Update 10/18/23: Delta has walked back many of the changes described here and has announced new benefits: Delta revises SkyMiles changes: more SkyClub visits, lower elite thresholds, better 1-time rollovers, vastly improved lifetime status.

The original post follows…

Delta has officially released the news about changes to their elite program for 2024 and beyond. Yikes. As I predicted, they’re settling on a single metric for earning elite status: MQDs (Medallion Qualifying Dollars). Also as predicted, they’re increasing the MQD requirements for each elite level. Unfortunately, the increases are much higher than I predicted, especially for top tier Diamond status. And for those of us rolling over a lot of MQMs into 2024, there’s good news and bad news. The good news is that we’ll be able to convert those MQMs to redeemable miles or MQDs or both. The bad news is that the conversion ratio to MQDs is bad… really bad.

Overview

Prior to 2024, Delta Medallion elite status required earning MQDs or an MQD Waiver and either MQMs (Medallion Qualifying Miles) or MQSs (Medallion Qualifying Segments). Starting in 2024, all of that complexity will go away and Delta will settle on a single metric: MQDs. The new MQD requirements are significantly higher than before, but Delta is at least introducing new ways to earn MQDs beyond paying for flights. Beyond flying, you will now also be able to earn MQDs through credit card spend, Delta car rentals, Delta stays, and Delta Vacations.

Elite Requirements

Starting January 1st, 2024, MQMs, MQSs, and MQD Waivers will be gone. Instead, to earn elite status for the 2025 elite year and beyond, you’ll need to earn MQDs. The following table shows the new requirements compared to the old:

| Elite Level | 2023 MQD Thresholds | 2024 MQD Thresholds |

|---|---|---|

| Silver Medallion | $3,000 | $6,000 |

| Gold Medallion | $8,000 | $12,000 |

| Platinum Medallion | $12,000 | $18,000 |

| Diamond Medallion | $20,000 | $35,000 |

As you can see above, MQD requirements are going way up. Silver MQD requirements increase by 100%; Gold and Platinum MQD requirements increase by 50%; and Diamond MQD requirements increase by 75%.

Earning MQDs

Flights

As always, MQDs will be earned for flights. Each dollar spent on flights, except for taxes & fees, will earn $1 MQD towards elite status. Basic Economy flights will not earn MQDs.

Delta Vacations

Delta Vacations bookings earn MQDs today for the flight portion of the trip, but starting in 2024 you’ll earn $1 MQD per dollar spent on the vacation package overall (less taxes and fees).

Delta Car Rentals and Stays

When you book a car rental through Delta Car Rentals or book a hotel stay through Delta Stays, you’ll earn $1 MQD per dollar.

Delta American Express Credit Cards

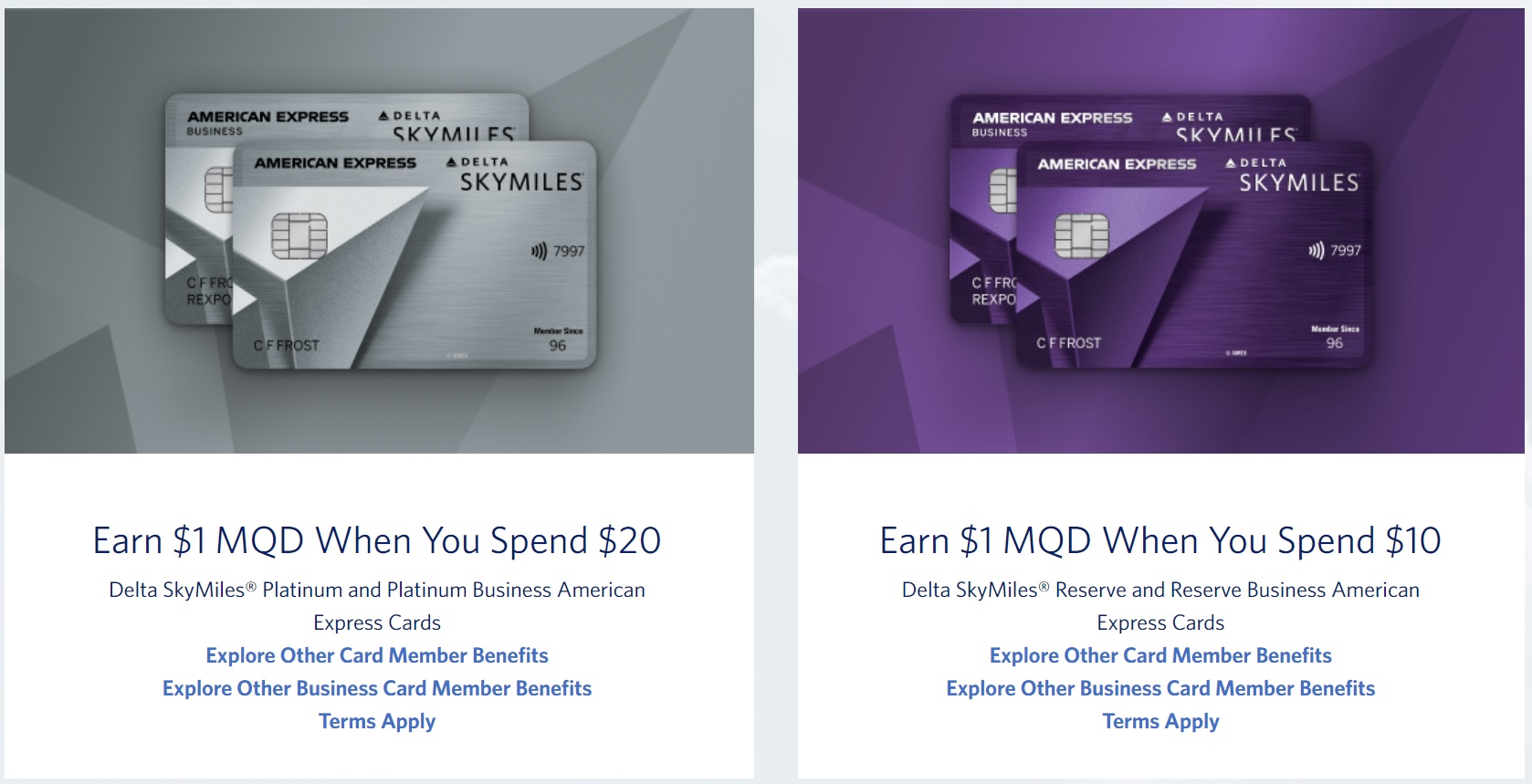

With Delta Reserve and Delta Platinum credit cards, you can earn an unlimited number of MQDs through spend, as follows:

- Delta SkyMiles® Reserve American Express Card: Earn $1 MQD per $10

- Delta SkyMiles® Reserve Business American Express Card: Earn $1 MQD per $10

- Delta SkyMiles® Platinum American Express Card: Earn $1 MQD per $20

- Delta SkyMiles® Platinum Business American Express Card: Earn $1 MQD per $20

Previously, $25,000 spend on a Delta Platinum or Delta Reserve card would earn a MQD Waiver, up to Platinum Medallion status; and $250,000 spend across one or more cards would earn a Diamond MQD Waiver. With the new program, $250,000 spend on a Delta Reserve card will earn only $25,000 MQDs which is $10,000 MQDs short of Diamond status.

For those who are used to the old way of earning MQMs and MQD Waivers with Delta credit cards, there are a couple of things to note:

- No limits to MQD earnings from spend in 2024 and beyond. Previously there were limits to how many MQMs you could earn from spend with each card.

- No gifting. With MQM Status Boosts earned on Delta Reserve cards in 2023 and before, you could gift those MQMs to another person. Starting in 2024, the ability to gift new elite earnings will be a thing of the past.

MQM Rollovers -> miles or MQDs

Excess MQMs earned beyond those required for the level of elite status acquired in 2023 for the 2024 elite year will rollover into 2024. At that point, SkyMiles members must choose whether to convert those MQMs into redeemable miles or MQDs or both. Here are the conversion ratios:

- Rollover MQMs convert to MQDs at a ratio of 1 MQD per 20 MQMs

- Rollover MQMs convert to redeemable miles at a ratio of 1 mile per 2 MQMs

SkyMiles members with rollover MQMs will be able to choose the method of conversion in 25% increments. In other words, you can choose to have 0%, 25%, 50%, 75%, or 100% of your MQMs converted to MQDs and the rest will convert to redeemable miles.

If you don’t choose by December 31, 2024, all Rollover MQMs will automatically be converted to MQDs.

No MQD Rollovers

In the new program, if you earn more MQDs than required for the level of status you attain, the extra MQDs will be wasted. Delta is not planning to roll over the extras.

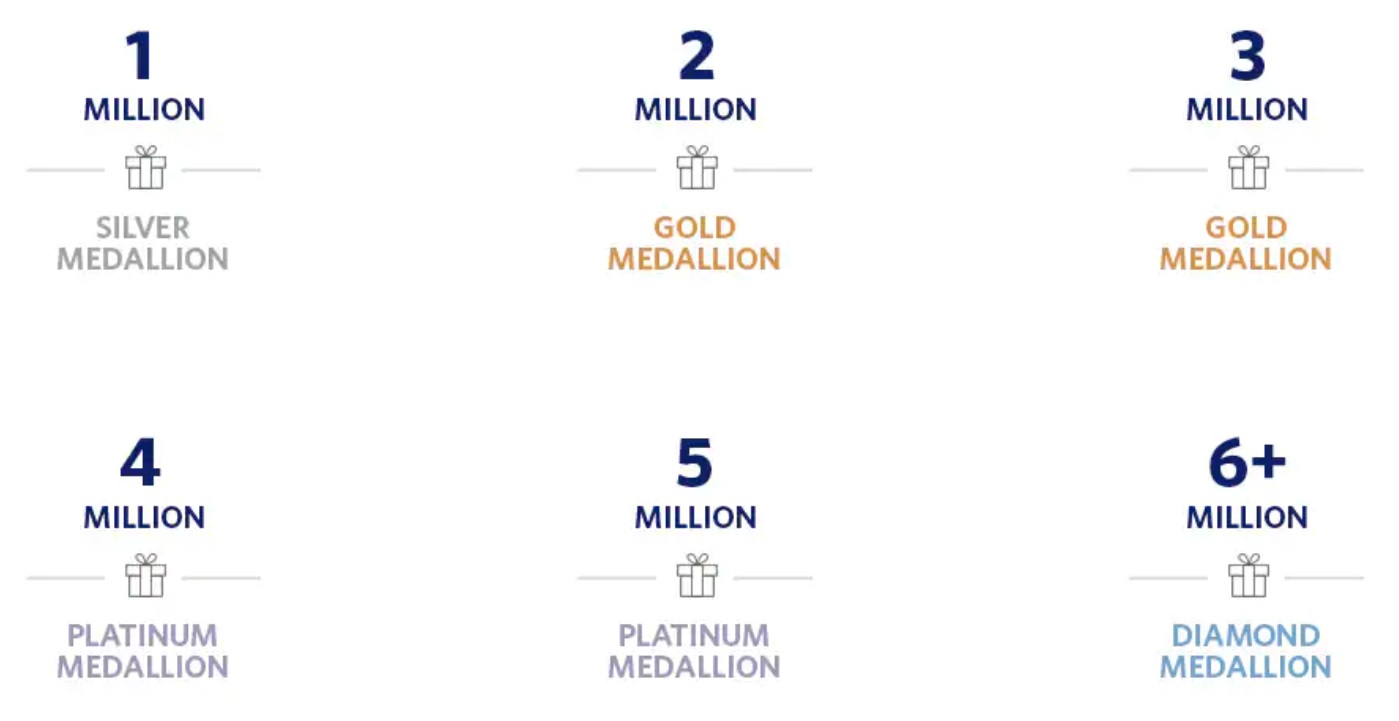

Million Miler Status

Delta offers special status for “Million Milers”. Previously, Million Miler status was based on MQMs earned. Starting in 2024, it will be based entirely on distance flown. All MQMs earned prior to January 1 2024 will count as miles flown regardless of how they were earned.

One new benefit of Million Miler status will be that your Million Miler status will increase the chance of complimentary upgrades more than it does today. Million Miler status will become the 3rd consideration in placing you in the upgrade queue behind Medallion status and fare class.

Analysis

For those who earn Delta Medallion status entirely from flying, it’s going to be much tougher to achieve the same level of status going forward. MQD requirements have increased by a minimum of 50% (100% for Silver, 50% for Gold and Platinum, and 75% for Diamond).

For those who earn Delta Medallion status entirely through credit card spend, things look good at low levels of spend. As long as you put your spend on a Delta Reserve card rather than a Delta Platinum card, the amount of spend required to earn Silver or Gold status is comparable to before. The amount required for Platinum and especially Diamond status, though, increases substantially:

| Elite Level through spend alone | 2023 Spend | 2024 Spend |

|---|---|---|

| Silver Medallion | $60K Delta Reserve | $60K Delta Reserve |

| Gold Medallion | $110K: $60K Delta Reserve + $50K Delta Platinum | $120K Delta Reserve |

| Platinum Medallion | $150K: $120K on one Delta Reserve + $30K on another (one personal, one business) | $180K Delta Reserve |

| Diamond Medallion | $250K: $130K on one Delta Reserve + $120K on another (one personal, one business) * this actually left you 5K short of the required MQMs unless you had enough rollover. |

$350K Delta Reserve |

The problem with the above analysis is that it doesn’t consider rollover MQMs. Many of us have been able to rollover lots of MQMs from previous years and so the only spend required to reach as high as Platinum Medallion status was $25,000 to get the MQD Waiver. Since rollovers won’t exist in the new program, elite status through spend will be even harder to achieve than shown above.

I suspect that most people interested in Delta elite status will earn MQDs through a combination of flying and credit card spend. Let’s look at how much spend is required for each elite level if you earn $3,000 MQDs per year through flying (I picked that number because it was the MQD requirement in 2023 for Silver Medallion status):

| Elite Level through spend combined w/ $3K MQDs from flights | Delta Reserve Spend |

|---|---|

| Silver Medallion | $30K |

| Gold Medallion | $90K |

| Platinum Medallion | $150K |

| Diamond Medallion | $320K |

Now we see a more complex picture for those who earn $3K of MQDs from flying. Those seeking Silver Medallion status will need to spend $30,000 on a Delta Reserve card (or twice that on a Delta Platinum card). That’s $30K more spend than would have been required in 2023. The spend needed for Gold status, though, is $20K less than the spend required in the old program (unless one had MQMs rolling over) and the spend required for Platinum is the same $150K as required before. Diamond status, though, is still a much higher bar than before.

My Take

Ouch! I’m currently sitting on over 400,000 MQMs in my account. I had previously thought that I’d keep myself at Platinum status for many, many years simply by spending $25K each year on a Delta credit card in order to earn the MQD Waiver. With the new program, that plan is completely out the window. And I can’t even turn those MQMs into easy Diamond status next year. At the terrible 20 to 1 conversion ratio, 400K rollover MQMs will become only $20K MQDs. That’s $15K MQDs short of Diamond status! So, unless I commit myself to earning $15K MQDs next year, all those rollover MQMs will simply get me one more year of Platinum status. Boo!

For those who earn elite status from spend, there is some good news: there won’t be any reason to have multiple Delta cards going forward. If you had multiple cards (one personal and one business, for example), you can feel good about cancelling at least one of those cards. On the other hand, Delta Platinum cardholders will earn only half the MQDs from spend as earned with Delta Reserve cards. If you’re a Delta Platinum cardholder and you plan to continue to earn status through spend, it will be absolutely necessary to switch to the Reserve card. I suspect that many people will, instead, decide that seeking Delta elite status simply isn’t worth it anymore.

The one saving grace of all this is the hope that there will be far fewer elite members starting in February 2025. If so, complementary upgrades should become easier to get. Additionally, it seems to me that Delta is going to have to do more to incentivize earning high level elite status. Last year they nerfed the Global Upgrade certificates available only to Diamond elites. Will they do something next year to add value instead? I think they’ll have to.

It is what it is. I am not a fan of these programs giving away loyalty; not flying, not staying, not renting. I’m sorry. As one who travels, it is annoy to see folks who haven’t put in the time get status so it means it is watered for all and then they complain about it and they are the reason it sucks now.

For that reason, I left Marriott and started staying at Hilton, even though I got LTE the original way.

Just as giving away access to the SkyClub, people who paid for it was pissed at all the freeloaders. I’m glad Delta is reigning in some of it’s mistakes since if you paid for this as a frequent traveler, having to sit in a crowded club is truly a drag. Traveling is a pain enough than having to share with folks who don’t know the etiquette or are jerks.

If Delta intends to push their frequent flyers away to American, this is a great way to do it.

Hey Greg

Delta question…..

Delta articles state (only) “Rollover MQM’s can be used at 100k/yr to maintain your 2024 status”

It does NOT define details on 2024 status…..such as….

Do you have any insight on this as I have over 400k mqm’s and would like to become diamond in 2024 so “extension” would be perfect for me.

PS…..I’m a lifetime Platinum.

Thanx

It definitely means status earned in 2023. Status earned in 2024 would be referred to as 2025 status.

Hi Greg – Thanks for the great article. It looks like Delta updated their 2024 FFM program sometime in Oct 2023 (after you published this original article) so that the dollars to earn MQD went down a bit. Does the rest of your article hold true, except that the foundational dollars required per tier is now lower? It will still be a difficult task to earn Platinum status.

Silver Original $3k –>First Change $6k–> New change for 2024 of $5k

Gold $8k–>$12k–>$10k

Platinum $12k–>$18k–>$15k

Diamond $20k–>$35k–>$28k

Also, I have the Delta Platinum business card; my wife and I each hold a card separately, but it would seem, especially with the change, that we are better off to convert the platinum card to the Reserve card. If I have the Reserve card (or, I should say my company), could both of us have a Reserve card on one account, and add to our spend additively (i.e., she spends, I spend on our Reserve cards, and it would go to one (my) Delta account? Thanks in advance.

There’s a link at the top of this post to the newer post with the revised details. I’ll try to do something to make that more obvious.

Regarding spending towards a single account: yes you can do that simply by adding an employee card for your wife to your account.

[…] Delta announced their 2024 changes (see: Delta’s 2024 elite program — it ain’t pretty). My plan for keeping Platinum elite status long-term was kaput. All of my hundreds of […]

This seems awful. But two questions – 1.) currently, MQDs are quite odd for money spent on flights, where it is not 1:1 and based on some weird formula. Will this change with the new regime? 2.) for the lounge visits allowed for cardholders in 2025/beyond – are they additive, i.e. if I have both platinum and reserve card, would I get 16 visits? This lessens the blow a little bit. It’s just irritating because it’s a huge effort now (and breeds resentment toward Delta) to get what we easily got before. I think they are going to need to tweak it.

1) Are you thinking of MQMs? Except for special things like partner flights and Delta Vacations, MQDs are awarded 1:1.

2) Yes they’re additive

“The one saving grace of all this is the hope that there will be far fewer elite members starting in February 2025. If so, complementary upgrades should become easier to get.”

The world loves a dreamer, Greg. Lol!

(Delta doesn’t want you to get a complementary anything, especially an upgrade.)

Wow, what a devaluation of everything that kept me coming back to Delta and using the AMEX Reserve. I would like to see a new “value” put on the Reserve card as so many benefits are now lost since making Medallion Status got so much more difficult.

I’ve been Platinum Medallion for several years now. That’s ending in 2025 now. So many benefits from that status I’ll never see again.

I’m astounded by how many business flyers can’t even make status anymore. Makes me wonder, who is this suppose to benefit??? I’d be curious to see a poll on who will keep Diamond and Platinum that have it now.

Hi Andrew,

Been a platinum for several years but it will not happen any longer. I fly many miles but $$ wise I will never reach 18K even if I add the spending from my Delta Platinum Amex.

Solution: I switch to United already and will be a Platinum by the end of the year (already gold now) and I have applied for the United Club Visa (same price of the Delta Amex) which allows me to access all lounges for free

[…] passengers, formerly known as Delta elites, wondering where the comfort plus has gone. In a series of stone-faced announcements over the last two weeks, Delta let many of its ordinary, red-blooded road warriors know that, really, they were never that […]

This new program while it really is a kick in the crotch, it still is doable. It incentivizes spending on flights. With a 1-1 ratio you just need to spend 18K on flights and boom you are platinum. Delta 1 to Milan for wifey and I and we are 50% there. It’s cheaper than spending 180K on the Reserve. I think I’ll get Platinum again by doing half or 9K on flights and 90K on the Purple card. Done ✅

Sad. I was literally thinking of flying my parents, brother, and girlfriend to and from Dubai next year as a gift, which would also serve in securing my annual status and us all traveling comfortably. Now that’s simply not happening or we’d fly emirates (in half the time mind you). Ahh, it was fun while it lasted.

Doesn’t seem like Delta cares if you stop using their card at the end of the coming years. OK, my MQDs are at $18,000 in September so I won’t make Diamond. I’ve already spent $75,000 for unlimited sky club access so why keep using the reserve card? Switch to a Marriott or Hilton Amex for the same card protections but an entirely different set of perks, or even their Blue Cash card. Redeemable miles just aren’t worth it alone to keep using the Skymiles cards IMO once you’ve maxed a status since they aren’t rolling any portion of unused MQDs. Curious what happens to the 360s…or (gulp) what it takes to earn that now!

Will award tickets earn MQD’s in 2024? It’s unclear.

That’s interesting. I don’t see anything in the official announcement that addresses that question, but I also don’t have any reason to think that they would take away MQD earnings on award tickets so I feel confident that they will earn MQDs in 2024.

I remember in the early 1990s, when Continental tightened up on many benefits, (CO also canceled service to many cities and ended their hub in Denver). The FF crowd were howling. Many did leave Continental, causing the airline to lose more money. This was after AA introduced the “Value Plan” for fares in 1992, which caused many competitors (including CO) to lose money. It also caused CO to re-enter bankruptcy. Gordon Bethune was brought in, in late 1994, to clean up the mess. One of the first things Bethune tackles is overhauling the FF program, “OnePass”. He turned Continental into one of the world’s most admired airlines. He wrote a book, “From Worst to First: Behind the Scenes of Continental’s Remarkable Comeback”.

Which makes me think that all the bean counters, may be very off in their calculations, of how many FF that Delta will lose? The MQD numbers are not incremental at all. The MQD for Silver is double. As a Silver, one gets very few upgrades. The free baggage and early boarding is not costing Delta that much money to cause it to double the qualification? Is there more to these changes than just meets the eye? Delta isn’t losing money so that isn’t the issue. Someone commented that these changes will cause competitors to change their FF programs. I am not so sure about that. AA has really attracted more customers with Loyalty Points.

I also have a business Delta AmEx and a personal along with a Business AmEx Platinum with 500,000 miles