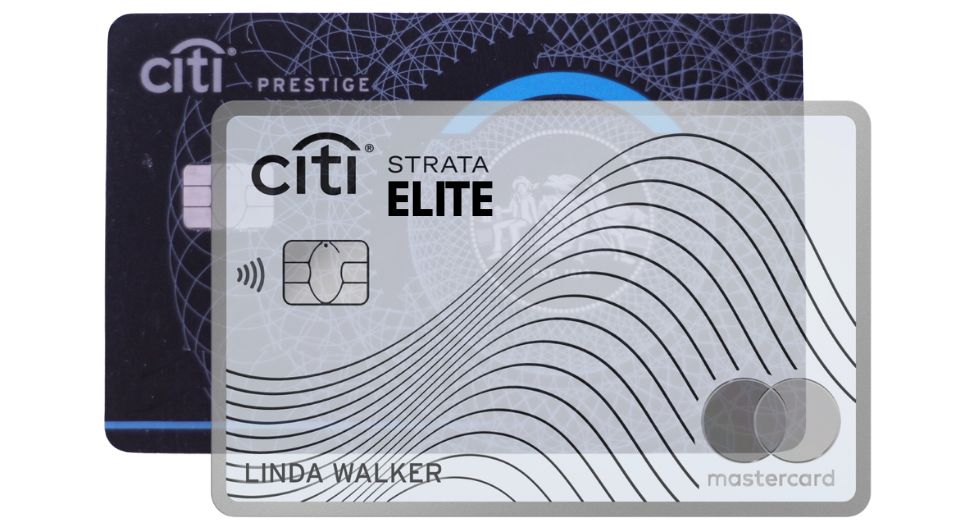

After being deluged with Chase Sapphire Reserve and Reserve for Business speculation over the last few weeks, there’s a new topic catching steam in the blogosphere: the prospective launch of the long-awaited Citi Strata Elite card.

A source from Citi shared some details with us earlier this week, which Greg wrote about, and we’ve seen additional data shared with Doctor of Credit by someone else who claims to be a Citi employee. Dave over at MilesTalk took the novel approach of walking into a Citi branch and asking questions, and learned some more useful information…including that the card will be launching in-branch on Sunday.

None of the info below was officially provided by Citi (outside of what MilesTalk learned), but there’s enough specific detail here (that agrees with our source) to make me think that the broad outlines are accurate.

Citi Strata Elite Details

Launch Date and Welcome Offer

We were told earlier that the Strata Elite would be launching this weekend, and that was confirmed to MilesTalk by a New York Citi branch. In fact, it’s supposed to go live in-branch this Sunday. We don’t yet know whether or not that means it will be available online as well.

- The initial welcome offer will be 80,000 ThankYou points after $4k spend, unless you’re a CitiGold client, which will kick it up to 100,000 points after the same $4,000.

In a world of triple digits, an 80K offer doesn’t really capture the imagination, although folks looking for Citi points will be appreciate, given how long the Citi Strata Premier has been at 60K. Getting an extra 20,000 points and saving $145 on the annual fee will undoubtedly have folks looking at the requirements for CitiGold. It requires $200K in assets on hand with Citi (inclusive of securities)…a big ask for most folks.

Annual Fee

- $595, or $450 for CitiGold clients

Rumored Earning Details

The Citi employee posting on DOC gave the full bonus category info as follows:

- 12x on hotels, car rentals and attractions when booked on Citi travel

- 6X on air travel when booked on Citi travel

- 6X on restaurants on every Friday and Saturday between 6 pm to 6 am ET

- 3x points at restaurants outside of Fri/Sat nights

- 1.5X on all other purchases

It sounds like those who currently have the Citi Prestige card will be forcibly converted to Strata Elite, knocking the 5x on dining that they can currently earn 24 hours a day and 7 days a week to 3x anytime and 6x on Friday and Saturday nights.

Also, the 5x that the Prestige currently earns on travel agencies and flights goes down to 1x (unless you book through Citi). Earning 12x on hotels is great, but if that means no elite benefits or points because you have to book through the portal, it certainly loses some shine, especially since the Prestige earns 3x on hotels when booking directly.

This earning structure is a big disappointment to me, as it tries to funnel all travel booking through Citi’s portal, which is something I’d never want to do willingly. We were hoping that it would more or less mimic the current 5x/3x structure on the Prestige, but it sounds like a significant downgrade.

Rumored Credits

It’s an ultra-premium card, so of course, it has to have coupons credits. Lots of credits. Here’s what’s supposedly on the menu:

- $200 Blacklane Credit (bi-annual) – $100 in the first half of the year and up to $100 in the second half of the year

- $200 Splurge Credit (annual) – Earn up to $200 in statement credits at up to 2 of the following brands: 1stDibs, American Airlines, Best Buy*, Future Personal Training and Live Nation

- $300 Hotel Benefit (annual) – $300 off a hotel stay of two nights or more booked through cititravel.com

Just like Chase and Amex, Citi has a hotel credit and, like Chase, it has to be used on a stay of two nights are more. Unlike Chase (and Amex), it sounds like it can be used on any hotel that can be booked through Citi Travel, as opposed to just properties that are part of the respective luxury hotel programs. That will make it easier to use without spending a ton of extra cash. Unfortunately, you still have to book through Citi Travel, and I find that many properties that I’ve seen are more expensive than what you find on Expedia or Booking.com.

The “Splurge” credit is a bit of an oddball, as you can use it for event tickets (through Live Nation), flights, electronics, personal training, or home furnishings (1stDibs). I probably wouldn’t have a hard time using that up between Best Buy and Live Nation, but what a random assortment of stores. At least it appears to be one lump sum that can be used throughout the year instead of another bi-annual split.

Speaking of bi-annual, you also get chauffeur credits! I almost forgot that Blacklane still exists. It’s effectively a black car service that you can either book by the hour or by origin and destination. It’s available around the world, so it could be reasonable to use for airport pickup or local transportation. In the US, rates seem to start at ~ $100 for an hour. Going from Seattle-Tacoma Airport to downtown Seattle, which is usually between $40-$70 using a normal rideshare, prices out at $125 when booked through Blacklane. So, that $100 credit may not get you far.

Additional Benefits

- Complimentary Priority Pass Select Membership – we don’t know whether or not restaurants are included

- Four American Airlines Admirals Club passes each year

- Up to $120 Global Entry® or TSA PreCheck® Application Fee Credit

This is pretty standard fare, although the Admiral’s Club passes will undoubtedly come in handy for some folks…especially if you’re not limited to using them when flying AA, like what Amex does with Delta SkyClub access on the Platinum cards.

I am curious to see what the Priority Pass will look like. It sounds like this will be a Mastercard, and the first of the new “Legend Elite” cards. Given that, we may see this being one of the rare Priority Pass subscriptions that includes restaurant access, as opposed to just lounges. For some folks, that won’t matter a lick. For others, like me, that would be a huge improvement, as my local airport has several worthwhile Priority Pass Restaurants, with more substantial meals than can be had in the lounges.

Quick Thoughts

Welp. If this is it, it’s very on-brand for Citi…a little more “meh” than “yeah.” I’ve been planning on picking up this card when it goes live, but looking at what’s on offer, I’m not so sure. Between Amex and Chase, I have a bad case of coupon fatigue and, at first glance, what’s on offer here doesn’t jump out at me as being worth the mental efforts of having more credits in my life…especially at $595/year. I’ll still be interested to see the final benefits (and their terms) spelled out in detail. For now, I can’t see running to my local Citi branch on Sunday to sign up.

[…] car rental and attraction centers, car rental and attraction centers reserved through Citi Travel. Citi Nights (Friday and Saturday evenings), other purchases earn 1.5x […]

Does Citi have a discount brokerage that can qualify for CitiGold?

it exists and is horrible 🙂 there were so many times I got execution failures. they dont charge for ETFs or single stocks. That is what I have there

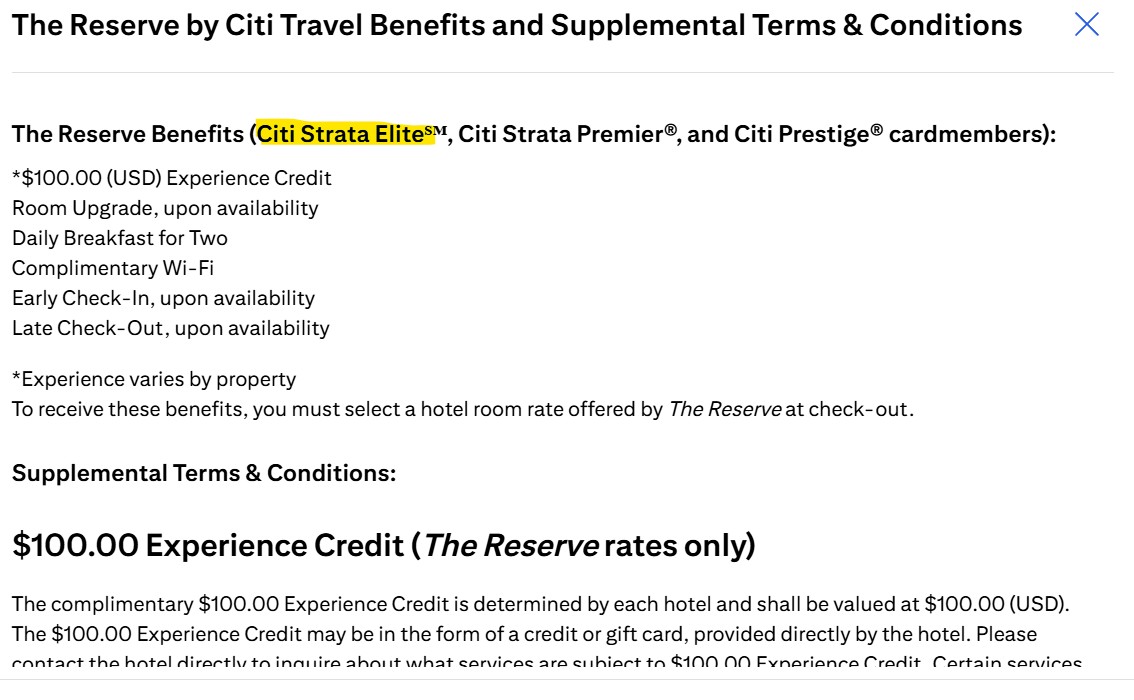

Citi Strata Elite does or will exist. When doing 4nf booking my prestige it shows up for The Reserve by Citi Travel Benefits, listing 3 cards: Citi Strata Elite, Citi Strata Premier, Citi Prestige)

Good catch!

While Chase’s Edit is an OTA, bookings do credit to hotel loyalty programs. Will bookings on Citi’s Reserve credit to hotel loyalty programs as well?

Great question. I don’t know. And if I knew someone at Citi to ask, I don’t know if I’d believe the answer (not that I think they’d lie but that I doubt many people at Citi know how this really works in practice)

Well, it’s 8 Pm Eastern on Sunday… do we know anything more?

Not that I’ve seen

Bonus Points Offer

Bonus ThankYou® Points are not available if you have received a new account bonus for a Citi Strata Elite℠ account in the past 48 months or if you converted another Citi credit card account on which you earned a new account bonus in the last 48 months into a Citi Strata Elite.

Protection Benefits

Should you apply and be approved for the Citi Strata Elite℠ Card, more information will be provided in the Guide to Protection Benefits you receive with your card. Benefits are subject to terms, conditions, and limitations, including limitations on the amount of coverage. Coverage is provided by New Hampshire Insurance Company, an AIG company. The policy provides secondary coverage only except for MasterRental, where coverage is primary outside the Eligible Renter’s country of residence.

Award Program Information

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time with or without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use AAdvantage® Rewards and Benefits that you have already accumulated. American Airlines is not responsible for products or services offered by other participating companies. All third-party provider terms and conditions apply. For more information on miles and Loyalty Points, visit aa.com/loyaltypoints. For complete details about the AAdvantage® program, visit aa.com/aadvantage. For the AAdvantage® terms and conditions, visit aa.com/aadvantageterms.

Travel booked on American Airlines may be American Eagle® service, operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Air Wisconsin Airlines LLC, PSA Airlines, Inc., or Piedmont Airlines, Inc.

American Airlines, AAdvantage®, Admirals Club, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

oneworld® is a registered trademark of oneworld Alliance, LLC.

Summary of the Citi Strata Elite℠ Card Terms and Conditions

CITI THANKYOU® REWARDS

With the Citi Strata Elite Card, you can earn ThankYou Points for purchases made on your Card. Unless you are participating in a limited-time offer, you will earn:

12 ThankYou Points for each $1 spent on hotels, car rentals, and attractions booked through Citi Travel® via cititravel.com or 1-833-737-1288 (TTY:711).

6 ThankYou Points for each $1 spent on air travel booked through Citi Travel via cititravel.com or 1-833-737-1288 (TTY: 711).

6 ThankYou Points for each $1 spent at restaurants, including restaurant delivery services, for purchases authorized between Friday 6:00 PM through Saturday 6:00 AM ET, and Saturday 6:00 PM through Sunday 6:00 AM ET (“Citi Nights℠”).

3 ThankYou Points for each $1 spent at restaurants, including restaurant delivery services, for purchases authorized at any time outside of Citi Nights.

1.5 ThankYou Points for each $1 spent on all other purchases, including the purchases excluded below.

Citi Travel

You will earn 12 ThankYou Points for each $1 spent on hotels, car rentals, and attractions and 6 ThankYou Points for each $1 spent on airfare booked using your Citi Strata Elite Card with Citi Travel via cititravel.com or 1-833-737-1288 (TTY:711). For bookings made with a combination of points and your Citi Strata Elite Card, only the portion paid with your card will earn points. Points are not earned on cancelled bookings that are refundable. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel by Agoda.

Restaurants

Includes purchases at cafes, bars, lounges, fast-food restaurants, restaurant delivery services, and take out restaurants. Excludes purchases at bakeries, caterers, and restaurants located inside another business (such as hotels, stores, stadiums, grocery stores, or warehouse clubs). You will only earn 1.5 ThankYou Points per $1 spent on restaurant gift card purchases if the merchant does not use the restaurant merchant category code for that purchase.

Citi Nights

You will earn 6 ThankYou Points for each $1 spent at restaurants, including restaurant delivery services, for purchases authorized between Friday 6:00 PM through Saturday 6:00 AM ET, and Saturday 6:00 PM through Sunday 6:00 AM ET when you use your Citi Strata Elite card.

Citi Nights eligibility is based on the day and time your restaurant purchase is authorized, not when the transaction is posted to your Account. For example, when paying for your dinner, the restaurant may authorize your purchase at 8:00 PM ET on a Friday night, but the transaction does not post to your Account until Monday. In this example, your purchase will qualify, because the purchase was authorized during Citi Nights. ThankYou Points will be issued to your Account once the purchase posts to your Account and is based on the amount of the final transaction, not the authorization amount.

Restaurant purchases made outside of Citi Nights may post to your Account on a Friday or Saturday. However, these purchases will not qualify for Citi Nights if the authorization for the purchase occurred at a time other than between Friday 6:00 PM through Saturday 6:00 AM ET, or Saturday 6:00 PM through Sunday 6:00 AM ET. For example, a restaurant purchase you made on Thursday night that posts to your Account on Saturday night would not qualify because the authorization took place outside the Citi Nights timeframe.

Merchant Classification for Rewards CategoriesMerchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. We don’t control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, we’re provided an MCC for that purchase. We group similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category, as recognized by Citi, your purchase will not qualify for additional points. For example, you won’t earn additional points for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code. Please also note – purchases made through mobile/wireless technology may not earn additional points depending on how the technology is set up to process the purchase. We reserve the exclusive right to determine which purchases qualify for additional points.

Only Purchases Earn Points.You’ll earn Points for purchases using your Card Account, minus returns and refunds. Balance transfers, Citi Flex Loans, cash advances, checks that access your Card Account, items returned for credit, unauthorized charges, interest and account fees, travelers checks, foreign currency purchases, money orders, wire transfers (and similar cash-like transactions), lottery tickets, gaming chips (and similar betting transactions) do not earn ThankYou Points. When using Citi Flex Pay, you only earn ThankYou Points on the original purchase. If your hotel purchase booked through the Citi Travel site qualifies for the $300 annual hotel benefit, you won’t earn points on the portion of your purchase that is offset by the benefit.

Open and Current Card Account.You may earn Points as long as your card account is open and current.

When You Will Receive Points.Points earned through a purchase with your Card Account will appear in your ThankYou Account at the end of the billing cycle in which you made the purchase. This means that Points earned on purchases made near the end of a billing cycle may take up to one additional billing cycle to appear in your ThankYou Account. Bonus Points may take one to two additional billing cycles to post to your ThankYou Account.

Please see the Citi ThankYou Rewards Terms and Conditions at Redirecting to Live Site, or call us at 1-800-THANKYOU (1-800-842-6596) to request a complete copy of the Terms and Conditions. (TTY: We accept 711 or other Relay Service). The Terms and Conditions include redemption information on the Citi ThankYou Rewards Program.

Changes to the ThankYou Rewards Program.ThankYou Rewards may be terminated with 30 days prior written notice. If ThankYou Rewards is terminated, you will have 90 days from the ThankYou Rewards termination date, or if required by law, date of notification of termination, to redeem all your accumulated ThankYou Points. The ThankYou Rewards Program may be changed at any time, and if required by law, we will provide notice. Rewards offered by ThankYou Rewards and the ThankYou Point levels required for specific rewards are subject to change without notice.

Up to $300 Annual Hotel Benefit via Citi Travel

Once per calendar year, enjoy up to $300 off a hotel stay of 2 nights or more when booked with Citi Travel via cititravel.com or 1-833-737-1288 (TTY:711). This benefit is subject to the following eligibility requirements: To receive the annual hotel benefit, you must pre-pay for your complete stay with your Citi Strata Elite Card, ThankYou® Points, or a combination thereof. If you choose to use the benefit, up to $300 will be applied to your reservation at the time of booking. If your reservation is less than $300, the remaining amount of the annual hotel benefit will be available for your next qualifying purchase in that same calendar year. If you cancel a booking for which you used any or all of your annual hotel benefit, the benefit will be returned to your account after the cancellation is processed and will remain available for use on any remaining days in the same calendar year. For example, if in November you make a qualifying reservation for March of the next year and use your $300 Annual Hotel Benefit, but you cancel the reservation in January, you will forfeit that benefit for the prior calendar year. If you use your annual hotel benefit for a non-refundable hotel purchase and you cancel your hotel booking, the non-refundable charge will still be offset by the benefit. All reservations must be changed or canceled through Citi Travel via cititravel.com or 1-833-737-1288 (TTY:711). If your hotel purchase qualifies for the $300 Annual Hotel Benefit, you won’t earn points on the portion of the purchase that is offset by the benefit.

Eligibility requirements:

Reservations must be made by the primary cardmember. Reservations can be made in the primary cardmember’s or Authorized User’s names.

Package rates such as air and hotel, or hotel and car rental do not qualify for the benefit.

Reservations made through any party or channel other than Citi Travel via cititravel.com or 1-833-737-1288 (TTY:711) are not eligible for the $300 Annual Hotel Benefit.

The $300 Annual Hotel Benefit cannot be combined in the same transaction with the Citi Prestige® Card Complimentary 4th Night hotel benefit if you have both the Citi Strata Elite and Citi Prestige cards. This benefit also cannot be combined with any other promotions or discounts on thankyou.com.

Up to $200 Annual Splurge Credit℠

Each calendar year, you may receive up to $200 in statement credits towards purchases made with an activated Splurge Credit merchant. Only the primary cardmember may sign-in at Credit Cards, Banking, Mortgage, Personal Loans | Citi.com or call 1-833-888-2168 (TTY: We accept 711 or other Relay Service) to select the Splurge Credit merchant(s) they would like to activate for their Splurge Credit. You may activate no more than 2 Splurge Credit merchants at any time. When you activate a Splurge Credit Merchant, we register your activation using Eastern Time. This could impact the day your new Splurge Credit Merchant is activated, or a merchant being replaced is deactivated, depending on your time zone. You may change your merchant(s) selection at any time. Once selected, a merchant is activated as of 12:00 AM ET on the day the merchant is selected. For example, if you select a merchant at 11:00 PM ET on a Wednesday, all purchases made with that merchant from 12:00 AM ET on Wednesday may qualify for a Splurge Credit. If more than two merchants are selected in any day, the final two selections at 11:59 PM ET will be activated for that day. Splurge Credit merchant options are subject to change at any time. If your activated Splurge Credit merchant is removed from the program, it is your responsibility to activate another merchant.

Once a Splurge Credit merchant is activated, credits will be issued for purchases at the activated merchant that post to the Citi Strata Elite Card, up to a total of $200 each calendar year. In order to receive a Splurge Credit, the Splurge Credit merchant must be activated when the purchase is authorized by the merchant. If the Splurge Credit merchant was activated when the purchase was authorized but is no longer activated when the purchase posts to the account, the purchase will still be eligible for a Splurge Credit. If the merchant does not authorize a purchase, for whatever reason, then the purchase will not be eligible for a Splurge Credit. Purchases made by either the primary cardmember or Authorized Users are eligible for Splurge Credits. However, the total amount of Splurge Credits will not exceed $200 per calendar year for the Account, regardless of who made the purchase.

Splurge Credits are applied after the purchase posts to your account. Splurge Credits are applied to the annual Splurge Credit amount for the calendar year the purchase was authorized. Eligible purchases that are authorized before December 31st, 11:59 PM each calendar year are eligible for statement credits within that year even if the purchase posts to your account the following year. Some merchants will not process a purchase transaction until the merchandise is shipped, this may delay when a purchase posts to your account. If a merchant authorizes a purchase repeatedly over time before posting the purchase to your account, Citi will use the last authorization date to determine eligibility. Citi is not responsible for when a merchant processes a transaction or how many times they authorize a transaction, if at all. Citi reserves the sole right to determine which year’s Splurge Credit benefit an eligible purchase is applied to.

To qualify for a Live Nation Splurge Credit(s), a purchase must be made directly on livenation.com or ticketmaster.com, and the purchase must be fulfilled by Live Nation or Ticketmaster. Purchases fulfilled by any other third-party service are not eligible to receive Splurge Credit(s). livenation.com and ticketmaster.com purchases made for events or venues outside of the United States and U.S. Territories are not eligible to receive Splurge Credit(s). Live Nation and Ticketmaster are not sponsors of this offer and are in no way responsible for the administration of the offer, the verification of eligibility, or the fulfillment of credits. All inquiries regarding the offer should be directed to Citi at 1-833-888-2168 (TTY: 711). American Airlines purchases that qualify for the Splurge credit are items billed by American Airlines or American Airlines Vacations as the merchant of record. Products or services that do not qualify for the Splurge credit are car rentals and hotel reservations, purchase of AAdvantage® status boost or renewal, and AA Cargo™ products and services. Citi reserves the sole right to determine which purchases qualify for a Splurge Credit. It may take up to 1-2 billing cycles for your Splurge Credit to appear on your statement. Splurge Credits are not applied to the Minimum Payment Due on your account.

Up to $200 in Annual Private Chauffeur Credit with Blacklane®

You will automatically receive statement credits totaling up to $100 from January through June and up to $100 from July through December, for a total of up to $200 per calendar year, toward purchases made with Blacklane using your Citi Strata Elite Card. Purchases must be made directly through the Blacklane app or their online website at blacklane.com. Purchases made by both the primary cardmember, and Authorized Users, are eligible for statement credits. However, each Account is only eligible for statement credits up to $100 for Blacklane purchases with a sale date from January through June and statement credits up to $100 for Blacklane purchases with a sale date from July through December, for a total of up to $200 in statement credits per calendar year. If your first ride with Blacklane in a 6-month period does not use the entire $100 credit, the remaining balance will be available for your next qualifying purchase within that 6-month period. Citi is not responsible for the sale date Blacklane submits with a purchase to your Account. Credits are assigned to a 6-month period based on the sale date provided by Blacklane with the purchase transaction, which may not be the date of service. For example, if you use Blacklane services on June 29th but the purchase transaction is submitted by Blacklane with a July 1st sale date, the purchase will be applied to the $100 statement credit for the July through December period. Statement credits reduce your account balance but are not applied to the Minimum Payment Due on your account.

Banking Relationship First Year and Annual Credits for qualifying Citigold® Private Clients

To qualify for the $595 First Year Banking Relationship and $145 Annual Credits, the primary cardmember must have an open and current Citi Strata Elite Card account with an assessed Annual Membership Fee of $595. Cardmembers paying an Annual Fee of $595 will earn a $595 statement credit in the first year of cardmembership and a $145 statement credit each year thereafter. The primary cardmember must also be an owner of a deposit account in the Citigold® Private Client Relationship Tier on the date your Annual Fee is charged to your Card Account. Existing deposit customers who are not in the Citigold® Private Client Tier and intend to Up-Tier to the Citigold® Private Client Relationship Tier must meet Balance Range requirements for three consecutive months to be Up-Tiered to the Citigold® Private Client Relationship Tier the first day of month 4. Existing deposit customers who enroll and meet Tier Acceleration requirements can Up-Tier in the next month. All Up-Tiering changes are effective on the first day of the month. The statement credit will be posted to your Card Account within three (3) billing cycles after the date your Annual Fee is charged to your Card Account.

Global Entry® Or TSA Precheck® Application Fee Credit

Citi Strata Elite cardmembers are eligible to receive one statement credit up to $120 per Account every four years for either the Global Entry or the TSA PreCheck program application fee. The application fee must be charged to your Citi Strata Elite Card to qualify for the statement credit. You will receive a statement credit for the first program (either Global Entry or TSA PreCheck) to charge an application fee to your Citi Strata Elite Card, regardless of whether you are approved for the program. Please allow 1–2 billing cycles after the Global Entry or TSA PreCheck application fee is charged to your Account for the statement credit to be applied.

For information on Global Entry, visit globalentry.gov. For information on TSA PreCheck, visit tsa.gov. Applications are made directly with these organizations, and this information is not shared with Citi, nor does Citi have access to Global Entry or TSA records. Citi does not share Account information with Global Entry or TSA. Decisions to approve/deny applications are made solely by these organizations, and Citi has no influence over these decisions. Citi is not notified of approvals or denials of applications. Statement credits are not applied to the Minimum Payment Due on your account.

Priority PassTM Select Lounge Membership

Primary cardmembers and their authorized users receive complimentary membership to Priority Pass Select. Priority Pass Select membership includes access to over 1,500 airport lounges around the world. Your Priority Pass Select membership includes access to airport lounges participating in the Priority Pass Select network but does not include benefits at restaurants, cafes, or markets in the network. To access a lounge, present your physical Citi Strata Elite Card along with a boarding pass for same day travel. Primary cardmembers and their authorized users may create a digital account with Priority Pass at http://www.prioritypass.com/citistrataelite to access a digital membership card, however this step is not required for entry. With the Priority Pass Select membership, you are permitted up to 2 guests per visit to any participating lounge. Some lounges do not admit guests. You will be responsible for any guests accompanying you to a participating airport lounge. Some lounges may allow more than 2 guests, but only 2 guests are included with your Priority Pass Select membership. For additional guests, your Citi Strata Elite credit card will be charged $35 per guest, per visit. Priority Pass may use your information for marketing related to the program. Your Citi Strata Elite account must be open and in good standing to maintain your membership. Lounges participating in the Priority Pass network are owned and operated by independent third parties and their participation and/or facilities may change or be discontinued without notice. Access to a lounge may be denied, at the lounge’s discretion, due to capacity or if the lounge is reserving space for pre-booked members, among other reasons.

Priority Pass Select membership is subject to the Priority Pass Select Terms and Conditions. For the full conditions of use, please visit Conditions of Use | Priority Pass or call 1-800-352-2834.

Four Admirals Club® Citi Strata Elite℠ Passes to American Airlines Admirals Club® Lounges

Each calendar year, the Citi Strata Elite primary cardmember will receive four digital Admirals Club® Citi Strata Elite℠ Passes (“Pass” or “Passes”) to the Admirals Club® lounges.

The primary cardmember must redeem one Pass to enter an Admirals Club lounge and may redeem available passes for each accompanying adult 18 years of age or older. The primary cardmember may redeem all four passes in one visit to bring in a maximum of three adult guests. The primary cardmember must be present with each accompanying adult for them to enter any Admirals Club lounge location. Once redeemed, a Pass is valid for a 24-hour period and can be used in multiple locations during that time. Up to 3 children under 18 years of age who are traveling with an adult who redeemed a Pass may also enter the lounge. Any Passes not redeemed at the end of the calendar year will be forfeited. To review a current list of Admirals Club lounges please visit aa.com/admiralsclub.

To access an Admirals Club lounge, the primary cardmember must present for themselves and on behalf of accompanying adults: a Pass located in their AAdvantage Wallet (located in the American Airlines Mobile App); or their boarding pass including their AAdvantage® number. The primary cardmember and any accompanying adults must also present: (i) their current government-issued I.D.; and (ii) a boarding pass for same-day travel on an eligible flight, which includes any departing or arriving flight that is (1) marketed or operated by American Airlines, (2) marketed and operated by any oneworld® carrier, or (3) marketed and operated by Alaska Airlines; and (iii) any additional documentation required by American Airlines. All persons must be of valid drinking age, based on applicable law, to consume alcohol.

All Admirals Club membership rules, terms and conditions apply. AMERICAN AIRLINES RESERVES THE RIGHT TO MODIFY ANY OR ALL RULES, TERMS AND CONDITIONS AT ANY TIME WITHOUT NOTICE. SUCH MODIFICATIONS SHALL BE EFFECTIVE IMMEDIATELY AND INCORPORATED INTO THIS AGREEMENT. BY ACCESSING ANY ADMIRALS CLUB LOUNGE YOU SHALL BE DEEMED TO HAVE ACCEPTED THE ADMIRALS CLUB TERMS AND CONDITIONS. To review the complete Admirals Club membership terms and conditions, visit aa.com/admiralsclub. Upon closure of the Citi Strata Elite account for any reason, all Passes not redeemed are forfeited. If the primary cardmember’s AAdvantage account is closed for any reason, any remaining Passes may not be redeemed, and any remaining Passes or new Passes will not be deposited until the AAdvantage account is reopened or a new AAdvantage account is opened and linked to the Citi Strata Elite account.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time with or without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use AAdvantage® Rewards and Benefits that you have already accumulated. American Airlines is not responsible for products or services offered by other participating companies. All third-party provider terms and conditions apply. For more information on miles and Loyalty Points, visit aa.com/loyaltypoints. For complete details about the AAdvantage® program, visit aa.com/aadvantage>. For the AAdvantage® terms and conditions, visit aa.com/aadvantageterms.

The Reserve by Citi Travel Benefits and Supplemental Terms & Conditions

The Reserve Benefits (Citi Strata Elite℠, Citi Strata Premier®, and Citi Prestige® cardmembers):

*$100.00 (USD) Experience Credit

Room Upgrade, upon availability

Daily Breakfast for Two

Complimentary Wi-Fi

Early Check-In, upon availability

Late Check-Out, upon availability

*Experience varies by property

To receive these benefits, you must select a hotel room rate offered by The Reserve at check-out

*Experience varies by property

To receive these benefits, you must select a hotel room rate offered by The Reserve at check-out

Supplemental Terms & Conditions:

$100.00 Experience Credit (The Reserve rates only)

The complimentary $100.00 Experience Credit is determined by each hotel and shall be valued at $100.00 (USD). The $100.00 Experience Credit may be in the form of a credit or gift card, provided directly by the hotel. Please contact the hotel directly to inquire about what services are subject to $100.00 Experience Credit. Certain services subject to the $100.00 USD Experience Credit may require advance reservations. Contact the hotel directly for more information and in order to obtain reservations, if required. Back-to-back stays within 24 hours at the same hotel are considered one stay. Benefits shall be awarded once per stay. If the $100.00 Experience Credit and other benefits are not consumed during the eligible stay, no refunds or compensation shall be provided to you and the remaining balance will be forfeited.

Room Upgrades (The Reserve rates only)

Room Upgrades are based on availability and only certain hotel room categories may be available for upgrade.

Daily Breakfast for Two (The Reserve rates)

Daily Breakfast for Two is included and may be provided directly by the hotel or in the form of a gift card or credit. If breakfast is included as a standard amenity of the hotel, no additional compensation or amenity will be provided to you.

Complimentary Wi-Fi (The Reserve rates and Hotel Collection)

Complimentary Wi-Fi is provided, with the exception of select hotels where Wi-Fi is included as part of a mandatory daily resort fee or is not available. If Wi-Fi is included as a standard amenity of the hotel, no additional compensation or amenity will be provided to you.

Check-In/Check-Out (The Reserve rates and Hotel Collection)

Early Check-In eligibility is determined at time of check-in and is subject to availability.

Late Check-Out eligibility is determined at time of check-in and is subject to availability.

General

Both The Reserve Benefits and Hotel Collection Benefits are subject to change, availability, may vary by hotel and benefits cannot be redeemed for cash and may not be combined with any other offers. Benefits must be used during the stay booked and may not be used at a later date. Benefits are available only when you book with Citi Travel® using your eligible Citi card. All bookings in the Hotel Collection and The Reserve are also subject to Rocket Travel by Agoda’s Terms and Conditions of Use for Hotels, Cars, and Attractions, above.

The Hotel Collection Benefits and Supplemental Terms & Conditions

“Hotel Collection Benefits (All eligible cardmembers who with access to Citi Travel®):

Daily Breakfast for Two

Complimentary Wi-Fi

Early Check-In, upon availability

Late Check-Out, upon availability

To receive these benefits, you must select a hotel room rate within the Hotel Collection at check-out”

Daily Breakfast for Two (Hotel Collection rates)

Daily Breakfast for Two is included and may be provided directly by the hotel or in the form of a gift card or credit. If breakfast is included as a standard amenity of the hotel, no additional compensation or amenity will be provided to you.

Complimentary Wi-Fi (Hotel Collection rates)

Complimentary Wi-Fi is provided, with the exception of select hotels where Wi-Fi is included as part of a mandatory daily resort fee or is not available. If Wi-Fi is included as a standard amenity of the hotel, no additional compensation or amenity will be provided to you.

Check-In/Check-Out (Hotel Collection rates)

Early Check-In eligibility is determined at time of check-in and is subject to availability.

Late Check-Out eligibility is determined at time of check-in and is subject to availability.

General

Hotel Collection Benefits are subject to change, availability, may vary by hotel and benefits cannot be redeemed for cash and may not be combined with any other offers. Benefits must be used during the stay booked and may not be used at a later date. Benefits are available only when you book with Citi Travel® using your eligible Citi card. All bookings in the Hotel Collection and The Reserve are also subject to Rocket Travel by Agoda’s Terms and Conditions of Use for Hotels, Cars, and Attractions, above.

Access to Death & Co®’s “Fashioned”

To access Fashioned, primary cardmembers and authorized users 21 years of age and older must register for Fashioned via Citi | Death & Co, entering their Citi Strata Elite℠ Card as the payment method. Cardmembers will receive access to Death & Co®’s lifestyle platform, Fashioned, that hosts cocktail and lifestyle centric content. Complimentary access is only granted by enrolling with your Citi Strata Elite℠ Card as the payment method.

Death & Co® may use your registration information for marketing communications related to the Fashioned platform.

Access to Fashioned is subject to the Death & Co® Terms of Service which can be reviewed at deathandcompany.com/citi/terms.

For Adults 21+. Please Drink Responsibly. Enjoy in Moderation and Know Your Limits.

Death & Co® is a registered trademark of Death & Co Proprietors LLC. All rights reserved.

Citi® Flex Pay Terms and Conditions

Your Citi Flex Pay monthly payment will be added to the Minimum Payment Due each billing cycle until paid in full.

To use Citi Flex Pay on an eligible purchase, your account must be current, under the credit limit, and have the applicable Citi Flex Pay terms. Other factors may apply.

Additional Information

Any benefit, reward, service, or feature offered in connection with your Card Account may change or be discontinued at any time for any reason, except as otherwise expressly indicated. Citi isn’t responsible for products and services offered by other companies.

Fraud, Misuse, Abuse, or Suspicious Activity

If we see evidence of fraud, misuse, abuse, or suspicious activity, as determined by us in our sole discretion, we reserve the right to take action against you. This may include, without limitation and without prior notice, any or all of the following:

Taking away your accrued Points

Stopping you from earning Points

Suspending or closing your Citi® Account or ThankYou® Account

Taking legal action to recover Rewards redeemed because of such activity and to recover our monetary losses, including litigation costs and damages

Some examples of fraud, misuse, abuse and suspicious activity include:

Buying or selling Points

Repeatedly opening Card Accounts for the primary purpose of acquiring Points

Using your Card Accounts in an abusive manner for the primary purpose of acquiring Points

Using your Card Account other than primarily for personal, consumer or household purposes

Points redemptions that you didn’t authorize

Please contact the ThankYou Service Center at 1-800-ThankYou (1-800-842-6596) (TTY: We accept 711 or other Relay Service) immediately if you suspect your ThankYou Account is the target of fraud or suspicious activity. For more information, please see the Citi ThankYou Rewards Terms and Conditions at Redirecting to Live Site.

Customer Service Contact Information

For questions about your Citi Strata Elite℠ account, contact customer service at 1-833-888-2168 (TTY: We accept 711 or other relay service).

American Airlines, AAdvantage®, Admirals Club, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

Blacklane is a registered trademark of Blacklane GmbH.

Citi Travel is powered by Rocket Travel by Agoda.

Mastercard, World Legend and the circles design are trademarks of Mastercard International Incorporated.

The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC.

The TSA PreCheck® trademark is used with the permission of the U.S. Department of Homeland Security

©2025 Citibank, N.A.

Citi, Citi and Arc Design, and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

Awesome! Where did you find this?

What crazy thing did Citi do this time? 😉

https://www.citi.com/gcgapi/prod/public/v1/staticcms/USMKT/en_US/appid/Additional_Info_Pages.json

Link has now been found:

https://online.citi.com/US/ag/cards/displayterms?app=UNSOL&HKOP=6f0eab35208d24750d9e645733b0c44a841349e0abc4bfefbb8539d60b60c8c2&ID=3000

Thanks! Where was this first found? I want to give credit to the appropriate source.

Posted by a Mod on Reddit:

https://www.reddit.com/r/CreditCards/s/O6nyfjkrnJ

It was 2 hrs after the post in another forum which I saw and pasted here, although that post missed a paragraph regarding CitiGold $145 off. That post also found its source from a json file on Citi web site, not the page you cited above. There probably exist multiple web page/file that Citi didn’t properly guard

I am now pretty sure this guy is the original source for both links (the json file and the better formated url link.

https://www.uscardforum.com/t/topic/414238/381

His json file in reply #295 is earlier than anything I can find, and the url link he gave later in another reply (#374?) is 2 hrs earlier than the Reddit mod who cited the same link.

Not only that, he named the tool and the method he used to find the pages.

Thanks!

One difference between this ToC and the rumors is the ToC says the $145 discount is only for CitiGold Private Client members, requiring a cool million in assets.

True. Another difference is this text implying Citi Prestige will still be around:

The $300 Annual Hotel Benefit cannot be combined in the same transaction with the Citi Prestige® Card Complimentary 4th Night hotel benefit if you have both the Citi Strata Elite and Citi Prestige cards

First thing I noticed as well – is there hope us Prestige cardholders won’t be forcibly converted or is this language in there to cover a “transition period” between when the Elite launches and when Prestige card holders will be forcibly converted?

It could be either, we still don’t know.

Prestige holders can certainly get another SUB on this, not that the SUB is very attractive though.

One thing that just dawned on me is whoever holding this card needs to be really sharp on time zone conversion, you need to figure out if your meal falls into the “Citi Night” in ET. Like Sunday brunch in Europe or Monday work lunch in Asia…

Looks like that section was left off; Citigold will receive the discount

Launching in Branch on Sunday? What branches are even open on Sundays?

What crazy thing…?

There are 2 open today in NYC

I’m assuming the AA daypasses are limited to when you’re flying AA. Even the passes you can buy direct from AA have this requirement.

Could this launch result in net negative cardholders for Citi? I would guess that many who still have the Prestige are finding ways to get good value. If those easy wins are replaced with impractical limousine coupons and 2x fewer dining points five days a week, those forced conversions probably won’t renew. I guess the game is to shed those users and catch the big fish who haven’t heard about breakage.

I don’t see the broad appeal for this card, so in that sense Citi has missed the mark. But I think this is actually pretty interesting for my personal circumstances.

If you live near an AA hub (I do), the Splurge credit and club vouchers are useful to have. If this card is required for the rumored AA transfers it makes it almost a requirement for more AA miles.

I don’t like the hotel credit being for 2 nights, but if it is usable on any hotel that is a big plus. I much prefer the VentureX credit to FHR or Chase Edit for its ease of use, not everyone wants to always ball out on a luxury property.

CitiGold is the play here. $145 off the annual fee and 20K more points. Retirement accounts qualify for CitiGold and there have been related bonuses for initial funding so it would make a great double dip.

Yikes, what a disaster. I reckon I will downgrade my beloved Prestige to the Premier when the AF comes around. They completely nerfed the travel bonus category, partially nerfed the dining category, and replaced the existing very easy-to-use travel credit with a confusing patchwork of oddball credits.

The Friday and Saturday night dining thing is just goofy. And it’s absolutely baffling that it’s based on ET rather than on the user’s location. So if you happen to be in Asia it only works for breakfast or lunch?

Consider PC to a custom cash and apply new for the strata premier for the sub if eligible

“for purchases authorized between Friday 6:00 PM through Saturday 6:00 AM ET, and Saturday 6:00 PM through Sunday 6:00 AM ET.”

That could be really good for spend in Asia, especially in Japan. It is because the equivalent Japanese time is Saturday 7am to 7pm, Sunday 7am to 7pm. It will cover breakfast, lunch and early dinner.

Went into a branch today (7.19.25) and they told me it will be available on 7.27.25.

Details? Yes. Juicy? Not so much.

So I guess if you have a local restaurant you frequent the move is to buy gift cards after 6pm Fridays and saturdays and use the cards whenever you need

Citibank has branches in just 21 states. To make an offer branch-only is just insulting.

It will just be for a few weeks (or days) and will then roll out more widely.

How do you launch a credit card in a branch on a SUNDAY?? I’m not sure I’ve seen a bank branch open a Sunday since SunTrust (now Truist) closed its Publix branches in Georgia.

The original CSR was also launched in branch on a Sunday, with online apps the next day. And yes, most Chase branches are closed on Sundays. I ended up going in person to one of few open in NYC (in Chinatown) that day to apply

Interesting!

Anyone have a guess if food delivery apps will code for the 6x on fridays/saturdays?

yes

maybe also gift cards with the restaurant as chipotle does

the fact you even ask, shows you playing right into their stupidity. just say no