The Citi Custom Cash Card has debuted this morning and it looks like a keeper: in addition to a decent welcome bonus, this card offers what is arguably the most user-friendly 5x earnings on a consumer card with no annual fee: you earn 5x ThankYou points on up to $500 in purchases in the eligible category in which you spend the most each billing cycle (then 1x thereafter). There are no rotating categories to track. This should make for an easy 30,000 ThankYou points each year for anyone able to max out $500 in purchases each month in an eligible category. Those categories include Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs and Live Entertainment.

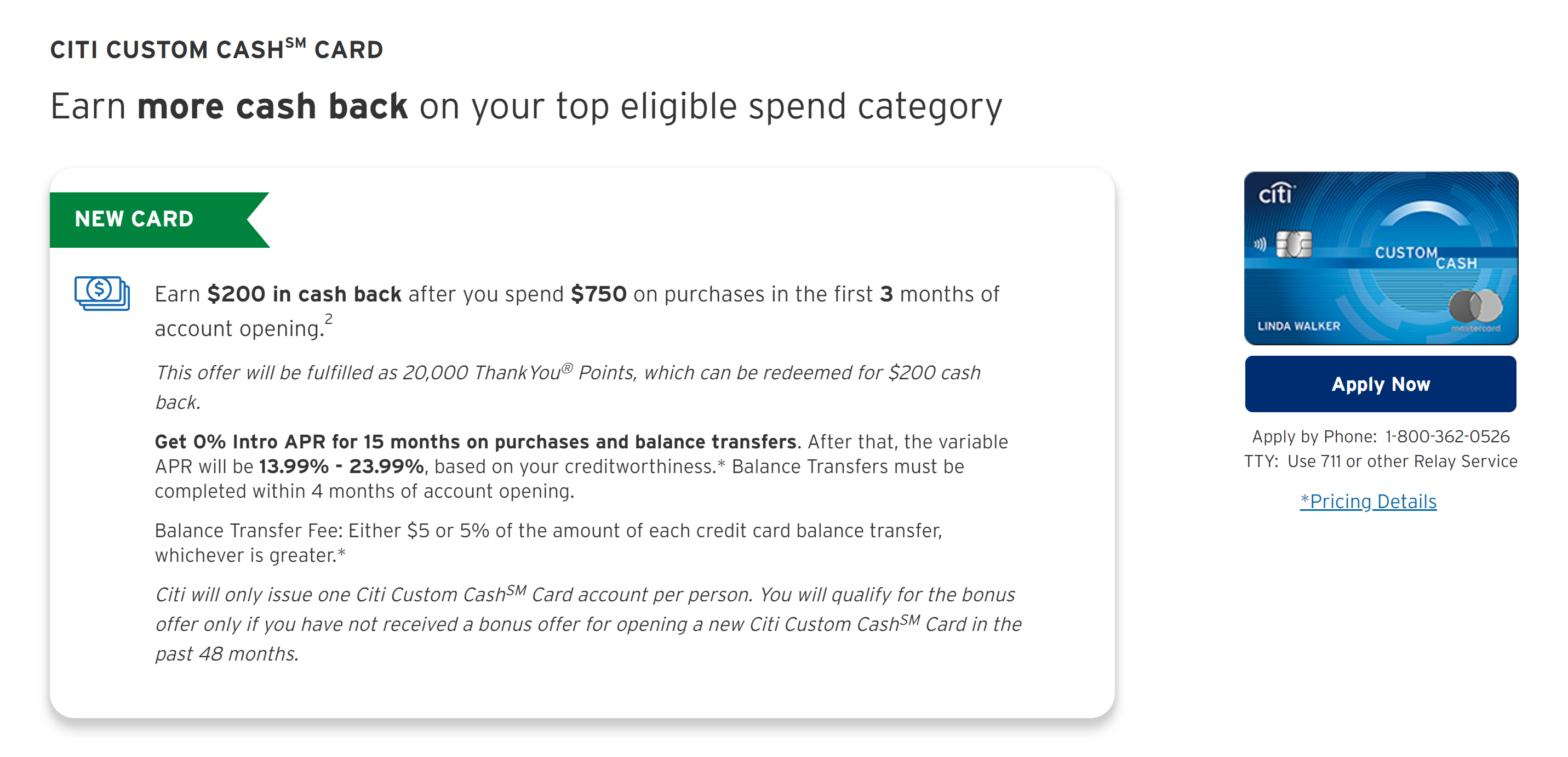

The Offer & Key Card Details

| Card Offer and Details |

|---|

Quick Thoughts

I find this card very intriguing. The welcome bonus isn’t huge but is respectable for a consumer card with no annual fee. Citi markets the offer as “$200 cash back” that is “fulfilled as 20,000 ThankYou points”, which makes it clear that this card will also carry the ability to cash out points at a value of $0.01 per point. That is interesting because Stephen recently reported on how this 1c per point cashout capability was extended to the ThankYou Preferred card (it had also recently become available on the Premier card).

Citi says that they will only issue one Custom Cash card account per person. It isn’t clear to me whether you may be able to product change your way into more than one, but an individual will apparently not be able to open more than one. The good news is that they are not restricting the card and bonus based on your activity with other ThankYou cards. The offer terms state “Our policy is to offer only one Citi Custom Cash℠ Card account per customer. Bonus is not available if you received one for opening a new Citi Custom Cash℠ Card account in the past 48 months.” If you have recently opened a Premier or Prestige card, you should still be eligible for a Custom Cash card.

This seems like a great card to have in two-player mode. For example, a married couple could have each partner get the card and label those two accounts for different categories (for example, one could be for gas and the other for dining). They should then be able to add each other as AUs to make sure that each partner has both a 5x gas and 5x dining card (you’ll just want to label those cards right away to be sure you don’t mix them up!). With $500 spend in two categories each month, a couple in 2-player mode could net an easy 60,000 ThankYou points per year. That’s enough points for both people to fly round trip to Hawaii twice in economy class or once in business class via Turkish Miles & Smiles as one example of how far that can take you.

I love that the Custom Cash card lets the cardholder choose the category based on spend. That is infinitely more user-friendly than needing to track rotating categories. While you could switch categories each billing cycle, I’d find it easy to pick a single eligible category and kind of set it and forget it — just dedicate your Custom Cash for that purpose. I imagine that most readers spend at least $500 per month in one of the included categories. You obviously want to avoid overshooting the $500 cap or putting additional spend on the card since all purchases beyond the $500 per billing cycle that earn 5x will instead earn only 1x. That’s an equivalent of 1% cash back and represents a very poor return on spend.

Overall, I find this card very interesting and I think it is probably a solid fit for many people who have points in the Citi ecosystem. Keep in mind that you’ll either need to have a Citi Premier or Prestige card or need to transfer your points to someone who does in order to be able to take advantage of transfer partners. The card may still be worth it even for those who aren’t yet invested in the Citi ThankYou ecosystem as 5% cash back on $500 per month would be an easy $300 in cash back per year. I know a lot of people who would be quite happy with that kind of return on a card with no annual fee.

Citi custom cash+WF propel+Freedom unlimited. Best free setup ever

Your tips on how to maximize the benefits of this card are helpful, especially for a couple. Thanks!

Just to clarify, purchases for each billing cycle (not calendar month) are analyzed automatically and you get 5X ThankYou Points for the category (Citi’s has ten eligible categories) in which you spent the most.

That means you should keep track of how much you are spending per billing cycle. The 5X ThankYou Points are only for the first $500 spent and 1X thereafter.

BTW, you can get 30K ThankYou Points or $300 for applying in branch. Some blogs are saying only through June 17, but according to my Personal Banker at Citi the offer is currently ongoing. (Sorry if this costs you a referral bonus, but I want to share the best offer available!)

A data point. I tried to product change my Reward+ to the Custom Cash via messanger in app and was told they can’t product change to the Custom Cash.

Will spend at Costco quality for the 5X?

[…] In the world of travel credit cards, Citi has largely remained on the sidelines over the last year as its rivals have boosted points earning multiples, benefits and sign-up bonuses. That changed this week with the introduction of the no annual fee Citi Custom Cash card, which gives its cardholders 5X points in the category with the highest spend each month, up to $500. This is a great way to rack up Citi’s valuable ThankYou points when you pair it with the Citi Premier or Prestige cards. Check the details out here. […]

For another month, I will get the 10x from the Plat. card, but after that the Gold card earns 4x at groceries (up to 25K), so this new card earns 1x more than the Gold card. I would earn 6000 more TY points than MR points. Is that worth burning a Chase 5/24 spot? I will get under 5/24 in Dec. Citi told me today they are not product changing to the new card yet. For me, unless they will product change, the extra 6K TY points over MR is just not worth a new application and screwing up 5/24. I did that with the Plat. card, but that was too good to pass on.

In a similar boat, though I’m thinking about ditching the gold card. Have to factor in the difference in AF ($250 vs $0) to that 4x vs 5x.

Or whatever _effective_ annual fee you end up eeking out of the Gold card. Personally, I don’t like the hassle of using monthly credits, so I’m closing it soon.

Interesting! I’m planning on changing my prestige to something else since my annual fee just came due and this looks like a great option!

I like this card but the issue is that the only category I consistently have $500/mo spend in is groceries. And I usually have about $700-$800 in grocery spend which means in 2-player mode I’m stuck buying a gift card every month to max out.

It’s too bad they don’t have a shopping category — either in store or online.

Might be a solid PC from the Dividend card – more flexibility with the 5x cats

Citi told me today on Chat they were not doing product changes on this card yet. I wanted to swap the Preferred or Rewards +. I find neither of those to be very useful.

Yeah I converted 2 other even less useful cards for those. This offer got me looking at my boring 6-card Citi line-up. Have been waiting for lightning to strke for years now with their portfolio but still no AA transfer partner etc

Will any of these categories work worldwide or only in the US?

Should be anywhere, but with a 3% FTF little reason to do so.

Thanks, I hadn’t noticed the forex fees.

Applied and approved instantly today, got the instant account number as well to start using it immediately. It will be a nice addition to my Prestige/Premier/Preferred collection.

So, I have an AT&T Access card that I barely use. I was just late on the ability to PC to the Access More (which is why I initially got the card). I have not followed the PC change rule but since both the Access card and this new card earn TYP, what is the general thought about if my points would expire 60 days after PC?

Since it is a Thankyou card, I am assuming/hoping this would keep the same card number if converting from a Prestige/Premier/Preferred, so would not reset the 24 month clock, and also keep points from expiring?

If so, it’s a useful point placeholder, unlike the Preferred. Also hoping can get more than one (through product changes).

Sorry, replied under the wrong message

I don’t think card number changing from a conversion resets the 24 month clock anymore. They changed how SUBs are tracked in their system 2 years ago.

Really? Wow, I am out of touch! That is very good news, actually. I am assuming there are several DP confirming that?

I’d like to know more about this too. I hadn’t heard of a change with this.