NOTICE: This post references card features that have changed, expired, or are not currently available

UPDATE 1/14/2016: The Ritz credit card signup bonuses now offer free nights rather than points, so this post is no longer relevant.

UPDATE 9/26/2014: Unfortunately, the Ritz Carlton credit card signup offers described in this post have expired.

One of the biggest and best opportunities for free travel is the Southwest Companion Pass. Earn 110,000 Southwest Rapid Rewards points in one calendar year and you get a companion pass good for an unlimited number of flights for the rest of that year and all the next year. Think about that. If you manage to earn the companion pass early in the year, you can bring along a designated companion, for free, for any and every Southwest flight you book (with points or with cash) for nearly two years.

For those who fly Southwest with a companion often, this represents an amazing value. And, now that Southwest has begun flying internationally (Costa Rica, Aruba, Mexico, etc.), the deal is even more spectacular.

In my recent Big Wins post, I showed how to get the needed points quickly by signing up for two credit cards. There is, though, another way. This option includes not just the points needed for the Southwest Companion Pass, but a 7 night hotel stay as well.

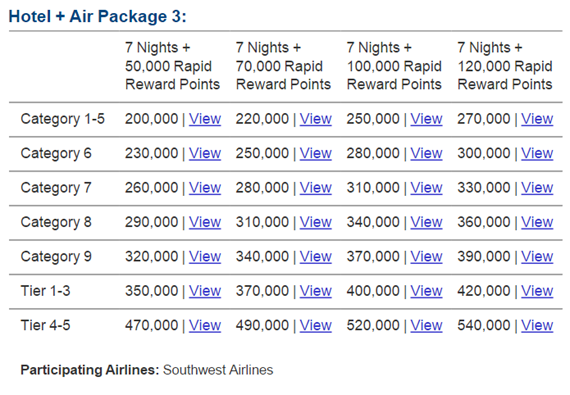

The key to this alternate approach is Marriott’s Air and Hotel packages (also called “travel packages”). With enough Marriott Rewards points, one can book a 7 night hotel stay and get up to 120,000 airline miles. When booking a package like this there are many options for what type of miles you want to earn (American Airlines, Delta, United, etc.), but the key to this plan is to choose Southwest Rapid Rewards points. Marriott has a chart dedicated just to that option:

As you can see in the chart above, one can exchange 270,000 Marriott Rewards points for 120,000 Southwest Rapid Rewards points and a seven night stay in a Category 5 Marriott. In other words, if you had 270,000 Marriott points to spend, you could get enough Southwest points for a companion pass (and for a lot of travel) and you’ll also get a seven night stay to boot.

That’s great, but where do those 270,000 Marriott Rewards points come from? Enter Ritz Carlton.

Puttin’ on the Ritz

Even though the Ritz Carlton chain is owned by Marriott, and even though the Ritz rewards program is identical to Marriott’s, they’ve kept the two separate, in name. In reality, they are one and the same. Ritz points can be used to book Marriott properties and Marriott points can be used to book Ritz properties. You can call to switch your Marriott account to a Ritz account or vice versa.

There are currently two big Ritz credit card signup offers (found here). With one offer you get 70,000 points and the first year annual fee is waived. With the second offer, you get 140,000 points, but the first year fee is not waived. Choosing the 140K offer is like buying the extra 70,000 points for $395 (the annual fee amount). Normally I’d say that’s not a great bet to make. In this case, though, it’s a great deal.

Here’s the trick:

1) You and your spouse or domestic partner both sign up for the 140K Ritz Carlton credit card offer. Within a month or two after you’ve met the required $2,000 minimum spend on each card, you’ll each have at least 142,000 points.

2) Wait until January 1. Then call Marriott (or Ritz) to book an air and hotel travel package. According to Marriott’s website, you can transfer points to your spouse or domestic partner when booking awards (terms & conditions can be found here). Pick a package that gives you enough Southwest points for the Companion Pass (or gets you close enough to where you can earn the final points another way). For example, 270,000 points is enough for 120,000 Southwest Rapid Rewards points and 7 nights in a Category 5 hotel. Alternatively, you can choose to get a Category 6 hotel and 100,000 Southwest points for 280,000 Marriott/Ritz points. Or, if you already have a stash of Marriott points, consider a more expensive package such as the one that gives you 7 nights in a Category 7 hotel and 100,000 Southwest points in exchange for 310,000 Marriott/Ritz points.

Hotel ideas

- Costa Rica Marriott Hotel San Jose: Category 5. With Southwest now flying to Costa Rica, you can use the Southwest points and the companion pass to fly to Costa Rica, and then use the 7 night certificate for a free stay.

- Gaylord Texan Resort & Convention Center: Category 6. In recent years, Marriott has moved many desirable properties up in category so that it is now difficult to find appealing category 6 properties in the United States. This one looks pretty good though.

- Renaissance Aruba Resort & Casino: Category 7. With Southwest now flying to Aruba, you can use the Southwest points and the companion pass to fly to Aruba, and then use the 7 night certificate for a free stay at this resort.

Pictured below: The Inn at Bay Harbor in northern Michigan. When I last visited this was a category 5 property, but it has been bumped up (twice) since then to category 7:

Additional value from the Ritz credit card

While you have the Ritz credit card, you might as well get full value from your $395 annual fee. Here are some ideas:

- Use the card for airline fees and call to get those fees reimbursed, up to $300 per calendar year. This means that it is possible to get up to $600 in fees reimbursed in your first cardmember year! See “How to increase credit card signup bonuses” for more.

- Get free access to Lounge Club airport lounges

- Enjoy Gold elite status, which guarantees free internet and breakfast or hotel club lounge access at many Marriott properties worldwide.

Read more

- Loyalty Lobby offers much more in depth information about Marriott travel packages including valuable information about upgrading or downgrading packages, as well as how to deal with situations where award nights are not available on seven consecutive days.

- Frugal Travel Lawyer details how she used a Marriott travel package to get the Southwest Companion pass.

- The Miles Professor details the same Ritz 140K solution as I’ve described here. She offers additional details and hotel suggestions. Note: I found the Miles Professor post as I was wrapping up this one. I could have saved a lot of trouble by simply directing readers there!

I know this is an older post, but just signed my wife up for the Ritz-Carlton 140K offer. I am going to pass on getting one as I am maxed out with Chase right now. While I agree for the most part that Marriott points are not extremely valuable, I like the above option for the Marriott hotel and flight options. While I normally wouldn’t do the spend to get Platinum status, I see it as a way to achieve 3 things at one time. 1. Get Marriott platinum status, 2. Get United silver status and 3. allow me a quick way to renew our SW companion pass for another year. I don’t know of another way to get all 3 for the $75K spend.

Good point!

Do airline gift certificates still qualify for ‘airline fees’ of $300/year with this card?

They technically aren’t qualifying purchases, but yes many people have had success calling to get these reimbursed

Hi FM,

If I apply for it today, is it possible to get the $300 annual credit for 2014 and 2015? It looks little difficult compared to Amex Platinum. Any thoughts?

I don’t know. This would be cutting it very close!

This is “old reliable” for the lazy blogger. This gets trotted out every month or so when the bloggers have nothing else to write about. It’s been hammered so much I can’t believe it hasn’t disappeared months ago. Just start the count down clock now, and you bet the bloggers won’t admit they were the reason.

do buying drinks aboard count as airline fees that can be reimbursed? What about buying something out of those ridiculous airline catalogs? If so, it’s at least a way to get something for it

I don’t yet have experience with the Ritz card as to what exactly counts and what doesn’t for the airline fee reimbursements.

Good luck with that, as I have spoken to two CRs about using the airline reimbursement for gift cards. They stated that it would not qualify. That is not to say that they may not catch it, but note that in order to use the airline credit you must call and request the credit for said spending. This gives them a great chance to further review the dollar amount and potentially deny the charge. You should try it and let us know. My recommendation being that you purchase small dollar amounts and not all at once.

Nice one.

if some actually jumps through all of these hoops and books the trip, please do tell. the process seems pretty fun though.

what about the actual value of the nights/flights option?.. any use if no companion pass (ex. united)?

thanks

As long as you value the 7 night stay, its a good deal even for other airlines like United. With United you get 20% more miles due to their relationship with Marriott. And, currently both AA and US Air are offering bonus miles on miles transferred from Marriott. These packages would count for that.

My husband and I each have a Marriott credit card. I remember reading that you can’t have, (or don’t receive a bonus), from the Ritz card if you presently have a Marriott card. Is this true?

That’s not true

@Greg The Frequent Miler

genius.

not for me, as i wouldnt spend more than 3 days at a resort/beach hotel, but genius none the less.

I need JAL points to fly Emirates in Southeast Asia and Australia and this seems a lot faster than MS with my SPG card………

Yes, but unfortunately the points to miles exchange rate isn’t as good for JAL and other airlines in Package 2

Yes but it is like the buffet in Killeen Texas where the food is horrible but you get a lot of it……….unless of course there is another Emirates partner with a better Marriott partner rate AND the ability to book without starting or stopping in the USA……….

If I bought gift cards on southwest website would those be reimbursed?

I don’t know.

p.s.

thanks for the tip that Ritz can be converted to Marriott, didn’t know that. Looks like the RC will be in my next app-o-rama

If I already have companion pass would this extend it another two years or in my case one year?

yes

Yes, but it would be better to wait until the following year (and hope this deal is still alive) so as to get two years of benefit from it.

With cards like this where the airline reimbursement is every calendar year, wouldn’t it be possible to collect three rounds of reimbursements? One in December, one at any point in 2015, one next January, then cancel and have annual fee refunded?

Yes, that should be possible as I pointed out yesterday: https://frequentmiler.com/2014/09/22/how-to-increase-credit-card-signup-bonuses/