Buying groups can be an appealing way to increase credit card spend (thereby earning nearly limitless rewards), but not without significant risk. On this week’s Frequent Miler on the Air, we discuss what buying groups are, how they operate, ways you can use them to stack up rewards, and pitfalls you need to avoid so that you’re not left holding the (empty) bag.

Elsewhere on the blog this week, Amex makes some major changes to both business and consumer Gold cards, Greg and I both use readers as a sounding board for end of year plans, Tim asks if we are all overvaluing the Ventana Big Sur, and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

Subscribe to our podcast

00:00 Intro

00:47 Giant Mailbag

08:30 Card Talk: Amex Business Gold card

20:37 What crazy thing . . . did Marriott phone reps do this week?

25:48 Award Talk: Capital One “Move Rewards” is back

28:32 Award Talk: JetBlue status match update

31:07 Main Event: Buying groups: Big risks / big rewards

42:26 How buying groups operate

45:55 Some common risks

58:30 Is it ethical?

1:12:34 Question of the Week: I got the Citi Premier card and forgot to meet the spending requirement, so I never received the bonus. If I close the card and apply new, would I be eligible for the bonus?

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

A buying group deal gone wrong

This week’s podcast topic was inspired by recent experience with a buying group deal that did not go smoothly. Luckily, I came out of this deal even with where I began, but for a while things looked like they might turn out much worse. While it is easy to get drawn into buying groups as a means of generating easy spend, this post should serve as a reminder that these groups can be a risky endeavor.

Major changes to the American Express Business Gold card: here’s what’s happening

American express made major changes this week to a card that can be popular with resellers, the Business Gold. Interestingly, the changes seem focused on making this card more broadly appealing (while sacrificing some things that likely appealed to more traditional business owners), Overall, I think the changes make this card an easier keeper for more people.

Amex adds once in a lifetime family language to Gold Card

Unfortunately, Amex was hard at work changing things this week and one thing they decided to do was make it harder to earn the bonus on this other keeper card, the consumer Gold card. You are now officially locked out of the bonus if you have or have had a Gold or Platinum card before. That’s an awful change in my opinion, but one that seems to match with Amex’s new propensity to add lifetime language to a wide variety of cards. Sadly, it looks like the Amex Points Parade is finally winding down.

Plans for expanding my credit card collection

While the Amex points parade might be a thing of the past, you can still easily organize your own parade of points with other great welcome offers. In this post, Greg points to the cards he’s pretty sure he wants and needs to get as we near the end of the year. Funny enough, before he had even published it, I had already gotten the Aviator Red and was considering it for my wife also — although Greg later went back and updated this with the card he really intends to get first.

Nick’s end-of-year status push strategy

Speaking of the end of the year, we are entering the phase where people do highly irrational things in the hunt for elite statuses that they probably don’t need (especially if they listen to our podcast). I am not immune to this rat race, and in this post I lay out what I’m going to push for as we near the end of the year and why. The shakiest part of this plan is my push for Marriott Platinum. A couple of readers recommended that I sign up for the Marriott Bonvoy Brilliant card without a welcome bonus to solve that problem. That’s an interesting solution, but I think I’ll first wait and see if any unexpected stays chip away at the nights I need.

Digging into JetBlue’s amazing status match for Delta elites

While I chip away with mattress runs, Greg is busy shooting straight to the top with JetBlue’s status match. Even better, his wife landed top-tier JetBlue status, complete with helicopter transfers between Manhattan and JFK. There is no doubt that this is a very generous match that Delta elites should strongly consider.

Credit card cell phone insurance compared

If you are paying your cell phone bill with a credit card, one factor you’ll surely want to consider is cell phone protection. Many cards offer coverage for that expensive little supercomputer in your pocket, but not all coverage is the same. Personally, I intend to switch things up and use the Amex Business Gold card now that it features both good cell phone coverage and a decent return on spend if you make that one of your two highest spending categories each month.

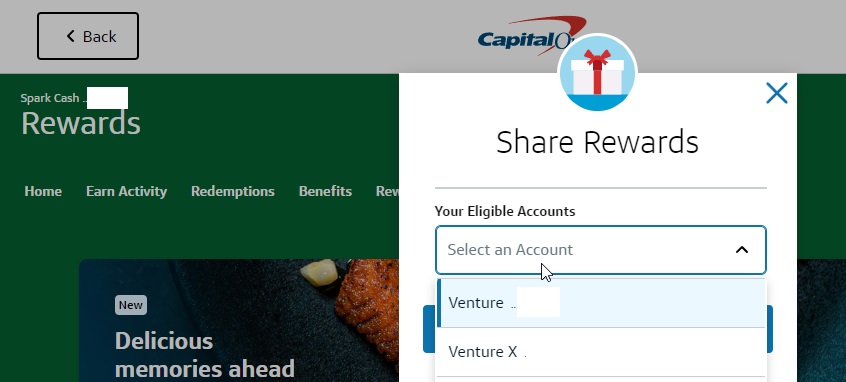

[Back again!] Huge: Convert Capital One cash back to miles by moving rewards

In other credit card news this week, Capital One has brought back the functionality to move rewards online between your own Capital One accounts. That is great news in itself, but things might be about to get even better. At login, I was prompted to add an authorized user card to my own login, so now I can view recent transactions on a card I have under my wife’s Venture card account. Hopefully, they ultimately intend to make it possible to move rewards to and from other people with this functionality.

Marriott Rules for extending free nights

Speaking of function, Marriott phone reps continue with their dysfunctional answers about whether or not it is possible to extend Marriott free night certificates,. While people report to us stories all the time of the (incorrect) information supplied by one phone rep or another, the bottom line is that yes, it is still possible to extend free night certificates. In fact, my wife just got a Chase 85K free night certificate extended this week — albeit not on the first phone call.

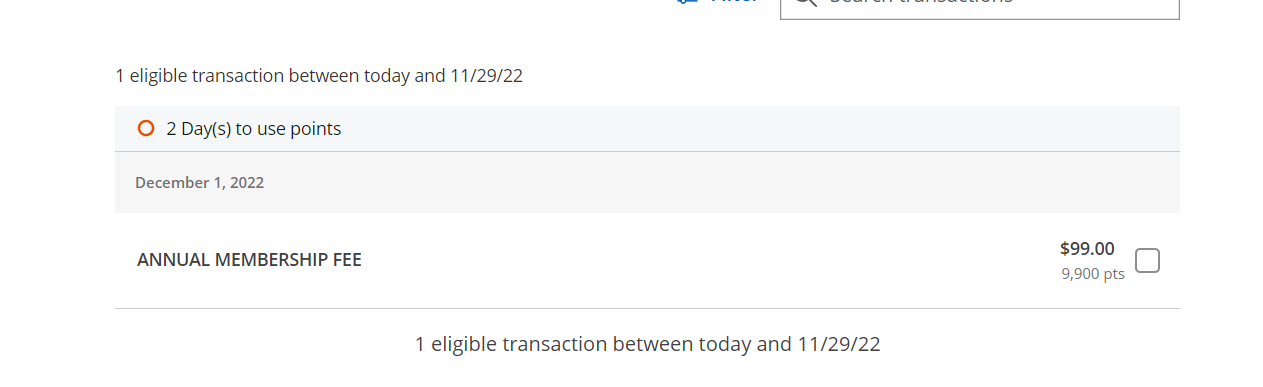

Chase “Pay Yourself Back” Complete Guide

If you are hoping to use Chase Ultimate Rewards points to pay yourself back for purchases, you first need to be aware that the types of purchases which qualify are extremely limited. However, Pay Yourself back as been extended again through the end of the year.

Is Alila Ventana Big Sur overrated? Or just overvalued?

In this post, Tim examines the famed and much-loved Ventana Big Sur. Greg has very much loved this place and so have many other folks I know. Personally, I’ve never been drawn to it. Surely that is largely because I’ve never been far enough south of the Bay Area to truly understand the beauty of the area. In other words, you should take my opinion with a grain of salt, but I didn’t find it hard to believe the argument that this place is overvalued. However, I simultaneously remain giddy that we get to be so selective about things as to decide that a $2,000/nt resort “isn’t worth the money”. What are your thoughts on this one?

That’s it for this week at Frequent Miler. Keep an eye on our last chance deals to grab those you want before they expire.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

The main benefit of National Executive Elite is that you only need 5 Car rentals before you get a free Rental for a day

(Executive: 6 rentals; Emerald: 7 rentals)

That’s right! I got mixed up and was thinking that the 5 rentals was for requalifying.

If the buying group won’t be able to homora deal gone South, then you shouldn’t sell them anything. The way it is now, there’s adverse selection and the buyer takes that risk.

I wouldn’t say big reward….big risk but certainly not big reward.