in HTML, or the email is being sent in plain text. I’m guessing there is something you can tweak in the email comment extension / settings to this affect?

If you’re in the no-bonus case, would it affect an SPG Consumer upgrade to SPG Lux/Bonvoy Brilliant in the future? I don’t really want to open the Bonvoy Brilliant, and am planning to close my SPG Biz (pretty much taking on the Chase Bonvoy Biz would be my replacement for it)

I don’t think it would affect the upgrade but it would affect trying to apply new for the Lux.

[…] I want to make clear that I’m not trying to determine if it’s worthwhile to apply for this card in the next 14 days before the application links disappear. If you’re interested in reading about that, I recommend this excellent article from Greg on The Frequent Miler, which goes over the pros and con…. […]

[…] with articles about the combined cards and the rules for getting each one. I’ll refer you to this article by Greg on Frequent Miler about whether you should apply for the Chase Marriott Business Premier card or not, since he wrote […]

Thanks for this post! I was just wondering the same question.

Does the Chase Marriott Biz card allow the points to be combined with your Chase account that would have a CSR CF CFU and Ink cards? Unlike the IHG where you can only transfer to IHG.

No, it is specifically a Marriott card. All points go into your Marriott account.

Last summer when the Chase/Amex bonus rules came out having the Chase Ritz-Carlton card seemed to preclude any of the bonuses or was it just the SPG Lux card. Does the Ritz-Carlton card effect this Chase Marriott business card?

No, the Ritz card doesn’t affect your eligibility for a bonus on this card. The only cards that affect it are the SPG cards

FYI, I just got this card about two weeks ago and am way over 5/25.

[…] make you ineligible for the Amex Business card relaunching next month with a 100,000 point bonus. Greg over at Frequent Miler does a very thorough job breaking down the pros and […]

I never understood why getting the bonus for a Chase business card is precluded if you have a personal Amex. Lots of people want a separate business card and Chase is encouraging me to go with a competitor. It makes no sense.

No one really knows but it appears as if Marriott is behind the limitations on stacking bonuses just like they appear to be behind the limitation on stacking free nights.

Sorry, meant “elite nights”

4x is important because it is the best way to generate Marriott points. SO if you’re like me and looking at needing 80K in the next few months for some aspirational redemptions this card is your card.

It’s also the best card to MS Alaska points.

True

And you should’ve included the 4x at restaurants which the non biz Marriott/SPG cards do not earn

Hi Blue. I’m trying to get more alaska pointsto fly my family of 5 to Asia. I have the Marriott business card. How do I ms with this card for alaska points? Thanks in advance!

You do whatever MS you prefer for the 4X bonus, and use the Marriott packages or transfer directly to Alaska.

I was informed by folks on Reddit recently that 5/24 apply for the Marriott Biz. Were they wrong?

Yes. Or things may have changed. People over 5/24 are getting this card.

I wonder if Marriott opened up the spigot to get more in before it closes down permanently.

@Greg, this: “•are a current cardmember, or were a previous cardmember within the last 30 days, of The Starwood Preferred Guest® Credit Card from American Express;” – I currently have the personal SPG card which was opened 2 years ago. I would still be eligible for this Chase card then right (not eligible only if I applied/received the SPG card w/in 30 days)? If I’m reading this correctly. Thanks!

You are a current cardmember so you are not eligible for the bonus.

I still have separate Marriott and SPG accounts. Have you seen any DPs of still getting the bonus on Chase even if you have SPG cards? I could use a new address on my Marriott account, which only has a Ritz attached to it.

Does anyone know of any other Chase Cards w/o 5/24 restrictions? I am out of luck at this point with just about all the banks and cards after doing this hobby for 10+ years.

ANYONE? HELP A BROTHER OUT!

Over on Doctor of Credit, someone claimed that the Aer Lingus card isn’t subject to 5/24. I don’t know if that’s true or not.

Mathew, no I haven’t seen any datapoints on that

I guess the other problem I could run into is my SPG and Marriott are linked together, so even if I can use an alternate mailing address and my original Marriott number to apply, the Marriott number may still realize I have the SPG cards. There is a way to unlink my calling in, hmm…

Didn’t work – could have tried with a new Marriott number and then merge, but eh – risky. “You are not eligible for the new cardmember bonus because you currently have or had a Starwood Preferred Guest card, as described in the eligibility criteria. We have not performed a credit check yet. Would you like to continue your application to get this card without a new cardmember bonus?”