The other day, Tim published a fantastic post about using points to stay at the Paradores of Spain. If you don’t know what the Paradores are, know that I didn’t either and am thankful for the education Tim gave me there. Along with teaching us about what may be the coolest type of lodging in Europe, Tim made the point that he finds Ultimate Rewards pricing to be more closely parallel to direct booking pricing on International stays. He may be right about that, but my recent frustration with Ultimate Rewards has been how much is missing from Chase Travel℠. Even when I want to use my Ultimate Rewards points at a value of 1.5c per point, I often can’t because Chase is missing what I want.

To be clear, I love Ultimate Rewards points, I just prefer to use them for Hyatt stays or occasional airline transfers and I don’t often use them to book travel through Chase Travel.

My hesitation with Ultimate Rewards

Tim made mention in his post that I often argue that Chase Ultimate Rewards are only kinda sorta maybe worth 1.5c per toward paid travel when you have the Chase Sapphire Reserve card. More accurately, they are worth 1.5c per point toward Chase Travel price. When Chase Travel has the best price you could get on whatever travel you’re booking, you are getting 1.5c per point. But when you could otherwise use a AAA discount or click through a shopping portal or use a coupon code or book that Avis rental car through Amazon to get 10% back in an Amazon gift card, you’re not really getting 1.5c per point if you’re booking through Chase.

For example, if you’re looking at a hotel that costs $150 through Chase Travel, it would cost 10,000 Ultimate Rewards points. However, if you could click through a portal to get 5% cash back on your booking or you could use a AAA discount for 10% off, then your comparison point shouldn’t be $150 but rather $142.50 or $135 (which means 1.425c per point or 1.35c per point). If the hotel you want is on Hotels.com, consider that you could have essentially gotten 10% back toward a future stay via their Hotels.com Rewards program (and maybe purchased discounted Hotels.com gift cards to pay less than sticker price for your stay). I find the opportunities to truly get 1.5c per point in value toward hotels to be somewhat few and far between.

However, as I said at the beginning, Tim made the point that internationally, Chase Travel stacks up better. It certainly may, but I’ve been disappointed lately at how poorly it stacked up in a couple of situations for my real-world travel needs.

Hotel selection limitations

I’ll (hopefully) be taking a trip to Europe this summer that will include a few quick nights in Northern Italy. I was looking at Lake Como, but a reader specifically recommended a town called Stresa on Lake Maggiore.

Jumping a few steps ahead, I initially settled on a place that looks great in a nearby town called Belgirate (though truthfully there were lots of really interesting options around Stresa, particularly on the small islands nearby!). I was initially searching via Airbnb (because of Chase Pay Yourself Back) and Expedia (because I expected that results at Expedia would be approximately the same results as Chase without the need to log in to my Chase account to search until I was ready to book).

As an example for this post), I searched Belgirate, Italy from June 22-24, 2022 (checking in about two weeks from the time of writing this post). At this late juncture, Expedia shows 43 properties available within 5 miles of the center of Belgirate. It’s worth noting that many of those options appear to be apartment rentals more like Airbnbs, but there are also a number of hotels (none of them are chain properties).

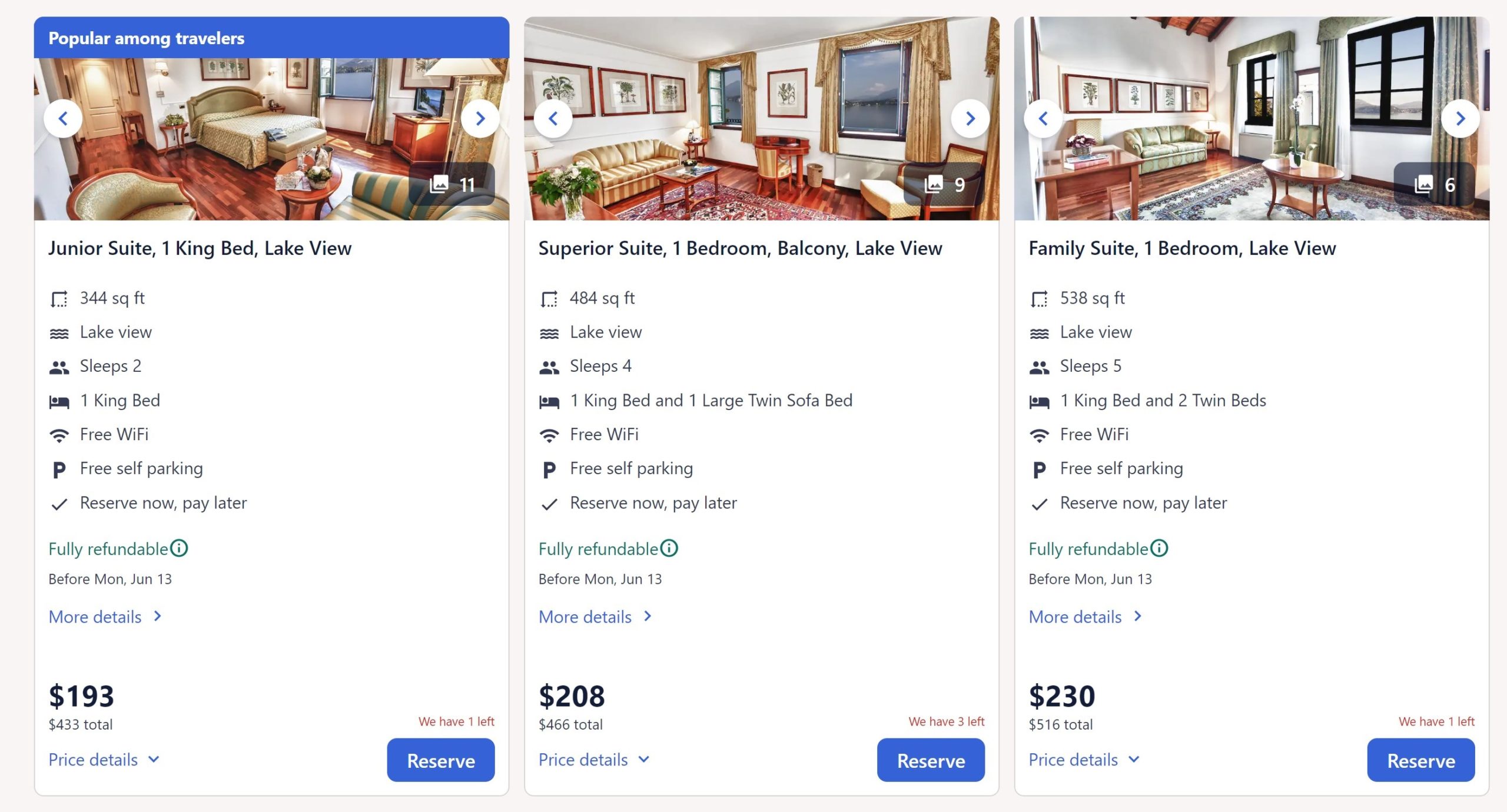

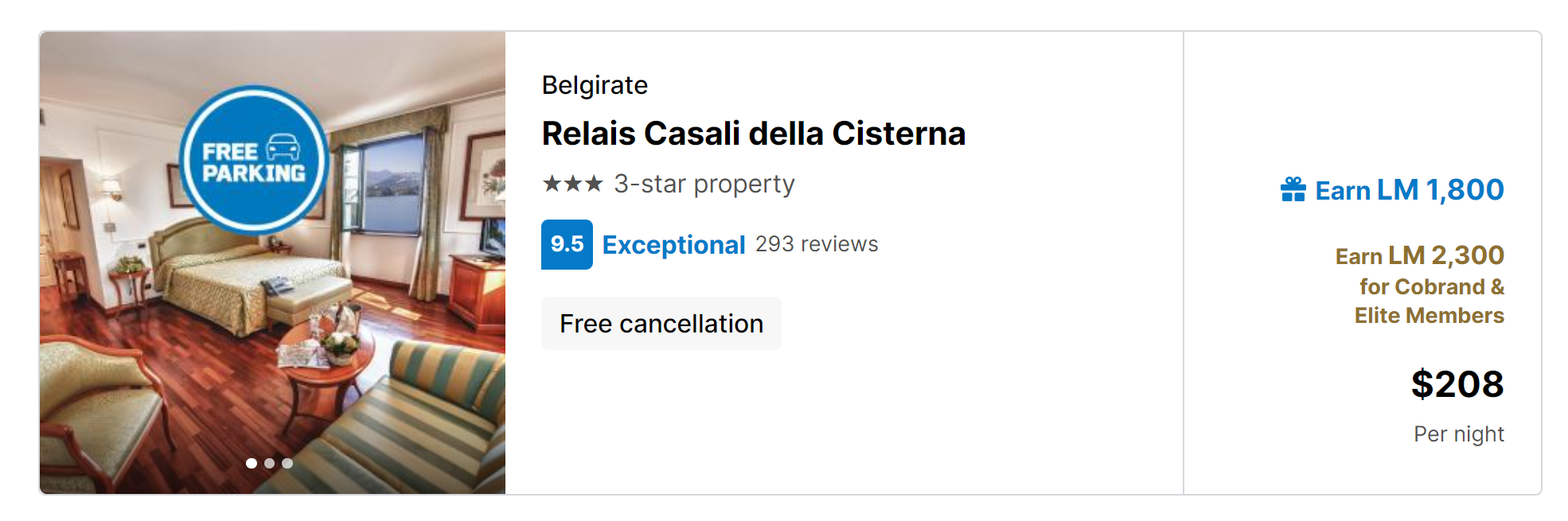

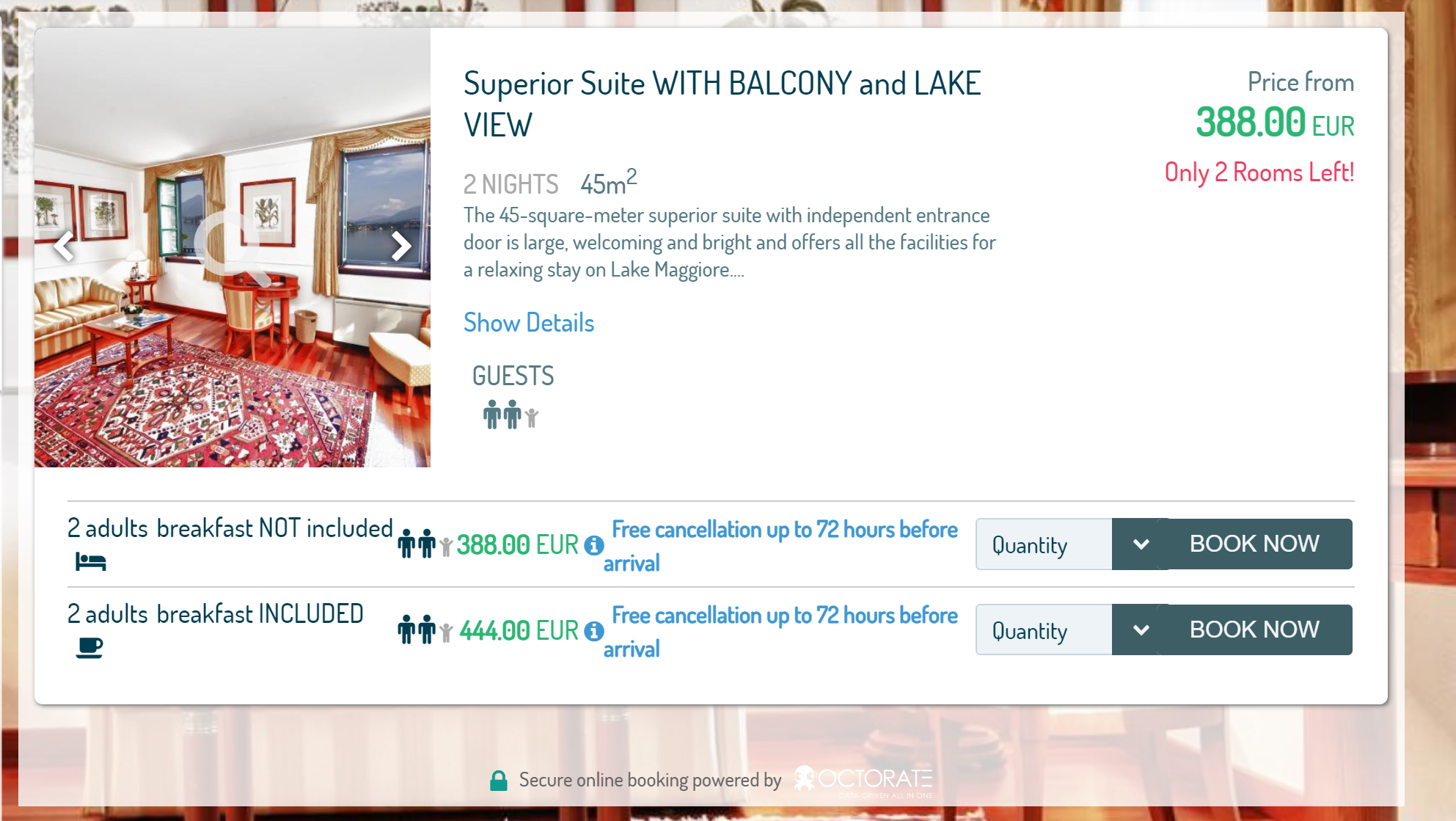

I was particularly excited about a property I saw called Relais Casali della Cisterna. It has multiple room types available during these June dates (and it also did during my actual trip dates), including a couple of suites with what look to be incredible views that conveniently sleep an entire family for reasonable prices. Furthermore, reviews appear to be outstanding across multiple sites.

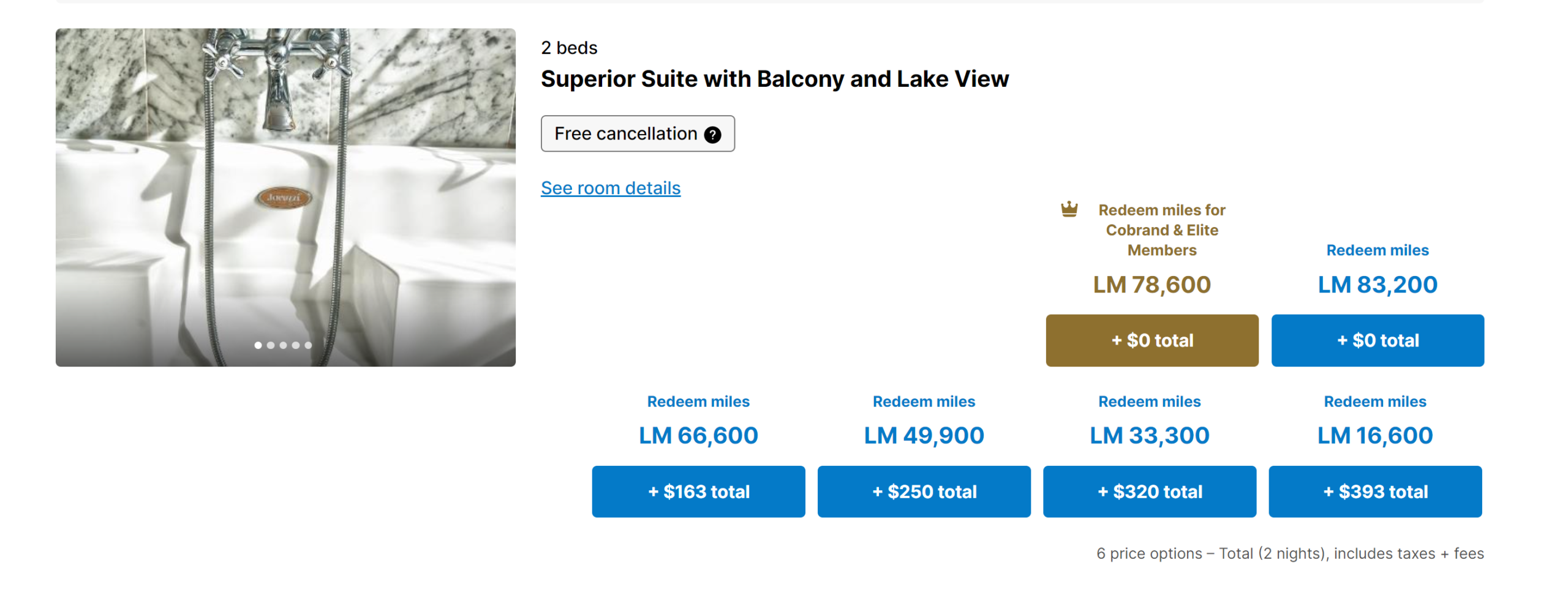

I was initially pretty excited when I saw suites that sleep 4 or 5 people for less than $250 per night. That Superior Suite above has a balcony and looks excellent. At $208 per night, I was thrilled at a stay that I expected would be fewer than 14,000 Ultimate Rewards points per night.

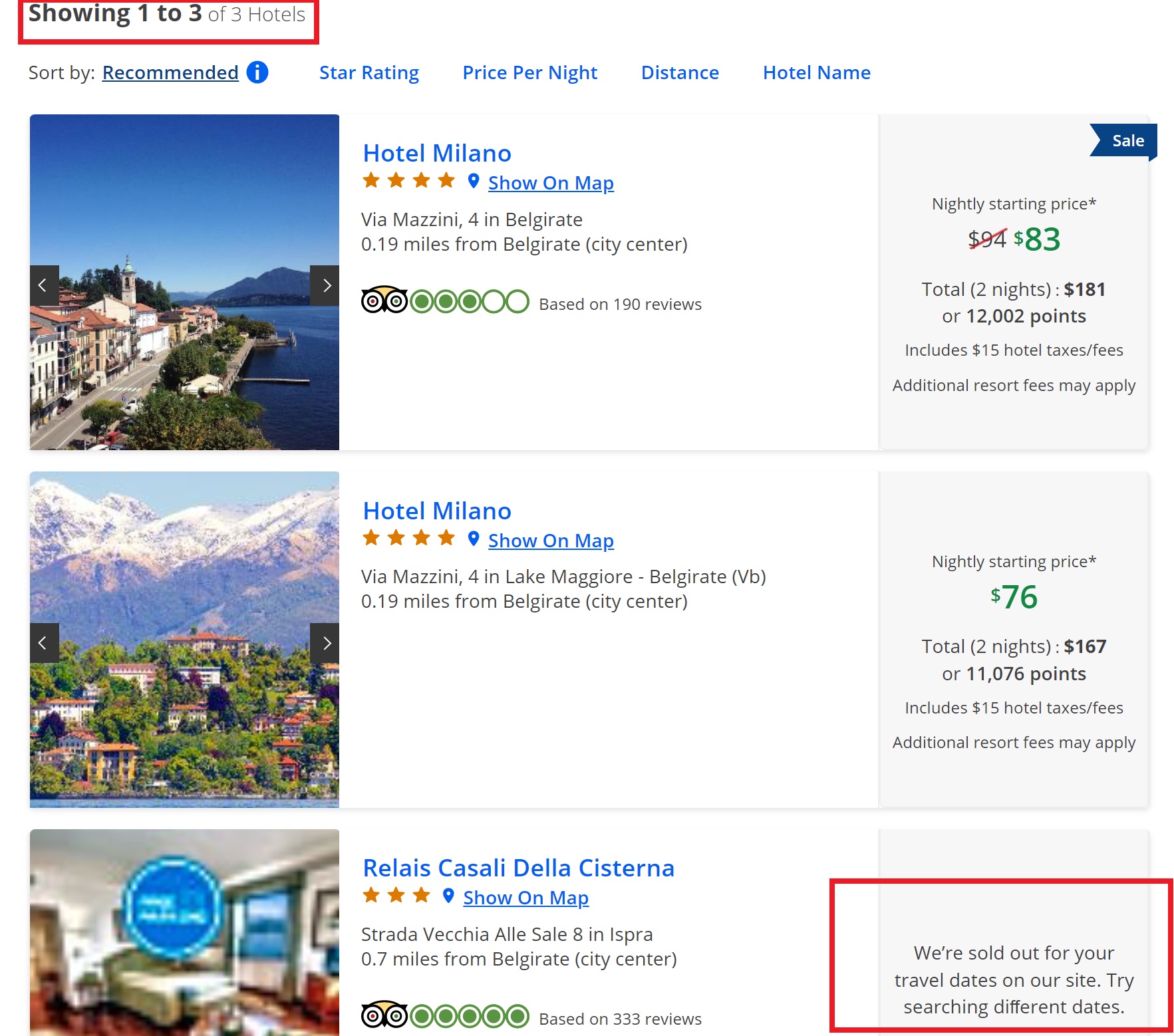

Chase shows a grand total of three hotel options in Belgirate. Actually, make that two hotel options (the first two, as you’ll notice below, are actually the same hotel). In fairness to Chase, most of the options that come up via Expedia are really in the nearby town of Stresa, so perhaps I shouldn’t be so harsh about the limited booking options. The good news is that Relais Casali della Cisterna is one of the 2 options in Belgirate. The bad news is that it shows up as sold out for those dates. And every other date I’ve tried.

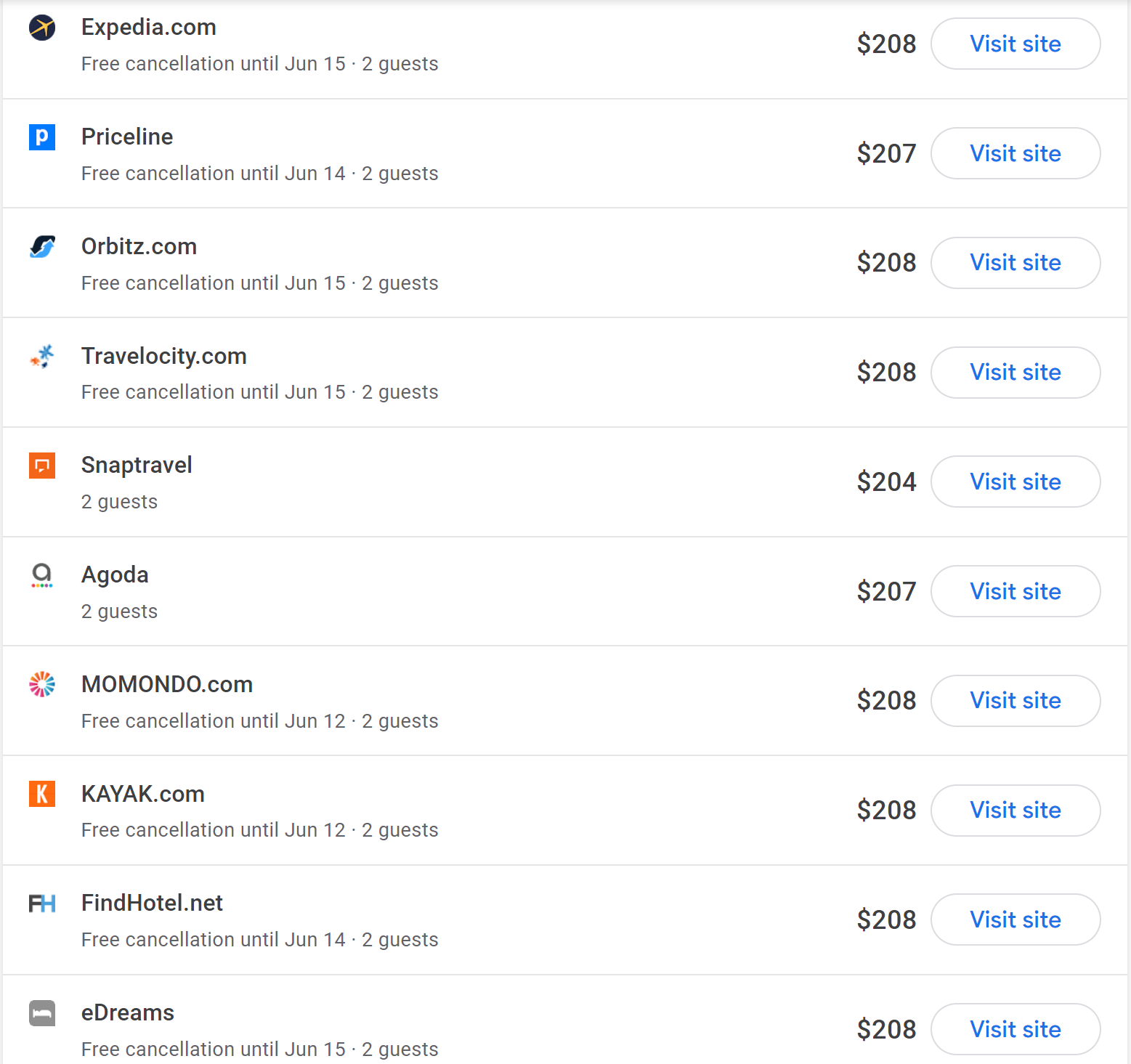

I guess it’s probably not Chase’s “fault” that the hotel shows up as sold out here. It appears to be a small family-owned/operated hotel and maybe they accidentally flipped off some switch that should be on. That said, that switch appears to be “on” at almost every other OTA on earth.

However, this property seems to have something against credit card portals as they are unavailable via Chase Travel, Amex Travel, Capital One Travel (the name populates in the search bar, but then the property doesn’t even show up in the list), Mastercard Travel, US Bank’s travel portal, or Rocketmiles.

That said, it was available to book and earn miles or redeem miles via Avianca LifeMiles (albeit at poor value either way).

My frustration here is that I didn’t want to pay cash. I wanted to use my points to good value….and I couldn’t for that property. In that case, my best options if I wanted to use points would be to:

- Redeem Amex points via Schwab at a value of 1.1c per point and use cash to pay for the hotel (18,909 points per night to cover the $208 suite in this case)

- Book and pay with my Capital One Venture card and redeem points at a value of $0.01 per point to reimburse the charge (20,800 points per night to cover the $208 suite in this case). I imagine I could probably book via Hotels.com to earn Welcome Rewards and maybe even click through a portal to get there and still stack with the Venture Card to reimburse the purchase.

- Cash out Chase points (or any type of cash back / cash-based points) at a value of $0.01 each and pay with cash (20,800 points per night pay me back for the charge)

- Use Chase points to cover dining purchases until I reach $208 per night worth of dining purchases and redeem points at a value of 1.5c per point to cover the dining purchases and then use the cash I would have paid for meals to pay for the room. That indirectly gets me sort of 1.5c per point, but I say “sort of” because it means sacrificing the chance to earn 4x on an Amex Gold card or even more on a card that’s earned the current +5 referral offer when paying for my dining purchases.

Otherwise, I could just suck it up and pay cash or book a different place. I don’t love any of those options.

To Tim’s point, the price I was seeing via OTAs did indeed match the price I saw booking direct (more or less), which came to the equivalent of about $207.20 per night. That said, booking directly also provided the opportunity to book a rate with breakfast included, which wasn’t an option via Chase.

This is one highly specific hotel example that is hardly representative of Chase Travel. However, it illustrates why I get am not so quick to extol the virtue of 1.5c per point toward paid travel. Truthfully, I don’t typically prefer boutique-style hotels over the predictability of chain properties anyway, so booking via Chase Travel rarely makes sense for me since I’d rather book a chain property and then I’d rather book direct and earn hotel points / elite credit. However, I know that others do prefer those more unique properties and they often report that prices via Chase are similar to direct booking prices.

Personally, if I’m going to book paid travel with Chase points, I’d ordinarily lean toward booking flights, but that doesn’t always work out as I’d like either.

Intra-European flights: Missing extra fare classes

Unfortunately, I recently ran into another weakness of using credit card points for intra-European travel: lack of availability of different fare classes, which can make a difference given the way many European carriers unbundle fares.

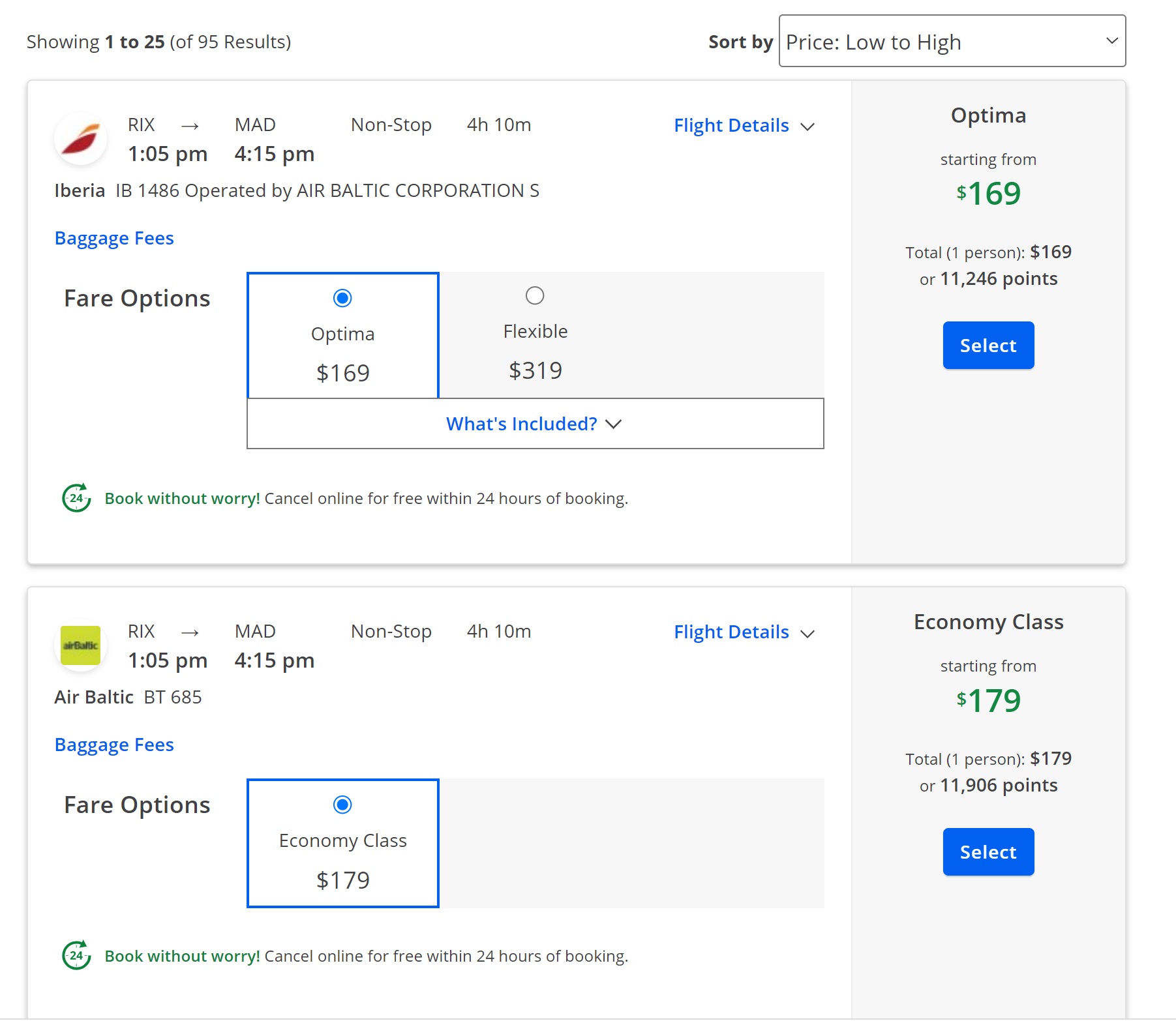

As an example, take an Air Baltic flight from Riga, Latvia to Madrid, Spain (note that I wasn’t looking to book this specific flight, but the situation was similar). The flight came up via Google Flights at $156 on June 30, 2022.

It actually came up a bit more expensive via Chase at $179 (second option below) or it was alternatively bookable via Iberia for $169.

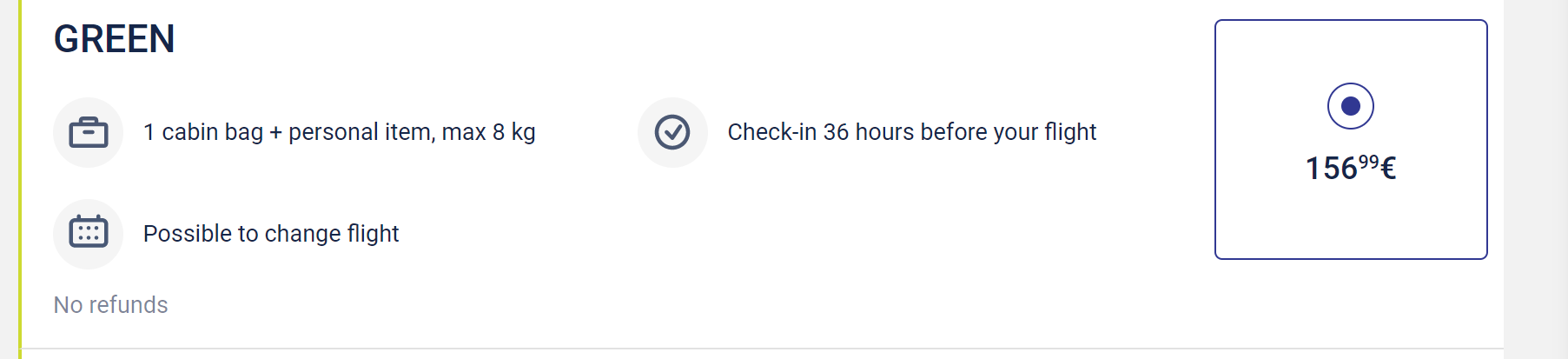

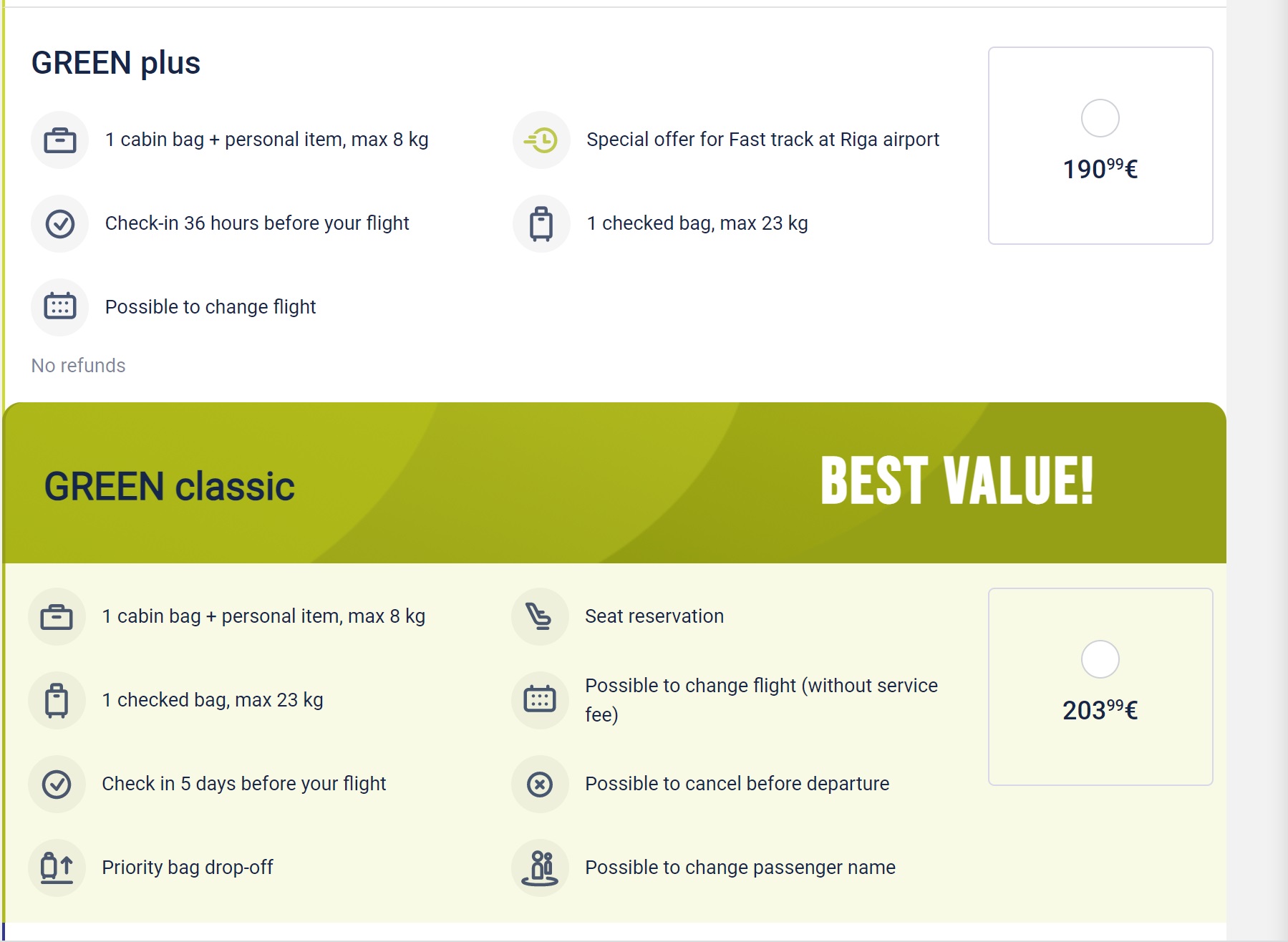

The problem is that those fares are what Air Baltic labels a “Green” fare. That doesn’t include a checked bag or seat selection.

If you book directly via Air Baltic, you have additional fare options, including Green Plus or Green Classic, which each include a checked bag (classic also includes seat selection).

Unfortunately, you can’t book those bundled fare options via Chase.

In my case, I was booking a flight on a different airline with a similar situation: economy tickets through Chase were about $150, which turned out to be the no-frills fare that included no checked bag or seat selection. I could book a fare directly through the airline that included those things for around $175 per person — but then that meant spending more than $500 cash for my family (we definitely need some checked baggage and seat selection).

In the end, I booked a business class fare that was about $225 per passenger ($675 total) and I used the Amex Business Platinum Pay With Points rebate to get 35% of the points back. That meant I ended up using just shy of 15K points per passenger. It pained me a bit to pay more for intra-European business class (which I know just consists of a blocked middle seat), but on the flip side I didn’t really want the hassle of trying to add checked bags and seat selection a la carte to what amounted to a basic economy fare. Still, I couldn’t help but feel a little disappointed that points had once again failed to net me the full 1.5cpp that I’d hoped.

Rental Cars: Forget about it

When it comes to rental cars, I rarely even waste the time to log in to Chase to search because I know that their prices won’t come close to matching what I can find via Autoslash.

Case in point: for the same trip, the cheapest economy class car via Chase that came from a major international rental agency comes from Avis at about $874 all-in (or just over 58,000 Ultimate Rewards points). Instead, I booked via Avis for about $400 (plus additional fees for car seats unfortunately, so about $500 all-in with the add-ons) and I expect to get 10% back from Amazon via this old deal I had entirely forgotten about. In this case, it’s a one-way rental as I’ll fly into one airport and out of another, so I would be tempted to give Chase a total pass if not for the fact that I don’t think I’ve ever seen their prices even match what I find via Autoslash (forget about beating those prices). The fact that I’ll be paying cash for this certainly held some weight in determining hotel and flight details discussed above as I wanted to minimize the number of things I paid for with cash rather than points.

There are still situations where Chase Travel is great

My recent frustrations with Chase Travel aside, Tim obviously showed situations at the opposite end of the spectrum where you could book a room in a castle for a little over 8K Ultimate Rewards points per night. There are certainly times when booking via Chase Travel can make a lot of sense and I have certainly booked hotels via Chase on more than one occasion. For this trip I’ve recently been trying to finalize, I’ve been trying to use Chase Travel because I would like to minimize my cash outlay.

At the end of the day, the Joy of Free is worth something and I know that I have acquired my Chase points at far less value than I’m getting (whether I’m getting 1.5c or 1.4c or 1.25c it is still far below my acquisition cost for Chase points). Because of that, I am sometimes willing to accept a bit less than 1.5c per point in value — though I’m careful to recognize that I’m not getting 1.5c.

In general, I find Chase Travel is typically good for airfare since airfare prices are fairly standard across multiple websites. Intra-European airfare or airfare on low-cost carriers can be an obstacle (though Greg proved that low cost carriers are not necessarily an insurmountable obstacle). But overall, I do like the option to use points at 1.5c per point toward all economy class airfare via Chase with the Sapphire Reserve as opposed to Amex, which only allows you to use points at good value toward economy class airfare on a single chosen US-based airline (and only if you have the Business Platinum card).

Bottom line

I love Chase Ultimate Rewards points, but I’ve recently been pretty frustrated when trying to use them to good value to cover paid travel for an upcoming trip. Chase didn’t have the hotel I wanted (nor many of the other nearby options shown on other booking portals), nor did they have intra-European economy class fare bundles that included checked baggage and seat selection on at least a couple of different airlines. While I could still use points to decent value, especially considering how easily Ultimate Rewards can be amassed, I have struggled to get a full 1.5c per point toward my recent trips. There have been times in the past when it has worked out, but this type of trip is why I always hesitate on the bump in value for paid travel — sometimes you just can’t make it work out to that full value.

Excellent post, Good you took this on. Not so funny thing, had similar intense frustration with chase UR portal today, while attempting to add a night here in Virginia Beach. (and yes, we were keen to check out some of the still independent “boutique” hotels…. which have certain amenities the big name chains have been phasing out… boo, but another subject..) I knew several of the boutique hotels (large places, actually) had lots of availability for desired nights…. but when I tried manually plugging in their hotel name(s), the Chase UR portal would arrogantly spit back at me that they were sold out for the desired nights. (which was utter poppycock, as again, I knew from other search engines, they had lots of rooms left.)

Somebody noted that the Chase UR search engine is no longer powered by Expedia…. Is that true? If so, telling….

ps, Nothing worse that asking for “help” from the Chase UR “virtual assistant.” (I HATE dealing with bots to begin with, but the Chase UR va takes the utter frustration to a new low….) Is anybody at Chase listening?

Oh, but wait, CEO Jamie Diamon is no doubt sore as Chase shareholders overwhelming rejecting his pay/bonus package. (first time ever…. a disgrace so much deserved…. and which of course the supplicant financial media, the money honeys at CNBC & faux biz so dutifully minimize)

Just another bit of grief with Chase portal that I found out today. I needed 4 hotel rooms and tried to book them in a small riad. The site allowed me to add all 4 and then confirmed three of the four and rejected the 4th one, they raid, didn’t have 4 rooms available. The 3 were booked on a non-refundable rate, so then they didn’t want to cancel them, even though they couldn’t provide what I had booked. Right now, they are saying that they have submitted paperwork to get a refund.

So they will allow you to book multiple rooms that are not actually available.

What a mess.

This is a big issue with the Chase Travel Portal ( which iinm is no longer Expedia), there’s just no international hotel selection- they show you a few of the popular options and that’s it.

Chase portal is fine for flights on US carriers, just make sure you check which fare class you are booking. Otherwise, PYB on qualifying purchases is better since you are still earning points on the purchase, increasing the net value of the redemption! Plus, you don’t have to worry about hotel/car rental headaches from having that middleman!

Nick I agree 100%. As a frequent Delta flyer I find Delta does not release hardly any of there flights to Chase if you are looking 6 months out. I wish chase would just give me 1.5 cents back on travel and I could book what I want wherever I find the best price. Chase could get rid of the entire travel department. I could deal with the airline or hotel when I need to make changes.

Brad, parallel to your point about Delta inventory access, even if the Chase UR portal has access to a particular hotel, it might not have access to the specific room type one wants. But, go over to the Luxury Hotels and Resorts side and it’s there. So, they’ll let you earn points at 3X but not 10X. That’s (messed) up.

In my humble opinion, on these sorts of deals (the Spanish Paradores, etc), paying with Chase points isn’t really getting 1.5cpp in value anyway, namely because one could use the Sapphire Reserve (or Citi Premier) to pay the cash price for the stays and earn 3x points instead.

Example: Staying at a property that costs $150 (booking directly with the property or with Chase Travel) you’ll pay 10k Chase points to stay there. But one could argue the effective price of staying there is actually $143.25 (which is the price you’re basically paying if one includes the 4.5% discount due to the 3x points earned, using a value of 1.5cpp).

Since you’re missing out on those extra points, I’d argue that one only gets 1.43 cpp on those sorts of stays. Comparing to other OTAs, the calculus could get worse if one includes the possibilities of not earning free nights via booking with hotels.com instead (or similar). Assuming one maximized the value of the 10th night free with hotels.com that puts the effective price in the above example at $143.25×0.9=$128.93 for 10k Chase points, therefore I’d argue only getting 1.29 cpp in comparison. One still earns 3x on the Sapphire Reserve paying for a hotels.com stay, but of course availability might be different for hotels.com.

In a sense, comparing against hotels.com is kinda nice because it’s more of an apples to apples comparison since it and Chase Travel are both OTAs.

Personally though, I prefer booking directly with boutique hotels anyway, since that tends to be the most flexible option (and easiest if plans change).

Anyways I know a lot of us hate the math, and I hate to bring it up, but I’d love to hear your thoughts on this.

I think it’s a very valid point. I’d even say it applies to those “omg I got 5c/point “value” on my J award!” redemptions too. That J ticket that retails for $5,000 would probably have earned 5x when purchased with the Amex Plat and another ~25k RDMs from the airline. So the 5c/pt is now down to maybe ~3.3c/pt…

How did you get a drop from 5cpp to 3.3cpp? 5x MR is like 7.5c, 25k miles is $375 knocking another 7.5%, but 15% off 5cpp is 4.25cpp, not 3.3cpp

Original valuation = $5000/100k = 5cpp

Adjusted valuation = $5000/(100k+25k+25k) = 3.3cpp

I’m sure plenty will disagree with my suggested formula (not claiming it’s absolutely right, just food for thought), but you can quibble with lots of those calculations, eg. is it really worth $5000 if you’d never have paid $5000 for that ticket to start with? Can I really use (for example) $129 as the value of my Jetblue award fare when I was perfectly content with the $99 basic economy fare but can’t redeem it as an award because Jetblue only offers Blue award fares?

For my J award example, here’s my argument:

Starting point balance = 100k

Ending point balance if redeeming J award = 0

Ending point balance if paying cash for J ticket = 100k+25k+25k = 150k

Real cost of J award redemption = difference between the two ending balances = 150k – 0 = 150k

With this line of thinking one would never cash out their points

John, that’s not what I’m saying. I’m simply pointing out that the cpp value may not really be 1.5cpp in these situations. If you’re happy to use your points to book hotels in Chase travel at 1.29 cpp then great. It’s better than cashing out at 1cpp, but I’m just saying it’s (probably) not 1.5.

Personally I prefer to transfer the points to partners and then redeem directly, or use PYB where you can still earn points on the redemption. As for Chase Travel, I think using points there to book airlines (since you’re still earning miles and such) tends to make the most sense, as opposed to hotels etc.

Vee, all I can say is great minds think alike! In the JetBlue example, I would base my redeeming cpp against the ticket that I would’ve gotten otherwise ($99 in that case).

@john – you should pick whatever line of thinking that makes you feel good about your redemption. If the J ticket was $10,000 at its peak, you should count it as 10cpp, if it earns you extra brownie points from the spouse, add another 3cpp, etc 🙂

Nick, If you book a cruise with Ultimate rewards points at 1.5, that would seem to be a reasonable redemption.

This is an excellent gets-you-thinking article. And, the funny thing is that while some of these portals use the same third-party back-end provider, they often have different pricing on the same booking.

Nick,

My wife and I just spent a week on Lake Como. If you have any questions about the area I probably can help out while it’s still fresh in my mind. It was awesome!

Jeff

Would you recommend any points hotels? How many days would you spend there? thanks!

By the time we had nailed down exactly where we wanted to go, all the big hotels had no availability. We did walk the grounds of the Lake Como Sheraton and it was really nice. Book early if you want to use points.

As far as time goes, I’d stay at least two nights. That would give you time to take the ferry to other little towns and do some exploring. We really liked Varenna because it was quiet and had a local vibe.

Do not attempt to drive around this area, it is crazy and just not worth it.

When you say do not attempt to drive around this area, what do you mean by it is crazy? What are some places that you feel comfortable driving that others think are crazy?

I’m asking because we’ve driven in lots of cities and foreign countries and generally aren’t intimidated to drive, so I’m wondering whether crazy to you means people drive a little unpredictably and the roads are busy and confusing or there are a hundred foot cliff drop offs with no guard rails and people just lay on the horn as they approach a bend in the road so that people coming in the opposite direction around the bend know that they’re coming and can hopefully stop in time (as was the case in most of Ecuador when we lived there for the better part of a year). Not sure that older and wiser me would still drive in Ecuador, but we’ve driven the Amalfi coast and other parts of Italy before without issue, so I’m trying to size up what you’re saying.

I think if you are driving point to point on your trip and you want to drive to Como and drop off your vehicle then that is doable. If the plan is to drive around the lake and visit different towns, I’d recommend to not do that. The only real point to point access between towns on Lake Como is a two lane road that is packed all day long. We took a day trip to Switzerland to ride this train (Bernina Express) that goes up to St Moritz so we were in one of those giant tour buses driving the lake ring road. Lots of times where other vehicles had to stop, back up so the bus could get through, motorcycles constantly trying to pass you in the middle of the road. That type of thing… Fender bender on the way back delayed us for about an hour since there is no way to take an alternate route.

I checked driving directions on google maps a few times while we waited for a ferry and most times the ferry was either faster or equal to the drive times google gave. And that is only drive time and not time spent trying to find parking, etc.

We took an Uber from MXP to our hotel near Como and I would have no issue recommending driving in this region. I’ve driven in Germany, Great Britain and most recently on a family vacation where we drove from Paris – Chamonix- Nice then went by train from Nice – Cinque Terre – Venice. No way would I be trying to drive/park in Cinque Terre and of course Venice. Uber/Lyft came in real handy in cities and airport transports where the cost of 4 subway/train tickets was more than the Uber.

Alternatively, book a fully refundable Airbnb, cash out points at 1.5 cpp, then cancel the Airbnb. Pay cash for what you want, how you want.

This is why the Altitude Reserve continues to be king in my view. Stack all your portals, discounts, etc. and then redeem at $0.015/pt. Plus you still earn 3x on the purchase as redeeming points doesn’t cause you to lose earnings. A 40,000 points redemption on a $600 hotel charge earns you 1800 points for a net cost of 38,200 points.

At US Bank, to get that 1.5 CPP redemption, one must either 1) use US Bank’s travel portal (same issue) or 2) use the mobile app’s instant redemption feature (which must be activated). One limitation is that the mobile app’s instant redemption feature ONLY works on purchases from US-based vendors. A purchase from a non-US airline, even if denominated in US Dollars, is not eligible. A purchase from a non-US hotel, even if denominated in US Dollars, is not eligible. It’s in the terms and conditions.

That being said, a person can always get CASH for points at 1.5 CPP. Better than the Amex Schwab 1.1 CPP rate. Nick? What you do is buy a fully refundable plane ticket from a US-based airline and use mobile instant redemption. Then, cancel the ticket the next day. The refund is in cash and not a restoration of points. Then, use your cash how you’d like.

A general problem with this card is that large purchases frequently trigger a fraud lock and unlocking is usually a two-hour phone call.

Money is fungible. You redeem AR points for $0.015 on any eligible transaction immediately when available via real time rewards. There is no benefit to keeping points around.

YMMV, but in my experience I’ve never had a charge declined or had a fraud lock and I make ~$40k in mobile wallet purchases/yr.

Understood. But, it must be an “eligible” transaction — all others are 1 CPP.

Regarding the fraud lock, I did mention “large” purchases. In spite of the card being intended for higher end clients, as a practical matter, one can’t scale that 4.5X overall benefit. Small stuff, great. Big stuff, nope. And, the team that handles the large purchase fraud codes for the Altitude Reserve only work M-F 8am – 6pm CT. A large purchase at 4pm Pacific Time on a Friday might lock your card until Monday morning. I have lost more time value getting my card unlocked than the benefit I receive from the card. Under YMMV, for others the card is great but for me it will not be renewed.

I make single $2000+ mobile wallet transactions every month for 4 years, never once been fraud locked. No you can’t MS, but you can make big transactions without issue.

Your argument about “eligible” purchases is silly. Don’t redeem for under $0.015/pt. UR are only worth $0.008 at Amazon…hence why it is not smart to us UR at Amazon.

No, I said “large” purchases.

Pax vobis cum.

I was wondering if booking a foreign hotel through Expedia, Travelocity, etc, would allow the real time rewards. I know it doesn’t work if booking directly, but it seems like there should be a way to make it seem domestic. A good experiment, Nick!

Try looking at BKK-Samui (USM). $80-$100 is normal on BKK Airways. On Chase, typically it ranges from $150 -$220.