NOTICE: This post references card features that have changed, expired, or are not currently available

There’s no doubt that the top story this week has been the Equifax data breach. Cyber criminals made off with the keys to the kingdom this week and we are left hoping for the best while not receiving the best support from Equifax.

But aside from that dark cloud, we also brought some thoughts this week on staying ahead of the curve: whether getting top tier status with fewer stays, opening an overlooked credit card, or getting a free meal at the airport. Read on for this Frequent Miler week in review.

Should Nick mattress run for SPG Platinum?

As the year comes to a close, I’ll admit that I’m in a slight panic: as it stands right now, I will have no top-tier hotel status in 2018. So when I received this email, I was intrigued – especially considering the fact that I do have an SPG stay planned. Greg made a good argument as to why I should do a Marriott challenge instead of an SPG challenge. But I think I might not take his advice on this one. Don’t get me wrong: he makes a compelling argument and I haven’t definitively decided not to listen to his wise advice. However, for a number of reasons, I’d like to try out SPG Platinum. I think I’m going to take up Starwood on this one….to be continued….

A super card for college savings

I’ve always said that there is value in diversification, especially when it comes to MS, and this Marvel Mastercard is a great example of how to diversify without sacrificing earnings. If you are interested in saving for college, this isn’t the only card you’ll want to have — but it will be a nice compliment on which to split your spending.

Priority Pass adds Denver Restaurant

Having done a bit of economy class travel in Europe over the past couple of years, I’ve found Priority Pass to be most useful when traveling in international economy class. Here in the US, it’s awesome if you live near an airport that has a lounge and you can easily get to the right terminal to use it, but I’m rarely in that situation myself. And so I’m excited that Priority Pass is expanding in a “think-outside-the-box” kind of way. On the other hand, this post made me feel disappointed in myself for A) Forgetting that they recently added a similar option at London Gatwick and B) Not downloading the Priority Pass app update before I flew out of Gatwick this week. A few bucks down the drain on pizza/water/snacks. Doh! Still, this is a welcome change and trend.

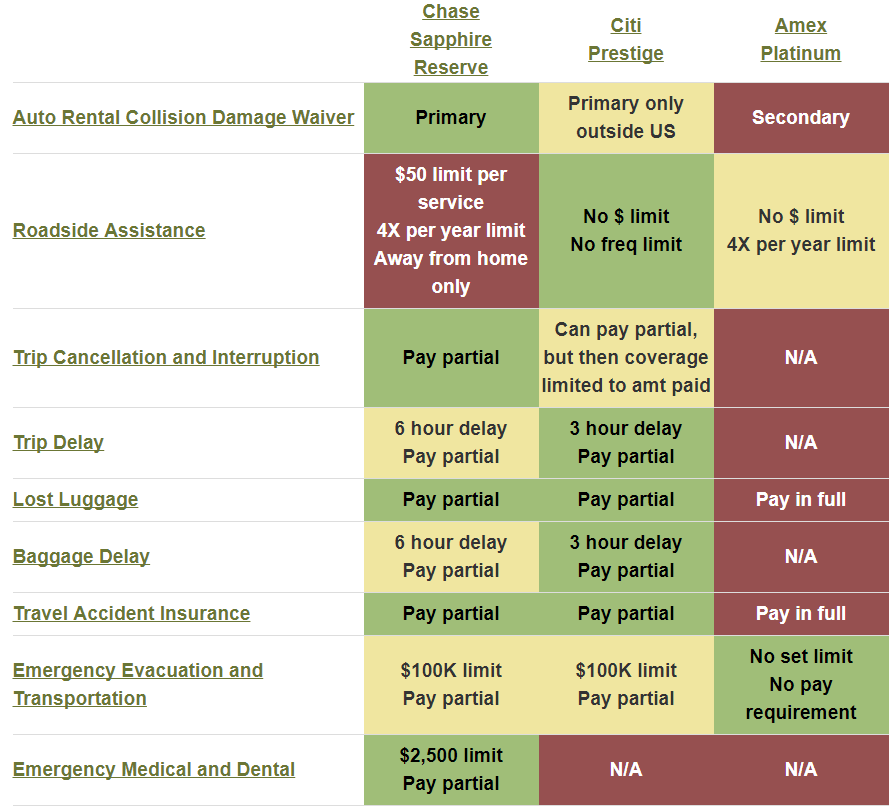

When does credit card travel insurance cover award flights

In a post with plenty of comments/questions, Greg compares travel insurance for award flights based on a number of different credit cards. This topic almost became extra relevant for me this week when I nearly missed the bag drop off time for a flight paid for with Membership Rewards points and I wondered whether or not I had any coverage. I would have been out of luck! Read on for details about when you’re covered and for what.

Chase business cards don’t add to your 5/24 count

I’m convinced: this is the truth. I’m also sure that many people have been told that they were declined because of 5/24 when the real reason was something else. When building credit years ago, I learned that the reason given for declining an application is not necessarily the actual/most relevant reason. For instance, I remember reading claims on Internet forums about how Bank A would not approve a new card if you had more than 8 inquiries on your report in the previous 6 months. I saw screen shots of letters that claimed “too many inquiries” as the reason for declining an application. And yet I later experienced instant approval with Bank A despite many more than 8 recent inquiries. And so I further fully subscribe to Greg’s conclusion that denials are much less convincing evidence to me than approvals — and reports of approvals have consistently trickled in, proving to me that the hypothesis is true. That doesn’t mean that anyone is a lock for approval, just that there is a possibility for approval when it’s Chase business cards bringing you over 5/24.

Why I converted from Ink Plus to Ink Business Preferred

In the interest of science, Greg converted an Ink Plus to an Ink Business Preferred. While I won’t be following in his footsteps on this one (I only have one Ink Plus), I think it adds to the value of the already-excellent 80K signup bonus on this card. Read on to find out why.

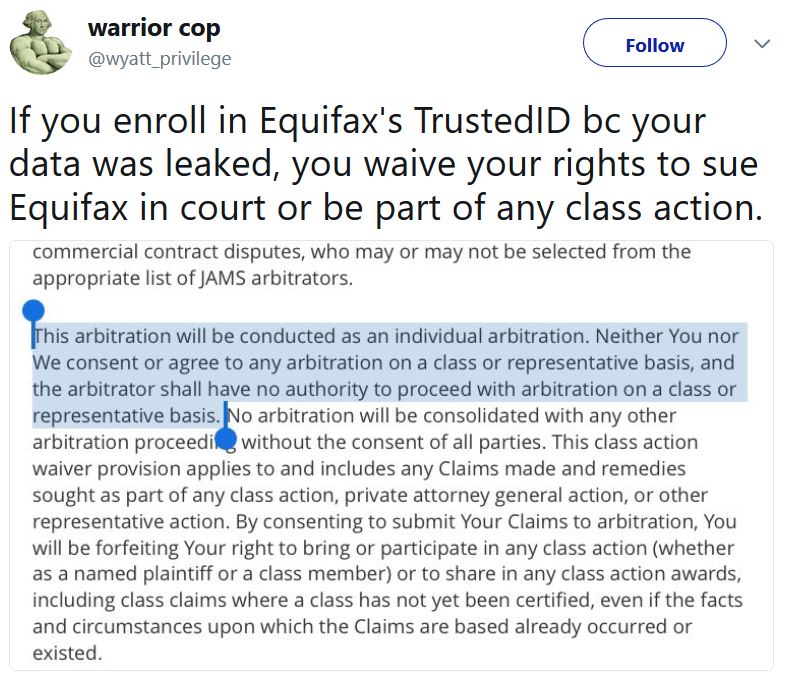

Equifax data breach: Find out if you’re affected and get protected

In news that makes me feel sick to my stomach, Equifax has been breached and the barn doors were left wide open, with millions of social security numbers, driver’s license numbers, names, birthdays, addresses, etc leaked to cyberspace. I have long been uncomfortable with the amount of personal information collected by and entrusted to the credit bureaus and Lexis Nexus — this breach demonstrates why. Read this post to find out more, but you might want to hold off on taking action until you read the next post . . .

Is the Equifax cure worse than the hack? Here’s what I plan to do…

Unfortunately, Equifax’s fix isn’t going as smoothly as I would hope after they took six weeks to make this information public and plan a solution. What bothers me most about this breach is that in addition to the potential to ruin credit someone’s credit, it makes me question the safety of money in the bank; if hackers have every piece of personal information necessary to reset a bank account login or set up an ACH transfer, I just can’t imagine the breadth of theft possible. Read this post to find out what Greg is going to do to protect himself. As for me, many will picture me with a tinfoil hat when I say this, but I’m considering investing more in physical gold/metals in order to reduce my exposure at the bank. I won’t argue it’s a brilliant solution, but now more than ever I’d like to make sure I’m diversified in case of the worst.

That’s it for this week in review — check back soon for our week in review around the web and this week’s last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)