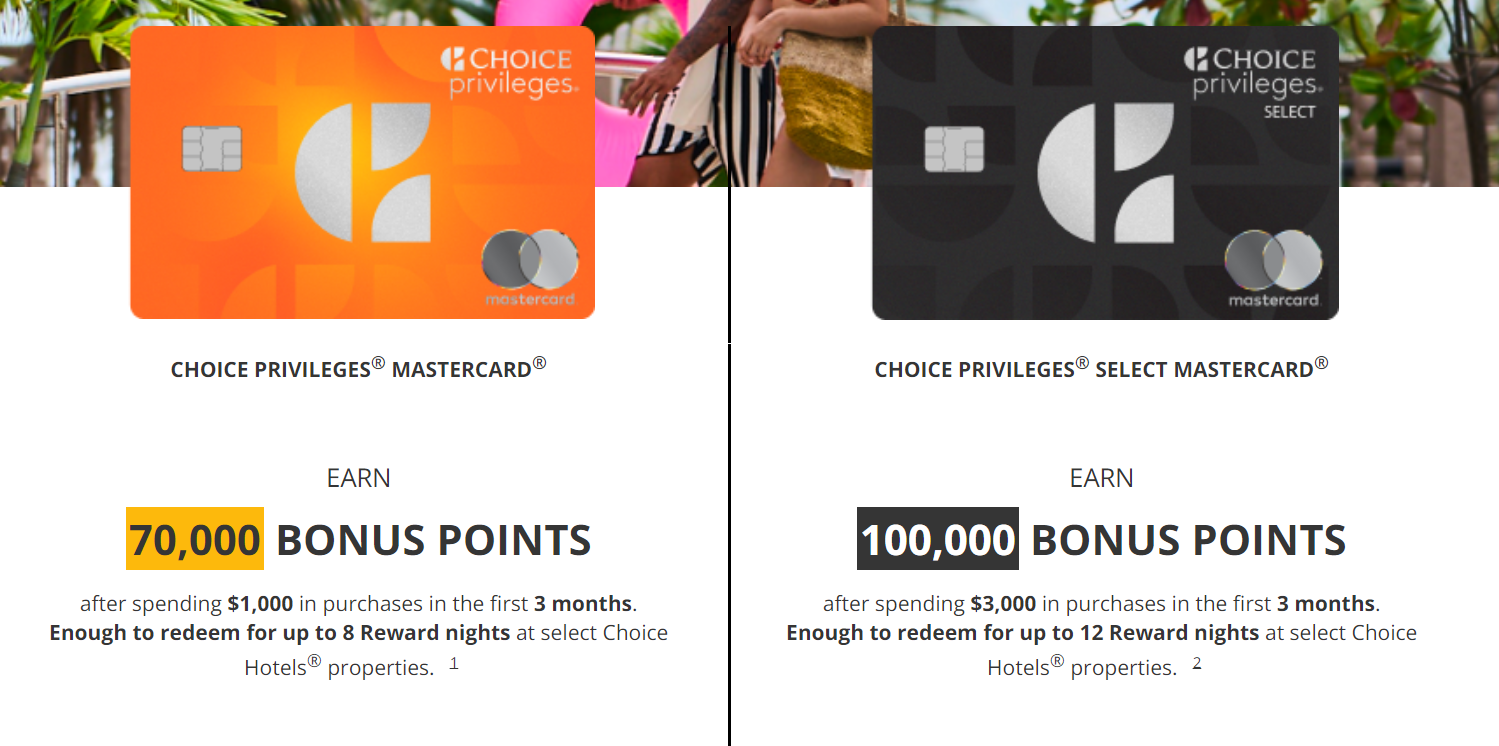

Choice Privileges has two credit cards issued by Wells Fargo, both of currently have vastly improved welcome offers: 70,000 points for the no-annual fee Choice Mastercard and 100,000 points for the Choice Select Mastercard. I believe that the 100K offer is the best that we’ve ever seen on a Choice card.

A reader shared this link with us and I’m not 100% sure if it’s targeted or not. For the moment, we’re putting it on the best offers page, but if anyone doesn’t see the offers below when they click though, please let us know. (h/t: DDG)

The Offers & Key Card Details

| Card Offer and Details |

|---|

ⓘ $234 1st Yr Value EstimateClick to learn about first year value estimates 60K Points Non-AffiliateThis is NOT an affiliate offer. 60K after $3K spend in first 3 months$95 Annual Fee Alternate Offer: Choice members may be targeted for a higher offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Worth getting for the welcome offer and keeping for the 30,000 anniversary points. The 5x categories could also be interesting for some. Earning rate: 10X at Choice Hotels ✦ 5X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Platinum status ✦ 30,000 bonus points each card anniversary ✦ Cell phone Protection ($25 deductible, $800 max per claim) |

| Card Offer and Details |

|---|

ⓘ $378 1st Yr Value EstimateClick to learn about first year value estimates 60K Points Non-AffiliateThis is NOT an affiliate offer. 60K after $1K spend in first 3 monthsNo Annual Fee Alternate Offer: Choice members may be targeted for a higher offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Decent bonus for a no-annual fee card, but not a great keeper unless you value the Choice Gold Status Earning rate: 5X at Choice Hotels ✦ 3X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Gold status ✦ Cell phone Protection ($25 deductible, $800 max per claim) |

Quick Thoughts

These are both excellent offers, elevated by 30,000 and 40,000 points from the current widely-found public offers of 40K and 60K, respectively.

The no annual fee card has some decent bonus categories, earning 3x at grocery stores, gas stations, home improvement stores and phone plans. That’s not bad for a card with no annual fee, but there are better options out there and so we wouldn’t recommend putting spend on the card after earning the bonus from the welcome offer.

The Choice Privileges Select is far more interesting as a potential keeper card. You can earn 100,000 Choice Privileges points after spending $3,000 in the first three months, which I think is the highest bonus we’ve ever seen on a Choice card. It also offers bonused spend at grocery stores, gas stations, home improvement stores and on phone plans, except at a 5x rate.

Perhaps most enticing is the fact that you earn 30,000 bonus points after renewing the card each year. 30,000 points are worth well in excess of $95, so it could certainly be worth paying the annual fee each year.

However, if you’re just interested in racking up Choice Privileges points, you may be better served by another bank – Citi. That’s because the Citi Strata Premier card also has a $95 annual fee and currently comes with a welcome bonus of 75,000 ThankYou points. Those transfer to Choice on a 1:2 basis, so that’s worth 150,000 Choice points – 50% more than you’ll get with the Wells Fargo Choice Privileges Mastercard Select card with the same spend.

how do people get value out of this? certainly not domestic. Choice properties are super low-quality and yet more expensive nightly rates (with points) then their Hilton, Hyatt, Marriott competition

I saw the 90k on Choice website Thursday so I applied since it was the best offer I have seen since the launch. I have an account with them but

never received an email.

Is it possible to hold both cards? I currently have the Select, but I wouldn’t mind another 70k points.

Interesting. I got an email today offering 60k/90k (rather than 70/100), but I can see the 70/100 following your link (in the same browser I just used to see the 60/90, even).

Neither version seems to be offering to waive the annual fee for the Select, though.