The Citi Strata Elite card is now available online. The main difference compared to earlier reporting is that the online welcome bonus is for only 80,000 points (compared to 100K predicted). In more positive news though, the ability to transfer points to American Airlines is live! This is the case not only for Strata Elite cardholders, but Prestige and Strata Premier cardholders too.

Update: We have received confirmation that the in-branch offer will be 100,000 points after $4K spend in three months.

Card Offer & Details

- Online Offer: 80,000 ThankYou points after $4K spend in 3 months

- In-Branch Offer: 100,000 ThankYou points after $4K spend in 3 months

- Card URL: www.citi.com/credit-cards/citi-strata-elite-credit-card

- Application Rules

- Bonus ThankYou® Points are not available if you have received a new account bonus for a Citi Strata Elite℠ account in the past 48 months or if you converted another Citi credit card account on which you earned a new account bonus in the last 48 months into a Citi Strata Elite.

- Annual Fee: $595

- Citi Gold customers: $145 rebate (e.g. $450 annual fee after rebate)

- Citi Private Client customers: first year $595 rebate, then $145 rebate each year thereafter.

- Authorized User Fee: $75

- Earning rate:

- 12 ThankYou Points for each $1 spent on hotels, car rentals, and attractions booked through Citi Travel® via cititravel.com or 1-833-737-1288 (TTY:711).

- 6 ThankYou Points for each $1 spent on air travel booked through Citi Travel® via cititravel.com or 1-833-737-1288 (TTY:711).

- 6 ThankYou Points for each $1 spent at restaurants, including restaurant delivery services, for purchases authorized between Friday 6:00 PM through Saturday 6:00 AM ET, and Saturday 6:00 PM through Sunday 6:00 AM ET (“Citi Nights℠”).

- Citi Nights eligibility is based on the day and time your restaurant purchase is authorized, not when the transaction is posted to your Account. For example, when paying for your dinner, the restaurant may authorize your purchase at 8:00 PM ET on a Friday night, but the transaction does not post to your Account until Monday. In this example, your purchase will qualify, because the purchase was authorized during Citi Nights. ThankYou Points will be issued to your Account once the purchase posts to your Account and is based on the amount of the final transaction, not the authorization amount.

- Restaurant purchases made outside of Citi Nights may post to your Account on a Friday or Saturday. However, these purchases will not qualify for Citi Nights if the authorization for the purchase occurred at a time other than between Friday 6:00 PM through Saturday 6:00 AM ET, or Saturday 6:00 PM through Sunday 6:00 AM ET. For example, a restaurant purchase you made on Thursday night that posts to your Account on Saturday night would not qualify because the authorization took place outside the Citi Nights timeframe.

- 3 ThankYou Points for each $1 spent at restaurants, including restaurant delivery services, for purchases authorized at any time outside of Citi Nights.

- 1.5 ThankYou Points for each $1 spent on all other purchases, including the purchases excluded below.

- Credits:

- $300 Annual (Calendar Year) Hotel Benefit via Citi Travel

- Once per calendar year, enjoy up to $300 off a hotel stay of 2 nights or more when booked with Citi Travel

- You must pre-pay for your complete stay with your Citi Strata Elite Card, ThankYou® Points, or a combination thereof

- Processed as discount, not rebate (sounds similar to VentureX travel credit, but this one is only for hotels)

- Can use less than $300 and the rest on subsequent booking within the same calendar year

- If reservation is cancelled, you get the credit back (as long as it’s still the same calendar year as when you used the credit)

- The $300 Annual Hotel Benefit cannot be combined in the same transaction with the Citi Prestige® Card Complimentary 4th Night hotel benefit if you have both the Citi Strata Elite and Citi Prestige cards. This benefit also cannot be combined with any other promotions or discounts on thankyou.com.

- $200 Annual Splurge Credit℠

- Every calendar year, earn up to $200 in statement credits on your choice of up to 2 of the following brands: 1stDibs, American Airlines (exclusions apply), Best Buy®, Future Personal Training, and Live Nation (exclusions apply).

- Must activate splurge credit merchants prior to purchase.

- May only activate up to 2 splurge credit merchants at any time.

- May change your selection at any time.

- LiveNation includes TicketMaster too. Not eligible for events or venues outside of the United States and U.S. Territories

- $200 in Annual Private Chauffeur Credit with Blacklane®

- Up to $100 January through June

- Up to $100 July through December

- $300 Annual (Calendar Year) Hotel Benefit via Citi Travel

- Additional Benefits:

- Points Transfer. The card’s landing page shows the ability to transfer to partners, including American Airlines! (Note: You can find Citi’s usual transfer partners here)

- “Points transfer to American Airlines, JetBlue, Virgin Atlantic, Cathay Pacific, Eva Air, Choice Hotels, The Leading Hotels of the World® and others.” Elsewhere on the landing page it says: “Additional benefits of this travel credit card include no foreign transaction fees on purchases, as well as Points transfer to American Airlines, JetBlue, Virgin Atlantic, Cathay Pacific, Eva Air, Choice Hotels, The Leading Hotels of the World®, and others.”

- Travel protection benefits:

- Trip Cancellation and Trip Interruption (Common Carrier)

- Trip Delay

- Lost or Damaged Luggage

- MasterRental Coverage (Car Rental)

- Priority Pass Select Membership

- NO Restaurants

- Authorized users get their own membership

- Allows 2 free guests, then $35 per guest after that (no “and children” like the Prestige card)

- Four American Airlines Admirals Club passes each year

- Once redeemed, a Pass is valid for a 24-hour period and can be used in multiple locations during that time

- The primary cardmember must redeem one Pass to enter an Admirals Club lounge and may redeem available passes for each accompanying adult 18 years of age or older.

- The primary cardmember must be present with each accompanying adult for them to enter any Admirals Club lounge location

- Up to 3 children under 18 years of age who are traveling with an adult who redeemed a Pass may also enter the lounge

- To access lounge:

- the primary cardmember must present for themselves and on behalf of accompanying adults:

- a Pass located in their AAdvantage Wallet (located in the American Airlines Mobile App);

- OR their boarding pass including their AAdvantage® number.

- The primary cardmember and any accompanying adults must also present:

- (i) their current government-issued I.D.; and

- (ii) a boarding pass for same-day travel on an eligible flight, which includes any departing or arriving flight that is

- (1) marketed or operated by American Airlines,

- (2) marketed and operated by any oneworld® carrier,

- or (3) marketed and operated by Alaska Airlines;

- and (iii) any additional documentation required by American Airlines.

- the primary cardmember must present for themselves and on behalf of accompanying adults:

- Up to $120 Global Entry® or TSA PreCheck® Application Fee Credit

- Premium Hotel Benefits: Citi seems to have two hotel programs where one is called “The Reserve” and the other is the “Hotel Collection.” You might think this sounds familiar if you’re aware of Amex’s Fine Hotels & Resorts plus The Hotel Collection.

- The Reserve by Citi Travel (for Citi Strata Elite℠, Citi Strata Premier®, and Citi Prestige® cardmembers)

- $100.00 (USD) Experience Credit per stay (varies by property)

(Back to back reservations are considered one stay) - Room Upgrade, upon availability

- Daily Breakfast for Two

- Complimentary Wi-Fi

- Early Check-In, upon availability

- Late Check-Out, upon availability

- $100.00 (USD) Experience Credit per stay (varies by property)

- Hotel Collection (for all cardmembers with access to Citi Travel®)

- Daily Breakfast for Two

- Complimentary Wi-Fi

- Early Check-In, upon availability

- Late Check-Out, upon availability

- The Reserve by Citi Travel (for Citi Strata Elite℠, Citi Strata Premier®, and Citi Prestige® cardmembers)

- Points Transfer. The card’s landing page shows the ability to transfer to partners, including American Airlines! (Note: You can find Citi’s usual transfer partners here)

Still Unknown

- Do hotel bookings through The Reserve or the Hotel Collection earn points with hotel chains?

- What happens to Citi Prestige customers? The terms explicitly state that if you have both cards, you can’t combine the Prestige card’s 4th Night Free benefit with the Strata Elite’s $300 Hotel benefit so my guess is that they won’t forcibly convert Prestige owners to Elite cards. I hope that’s true!

UPDATE: A PR person has reached out with the following “Citi Prestige cardmembers can continue to use their card as they normally would. There are no changes to the Citi Prestige Card and its benefits.”

My Take

1.5x Base

I like the fact that the card offers 1.5x for non-bonus-category spend. I wish Amex and Chase would do the same with their premium cards! That said, the no-annual-fee Double Cash card earns 2x on all purchases, so this is hardly exciting.

No category bonuses besides dining!

It’s so weird that restaurants are the only bonus category for this card when paying directly (not through a portal). After all, the $95 Strata Premier card offers 3x for many types of spend: restaurants, grocery, gas stations & EV charging, flights, hotels, and travel agencies. And the no-annual-fee Double Cash earns 2x everywhere. Unless you spend heavily at restaurants on weekend nights, the Strata Premier & Double Cash combo is way, way better for points earning than the Strata Elite.

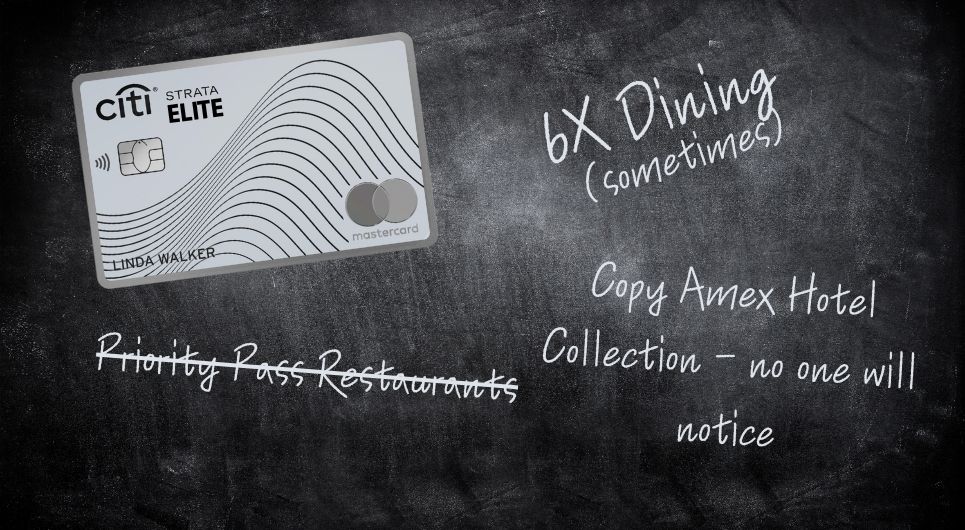

6x Dining: Cool but not enough

The ability to earn 6x at restaurants on weekend nights is interesting, but I don’t think that’s enough to move the needle for most people. Or, to put it another way, if I wanted the card for other reasons, I’d see it as a nice-to-have to be able to earn 6x when eating out on weekend evenings, but I wouldn’t get the card for that purpose. One thing I hate here is the fact that hotels are not a bonus category except when booked through Citi’s portal. The reason I bring this up here is that restaurants are often inside hotels, and you never know whether your dining tab will code as a restaurant or hotel when you pay. With the Citi Prestige card, I like the fact that if I don’t earn 5x, I’ll at least earn 3x in those situations (since it earns 5x at restaurants and 3x at hotels). But with the Strata Elite, you’ll only earn 1.5x when a restaurant codes as a hotel.

Priority Pass: Disappointing

I find it really disappointing that this card’s version of Priority Pass doesn’t include Priority Pass restaurants. Boo!

Hotels booked through Citi are the key

For those who book paid hotel stays often, there’s a lot to potentially like here. You’ll earn 12x on all bookings through Citi. You’ll get $300 off per year for a 2+ night stay. And you’ll have access to multiple hotel collections which offer free breakfast daily.

I haven’t booked hotels through Citi in a very long time because the pricing used to be horrible. Even with the Prestige card’s 4th night free, I’ve found times where the Citi portal still cost more than other options. But some readers have reported that it has gotten much better. So, I did a quick experiment to check prices of a few hotels against Hotels.com for 3 night stays and I looked at the complete price after all taxes and fees. Surprisingly, Citi’s prices were usually better! Keep in mind that this is a very, very small sample. Here’s the data:

- Crowne Plaza Utrecht

- Non refundable: Citi: $487, Hotels.com: $524 (Citi cheaper)

- Refundable: Citi: $698, Hotels.com: $578 (Hotels.com cheaper)

- Reikart House:

- Refundable: $1327, Hotels.com: $1327 (tie)

- The Londoner

- Non refundable: Citi: $1703; Hotels.com: $1818 (Citi cheaper)

- Refundable: Citi: $2052; Hotels.com: $2190 (Citi cheaper)

The main problem with Citi’s hotel search is that I couldn’t find a way to see the full price after taxes and fees unless I clicked all the way to the check-out screen. That’s really annoying.

My coupon thoughts…

I hate the prevalence of coupons on these high end cards, but that’s the landscape we’re now tied to. Here’s how I might personally use / value each coupon if I had the card:

$200 Blacklane Chauffer Service Credit ($100 bi-annual)

I found that Blacklane would charge about $150 to take me to the airport. Since Uber or Lyft is often around $60 or $70, the $100 rebate would mean a discount of only about $10 or $20. So, I would value this coupon at $0, but I’d probably use it twice a year if I liked their service.

$200 Splurge Credit (annual) – Earn up to $200 in statement credits at up to 2 merchants.

I probably book and cancel enough AA award flights each year to use this credit without thinking about it, thanks to paying award taxes and fees. This one is worth very close to face value for me.

$300 Hotel Benefit (annual) – $300 off a hotel stay of two nights or more booked through cititravel.com

Until I did my little experiment described above, I thought that this benefit would be worth very little to me. But now that I see that Citi at least sometimes has very good prices, I actually think that this might work out well. Until that thought is proven false, I’ll estimate the value of this coupon at $200.

So, with all of the above, I value the Strata Elite coupons at a total of about $400. I also have Citi Gold, which offers an automatic $145 rebate each year. So, altogether, my valuation comes to $545, which is $50 short of the card’s annual fee. If approved, I’ll probably keep the card long term only because of what I do at Frequent Miler (it’s helpful to have each of the major rewards cards). If I weren’t in this business, I couldn’t imagine being excited enough about the card to want to keep it for its coupons.

My conclusion

Since I earn 5x every day at restaurants with my Prestige card, and since I have better versions of Priority Pass with other cards, the Strata Elite is NOT a card I’d be interested in having long term. That said, I’ll happily pick up the 100K welcome bonus (if approved) and use the coupons for a year, and then downgrade to a fee-free card.

On the other hand, if Citi’s hotel prices prove to be pretty good, and if their two hotel collections are any good, then my Citi Prestige card (no longer available to new applicants) with its 4th Night Free benefit is looking better than ever. Please, please, please, Citi, don’t take it away!

UPDATE: A PR person has emailed us the following: “Citi Prestige cardmembers can continue to use their card as they normally would. There are no changes to the Citi Prestige Card and its benefits.”

Any word on the answer to this question in the blog: Do hotel bookings through The Reserve or the Hotel Collection earn points with hotel chains?

[…] to lower your expectations. After years of working on an elite card, it appears it is almost here: Citi Strata Elite complete details leaked. And as expected, it blows. I mean, it does not even make much sense even for the Signup bonus wtf! […]

I applied today using a 100k link from a branch. Was immediately denied, so I called reconsideration. The agent said I wasn’t approved because I just got the AA platinum card a couple weeks ago. He said Citi has a hard rule that you can’t get more than one card in a 30 day period and there is no way around it. He said this rule is to protect customers from hurting their credit with too many inquiries. Huh? This is different than the velocity rules I see listed on FM and other sites. Anyone have experience with this? Should I HUCA?

I’ve read that you can transfer these points to AA for miles. However, do they transfer strictly as miles, or miles and Loyalty Points?

if no Loyalty Points, then it’s a no for me.

Miles only

Check the comments over at doctor of credit on the article “Get 100k point bonus on Citi Strata Elite” if you are considering applying

DP: The 100k welcome bonus tracker is now showing in my account after applying using the doc link. Still waiting on card to arrive.

Can confirm emailing works to clients, if anyone is on the FB page I can’t email a link

Hi Robert. Can you help me with the link. I am on the facebook group as well as Akash Delsaria

Pm you

Hi Robert

Sorry to spam.

Not sure if you meant you already PM’ed me, or you plan to. I don’t use FB much, but I can’t seem to find a message from you. My full name is Akash Delsaria, and that is what I use on the FMI group.

Thanks again

Hello I messaged you I believe unless is the wrong person on the fb group

Hi Robert, I would like a link too please! Thank you!

Name on fb group?

Please send to me too: Jeff Brune

Sent

Also do you know if this will still be around in two weeks? Or is there a risk the 100k will be gone?

No word on this at the moment , it is a limited time offer will last either the whole quarter or 2-4 weeks

Julian Atanassov

I would love a link as well: Tara Mooney. Thanks for sharing!!

You can’t pc to this card yet apparently.

Has anyone opened a new card with Citi and requested expedited delivery? I have a big trip coming up next week and am considering applying today but only if I can be sure that the card will arrive prior to trip.

I opened the Strata Elite today and it immediately gave me a card number that I successfully added to my Google Wallet. I know that’s not your direct question, but I would also encourage calling to expedite arrival of the card.

Also- wanted to share that the email says I’ll receive the card in 3 business days

Thx for the info

I applied and got approved today too, but it didn’t give me a card # and I don’t see it on my citi online account either

When I was approved for my Premier card (6+ months ago), I had asked to have it expedited and they wouldn’t. Not sure if they provide better “premium service” for this premium card though.

I was approved on Monday a.m. The card was shipped overnight FedEx on Thurs & I received on Fri (4 days ttl).

THE big question is whether Citi Travel hotel bookings will qualify for loyalty program credit as Chase and Bilt do (and some Amex). Hopefully, the FM team can obtain an answer from Citi corporate.

Really want to know this as wel.

Got sign-up bonus with original Strata card launch & it’s temporary AAdvantage transfer. Does anyone know of that was >48 months ago, please?

Go to your credit report. You’ll see the account opening date. At some point in time after that, you earned the sign-up bonus. The 48 months is based on when you earn the SUB and not on the account opening date.

Unfortunately current Prestige cardholders will be forced to be converted to this card, not sure what happens if they apply for this card before the conversion happens, probably involuntarily shut down but don’t quote me on this part though…we will see more like this happen when Barclay AA card collection fully convert to Citi AA cards later. It is MESSY! But it’s Citi, it is supposed to be so…

Do we have any confirmation on when existing Prestige members will be moved over?

My most recent renewal posted April 17, so if it goes by renewal date, I have quite some time to continue to enjoy my Prestige perks.

Pointsguy is stating Prestige cardholders will remain Prestige cardholders and can also apply for the Strata Elite while still holding the Prestige and earn the bonus

By EOY I think. ..

Will the $200 Splurge credit at Best Buy work for third party gift cards? If so, using for Amazon GCs has close to face value.

I’m still skeptical about the Citi portal. I have the Strata Premier and I haven’t been able to find a good use for the hotel credit yet.

Likewise. Always more expensive even with the hotel credit!

Hope this is true!

https://www.doctorofcredit.com/source-citi-has-no-plans-to-discontinue-prestige-card-product/