Chase is in the process of jettisoning the simple old way of getting 1.25x to 1.5x value from your points through Chase Travel℠ and replacing it with the new “Points Boost” feature where you can get up to 2x. For flights and hotels, Points Boost has a greater upside, but only when boosts are available. In short, you have a good chance of coming out ahead if you like booking certain flights (especially United flights), and luxury hotels. Unfortunately, Points Boosts do not appear to be available for any Activities, Cars, or Cruises booked through Chase Travel.

Overview

For those who applied new as of June 23, 2025, Points Boosts are the only way to get enhanced point value when booking flights and hotels through Chase Travel with the Sapphire Preferred, Ink Business Preferred, Sapphire Reserve, or Sapphire Reserve for Business cards.

For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.25x (Sapphire Preferred and Ink Business Preferred) or 1.5x (Sapphire Reserve) through Chase Travel until October 26, 2027. During that time, if a Points Boost is available at a better rate, you will automatically receive that better value.

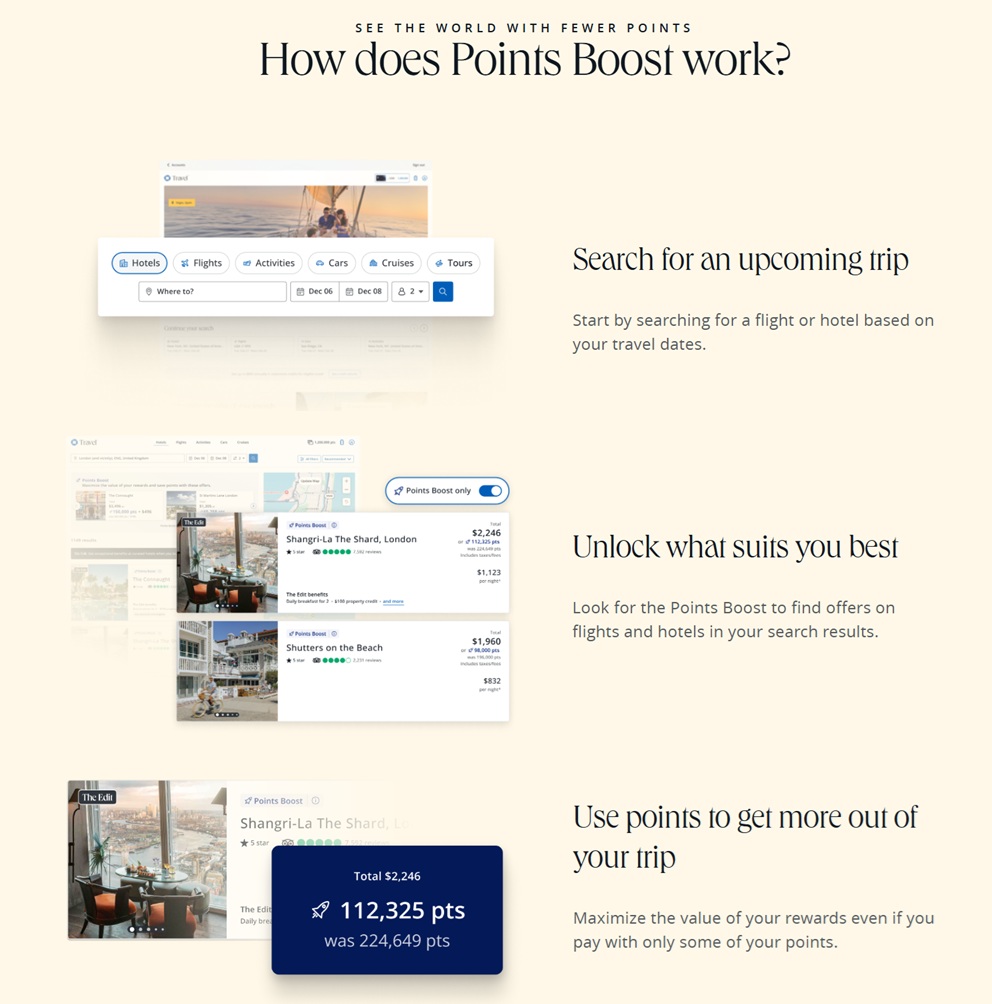

When you search for flights or hotels through Chase Travel, Points Boosts automatically show up in the search results and you have the option to check a box to view only Points Boosted results.

Points Boost Range: 1.25x to 2x

I ran a number of searches when logged in with various cards to see what boost values we can expect. Here’s what I found when Points Boosts were available:

Sapphire Reserve

- Hotel Point Boosts:

- The Edit hotels: 2x

- Other hotels: 1.75x

- Airfare Point Boosts:

- Economy: 1.5x

- Economy Plus & Premium Economy: 1.75x

- Business & First Class: 2.0x

Sapphire Preferred & Ink Business Preferred

- Hotel Point Boosts: 1.5x (The Edit is not available to these cards)

- Airfare Point Boosts:

- Economy: 1.25x

- Economy Plus & Premium Economy: 1.5x

- Business & First Class: 1.75x

Points Boost Availability

Hotels

Overall, availability of hotel boosts varies tremendously by location…

- Sapphire Reserve: Since all of The Edit hotels are automatically boosted to 2x, I found decent availability of hotel Points Boosts in major cities that have a good number of The Edit hotels. In other cities, availability of Points Boosted hotels varied a lot. Some small cities I searched had a decent selection and others had very few or none. In Spain I found 43 Points Boosted hotels in Madrid, 49 in Barcelona, and none in Toledo.

- Sapphire Preferred & Ink Business Preferred: These cards have fewer Boosted hotel options since they don’t have access to The Edit. In Spain, I found 31 boosted hotels in Madrid, 41 in Barcelona, and none in Toledo (but I did accidentally find 1 in Toledo, Ohio).

Airfare

Chase told us that Points Boosts would be available for select airlines (which will change over time) and that the value you get will depend on the cabin-class booked. Specifically, they wrote:

The airlines in the program will change on an ongoing basis. To paint a picture for what cardmembers can expect at launch, they will see airlines including United Airlines, Air Canada, Southwest Airlines, Emirates, Qantas, Singapore Airlines, and more.

The air inventory for Points Boost will include Economy, Premium Economy, Business and First-Class. Points Boost offers for flights are dependent on the cabin classes and offers will range from 1.25x up to 2x based on airline, cabin class and card.

Here’s what I found (your experience may vary):

Points Boost values vary by cabin class as follows

-

- Economy: 1.5x (Sapphire Reserve), 1.25x (Sapphire Preferred & Ink Preferred)

- Economy Plus & Premium Economy: 1.75x (Sapphire Reserve), 1.5x (Sapphire Preferred & Ink Preferred)

- Business & First Class: 2.0x (Sapphire Reserve), 1.75x (Sapphire Preferred & Ink Preferred)

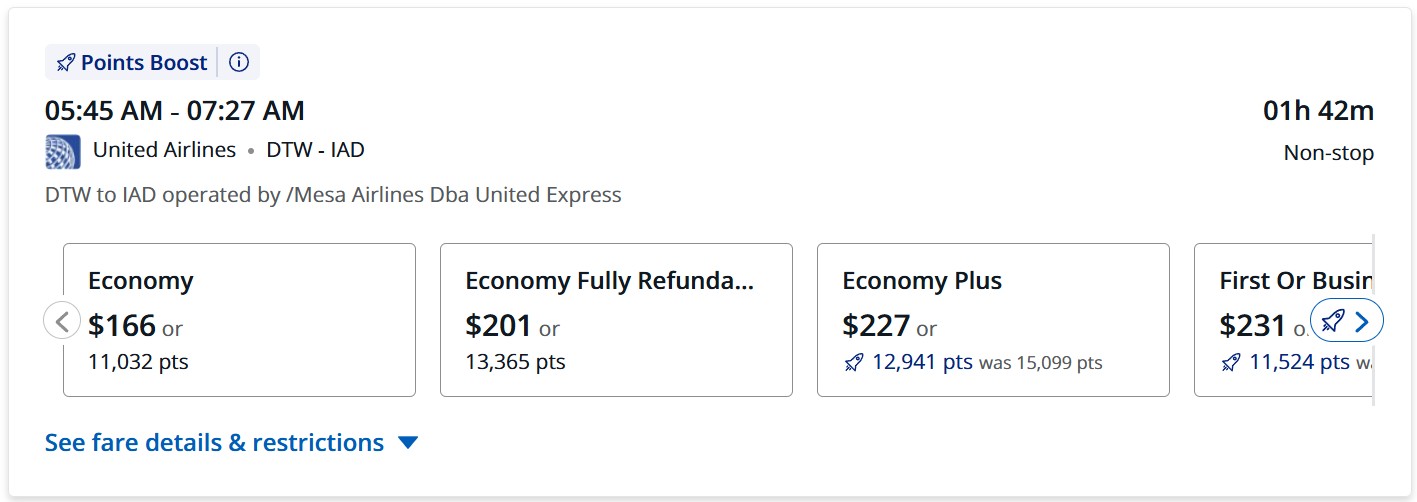

These differential boosts can lead to interesting opportunities where it can make sense to book a higher class of service without paying more points. In the following example, economy and first class can be booked for about the same number of points (just over 11,000 points), whereas Economy Plus costs nearly 13,000 points. If you were planning to book Economy Plus with points, you’d obviously be better off booking first class instead. And since the difference in price between economy and first class is so small, you might as well book first class even if you were planning to fly economy:

Availability of Points Boosts varies tremendously by airline

For each airline that Chase told us would be included in Points Boosts, I didn’t do an exhaustive search for availability, but here’s what I found with the searches I ran:

- United: Points Boosts were available for almost every single flight (I found a few that weren’t boosted, but they were hard to find)

- Southwest: No boosts. I couldn’t find a single Southwest flight with Points Boosts.

- Air Canada: Some flights were boosted

- Emirates: Some flights were boosted

- Qantas: Some flights were boosted

- Singapore Airlines: Some flights were boosted

Reminder: Chase also told us that the list of eligible airlines will change over time.

Deflated Real World Point Value

Point Boost numbers show the value you’ll get from your points compared to Chase Travel’s cash rate. For example, a 1.75x boost means that you’ll get 1.75 cents per point value based on Chase’s determination of the cash rate. Often, though, the cash rate through Chase Travel is higher than found through other options, such as booking direct. In those cases, the effective value of your points is less.

Here’s a real example: Nick was looking at a hotel in New York, listed on The Edit, where the stay would have cost $650 through Chase Travel. Since all of The Edit hotels are boosted to 2x, that would have cost him 32,500 points. But he also found that the same hotel cost only $530 when booking directly through Marriott. If you forget about the extra perks that The Edit offers, you could argue that when booking the $650 stay through Chase for 32,500 points, Nick would only get 1.63 cents per point value when comparing to the true cash rate ($530/32,500).

Of course, there’s nothing new about this. With the old approach where Sapphire Reserve cardholders could get 1.5x for all redemptions through Chase Travel, the effective rate was often less due to Chase having inflated prices.

Inflated hotel prices: In my recent deep dive into The Edit, I found that many hotels were overpriced (but not usually by as much as Nick found), but a few were about the same as booking direct.

Inflated flight prices: In a quick look at flight prices I found that economy flights were often overpriced through Chase, but business and first class prices matched what I found on Google Flights. Caution: I didn’t do a very thorough analysis. This finding was based on 10 or so datapoints.

My Take

The Winners

The winners in the new scheme (besides Chase) are those who like to book luxury hotels through The Edit, and premium cabin flights, especially on United Airlines.

Luxury Hotels (when boosted)

I separately did a deep dive into The Edit and found that if you can live with the relatively small number of hotels available on the platform, it should be possible to do really well. If you have either the Sapphire Reserve or Sapphire Reserve for Business, you’ll get access to The Edit hotels and you’ll get 2x boosts on all of them. When pricing through The Edit isn’t too far above the cost to book direct, you’ll get excellent value from your Chase points by booking this way and you’ll still earn hotel rewards and elite benefits at participating chain hotels.

Premium Cabin Flights (when boosted)

When I compared flight prices found through Chase to those found on Google Flights, I saw that economy tickets often cost more through Chase, but business and first class was usually exactly the same. If this generally holds, it means that the boost amounts are truly the value you’ll get. So, for business & first class flights you’ll get 2 cents per point value with the Sapphire Reserve or Sapphire Reserve for Business, and 1.75 cents per point value with the Sapphire Preferred & Ink Business Preferred. Either way, that’s good value.

Finding boosted flights can feel like a lottery unless you’re looking to fly United Airlines. In my experience, almost all United flights appear to be boosted. For those who fly United often, points boosts can be a great way to use your points.

The Losers

Activities, Cars, or Cruises

Travel booked through Chase in these categories is not boosted at all. If you don’t have grandfathered 1.25x or 1.5x redemption power, then there’s no reason to ever redeem points for these as you’ll only get 1 cent per point value.

Unboosted Flights & Hotels

Under the new scheme, you’ll only get 1 cent per point value (compared to Chase Travel’s prices) when flights & hotels aren’t boosted unless you have grandfathered 1.25x or 1.5x redemption power.

Final Word

With my old Sapphire Reserve card, I hardly ever redeemed points through Chase Travel. In my opinion, 1.5 cents per point wasn’t enough value to be worth the pain that travel portals tend to incur (inflated prices, lack of ability to apply membership or coupon discounts, lack of hotel point earnings, finger pointing between the portal and the travel provider when things go wrong, etc.). With the new scheme, though, I probably will look for opportunities to use my points for 2 cents each towards The Edit hotels and premium cabin flights. For the former, you do earn hotel points and elite credits for stays at The Edit hotels (or at least, you should once Chase fixes issues people have reported). For the latter, when discounted business class fares are available, it can be a very good deal to book with a 2x Points Boost and earn airline miles for the flight.

So, for me, Points Boost seems to be a good thing. For anyone who liked taking advantage of the old 1.25x or 1.5x scheme, it’s mostly bad news. While there will be a few opportunities to do better than before, there will be far more “opportunities” to get terrible 1x value. In those cases, even if you want to book through Chase Travel for some reason, you’d be better off paying for the booking with your card in order to earn points, and then redeem points for cash for the same 1 cent per point value in order to pay your credit card bill. Or, better yet, take advantage of the ability to Pay Yourself Back for 1.25x to 1.5x value for select non-travel spend.

Frequent Miler team, you should probably revisit this topic. First explain that the points boost is really just a discount, the points are not boosted. And for last two months I’ve been tracking prices for select hotels mostly in USA some in Spain. I found Chase typically higher than the direct price by 7%-15%.

Chase likely is now the scummiest program of the big four. They’d rather spend money on marketing than actually deliver value to customers.

I tried to book LAX-MCO today and was pleased to see “Boost” offers of first class less than 25K points each way (with an unboosted premium economy seat still above 20K). But when I got to the seat assignment, it showed first class fully booked. The United site showed many seats available. If there were no seats available to Boost, then Chase is wasting my time by showing me an offer I cannot redeem. But of course they have to show me impossible Boost offers because there are so few options to begin with. If they were truthful, there would have been one or two flight offers available.

I thought this was a fluke, as I was looking 3 weeks out, so I kept going, and saw the same offer all the way through October – First class seat for a steal (yet no seats available). I gave up the search, as my head was sore from banging it against the wall.

For the past year, we have been told that the government wants to destroy the credit card points system with the Credit Card Competition Act.

Chase said “hold my beer” and cracked their knuckles…

So far, my searches are yielding moderate hotels at considerably higher prices than on the hotel brand websites. I looked at the Exeter Hotel in Reykjavik, a Mr. and Mrs. Smith Property. The price on Hyatt was roughly $289 (when converting euros to $$) or 18,125 Hyatt points (~1.6 CPP) but the price with taxes and fees on Chase was $333.5/night or 22,227 (1.5 CPP with a points boost).

This is annoying. Just means I have to run every search in both places before I can book hotels and flights now.

[…] Welcome to the new “enhanced” way to redeem your Chase points: (Update) Chase Sapphire Reserve ‘Points Boost’: Removes 1.5% Travel Redemption, Adds Boost Feature For 2% On Select Travel. It is interesting. But it is only the beginning, I expect it to get worse, way worse: Evaluating Chase’s new Points Boosts. […]

I only book luxury hotels with Chase @ 1.5x I can’t use chain points & elite benefits (Marriott; Hyatt; Hilton; Sonesta). Boutique independents almost always. Since inception of their program, my many Chase bookings haven’t been significantly higher than the AMEX, C1, or Citi portals but instead a LOT more discount with the .33 off. My 7 bookings didn’t increase in price at all yesterday (& in 2 cases now have a discount over 1.5 so I’m changing those). Until AMEX particularly changes their pathetic redemption value I’ll still use Chase until their pricing otherwise changes my behavior. Harder points to earn but they remain my favorite for booking nice independents.

Has Chase said if Points Boost is available if a routing includes 2 of the eligible airlines? For example, PDX-YXU would include both AC and UA.

No, they didn’t say.

After checking that example it shows up as a codeshare anyway. Maybe there aren’t many real cases of mixed airlines

I believe you are being either lazy or disingenuous. “Points Boost” is merely a trick, a misdirection, attempting to distract suckers from the epic and massive devaluation they’ve just made.

I’ve done a LOT of homework on the real-world results – I’ve just spent most of the past 36 hours comparing the real-world “new” costs to pre-devaluation costs – on many, many dozens of flights and an equal number of hotel stays. It is NOT good news.

As luck would have it, I have been on a tare in recent months booking a lot of international trips, almost all of them with Chase Ultimate Rewards (one way or another). In some cases I transferred UR points to United, Air Canada and other airlines on the so-called “points boost” menu (and others that are not), then booked award flights directly. A handful of bookings were made for flights on Chase’s travel portal, for connecting/positioning flights where booking with points directly was not an option). I’ve also used Chase URs to book a wide, wide range of hotels and other accommodations around the world (across Europe, South America, and Asia, from glitzy big-name luxury hotels, to small boutique accoms in far flung corners of the globe – from Italy to Thailand To Chile and more; I don’t have any interest in staying in low-end motels or in mega chain resorts, though I do enjoy a luxury city hotel occasionally…mostly I prefer mid- to upper-end places that have charm, character and are well located). My stays were booked via Chase’s travel portal and “paid” for with points, taking advantage of the 1.5X “boost” we have always got from having the CSR card.

In the last 36 hours, I must have looked at – and compared – prices for over a hundred flights and nearly as many properties. I compared (mostly) what I had paid for previously, in a handful of cases I also compared the “prices” I saw a few days ago (but had not yet booked) – right BEFORE the devaluation.

In all cases I compared those pre-“points boost” prices (with my 1.5X “boost”) to what I can now get with the oh-so-much-hyped “points boost” which in theory gets you up to 2X (but in practice seems to be a “negative boost” once you factor in the actual price).

My conclusion: Prices for everything booked through the Chase Travel Portal have simply gone up, by a little, or by a lot. Every single hotel, B&B or boutique accoms I looked at is now more expensive than it was before the devaluation. Every. One. How much have prices gone up? It varies quite a bit so its hard to generalize, but I’m finding prices have generally increased by at least 5%, and in many cases much more. The average price increase seems to be in the range of 10% to 20% but there were some cases where prices had shot up by more than 50%. I found exactly zero properties whose prices had not increased. None had gone down, none had held steady. All have gone up – every single one of them (I compared same dates, same rooms, for rooms I had previously booked or had been looking at).

For flights booked through the Chase Travel Portal, things were equally grim. Typically when I book flights, I use miles/points and book award flights directly with the airline or its partners. All are long-distance, international flights in business class. Sometimes I transferred Chase UR points to the airline first, but I always booked those (award) flights directly with the airline, using miles/points, never paid $$$ directly for those flights, and never used the Chase Travel Portal to “buy” premium-cabin, long-distance flights using UR points. I did regularly book shorter flights on the portal with Chase points (for positioning or to make logical regional connections, when award flights were not available, typically on smaller or low-cost carriers) – but I’ve never paid with URs on Chase’s site for a premium cabin flight – that has historically been a terrible way to burn points (and continues to be).

Again I compared dozens of flights that I had already booked (award flights, booked directly through the airline or partner), and also flights I have been stalking and planning (or hoping) to book in the weeks ahead. Those were compared against what it would cost me now to book the same flights while paying UR points thru the Travel Portal. I checked a LOT of flights.

The comparisons were equally disappointing. It would cost a heckuva lot more (sometimes stunningly large numbers) to book flights using URs on Chase travel portal. I saw costs approaching 1 million points in a few cases (got my attention there). In general, the costs in points for booking flights via the Chase portal were 20% to 50% higher than what it would cost to book awards directly with an airline. Every price was higher, often a LOT higher. I found not a single case where it would be cheaper to book a flight via Chase.

I also found a couple cases where a flight I previously booked via Chase (and still hold a valid ticket for in September) are no longer even being offered via Chase (in this case, Ryanair…maybe they are still working out details).

Chase has thrown us a bone – which is actually just a fig leaf – about the massive devaluation, by saying that we can use our points and still get the 1.5X boost until October 2027. That may be technically correct, but is fundamentally dishonest: because when they deployed this “upgrade” at the same time they raised prices across the board on virtually everything. So sure, enjoy your 1.5X for a little while, but the prices you are going to pay have gone up so much that you’re paying more now, even if you get the so-called “2X points boost”.

Yes, it’s true that for OTHER ways of using Chase points, there has been no evident devaluation (at least none that I’ve seen that is directly tied to this). You can still transfer points to various airlines, to Hyatt, etc. Those transfers have not been devalued, at least not by Chase (though the prices charged by airlines have certainly been going up up up).

Bottom line: What Chase just did was gut the program, massively devaluing the entire Ultimate Rewards points – and raised ALL prices, then offers a “Boost” in the value of your points, but that’s an illusion: you are still paying more – often, a LOT more – than you would have last week. A price increase is a price increase, and that’s what this is. All the hype, all the noise, all the spin, it’s just a distraction and mis-direction (and typical con man techniques).

“Points Boost” is just marketing spin, intended to distract and fool suckers into believing that the prices you’re paying didn’t just go up.

Of all these hotels and flights you searched for that became more expensive on Chase Travel, did you also compare previous and present prices when booking through other channels?

Yes, I did, on some of them.

On the hotels I cross-checked on booking dot com, for example, the prices have not changed there. (I did not do an exhaustive search, it quickly became pretty obvious who had increased prices across the board and who did not).

I also cross-checked the “prices” (in points) for award flights, comparing the cost on the airlines’ website (using their own miles) versus the price (in URs) when “buying” the same flight on the Chase portal. The prices on the Chase portal were (are) much higher. To keep it simple I just assumed 1 Chase UR = 1 mile on transfer partners United/Air Canada (which is not always completely true, but is close enough most of the time – there are occasional transfer bonuses, which I did not account for).

The price (in URs) when booking flights through Chase seem VERY much inflated (dramatically so, and way more than the increase in prices for hotels).

Seems pretty evident what was on Chase’s checklist over the weekend:

Raise prices, then declare a temporary “sale” to distract and misdirect.

Oldest trick in the book.

You can say a lot of things about the people who run this site, but “lazy or disingenuous” aren’t on the list. They even acknowledge the flaws in the new system, so while you can disagree on how far to push the positives, I’d call your initial opprobrium pretty hyperbolic.

The points boost is only available on select flights for select fares. It’s not the entire flight. So yeah it’s available on most United flights but only premium fares. Which is insane

I think it is good for card holders as 1.5x rate for other hotels that is better than 1.25x and for flights in economy still 1.25xbut they just have star alliance with Qantas. Please add avios

Checked some rates on my csp and super bad I think you guys might want to push the rrv down

Are other new benefits available now to old reserve holders, like the apple subscription or some of the twice per year perks that the first one expires June 30th, if so I’d best get busy…

No, the other benefits don’t come online for pre-June-23 cardholders until October 26

What about comparing Reserve versus Preferred to get the best value.

I quickly found a 1.75 Points Boost at a Category 3 Hyatt Place at a rate that was nearly identical to what was listed on Hyatt’s website across multiple fare classes (fully refundable, prepaid, etc.)

And given that an Ultimate Rewards transfer to Hyatt required 9K points per night, I was more than happy to pay 7.7K/nt through the Chase portal…if my math is correct, that’s a 14% savings.

To top it off, all of the surrounding “big 4” properties were 30 to 80 percent more expensive per night, despite it being a holiday weekend with a big conference at the convention center and a major league baseball team at the downtown ballpark, both within walking distance.

Not all The Edit properties get the Boost to 2%. Just did a quick check in Phoenix which is the closest to me for end of Oct and the Grand Hyatt Scottsdale came up with only 1.75% Boost. All the other Edit properties that came up were at 2%. Chase rate was $10 more than Hyatt rate so property credit gives you a little extra benefit even if already Globalist.

Thanks for this. I can confirm that you’re right about that. I sent that example to Chase to ask them what’s up. Hopefully its just a bug that they’ll fix.

Thanks for confirming and forwarding! I wondered if it was a Hyatt specific setting but it doesn’t necessarily appear so. I did a random search for NYC for the same dates and the Hyatt Edit sites all showed 2%.

Chase replied already. They wrote: “Thanks Greg! We appreciate you flagging to us. This should be 2X and it’s being fixed now.”

Hi Greg, thanks for this, Points Boost is interesting to me as I do use United for premium cabin and 1.75x is pretty decent. But my main issue is what happens in case of cancellation, irrops etc, as you point out “finger pointing between the portal and the travel provider when things go wrong” can be a drawback to booking using a travel portal. It’s why I sometimes hesitate to use it myself or recommend to others. So my question is, would you consider doing a post on how to avoid these issues or the best way to deal with them should they arise. In particular I like to book refundable “good enough” paid fares and hope cheap awards open up closer to departure. But I need to be confident that cancelling the travel portal ticket won’t be a huge hassle for the refund! Thanks!

That’s a good idea, but I don’t have enough experience with booking through portals to be an authority on how to avoid those issues. Points Boosts might change that though!

I’ve used the portal a lot over the years, as I like it for booking with points “in lieu of cash” for cash fare tickets that come with favorable fare rules like free stopovers and “combinable” fares (a couple favorites: SFO-PEK//MEL-SFO for 30.6K points, and SFO-ALG//TUN-CDG-SFO for 36.7K).

You’ve got a common concern. What I like to tell people is that most of the time it’s not an issue, so it comes down to the law of averages….if you have an issue only once every 20 bookings, the question is whether the savings from the other 19 makes it worth it.

That’s a highly personal answer that depends on your expectations, but deals like the ones I mentioned above keep me returning to the Chase portal for points redemptions that don’t exist on any other platform that I’m aware of. (And if they were bookable with the new 1.75 CPP Points Boost, those two examples would only be 26.3K and 31.4K, respectively!)

Having looked at a hundred+ fights last night (I really need to get some sleep…) there are other issues, too: Many flights booked through the Chase portal do not include seat selection. Even super-spendy, business class tickets – you can not chose a seat before check-in. That’s a deal-breaker for me. Look very carefully at any flights you might be tempted to book there before you click the “Buy” button.

PS: The actual prices for flights are sky-high on the Chase portal, even with “Points Devaluation Boost.” For my half-million points, I want to be able to choose a seat.

Booked an Edit Hotel using Points. Tried to add the hotel Reservation number listed on the Chase site to my Marriott account but got an error saying “We’re experiencing a technical issue. Sorry for the inconvenience. Please try again later.”

With this change, why would you ever use the Chase Travel portal to book anything that isn’t “boosted”, since most of them are priced somewhat higher than you can find elsewhere?

Correct. But, know that all hotel bookings via the Edit are boosted to 2cpp.

Exactly. You should never book travel that isn’t boosted (unless you want to use a travel credit like the $500 travel credit that’s part of the current CSR offer or the $50 CSP travel credit)

Citi travel and cp1 travel are pretty cheap(citi cheaper for my Citi csp)but chase and Amex never book unless points boos or 35 rebate