NOTICE: This post references card features that have changed, expired, or are not currently available

For the past few months, Amex has been throwing a points party to remember. Between the unbelievable Platinum card offer that’s been available through Resy and the +4 referral offer that ends today, many readers are likely to be receiving regular bonus points from American Express. The wallet I carry every day is almost entirely Amex cards now; I find myself using an Amex for almost every type of transaction whenever possible. However, we regularly receive questions about how to track all of these points. The good news is that this post will show you how to find the bonus points and how to roughly figure out which transactions generated them. The bad news is that Amex has made it really difficult to connect the dots if you use your card a lot…which you’re probably doing thanks to lots of bonus points.

How to find your +14x and +4 bonus points

Fortunately, once you know where to look, finding your bonus point earnings from the limited-time offers for bonuses on restaurants and US Shop Small businesses and from the +4 referral offer is quite easy.

For the sake of clarity, the bonus points I am talking about here are two entirely separate limited time offers:

- The best current Platinum card offer at the time of writing (11/30/21) is available through restaurant reservation website Resy and it offers an additional 14 points per dollar spent at restaurants and Shop Small businesses in the US on up to $25,000 in purchases over the first six months.

- The current referral bonus on most Amex-issued Membership Rewards points at the time of writing (11/30/21) is to get +4 points per dollar on all spend on your card for 3 months on up to $25,000 in purchases when you refer a friend who is approved by 12/1/21.

These limited-time spending bonuses post differently than other Membership Rewards points earned from ongoing spend.

On a card that does not have either of the above bonuses, you could ordinarily expect points earned from everyday purchases to post after your statement period has ended and you have paid off your statement balance. However, the above +14 and +4 bonuses post within a few days after the charges post from your transactions (which could be well before your statement cuts). This creates a real mess of transactions in your Membership Rewards points earnings.

Further complicating things, the +4 referral bonus only applies to purchases made on the card from which you generate the referral link that your friend uses, but if you have multiple qualifying Amex cards and you successfully refer people from multiple cards, you can earn this +4 bonus on each of your qualifying Amex cards. If you have successfully triggered this bonus on more than one Amex card, associating the bonus points with charges only becomes more difficult (but let’s be clear: having so many points coming in that I can’t figure out where they are all coming from is a problem I will bravely face any day of the week).

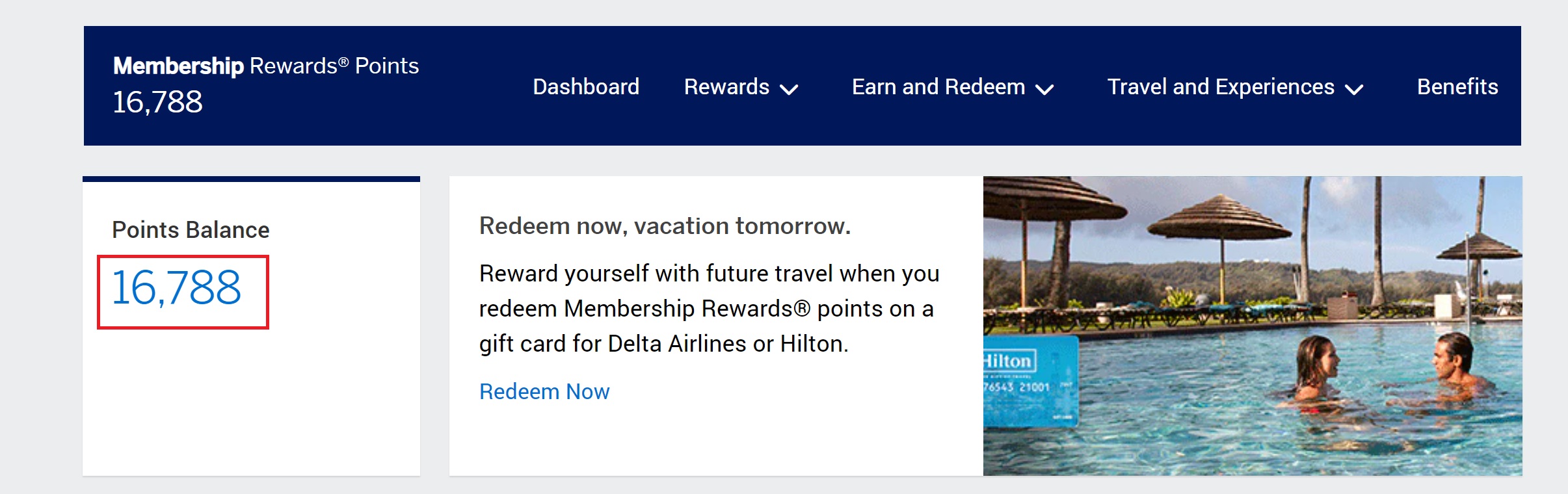

Again, finding these points isn’t terribly difficult. When logged in to the desktop version of the Amex site, find your Membership Rewards balance on one of your Membership Rewards-earning cards and click the blue button that says “Explore Rewards”.

On the next page, your “Points Balance” will be a hyperlink as shown here:

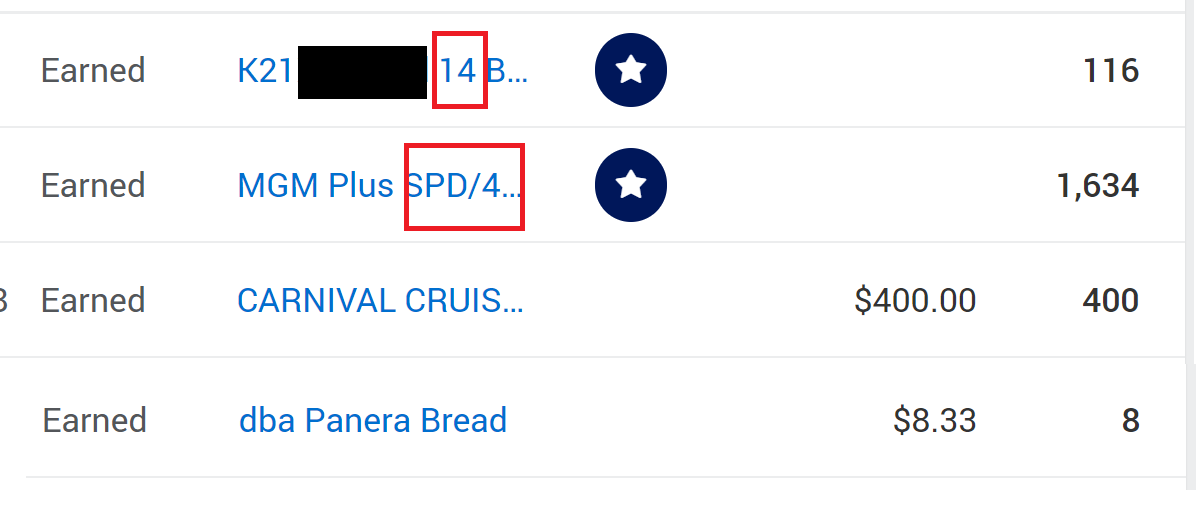

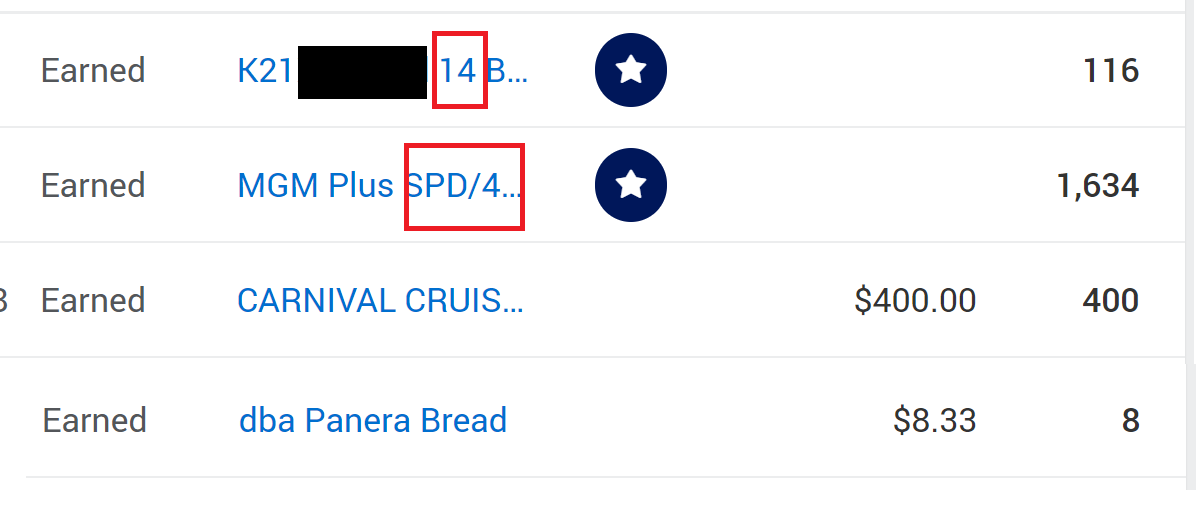

Click on your point total and it will bring you to a list of transactions and points earned from those transactions like what you see below.

Click on your point total and it will bring you to a list of transactions and points earned from those transactions like what you see below.

I don’t know why Amex has made a string of gibberish to signify the bonus points rather than clearly labeling them for the customer to understand more clearly, but the key standouts are that bonused transactions have the star and the number 14 in that string of letters and numbers signifies earning +14 points (such as at restaurants or when you Shop Small in the US) and the “MGM Plus SPD/4” signifies earning 4 additional points per dollar (such as from the referral offer).

I don’t know why Amex has made a string of gibberish to signify the bonus points rather than clearly labeling them for the customer to understand more clearly, but the key standouts are that bonused transactions have the star and the number 14 in that string of letters and numbers signifies earning +14 points (such as at restaurants or when you Shop Small in the US) and the “MGM Plus SPD/4” signifies earning 4 additional points per dollar (such as from the referral offer).

As I said, finding the points is easy. Making sense of them? Not so much.

Making sense of your bonus points

These +14 and +4 bonus points couldn’t post in a more confusing way.

First of all, if you have been earning under either of these offers, you have likely noticed that the bonus points from the +14 and +4 offers post to your Membership Rewards points balance almost immediately (within a few days of the transaction), whereas base points (or even those from ordinary long-term bonus categories like travel booked through Amex) typically do not post to your Membership Rewards balance until after your statement period closes and you have paid your bill (though they do show as “pending” in the points activity section shown above a few days after the charge posts). While you may be thinking of the Platinum card’s temporary bonus categories as 15x categories, those charges will really post to your Membership Rewards balance separately as 14x (relatively soon after the charge) and 1x (sometime after your statement period).

Making things all the more confusing, the +14 and +4 activity posts to your transaction history in the Points Activity section before the underlying transactions are even “pending” in the points earning activity.

For instance, here is that screen shot again showing +14 and +4:

In that screen shot, I have handily put together bonus points with the transactions that caused them, but in reality the +14 and +4 bonuses showed up a couple of days before the Carnival Cruise and Panera Bread transactions were even pending in my points earning activity (the transactions were of course pending in the purchase activity section of my account, but it takes a few days before they show up under the points activity screen shown above).

Looking at the transactions above, it is probably somewhat intuitive to line up the earning with those transactions, though it is confusing if you drill down on the numbers.

- I earned 1,634 points from the +4 bonus. That number comes from the fact that Amex lumps together charges that are made on the same day, so on that day I spent $408.33 ($400 at Carnival and $8.33 at Panera). $408.33 x 4 = 1,633.32.

- I earned 116 points at +14 for restaurants at Panera. That’s $8.33 x 14 = 116.62.

Did Amex round up on the first transaction (1633.32 –> 1634) and down on the section transaction (116.62 –> 116)? What kind of strange math is that?

It turns out that I got exactly the points I deserved, but accounting for them is so weird. Add it up:

- 1,633.32 + 116.62 + 400 (base Carnival earnings) + 8.33 (base Panera earnings) = 2,158.27

- Subtract the 2,000 total points earned on the $400 Carnival cruise (1600 at +4 and 400 at 1x) and I earned a total of 158.27 on the Panera charge of $8.33.

- 158.27 / 8.33 = 19x

As you can see, the Panera charge of $8.33 earned exactly the 19x I would expect (15x from the Platinum card welcome bonus + 4x from the referral bonus), but figuring that out is truly a pain. Had the Carnival transaction not been an even dollar figure, determining the fractional points and how Amex distributes them would be a real pain. Worse yet, don’t even ask to see all of the lumped-together transactions from the Black Friday to Cyber Monday weekend (since each day’s transactions get lumped together for the +4 and +14 bonuses and across all of my cards, days with many transactions are just a blob of points). I’m not going to pour the hours into figuring out which ones earned what. I’ll just have to trust that Amex got the math right.

This isn’t a new problem. I wrote about this odd math earlier this year after Amex had first debuted a similar Platinum card bonus (that has since expired).

Again, I am not complaining about the points parade. I’m marching proud in that parade right now and might build a float or two by the time all is said and done. Just don’t ask me where the points came from.

Why this is a problem

While having more points than you can easily account for is a problem anyone should be happy to have, it is indeed problematic for those looking for hidden gems coding as small businesses.

We’ve talked a lot about the Platinum card offer available through Resy. At an astounding 15x at restaurants and when you Shop Small in the US, the question of the year is “What counts as a small business?”. We’ve certainly noted a number of times that not all small businesses are tiny. And we’ve also mentioned repeatedly that the Amex Small Business Map, while perhaps a useful tool for finding some qualifying small businesses, is not a comprehensive list. I’ve already had quite a few transactions code as small businesses at merchants not on the map.

I have established a plan to buy a car confident that the charge at the dealership will code as a small business (and indeed a number of readers have confirmed that they’ve received 15x for various dealership charges from car down payments to service, etc). But before I put a $25K charge on my card, I’d like to know that the transaction will earn 15x. The best way to do that will be put make a test charge of some sort (I’m hoping to buy a keychain or perhaps put down a deposit over the phone a few days before actually buying the car).

The issue is that if I use my Amex cards for many other charges on the same day that I make a test charge at the dealership, I may have a hard time determining which transaction is triggering which points. Even if I only make the dealership transaction and nothing else on that particular date, if I use my cards the day or two before or after for charges similar in amount, I could see it still being very challenging to figure out which transaction is the precise one I’m wondering about since the +14 and +4 transactions don’t explicitly say to which charges they apply. You’re just left to hash that out yourself — and as established above, that isn’t always going to be easy.

Unfortunately, I don’t have a solution here. The best bet is probably just not using any of my Amex cards a few days before or after a key test charge and then to keep checking the points activity as shown above to see what posts to it in the days after the charge.

That’s unideal. Right now I don’t want to avoid using my Amex cards for a few days since I’m earning 5 or 6 points per dollar or more on everything thanks to the referral bonuses I’ve triggered. But at the end of the day, it’s a small price to pay to potentially earn 600K (see this post for more on that).

And thanks to the referral bonus, I am much less concerned about whether most of the individual transactions on my Platinum card will code as a small business. If I hadn’t referred anyone, it would be a different story: I’d be looking at either earning 15x total for a restaurant or small business or earning 1x if the transaction didn’t code as a restaurant or small business. Earning 1x is poor return on spend. However, since I have referred someone from my Platinum card, I am earning a minimum of 5x on all transactions right now (1x base + 4x from the referral bonus), so if a transaction that I expected to code as a small business does not code as expected, I’m still earning at a fantastic rate.

Regular readers who have seen my post about buying the car might wonder why I am even using my Platinum card right now since I intended to trigger the entire $25K US Shop Small and +4 bonuses in a single transaction (buying a car). I should note that I have been using the Platinum card for some purchases for the purposes of testing things out for posts like this one, but I still intend to earn the vast majority of the Shop Small and referral bonuses with the car purchase.

Bottom line

A lot of readers have asked how to know which transactions are qualifying as small business transactions. Unfortunately, there isn’t an easy way to know that if you have a lot of transactions and multiple bonuses. However, in the instances where I’ve checked Amex’s math, they appear to be getting it right, so the best I can do is really isolate a charge if it is very important to know that it triggered a specific bonus. Otherwise, I just have to kick back and enjoy the extended fireworks show that is my Membership Rewards account. Until I’m ready to buy that car (I’m working on it every day and think I’m getting close), I won’t sweat it too much since I’m earning at least 5x on the cards I’m using thanks to the referral bonus.

At the end of the day, that is probably the best strategy for dealing with this for those with the Resy Platinum offer: refer someone from that card. Then, on any transactions where you aren’t positive that the charge will code as a small business, you can still count on at least earning 5x (up to the $25K cap over the next 3 months). Just make sure to do that sooner rather than later: your referred friend needs to apply before 12/1/21 and be approved for you to earn the bonus, so today is the last day to trigger this. If you haven’t joined the parade, now is the time to get marching.

Just a DP here regarding PayPal purchases: I purchased a CSA from my local farm, which only accepted cc payments through paypal. I called a rep who assured me that yes, I would get the bonus on that purchase. However, following the article here, I don’t see the “star”, so assume I won’t be getting the bonus points, even though the name of the small business shows up; PayPal shows up first, and they don’t code.

Any data points on if the 4x bonus is for just the primary cardholder or does it apply. to anything spent using an additional card holders card?

It should apply to spend on AU cards as well

Hi- any idea how AMEX platinum with the +4 referral bonus will work for refundable airfare? I was considering purchasing some expensive FULLY REFUNDABLE first class airfare i

to meet the 25K spend- and then wait a couple months until well after the points have been posted and transferred out of my account to cancel the tix. Well I’m certain the AMEX will charge back the 5X for airline credits, just wondering how likely it would be that they would also clawback the 4X? Any speculation or data points would be appreciated. Thanks!

If I apply for resy offer today, any chance I get virtual number so I can do a same day referral to generate the +4x offer?

Yes, there’s an option immediately after approval to get the number. Not 100% sure you’ll see the referral offer on the account when you log in but I imagine it’s likely.

@LarryInNYC is this always the case for consumer cards? I recently got approved for 2 biz plat cards and neither one offered an option to get number immediately.

I applied for and was approved for two business cards in the last 24 hrs. One card showed the option to get account# on the approval page, but the other did not because the message I got instead was to call in.

@SgFM did they give you the number after calling in?

You don’t need the account number to refer someone. You just need to add the card to your existing login. When I was approved for the personal Platinum and the Business Green about a week ago, in both cases it gave me the option to “set up my online account” and add them to an existing login. I could only see the last 5 digits of the account number on the Business Green, but I was able to generate a referral link without a problem. I did get an instant number for the Platinum card, but I didn’t need the card number to get the referral link.

Mine did not show up on my accounts page the day I applied and was approved, but I went to the refer a friend page from my browser and it was there immediately.

I applied for and was approved for the Resy American Express Platinum card today. Now I have to use the $15 Uber credit for this month today. Next month will be even tougher. Since my wife has an Amex Platinum card we’ll have $140 of Uber credits to use.

Oops. I mean $90.

Uber Eats, order pickup to avoid fees. We do this every month

I do that often but it will still be hard to spend $90 in December. There are only two of us.

Trying to figure out what will count as a small business has been driving me insane. Grocery Outlet, listed on the NASDAQ and with 400+ locations on the west coast is a small business (presumably because they franchise?). But my local family owned grocery store with only two locations is not, apparently.

Are you using the Amex small business map to determine what’s a small business? If so, you can count on anything with the Shop Small badge to count. But businesses that don’t appear at all, or appear without the badge, might also count. The only way to know is to run a purchase through and watch for the extra points to appear in the “correct quantity” a few days later.

Yeah, I’ve been trying to use the map, but as you say it’s very incomplete. So I’ve ended up just having to do test purchases at a bunch of places.

It still just mystifies me that somehow my local family-run grocery store where I do all my shopping somehow isn’t a small business while the chain grocery store down the street is. On the plus side, the wine retailer I use does code as small business (even though it’s not on the map and is bigger than I would expect to count), so I’m just taking this opportunity to replenish my wine/whiskey collection.

@Nick Reyes, I thought regular personal plat and CS plat were considered different product and one can apply for both and hold both and get the points for both. I applied and been using Resy Plat since 11/4 and applied for CS Plat yesterday but was declined for the following reason. Any thoughts?

We regret we are unable to approve your application.

The reason for our decision is we have approved an application for the same type of Card within the last few months.

One Platinum card per 90 days. That’s a restriction that may have always existed, but nobody knew it until this year because nobody in their right mind would have had a reason to apply for two Platinum cards in such close proximity until this year. But yeah, that’s something we learned over the summer.

To be clear, they indeed are separate products, you just need to wait 90 days to get the second consumer Platinum card.

@Nick Reyes Thanks again! I guess I have 2 more months to go to wait! Hopefully that offer is still around.

Let me know if you have any questions on the whole buying a car. I placed 2 deposits on incoming builds and 1 to custom build for a Kia Telluride. Two were amex deposits and both looks like they got the 19X. All are fully refundable and you can walk away at any time. So that can be a way for you to test if you need to. I actually emailed every dealer in the country and could only find one that was willing to sell at MSRP and allow me 20K fee free on Amex. so will be flying down to LAS to pickup end of next week. Also, the name of the dealer vs what it’s doing business as differs slightly but address matched. I was not 100% sure until the deposit and bonus posted so now I’m good. Once I pickup and close that deal, I’ll cancel the other order, I might still keep the custom build order as that is the trim and color we want and I can trade in the pickup next week for about 5k above msrp with vroom and others. So lets see.

Is this only true for consumer cards (the 90 day platinum rule), or does it include the business platinum? Thanks!

Business Platinum too.

Is there any sort of notification that someone I referred has been approved? How long after they are approved can I start my spend?

Amex does send a email, but the timing on the email varies. When my wife referred me and I was instantly approved, she received the email instantly. But in other cases, we’ve found the email to take 24-48 hours to arrive. I think that you’ll actually start earning +4 from the day they are approved despite the fact that the email says you start earning +4 from the date of the email (and the email sometimes takes 24-48 hours to arrive). I wouldn’t bet a $25K charge on getting +4 prior to receipt of the email, but I’m reasonably confident that you’ll get +4 from the date of approval even if you don’t receive the email instantly.

I applied on 24th and approved and I actually received the extra 4X points on even transactions made earlier in the day before the approval. But instant approval does look like same day credit

I called Amex with this question yesterday because I did not immediately receive the confirmation email for the 4x after my friend was approved (like I had previously). I was told the 4x goes through its own approval process that can take up to 5 days and that I would not be earning the 4x until that went through. However, when the 4x is approved, it applies for that day and the next 92 days (that’s 3 months to Amex, apparently). I realize many associates have shared incorrect information before, but this is what I was told. I received the confirmation email early the next morning.

@Nick Reyes, Thanks for your input in all this. I’m actually going to pickup a car in a week and a half. Dealer allowed 20k on Amex with no fees. The dealer name and what amex small business search differed a bit but address was the same. I had to put a 2k deposit via amex which triggered the 19x. I also had a deposit down in another dealership for an order it too looks like it counted to 19X but I cant be 100% sure due to multiple transactions around the same day etc like the problem you listed above. All deposits for the 3 dealers I work with are refundable so there’s no issue to “test”.

Lastly, while the Resy Plat is just about a month old, I tried to apply for CS Plat too reading on DOC that is not considered same product, I did get a declined notice stating the following. I was surprised as I have not read any comments showing a decline like that. Any thoughts? I was hoping to use that card for truly food/small biz spend for hte next 6 mo:

We regret we are unable to approve your application.

The reason for our decision is we have approved an application for the same type of Card within the last few months. A Card has been sent to you. If you received the Card but haven’t confirmed it yet, please confirm you’ve received it at americanexpress.com/confirmcard or by calling the phone number on the back of your Card. If you haven’t received your Card, and it has been 10 days from the date of your original approval, please call us at 1-800-528-4800.

One cool thing is that the 4x for a referral even applied retroactively in my case. Spent at a restaurant in the AM, did the referral in the PM (approved instantly), and the 4x referral bonus applied to that purchase 2-3 days later. Nice!

That’s awesome! I hadn’t noticed that.

How many MR points do you keep saved up for future travel vs cashing some of it out?

There isn’t a one-size-fits-all answer to that. For me, having enough points on hand (between my wife and I) to take a trip any time we want to offers a feeling of freedom even if we’re not going to take off anywhere tomorrow. So for me, I’d want to have enough points for my next 2 or maybe 3 trips, though I wouldn’t argue with someone who only keeps the points on hand for their next trip (especially if they typically only travel once a year). How many points that is still varies based on the cabin class you want to travel and where you like to go, etc.

My general rule of thumb is 200-300K per passenger at least, but other people keep that number in different places. Points don’t appreciate in value, so there is certainly some sense in cashing out if you’ve got an abundance. We did cash out a hefty chunk of Membership Rewards points via Schwab before the drop from 1.25c to 1.1c per point.