In this post I’ve compared the requirements for earning elite status among the big three: AA, Delta, and United. In recent years, all three have simplified their programs to make it possible to earn elite status through a single metric. And all three make it possible to earn status through credit card spend. United confuses things by also considering a second metric (segments flown), but if we ignore that complexity, we can compare the three programs head to head. Which program offers the easiest path to status? Which is worst? The answers to these questions may surprise you (they surprised me!).

Overview

All three Airline elite programs used to award elite status based on distance flown. Now, as of Jan 2024, all three award elite status based primarily on how much money you spend with the airline. Delta is the most overt with this. Their elite metric, MQDs, stands for “Medallion Qualifying Dollars” and, other than a few exceptions, it is a direct measurement of how much each person spends on Delta flights. United’s system is similar but they chose to obfuscate a bit by calling their metric PQPs (Premier Qualifying Points) even though PQPs are really dollars spent flying United. United confuses things further by letting you earn status with a combination of PQPs and PQFs (Premier Qualifying Flights), but otherwise Delta and United have comparable elite metrics. American Airline’s system is very different. With AA, the amount you spend on AA awards loyalty indirectly. With AA, other than a few exceptions, anytime you earn redeemable miles, you also earn the same number of Loyalty Points. And since AA awards redeemable miles based on the amount paid for a flight, they also award Loyalty Points based on the amount paid. But, unlike Delta and United, there is not a one to one correspondence between the amount paid on AA flights and Loyalty points earned. This makes it difficult for people to compare elite requirements across programs. That’s where this post comes in…

How to earn status with American Airlines

AA awards status based on Loyalty Points earned within the status qualification period (March-Feb). In most cases, when you earn AA redeemable miles, you also earn the same number of Loyalty Points. This is very different from Delta and United because it includes earning points from AAdvantage e-Shopping, Simply Miles, and more. Some examples of where you do not earn Loyalty Points when earning redeemable miles are:

- With credit card spend, you only earn one Loyalty Point per dollar spent even when the credit card offers more miles per dollar. Additionally, miles earned from welcome bonuses and other bonuses, do not earn Loyalty Points.

- With portal rewards, you do earn Loyalty Points at the same rate as you earn miles, except that you do not earn Loyalty Points for portal-wide bonuses. For example, if a store offers 10 miles per dollar for purchases, you will also earn 10 Loyalty Points per dollar. However, if the portal is offering, for example, 1,000 bonus miles, portal-wide, after a certain amount of spend, you will not earn 1,000 Loyalty Points from that promotion.

- Bask Bank does not offer Loyalty Points for miles earned from banking.

How to earn status with Delta Airlines

Delta’s elite earnings are pretty straightforward. You will earn one MQD for each dollar spent for Delta Flights and Delta Vacations. With credit cards you’ll earn either 1 MQD per $10 spent (Delta Reserve) or 1 MQD per $20 spent (Delta Platinum).

Delta also awards MQDs on award flights when flying Delta. You’ll earn 1 MQD for each 100 SkyMiles spent on your award flight.

Other ways to earn MQDs:

- Delta Reserve and Delta Platinum cards offer an annual $2,500 MQD Headstart per card. It’s theoretically possible to have both the consumer and business version of each for a total of four $2,500 MQD Headstarts. In other words, you could start each year with up to $10,000 MQDs.

- Delta runs promotions periodically to award MQDs for booking hotels or car rentals through their site, or for making purchases at a Delta store, etc.

- When you earn Platinum Medallion status and again when you earn Diamond Medallion status, you can pick a 1,000 MQDs or 2,000 MQDs Accelerator.

How to earn status with United Airlines

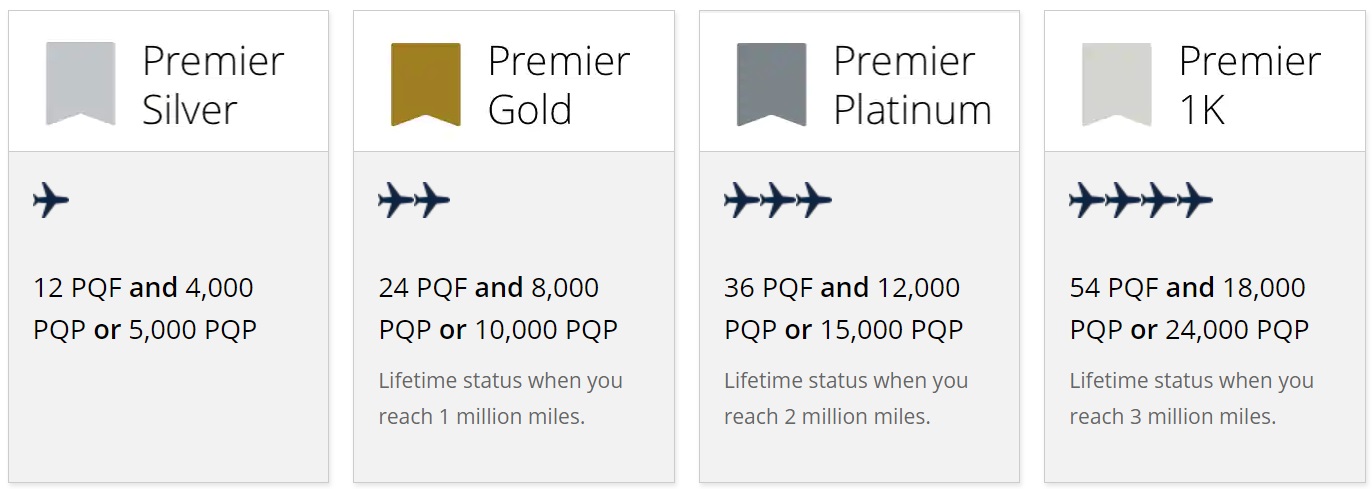

Compared to AA and Delta, United stands alone as having the most convoluted elite system. At a high level, though, it seems simple. Just like Delta, you can earn status entirely with dollars (PQPs) spent on United flights. Except that you do have to fly a minimum of 4 segments on United or United Express to qualify at all. If you fly many segments (also known as PQFs), you can qualify for status with fewer dollars (PQPs).

United award flights earn both qualifying dollars (PQPs) and segments (PQFs). For the first, PQPs, United gives you 1 PQP for each 100 miles redeemed. That’s the exact same equation that Delta uses for MQD earnings on award flights.

With credit card spend, you can earn 25 PQP for every $500 in card spend. Compared to AA and Delta (at least, with the Delta Reserve card), that’s pathetic (with the Delta Reserve card, for example, you would earn 50 MQDs for every $500 in spend). And to make it worse, there are caps to how many PQPs can be earned with each card (the no-longer-available United Presidential Plus Card and United Presidential Plus Business Card are exceptions with no caps). Clearly United is less interested than AA or Delta in awarding elite status to heavy credit card spenders.

Caps on earning PQPs with United credit cards:

- United Explorer Card: Up to 1,000 PQP in a calendar year

- United Quest Card: Up to 6,000 PQP in a calendar year

- United Club Infinite Card: Up to 10,000 PQP in a calendar year

Details about other United cards can be found here.

Elite status through flying

In this section you’ll find a comparison of the cost to achieve elite status through paid flights with each airline. For comparative purposes, this assumes that you’re not earning elite qualifying points through other means such as credit card spend, award flights (which is possible with Delta and United), car rentals, etc.

With Delta and United, the amount of spend required to achieve each level of status is straightforward since their requirements are directly based on the amount spent. With AA, it’s more complicated. AA awards more miles based on your elite status level when you fly. Therefore, the amount of spend required to reach or renew a level of status differs based on your status when you fly. In other words, elite earnings accelerate as you reach higher and higher levels of status and renewing high level status through paid flights is easier than getting it in the first place.

AA awards miles and Loyalty Points for paid flights, as follows:

- Base Member: 5 miles per dollar

- AAdvantage Gold: 7 miles per dollar

- AAdvantage Platinum: 8 miles per dollar

- AAdvantage Platinum Pro: 9 miles per dollar

- AAdvantage Executive Platinum: 11 miles per dollar

The following table assumes that all elite earnings are from flight spend. This is a necessary simplification in order to compare programs. In the real world, I believe that most people will earn status through a combination of flight spend, credit card spend, and other opportunities. Further, for American Airlines status, I made the simplifying assumption that once you reach a level of status, all further flight spend will earn points based on that level of status. In the real world, it is unlikely to be that clear cut since you’ll have some spend that overflows into the next level of status earning before your status changes.

| Airline | Tier 1 | Tier 2 | Tier 3 | Tier 4 |

|---|---|---|---|---|

| AA | Gold: 40K LPs | Platinum: 75K LPs | Plat Pro: 125K LPs | Exec Plat: 200K LPs |

| Fresh start1 | $8,000 | $13,000 | $19,250 | $27,583 |

| Renew status2 | $5,714 | $9,375 | $13,889 | $18,182 |

| Delta | Silver: $5K | Gold: $10K | Platinum: $15K | Diamond: $28K |

| w/ one card3 | $2.5K | $7.5K | $12.5K | 25.5K |

| w/ two cards3 | $0 | $5K | $10K | 23K |

| United | Silver: $5K4 | Gold: $10K4 | Platinum: $15K4 | 1K: $24K4 |

| w/ PQFs | $4K +12 PQF |

$8K +24 PQF |

$12K +36 PQF |

$18K +54 PQF |

1) Assumes starting with no AA status. LPs earned per dollar increase w/ each status level gained.

2) Assumes renewing the same level of AA status that was earned the previous year.

3) Those with a Delta Platinum or Delta Reserve card get a $2,500 MQD Headstart per card.

4) Requires a minimum of 4 segments flown on United regardless of the # of PQPs earned.

For the first three tiers of elite status, Delta status requires the least flight spend as long as you hold at least one Delta Platinum or Delta Reserve credit card. And if you have two cards, Delta requires far less spend. In fact, with two cards, you’ll have Silver status without any spend at all! For those without a Delta Platinum or Reserve card, though, United offers the cheapest path to status.

For top tier status, the picture is different. Here Delta requires the most flight spend and even after accounting for credit card Headstarts, Delta isn’t any cheaper than United. The best option at the top-tier is American Airlines for renewing status. Renewing AA top tier status requires only $18,182 in AA spend. United matches that, but only if you also fly 54 segments.

Note that the above analysis does not take into account the possibility that the AA flyer has the AA Executive card which offers 10K bonus Loyalty Points after earning 50K Loyalty points and another 10K bonus Loyalty Points after earning 90K Loyalty Points.

Elite status through credit card spend

The following table shows the amount of credit card spend required to reach each elite status level. This analysis assumes that status is earned 100% through credit card spend. Note that United caps the number of PQPs can be earned with each credit card. It’s not really possible to earn top tier United status through spend unless you have the no-longer-available United Presidential Plus Card or the United Presidential Plus Business Card since those cards have no caps.

| Airline | Tier 1 | Tier 2 | Tier 3 | Tier 4 |

|---|---|---|---|---|

| AA | Gold | Platinum | Plat Pro | Exec Plat |

| 1 LP / $ | $40K | $75K | $125K | $200K |

| w/ Aviator Silver1 | $35K | $60K | $110K | $185K |

| w/ AA Exec2 | $40K | $65K | $105K | $180K |

| w/ Both Cards3 | $35K | $50K | $90K | $165K |

| Delta | Silver | Gold | Platinum | Diamond |

| w/ one card4 | $25K | $75K | $125K | $255K |

| w/ two cards5 | $0 | $50K | $100K | $230K |

| United | Silver | Gold | Platinum | 1K |

| 25 PQP for every $5006 | $100K | $200K | $300K | $480K |

1) Aviator Silver card offers 5K bonus points at $20K spend, $40K spend, and $50K spend

2) The AAdvantage Executive card offers 10K bonus Loyalty Points after earning 50K Loyalty points and another 10K bonus Loyalty Points after earning 90K Loyalty Points.

3) Assumes putting all spend on the Aviator Silver card. The AA Executive card offers bonus Loyalty Points even if you do not put any spend on that card.

4) The Delta Reserve card earns 1 MQD per $10. To estimate spend for the Delta Platinum card, double the numbers shown.

5) Each Delta Platinum or Reserve card offers another $2,500 MQD Headstart. The numbers shown assume that all spend is put on a Delta Reserve card.

6) United has limits on how many PQP can be earned with each card. Additionally, United requires a minimum of 4 segments flown on United regardless of the # of PQPs earned.

For those interested in earning elite status entirely through credit card spend, Delta is best for Tier 1 status and AA is best for earning top tier status. Delta and AA are roughly the same for earning Tier 2 or Tier 3 status.

It’s interesting to see how poorly United fares here. If you’re interested in earning status through credit card spend, the amount of spend required is staggering. To make matters worse, unless you have the no-longer-available United Presidential Plus Card, or its business twin, you would need to juggle three different United cards to get to Platinum status through spend. And you’d have to fly four United segments per year too.

A note about earning AA status through spend: This analysis did not include the many additional ways you can earn AA Loyalty Points beyond credit card spend. For example, if you often shop online, you could easily earn huge numbers of Loyalty points by shopping through the AA portal. Similarly, if you link your Mastercard to Simply Miles, you may be able to earn additional Loyalty Points through spend at select merchants.

Conclusion

Several clear patterns emerged from the analyses presented above:

- Delta is the best for achieving low-tier status as long as you have a credit card. Thanks to Delta’s MQD Headstarts that you get by simply having a Delta Platinum or Delta Reserve card, Delta makes it very easy to earn Tier 1 status. In fact, with two credit cards, you’ll start off with Delta Silver status without even stepping on a plane or spending anything on your card.

- Delta is the best overall option for earning mid-tier status. United is a good alternative for earning through flying alone, but it’s a terrible choice for earning through card spend. AA is the opposite: it’s a great choice for earning mid-tier status through credit card spend, but it’s not a good choice for earning through flying alone. Delta is a competitive choice for earning mid-tier status in either way: through flying or through spend.

- AA is the best overall option for earning top-tier status. AA offers the cheapest path, by far, to earning top tier status through credit card spend alone. Additionally, while they’re not very competitive when trying to earn top-tier status entirely through flying, they’re arguably the best for renewing top tier status entirely through flying.

- United is a good choice for earning through flying, but a bad choice for earning through spend. United was a close second place across the board when it came to earning elite status through flying alone. On the other hand, United was a distant third across the board for earning status through credit card spend.

This is a great post. Would you please update it with the latest changes from United? Thank you!

This article reinforces my reasons for flying 75,000+ miles on Alaska Airlines each year to keep MVP Gold 75K status. That gives me One World Emerald status and American treats me like PlatPro. The only hoop I want to jump through is flying on planes.

Why not mention by having 4 cards (Plat/Reserve and Personal/Biz) you get 10K Headstart MQD? it will result in Gold status and 5K MQD away from Platinum.

In my experience, need Diamond to have a shot at an upgrade to J. Certs got better but even with Stays credits, entire 2000 af won’t be erased. Depends on your airports.

I am not saying getting all 4 cards to get Gold is the smartest move for all. I was just saying it’s an legit move for status chaser 🙂

AA’s scheme creates incentives for customers to spend in all revenue channels. Incredibly clever. Delta is missing the boat. My wife and I have substantial hotel spending that we would gladly move to Delta’s hotel portal if . . .

In effect United is giving 120 PQP credit for each segment;

they would be wise to combine both in 1 metric

– say 100 PQP for each segment and be done with it.

It is also stupid to treat the business club card holders badly

– they can put a lot of spend easily on the cards and generate revenue

Every time I read about this, I’m reminded of the extremely low return on investment of time and money trying to earn elite status…all to gain what? Lounge access (which you can get through a credit card)? The occasional business and first class upgrades (on short haul domestic flights)?

It’s much simpler and more productive to just focus on earning points though spend, SUB’s, retention offers, retention offers, and shopping portals. Then you can just buy the biz/first international tickets and pay cash for the domestic econ premium or biz class tickets (these days, they’re not that much more expensive).

Not if you fly internationally on a partner airline. From extra bags to priority lanes ,preferred seating , expedited security, first class lounge access status to me is definitely worth it. Not as much if you strictly fly domestically.

For example as a platinum pro I got on Iberia flight from Chicago to Madrid extra leg room seats upon ticketing , extra bag allowance , flagship access , priority lanes at check in and fast track in Madrid plus access to first class lounges in Madrid. This is all with a cheap award ticket of 34k avois RT To me the convenience is worth it.

To draw an analogy when I was in my 20s I never paid to valet my car. Now in my 50s I seek it when I go out. The convenience and less stress is worth it to me.

Yea, not for me. I just buy business/first class ticket with points. I get lounge access with a credit card (all the credits pretty much make my Amex plat a negative annual fee card). On coach flights, I get one or more free checked bags with an airline credit card (if you’re flying coach). Note that I’m in my 50’s, too, and I fly a 4 person family internationally at least once a year.

To each his own. Id rather use my points for economy that will get me more trips than use a bigger chunk for business class and bridge the gap in perks with my airline loyalty ( especially AA points that are not easy to get ) . Plus I often find it challenging to find availability for more than 2 award business class tickets

Yea, it’s definitely a challenge, so I usually try to plan out our vacations over a year in advanced to get award availability as it opens up. And if it’s a choice between coach and not going, I’ll definitely choose coach.

Delta not factoring segments flown into status is a mistake. You have elites who have to do single or double connections on every flight. I’ve regularly flown 150 or more segments a year. I really hope Delta crashes after all these changes because they need to award and recognize loyalty, not someone who only flies quarterly on expensive Delta One business-class tickets paid for by their employer.

This is an amazing article, excellent analysis and comparison! A keeper for sure

Personally I think that United’s method of achieving status based on flying and not using cc spend is a true metric of loyalty to the airline.

The flip side of this true statement above: United really wants to make sure you’re flying United (and earning PQPs that way), rather than people buying internet shopping portal stuff and charging it, which is who AA is rewarding. Totally different customer profiles.

So an AA frequent flyer is ok with an Amazon shopper taking his upgrade?

This AA frequent flyer is.

Keep in mind the less frequent flyers will take less of “my” upgrades, an added bonus. 🙂

From the perspective of a business, they would rather take a customer making them $30,000 a year for 2 RT First Class ticket than a customer taking a weekly $200 RT. They are both important but I am saying that the airlines would prefer the first customer given they generate the most income.

So if can manufactured spend 125K to achieve AA Platinum pro for a net cost of around $500 then is this a good deal ?

You get three guesses. A person could conceivably do it for all three. And, SW. The rub with Delta and United is they don’t afford the range of methods that AA does.

It depends on how you use the perks as to whether its worth doing for $500

Ugh I need help with this can the articles here don’t help they always say go to Facebook group which I can’t do.

I guess a follow-up article might compare what benefits one actually gets (or likely gets) from each airline’s tier status. I’d say AA/One World offers the best overall package, United/Star Alliance is in the middle, and Delta/SkyTeam is the weakest. As you guys have been there and done that, I’d love to hear your thoughts.

Great post. I’m amused by the absurdly high credit card spending needed to earn even a modest portion of status, never mind earning status solely or mostly through credit card spending. Earning status mostly through credit card spending is a very bad deal vs. other reward cards and only for the top 2% or 3%. I can’t really see anyone earning status mostly through credit card spending, if your rich enough to spend high 5 figures or 6 figures on a credit card, you would likely just buy first class seats making status essentially irrelevant.

“…Their elite metric, MQDs, stands for “Elite Qualifying Dollars”

I believe that MQD is actually an acronym for Medallion Qualifying Dollars.

Regardless, great article …saved me some number crunching as I contemplate jumping ship (plane) from Delta…thanks Greg.

Oops. Fixed.

United won’t apply credit card PQP to 1K. You have to earn that all by flying

I don’t think that is accurate. From

https://www.united.com/ual/en/us/fly/mileageplus/premier/qualify.html

”Members can apply PQP earned through co-branded MileagePlus credit cards toward Premier 1K status.”

and

”Cardmembers must meet the Premier qualifying flight (PQF) requirement for card-earned PQPs to be applied toward achieving Premier 1K status.”

It must have changed for this year as last year it wasn’t possible and you still have to fly 54 segments which likely means you hit it anyway.

The United Presidential Card (and biz version) are exceptions to this rule:

“Cardmembers with the UnitedSM Presidential PlusSM Card and UnitedSM Presidential PlusSM Business Card continue to be able to apply card-earned PQP to Premier 1K status without having to meet the PQF requirement for 1K.”

But I agree that I should update the article to make it clear

What about those AA flyers like me, who have lifetime platinum status after reaching 2 million points/miles/ in the past. I still fly, I pay for first class, where do I fit in?

The cost for you to earn Platinum Pro or Executive Platinum will be closer to the “renew status” section since you’ll always be starting at Platinum at a minimum.