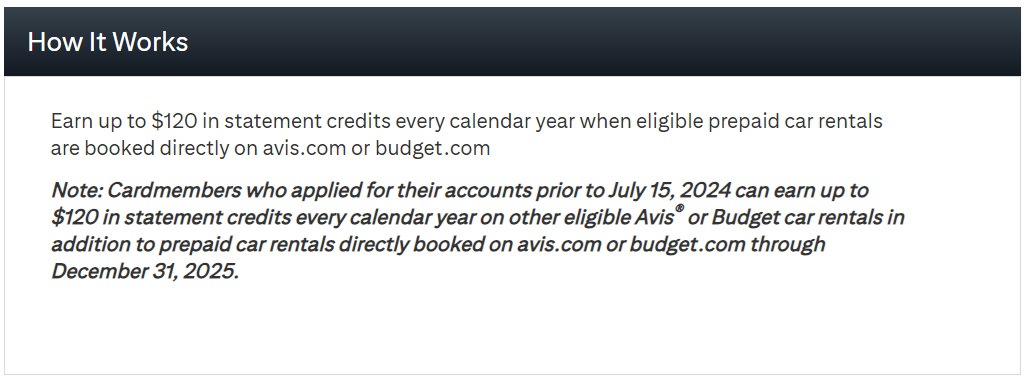

This must be the season for secret devaluations. AA & Citi seemingly didn’t want to be left out of the Bilt devaluation fun, so they quietly devalued the Citi AAdvantage Executive Card’s annual $120 Avis/Budget credit. Those who applied for the card after 7/15/24 can earn the $120 annual credits only through pre-paid rentals. Those who applied before 7/15/24 can continue to earn the credits through either pre-paid or post-paid rentals through the end of 2025, then only through prepaid reservations after that. What about those who applied exactly on 7/15/24? I have no idea.

The $120 Avis/Budget Credit Devaluation

A reader emailed to let us know that Citi and AA have removed all mention of the annual $120 Avis/Budget credit from public pages about the Citi AAdvantage Executive card. He wondered if the benefit had been removed altogether. I reached out to contacts at Citi to find out what was going on, but never heard back. Finally it occurred to me to sign into my own Citi account and to check out the benefits page for my Citi AA card. There, I found the answer. No, they haven’t removed the benefit, but they have changed it so that it will only work for prepaid reservations:

Those who applied for the card prior to July 15th get the rest of this year and all of 2025 to earn the credits the old post-paid way.

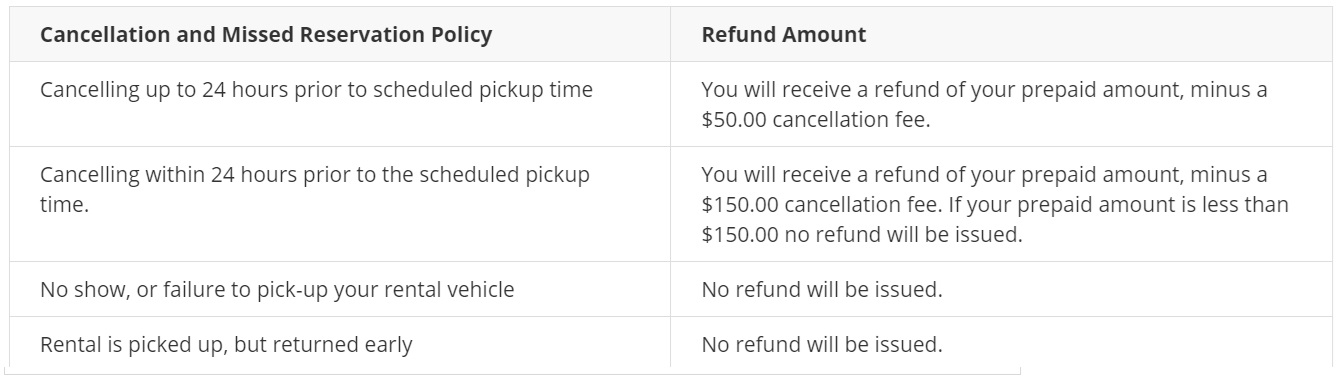

This wouldn’t necessarily be a big problem except that prepaid reservations can’t be cancelled for free. After looking at several post-paid reservations on both Avis’ and Budget’s websites, I found that there seems to be a consistent cancellation fee across both programs: $50 fee for cancelling more than 24 hours in advance, or $150 when cancelling within 24 hours. Ick.

Terms

If you applied before July 15, 2024:

For all cardmembers who applied for their account prior to July 15, 2024:

Up to $120 Avis® or Budget Car Rental Credit (Through December 31st, 2025)

Citi® / AAdvantage® Executive World Elite Mastercard credit cardmembers are eligible to receive a statement credit of up to $120 every calendar year when purchases of up to $120 or more made at Avis® or Budget car rentals or both are charged to your card account. The credit will be awarded on car rental spend that is inclusive of time and mileage, taxes, purchases, and other fees.

This statement credit only applies to Avis or Budget brands at participating locations. Car rentals not paid for directly with Avis or Budget will not qualify; for example, car rentals purchased through travel agencies, discount travel sites, vacation clubs, tour operators, or as part of a package offered by merchants, such as cruise lines and railways, will not qualify. The purpose of the car rental must be for driver and passenger transportation. Merchants that provide RV rentals or vehicle rentals for the purpose of hauling are not included in this category.

Statement credit(s) will appear on your Citi® / AAdvantage® Executive World Elite Mastercard monthly billing statement from Citi within 8-10 weeks from when the transaction was posted on your card account. One credit per card account. Applicable terms and conditions are subject to change without notice. To be eligible for this benefit, your Citi® / AAdvantage® Executive World Elite Mastercard card must be open and in good standing at the time of statement credit fulfillment.

Merchant Classification Codes

Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. We don’t control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, we’re provided an MCC for that purchase. We group similar merchant codes into categories for purposes of identifying your spend for statement credits. Sometimes you may expect a purchase to fit within a category, but if the code assigned to the merchant wasn’t grouped into that category, as recognized by Citi, your purchase amount will not be eligible for a statement credit.

Up to $120 Avis or Budget Prepaid Car Rental Statement Credit (Effective January 1, 2026)

Citi® / AAdvantage® Executive World Elite Mastercard credit cardmembers are eligible to receive a statement credit of up to $120 every calendar year of up to $120 or more on Eligible Rentals with Avis or Budget. Eligible Rentals means a prepaid booking that is made directly with Avis or Budget via www.Avis.com or www.Budget.com. For clarity, pay later bookings or any bookings that are made through travel agencies, discount travel sites, vacation clubs, tour operators, or as part of a package offered by merchants, such as cruise lines and railways, will not qualify. The purpose of the car rental must be for driver and passenger transportation. Merchants that provide RV rentals or vehicle rentals for the purpose of hauling are not included in this category. Duplicate, fraudulent, canceled, refunded purchases and purchases made in violation of either Merchant or Citi terms of use, as determined by Merchant or Citi, as applicable, are not eligible.

The credit will be awarded on car rental spend that is inclusive of time and mileage, taxes, purchases, and other fees.

Statement credit(s) will appear on your Citi® / AAdvantage® Executive World Elite Mastercard monthly billing statement from Citi within 8-10 weeks from when the transaction was posted on your card account. One credit per card account. Applicable terms and conditions are subject to change without notice. To be eligible for this benefit, your Citi® / AAdvantage® Executive World Elite Mastercard card must be open and in good standing at the time of statement credit fulfillment.

Merchant Classification Codes

Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. We don’t control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, we’re provided an MCC for that purchase. We group similar merchant codes into categories for purposes of identifying your spend for statement credits. Sometimes you may expect a purchase to fit within a category, but if the code assigned to the merchant wasn’t grouped into that category.

If you applied after July 15, 2024:

For all cardmembers who applied for their account after July 15, 2024:

Up to $120 Avis or Budget Prepaid Car Rental Statement Credit

Citi® / AAdvantage® Executive World Elite Mastercard credit cardmembers are eligible to receive a statement credit of up to $120 every calendar year of up to $120 or more on Eligible Rentals with Avis or Budget. Eligible Rentals means a prepaid booking that is made directly with Avis or Budget via www.Avis.com or www.Budget.com. For clarity, pay later bookings or any bookings that are made through travel agencies, discount travel sites, vacation clubs, tour operators, or as part of a package offered by merchants, such as cruise lines and railways, will not qualify. The purpose of the car rental must be for driver and passenger transportation. Merchants that provide RV rentals or vehicle rentals for the purpose of hauling are not included in this category. Duplicate, fraudulent, canceled, refunded purchases and purchases made in violation of either Merchant or Citi terms of use, as determined by Merchant or Citi, as applicable, are not eligible.

The credit will be awarded on car rental spend that is inclusive of time and mileage, taxes, purchases, and other fees.

Statement credit(s) will appear on your Citi® / AAdvantage® Executive World Elite Mastercard monthly billing statement from Citi within 8-10 weeks from when the transaction was posted on your card account. One credit per card account. Applicable terms and conditions are subject to change without notice. To be eligible for this benefit, your Citi® / AAdvantage® Executive World Elite Mastercard card must be open and in good standing at the time of statement credit fulfillment.

Merchant Classification Codes

Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. We don’t control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, we’re provided an MCC for that purchase. We group similar merchant codes into categories for purposes of identifying your spend for statement credits. Sometimes you may expect a purchase to fit within a category, but if the code assigned to the merchant wasn’t grouped into that category.

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] been reported by Frequent MillerThe Citi® / AAdvantage® Executive World Elite Mastercard® (See Rates and Fees) The benefit of a […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]

[…] reported by Frequent Miler, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) benefit of an up […]