NOTICE: This post references card features that have changed, expired, or are not currently available

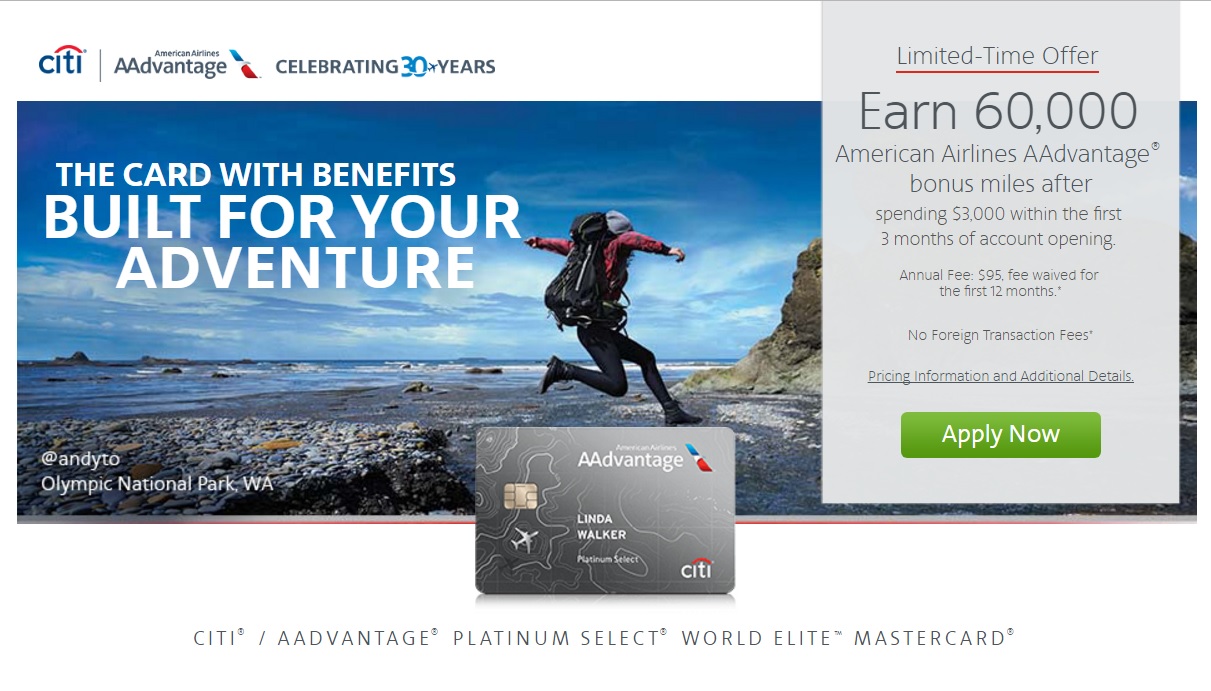

The Citi AAdvantage Platinum Select World Elite Mastercard is currently offering a sign-up bonus of 60,000 American Airlines AAdvantage miles after $3,000 in spending in the first 3 months. We’ve previously written about this increased offer. However, according to Sarah Gilbert at The Points Guy, this increased offer will end tomorrow, July 13, 2017.

Note that there is also the same increased offer on the Citibusiness version of the card, but that offer is not ending tomorrow per TPG. Also note that many readers have received targeted offers of 65,000 miles on these cards (my wife received targeted 65K offers for both the business and personal versions of this card). If you have old mail lying around, you might want to check for one of those offers.

Both of these offers are very good if you’re looking for AAdvantage miles. While AA miles aren’t very useful for flights on American Airlines these days since saver-level availability is almost nonexistent, there are still many valuable opportunities to use those miles with partners. Sixty-thousand miles will get you to Japan, Europe, or South America 2 one-way in business class on partners. The value can be even better when starting a trip in other regions of the world — I’ve found AA miles great for helping piece together my own round-the-world-type journeys by cherry picking sweet spots. Those interested in traveling domestically might be better off skipping this offer, whereas it can be great for international travel.

If you’re thinking about applying for this card, it looks like time is running out on the 60K offer. Find more information about this card and many others on our Best Offers page.

I was denied this, but given no call # or reference #. Is there a phone I can call?

Can this card be downgraded to the Citi double cash?

I don’t know for sure, but I imagine it could. I product changed my Citi AAdvantage card to an AT&T Access More early last year. At the time, the rep told me I could change to pretty much anything I wanted, which I believe included the Double Cash. But YMMV and I’m not positive. (Note my AAdvantage account was probably 18 months old at the time)

Downgrading to a different product, will be considered as closing for the purpose of getting next bonus 24 months language. (Opened or closed a card in the last 24 months. I downgraded my AA Executive Card to Double Cash and was told I was not eligible for next bonus for 24 months from the conversion date.

You’ve talked about this in some other posts, but do you know if same household but different person (i.e. husband & wife) count as separate applications or same for cc applications? I signed up my husband for a Citi bank card this year but don’t specifically have me on the account.

Of course — you can absolutely sign up separately for this and just about every credit card I can think of. That’s true whether or not you’re an authorized user on his account. Being an authorized user won’t stop you from opening your own account and collecting the bonus.

Remember that with Citi you generally have to wait at least 8 days between applications. If the Citibusiness offer sticks around, this means that a couple could end up with over a quarter million AA miles after and including minimum spend on the 4 cards (60K x 4 + $3K spend x 4). Also keep in mind the Barclaycard Aviator offer (50K after a single purchase and paying the annual fee).

My targeted 65k offer says its valid through 8/15/17. Will this be affected by the public offer expiring?

Nope. Your targeted offer should be good through the date printed on it.