Chase has arguably long offered the best automatic travel protections of any card issuer. This has been especially true for Sapphire Reserve and Ritz cardholders who get what I often describe as “best in class” protections such as 6 hour trip delay coverage and emergency medical & dental. But even lesser cards like the Sapphire Preferred and many of their airline and hotel branded cards have very good travel protection benefits relative to competitors. Chase probably still has the best credit card protections, but in some cases they’re not what they used to be. One feature that many Chase cards offer is Trip Cancellation insurance. It used to be the case that if you paid for all or part of a trip to their card, you were fully covered for this benefit even for parts that were not paid for with your card. Now, that’s no longer the case…

Pay Partial: Less useful for trip cancellation insurance

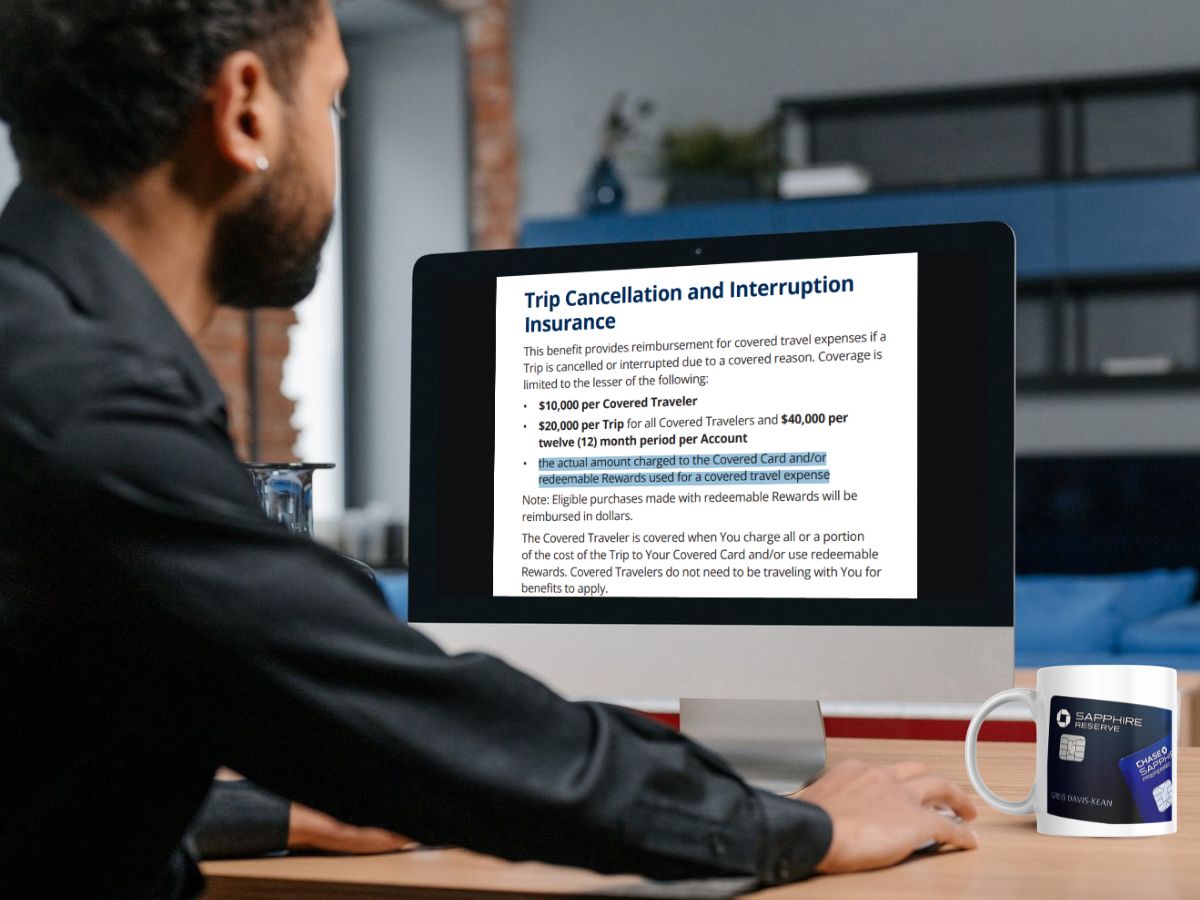

One of the reasons I routinely use my Sapphire Reserve card to pay fees associated with award bookings is that many of the travel benefits are fully covered as long as you pay any part of the trip with your card. That’s still true except with trip cancellation insurance. With trip cancellation insurance, the new benefit guide claims that the traveler “is covered when You charge all or a portion of the cost of the Trip to Your Covered Card and/or use redeemable Rewards,” but it also states that coverage is limited to “the actual amount charged to the Covered Card and/or redeemable Rewards used for a covered travel expense.”

Previously, you could charge just the fees on an award booking to the card and you’d be fully covered for your whole trip even if you didn’t charge things like prepaid hotel stays, cruises, etc. to your card. Now, to get full coverage, you’d have to pay all non-refundable bookings with your Chase card. In many cases, that makes sense to do anyway, but not always. Maybe you could save money by buying discount hotel or cruise gift cards, for example. In the past, you could claim all of that, but now you’d be limited to just the amount actually charged to your card.

I believe that you are still fully covered for Trip Interruption as long as you use your card to pay for necessary trip recovery expenses (change fees, one-way rental car drop-off fee, etc.) since those expenses would add to the “amount charged to the Covered Card”.

I found similar language on all of my Chase cards that offer trip cancellation and interruption insurance: Ritz, Sapphire Reserve, Sapphire Preferred, Ink Business Preferred, United Gateway, United Business, IHG Select, IHG Premier Business, World of Hyatt, World of Hyatt Business, etc.

I wondered about the part that says coverage is limited to… redeemable Rewards used. When booking an award flight, would they somehow account for the value of the miles used? I called Chase to ask and was forwarded to their claims department. There, I was told that the “redeemable Rewards used” refers to paying with credit card points, and does not consider other rewards such as miscellaneous airline miles.

Pay partial: still effective for other travel coverage

The good news is that I did not find similar language on other travel protections. Specifically, with the Sapphire Reserve card at least, all of these protections are still fully covered when you pay partially with your Chase card:

- Baggage Delay Insurance

- Lost Luggage Reimbursement

- Trip Delay Reimbursement

- Travel Accident Insurance

- Emergency Medical and Dental

- Emergency Evacuation and Transportation

Not that bad

I believe that Chase’s changes only affect situations where parts of your trip are non-refundable AND where you didn’t use a Chase card to pay for that portion. So, for example, if you plan to book a non-refundable cruise with discounted gift cards, paying partially (or entirely) for the flight to get to the cruise with your Chase card won’t help to recover the cost of the cruise. That said, if the cruise has a change fee that you can pay instead, I think you would be covered for that as long as you pay for the change with your Chase card.

Other options?

I haven’t yet found another credit card option that offers full trip cancellation coverage when paying partially with your card. There are a few that offer full coverage if you pay with your card and/or with rewards associated with the card, but none that I’ve found that offer full coverage when only pay a small amount with the card or the card’s rewards. If you find one, please let us know! In the meantime, I’ll still use my Sapphire Reserve to pay partially for travel but with the knowledge that I’m no longer effectively covered for any losses above the amount charged to my card or paid with Ultimate Rewards points.

[…] Now, Chase has updated the language to specify: […]

So if I have a cancellation/delay and need hote? I should pay cash on the CSR instead of redeeming points so I can recoup those charges and save my points? And as long as I don’t exceed the coverage limits, I can theoretically stay as nice of a hotel as I like and I will be covered? What if I’m forced to buy another flight so I don’t miss a cruise. Is the new flight reimbursed?

Yes, pay for trip interruption expenses (including airfare) with the CSR after verifying that your situation is eligible for that coverage

Awesome! Thank you Greg. I really appreciate it.

So if i were to pay using some of my UR points from CSR and use a non chase card, would I get the other perks like the delay and baggage insurance or I need to split the payment between the chase and non-chase card? Thanks

My understanding is that paying with UR points should be treated the same as if you paid with the card those points are associated with

[…] Chase partially tanks “pay partial” trip cancellation insurance by FM […]

Greg, it might well be that there has been no change at all. The prior terms and conditions state:

The Trip Cancellation and Trip Interruption benefit provides reimbursement for Eligible Travel Expenses charged to the Cardholder’s Account up to ten thousand ($10,000.00) dollars per Covered Person and up to twenty thousand ($20,000.00) dollars per Trip, . . . [Emphasis added.]

The new terms and conditions state:

Coverage is limited to the lesser of the following: • $10,000 per Covered Traveler • $20,000 per Trip for all Covered Travelers and $40,000 per twelve (12) month period per Account • the actual amount charged to the Covered Card and/or redeemable Rewards used for a covered travel expense

Maybe I’m wrong but both seem to say that coverage is limited to the amount charged to the Cardholder’s Account, as opposed to affording full coverage for partial payment.

I agree. Although some people have said even a partial charge to the card covered all charges, I read the Guide to Benefits the same way you did.

I tend to agree with this

As clear as mud! I still don’t gave a clue as to what is actually covered nor do I have a clue as to what you supposedly tried to clarify

Read the Card Benefits Terms and Conditions.

I also learned today that non-refundable tour/museum/etc. bookings aren’t covered by this 🙂 (even with old terms). I was worried that on an upcoming trip I was putting my tour bookings on the wrong credit card to be covered via trip cancellation insurance, but seems like it wouldn’t have mattered regardless.

Tours are covered, but not events/museums.

Covered expenses are: “Non-Refundable prepaid travel expenses charged by the Travel Supplier.”

Travel Supplier: “Travel Supplier – a travel agency, or Tour Operator, Common Carrier, or Provider of Lodging, or occupancy provider, or rental car agency, or Rented Recreational Vehicle Provider, or commercial recreational excursion provider.”

Tour Operator: “Tour Operator – an entity which organizes travel components into packaged arrangements for sale directly to the travelling public.”

So the tour would have to be something like an excursion to Stonehenge that includes the bus ride. But not a guided tour of some landmark that you simply walk to, like an old building in a historic downtown.

Exclusions for the museums, etc. specifically states: “Event Tickets or prepaid fees to theme parks, museums, golf courses, or other points of interest are not covered unless such expenses are included as part of a travel package.”

Gotcha that makes sense to me and an important note (the travel component part of the tour). In my case, I was making champagne house tours, so wouldn’t have been covered 🙂

[…] Chase partially tanks “pay partial” trip cancellation insurance by FM […]

The most surprising thing about all of this reaction is that nothing has changed. Paying any amount always “activated” the coverage, but only up to a policy limit of what you paid or the $10k/$20k ceiling (whichever was less). Did everyone just read past the very first sentence in the previous guide where the benefit is described?

It was always the case that the maximum you could claim was what you charged to the card or paid in UR (or United MP, or Hyatt points, etc earned on Chase cards). The new guide to benefits just re-writes this in bullet point form to add additional clarity to the exact same terms.

The definition of rewards also did not materially change. It’s always stated they only count points directly earned through Chase cards or their affiliated partners. This allows your United flights booked with MP to be covered regardless if the MP were acquired through flying or UR transfers, but not your Emirates flight booked with Skywards after transferring over UR and possibly MR or TYP.

The reality is that claims are statistically unlikely events, and most people have blissfully been traveling under the assumption they had protection for things that were never actually covered under the terms.

I tend to agree with you. I was reading the old terms independently from this a few months ago and I interpreted it as trip cancelation/interruption ONLY providing coverage for expenses “charged to the Cardholder’s Account”.

With the new terms “the actual amount charged to the Covered Card and/or redeemable Rewards used for a covered travel expense”

I think they are just clarifying this in the update.

I purchased partially 2 refundable “saver fare” tickets on Alaska Airlines and had to cancel due to a family emergency, with a Sapphire Preferred Card. Does this count for a refund?

If they’re refundable, why not just cancel and get the refund? Or are you asking if your other trip expenses are covered?

Alaska Saver fares are non refundable although there is a partial refund policy under certain circumstances which do not apply to me.

Do you know when this change took effect and whether it applies to cruises booked prior to the change? Thank you.

Most coverage is on a “claims” basis, which is WHEN the claim arises. Your claim would arise when the cancellation event occurs . . . as opposed to when you booked it. You can double-check this but that’s my sense.

IANAL, but this is not true based on my reading of other people’s analysis. The insurance coverage applies based on when the purchase is made. This should make sense because if you purchase a ticket with a card with insurance and later cancel the card, your trip is still covered by the insurance from that card (the terms are a bit wonky to read, but this is true). The same is true for extended warranty and purchase protection. When you make a purchase with the card, you agree to the contract at that moment, basically, and they can’t change the contract out from under you (since the contract doesn’t state that they can change the terms); you accept the new terms when you make the next purchase with the card after the effective date, 10/1/2024, and the new terms apply to those purchases.

In regards to covering airline miles: My understanding is that they still cover “redeposit fees” allowing you to cancel and redeposit your miles used in the setting of trip cancellation.

I just confirmed the language for the capital one venture x, and I’m pretty sure that they’ll cover the cancellation up to $2000 per person if you pay the full amount less rewards (this has worked for me in the past when paying just $5.60 in fees, and I think the language is still the same). So it sounds like the venture x now beats out Chase for trip cancellation. Unless I’m reading it wrong.

https://www.capitalone.com/credit-cards/benefits-guide/

Do you mean your Capital One rewards? If so, I agree.

I clicked on “Visa Infinite” at your link to view the terms.

It doesn’t appear to cover you when you use separate airline miles: “You charge the entire cost of the Trip using Your Account, less redeemable certificates, vouchers, or coupons, or rewards program associated with Your covered Account.”

I don’t consider my AA miles to be “redeemable certificates, vouchers, or coupons,” and “rewards program associated with Your covered Account” specifically means your Capital One miles/points.

Though if you’ve been reimbursed for using external miles, I’m interested in the datapoint.

Also, this coverage is only for the Common Carrier ticket, i.e. your transit. It does not cover hotels like Chase and some others do.

In January 2024 I was approved for a $1,000 delay claim for 2 passengers at $500 each on a Venture X. Our flights were on United metal and purchased using Air Canada Aeroplan miles with a Venture X (personal) covering the taxes and fees.

That’s a great datapoint. Thank you!

I’m concerned or skeptical about the “redeemable Rewards used” part.

If I book a flight with points, and pay the small fee (9/11 taxes, etc) with my CSR, and I have to cancel for a covered reason, what happens to those points? (Let’s say I’m not able to cancel in advance — I’m in a coma for 3 days.)

What if SOME, but not all of the points were transferred from Chase? What if it’s a mix of transferred points and points I earned in other ways? How do they know “which points” I’m using?

Am I only getting my fee of ~ $6 back and nothing else?

I might be wrong but I think someone answered that question below. The points being covered are Chase points used to book on the Chase travel portal . . . and NOT Chase points transferred to a loyalty program.

PS – Greg just wrote in a comment that he will tweak the article to emphasize this issue only affects non-refundable fares. Separately, I guess a question is: which airline loyalty program (other than Etihad) is not going to credit back your points should you cancel an itinerary?

If you’re in a coma for three days, are lost points really going to be top of mind? But, I suspect the loyalty program would be sympathetic to your situation.

Thanks Lee!

Most points of course you can cancel up until right before the flight, of course, so I was trying to think of a scenario where you are unable to cancel and lose your points.

I believe Iberia is also non-cancelable for partner awards.

Following up, I reviewed the terms and conditions and found a few notes for you. Hope this helps.

– Chase points used to pay for a canceled trip will not be restored but you would receive cash instead at the rate of 1cpp. The downside is if the booking took advantage of the CSR’s 1.5cpp rate.

– Just to confirm, loyalty program redeposit fees are covered. However, they are silent as to points on non-cancel awards. I’d suggest that while an award might be non-cancel, it might be changeable. And, initially, just move it as far in the future as possible to keep it alive, then move it again to the flight you would actually take.

Covered loss (among others):

Accidental Bodily Injury, Loss of Life, or Sickness experienced by You or Your Traveling Companion which prevents You or Your Traveling Companion from traveling on the Trip

The death or hospitalization of You or Your Traveling Companion’s Host at Destination

It would be nice to have a lawyer familiar with contract language review the terms for the premium credit cards.