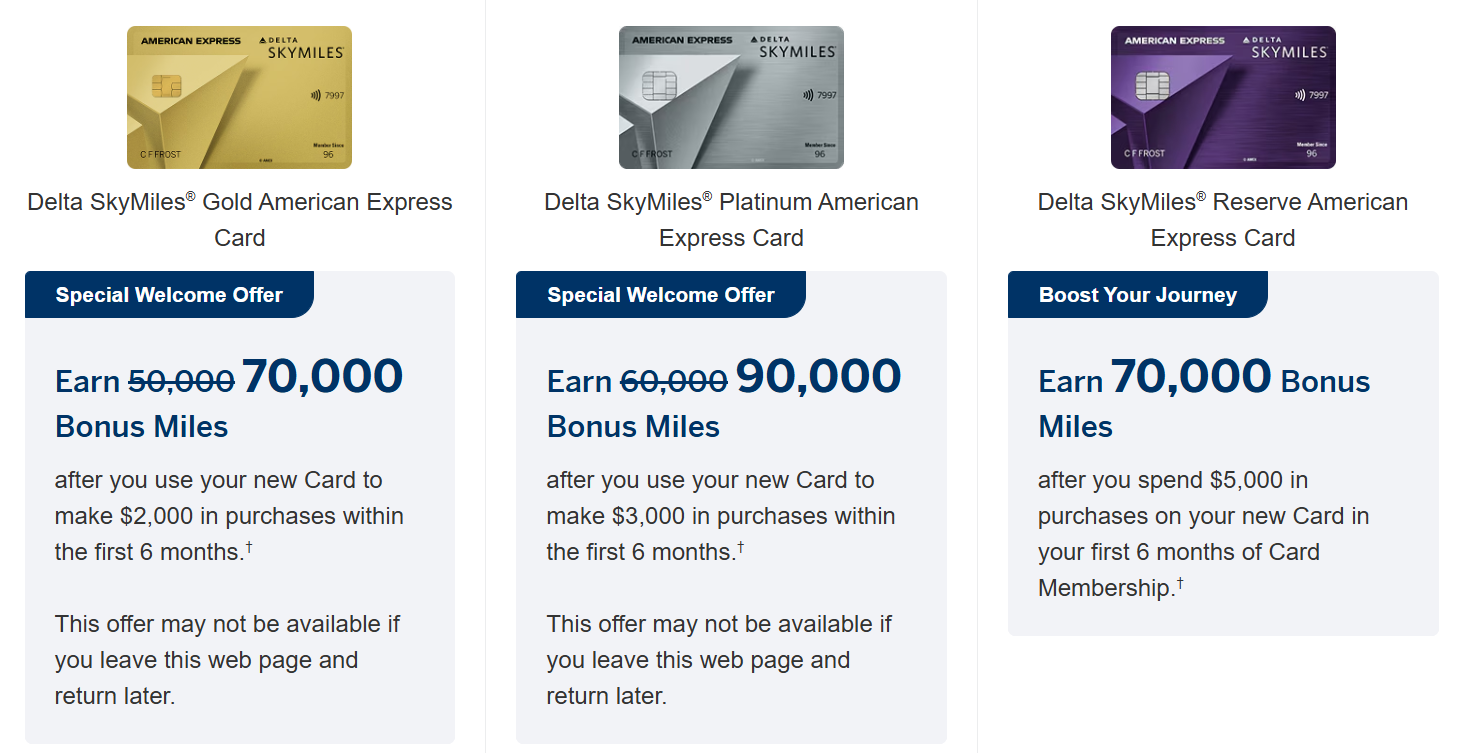

There’s another round of enhanced (and possibly targeted) welcome offers for the American Express Delta credit cards, featuring bonuses that are 20K higher than the current public offers.

I’m only seeing increased offers on the personal Delta Gold and Delta Platinum cards, but some folks are also finding better offers for the business and Reserve cards, depending on geographic location, browser configuration, etc.

The Deal

- There is a link that produces enhanced welcome offers for American Express Delta SkyMiles cards:

- Delta Business Gold: 70k SkyMiles after $2k spend in six months

- Delta Business Platinum: 90k SkyMiles after $3k spend in six months

- In addition, some people are seeing increased offers for the Delta Reserve and Delta business cards.

Key Card Details

For more card information and to find an application link, see our dedicated card pages by clicking the names of the cards below.

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Priority boarding, and free checked bag make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. $0 introductory annual fee for the first year, then $150 Earning rate: 2X Delta ✦ 2x eligible restaurants worldwide ✦ 2x US supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $200 Delta flight credit after $10K in purchases in a calendar year Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Get up to $100 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays ✦ Up to 6 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦ Priority boarding and first checked bag free on Delta flights. Terms and limitations apply |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate $350 Annual Fee Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X eligible restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year ✦ US, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Up to 12 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦Complimentary upgrades: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers ✦ Cell phone protection ✦ Terms and Limitations Apply. |

Quick Thoughts

These improved offers have bonuses that are 20k higher than the current, publicly-available versions: 70k for the Delta Gold and 90K for Platinum. Those targeted might find Reserve, Business Platinum and Business Reserve offers that are 100K+

These aren’t best-ever offers, so there’s not necessarily a reason to jump on them immediately. That said, if you are in the market for a new Delta card, adding an extra 20K to the haul is better than a kick in the pants.

I’m being targeted for 100K Platinum or Reserve, 85K Gold

I’ve been getting targeted for a 100k offer on the Personal Reserve for a while now; most recent offer (via email) was $8k spend in 6 months.

When using your direct link, I am getting:

Nice! Those are better than I was seeing.

Have you heard of any issues with churning the Delta Gold and downgrading after the first year to the Delta Blue to avoid the AF?

AmEx is particularly sensitive about canceling cards after the first year. You’re not going to get your welcome offer clawed back or anything, but you are risking getting put in pop-up prison. Best practice is to only open AmEx cards that you are planning to keep open for at least 2 year, or be willing to accept you might be locked out of some / all AmEx welcome bonuses and / or referrals for awhile.