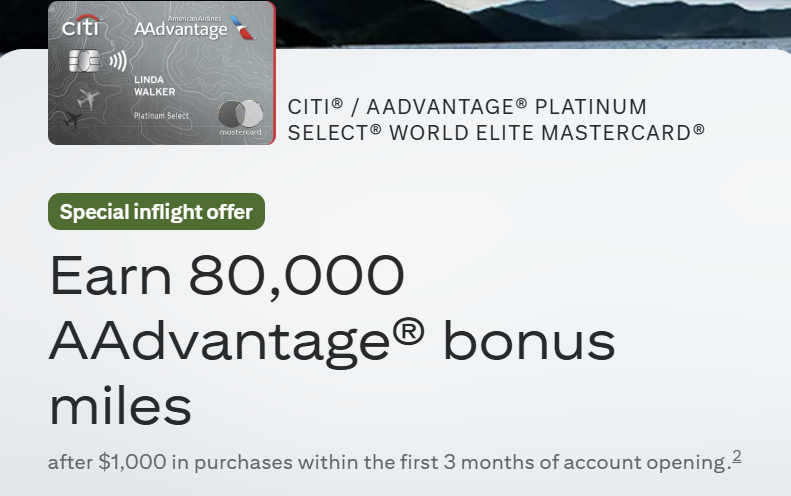

Citi and American Airlines have a boosted welcome offer on the Citi AAdvantage Platinum Select World Elite Mastercard. This is a terrific, in-flight offer that gives you 80,000 bonus miles after spending only $1,000 in the first three months. That matches the highest welcome bonus we’ve seen on this card (but at a lower spend than we’ve seen), and it also comes with a waived annual fee the first year.

Since this is an in-flight offer, you need a code to apply. You can either get one from an actual flight attendant, or just use a random six-digit number like 000000.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1103 1st Yr Value EstimateClick to learn about first year value estimates 80K Miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 80K miles after $1K spend in first 3 months. Ask flight attendant for a code or enter 000000$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: This is the best we've seen in recent times FM Mini Review: Excellent choice for a great intro bonus. Plus it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) Earning rate: 2X restaurants ✦ 2X gas ✦ 2X AA Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: $125 AA Flight Discount with $20K membership year spend Noteworthy perks: First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight food and beverage purchases ✦ Earn up to $30 in statement credits for each eligible Turo trip completed from October 19, 2025 to October 18, 2026, up to $180 statement credits in total |

Quick Thoughts

The current public offer on this card is only 50,000 bonus miles. This version provides an additional 30,000 miles AND also waives the annual fee for the first year. That’s a terrific deal.

If you’re looking for AAdvantage miles, this is a no-brainer, but make sure that you’re eligible before you apply. You might not be approved if you’ve earned a welcome offer for this specific card in the past 48 months. If you earned the welcome bonus for the CitiBusiness AAdvantage Platinum Select card or the Barclays Aviator Red card in the past 48 months, you’ll be fine.

You can use this code to apply, 809492. It worked on my flight yesterday

Any idea how long this will be around? trying to game out my 5/24

Apparently the ads for this in seatbacks on flights give the expiry date as March 31, 2026. It was previously due to expire on December 31, 2025, but there’s no guarantee it’ll get extended again beyond March.

With the waved $99 fee for the first year; is the strategy here to cancel the card and never pay the fee?

If you wanted to keep the credit line open, you could downgrade to a no annual fee AAdvantage MileUp card or possibly to a different non-AA card (e.g. Custom Cash)

[…] to reporting by Frequent Miler, in practice, you can enter a random number or “000000” as the code and receive the […]

AA and Citi bank have the Best Deal going right now especially with the no annual fee. The way I look at is 80,000 miles will definitely get you somewhere! I switched before the switched me – code even me was 573675

I used the 000000 code and was approved.

Has anyone received the miles using that code?

where to fill the code ? I would not find it in the application page

573675

Flight attendant here for American the code is 657085

Anyone have an actual code? All zeros seems like a good excuse for them to say you didn’t have the real offer.

I used 123456 and it worked.

hi, how you apply the code? i tried to add the code directly on url link but it no work

https://www.citi.com/credit-cards/inflight-info

Code is 814705

Try 224254

Try 224255. I got this on my last flight

Do we know when it expires?

Offer good til 12/31/25

share code with family and friends. And husband and wife can both apply

Code is 814705

Sorry. A typo. Code is 814705. Best offer ever!!

if u get approved, does this mean u will get bonus even if within 48 months from last SUB?

Where is the link? I clicked on everything and it doesn’t take me to an offer.

Any risk to Citi or AA shutdown if I apply using the dummy code and did not fly?

I applied myself using 000000 today, having not flown American in over a year, and was approved instantly. Just one DP, but I don’t think it’s likely an issue.

Nice applied had to confirm through text I requested it and instantly approved! Also approved for the Barclays Aviator Red during the 70K offer.

Just applied and was instantly approved. I picked up the 70k Barclays Aviator Red card a few months ago as well.

Dangit I just completed a SUB for Citi Strata, there’s no way they approve me for another card so soon.

No harm trying to apply. I was declined for Strata in August (despite several recon calls), ended up applying for 2 more cards from other banks since, and tried my hand at this offer expecting to be declined, but shockingly was approved.

The harm is that some banks are inquiry-sensitive, so even a denied application can hurt future approval chances.