| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

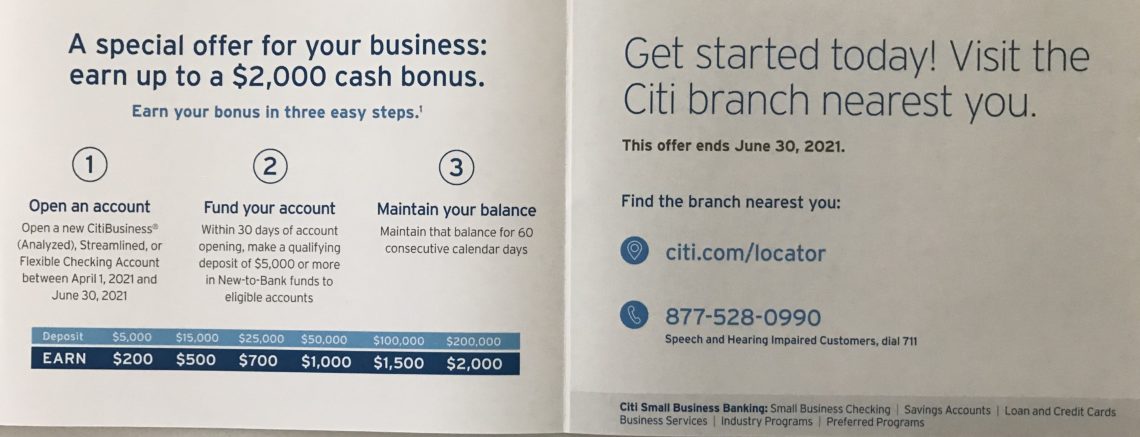

Doctor of Credit posted recently about a good promotion that’s come back for new Citibank business checking account customers. This offer is available in-branch only and gives up to a $2000 bonus when depositing various amounts of cash and then maintaining that balance for 60 consecutive days. The minimum deposit amount to get a bonus is $5,000, which will get you $200 after 60 days (this is also the best return, more on that below).

One difficulty is that it must be completed at a Citibank branch…which can be few and far between in some states.

The Deal

- Citibank is offering up to a $2000 bonus when opening a new business checking account, depositing $5,000-$200,000 and maintaining that balance for a minimum of 60 consecutive calendar days:

-

- $200 bonus w/ $5,000 deposit

- $500 bonus w/ $15,000 deposit

- $700 bonus w/ $25,000 deposit

- $1,000 bonus w/ $50,000 deposit

- $1,500 bonus w/ $100,000 deposit

- $2,000 bonus w/ $200,000 deposit

In order to receive the bonus you must:

- Open a new business checking account with a minimum balance of $25 in-branch using the promo code by 1/9/24.

- Deposit at least $5,000 by day 30 after account opening and maintain that balance for 60 consecutive calendar days after account opening.

Quick Thoughts

This seems like a very similar, if better, version of the Wells Fargo promo that we posted about earlier this week. You only have to leave the your deposit in the bank for 60 days to get the bonus, and there’s no direct deposit requirement. It’s better because the Wells Fargo version requires a $25k deposit, whereas this one starts paying out on as little as $5k. If you do have the $25k to stash, you’ll get $700 after 60 days instead of the $525 that Wells Fargo gives you.

Like the Wells Fargo deal, it’s important to note that the net upside is lower than the bonus provided. There are plenty of ways to get ~5% interest right now with savings accounts, CDs and T-bills, so you’re effectively losing 60 days of interest on whatever you deposit. For example, the opportunity cost on $25k is ~$200 in interest, making the incremental gain closer to $500 than $700.

An interesting feature of this deal is that the effective interest rate actually goes down the more you deposit. The $200 bonus on $5k corresponds to a ~24% annual interest rate, an excellent return. By comparison, the $2k on $200k is only ~6%, which is barely worth the effort. Smaller depositors are rewarded with better return on their money.

There’s minimum time commitment to this deal, no early-termination fee and you retain flexibility with your money. The Citi Streamlined Business Checking account is free as long as you have $5k in it, so anyone doing the promo would automatically have fees waived.

I’ve heard that it’s quite easy to open a Citi business account, but the in-branch requirement can be a doozy (for some of us). For instance, the closest branch to me right now, sitting in Western Washington, is ~1400 miles. For folks with a closer branch and some available cash, this might be worth a look-see.

I’m seeing the following on Citi bonus offers: QUALIFYING BALANCE LEVEL CHART. Qualifying Balance Level Cash Bonus $5,000 – $19,999 $300 / $20,000 – $99,999 $750 / $100,000 – $199,999 $1,500 / $200,000 and above $2,000

Is that the personal offer that you can see online? Those are effectively double the in-branch business offer.

I went to Citi > Banking > Citi Bonus Offers > Scrolled to (Citi Small Business) Earn up to a $2,000 cash bonus for your business. > Put in my zip code (I’m in CT if that makes a difference) and see the chart in the offer T&C’s.

Worked for me, thanks!