NOTICE: This post references card features that have changed, expired, or are not currently available

We reported very early this morning about the new American Express Gold Card, featuring the previously-rumored benefits like 4x at US Restaurants, 4x at US Supermarkets (on up to $25K in purchases, then 1x), up to $10 per month in statement credits for participating restaurant/food delivery merchants, etc. Two major downsides included a newly increased annual fee of $250 that is not waived in the first year and a relatively weak welcome offer of just 25,000 points after $2,000 in purchases in the first three months. However, readers were quick to point out that you can get a better offer via a referral from a friend.

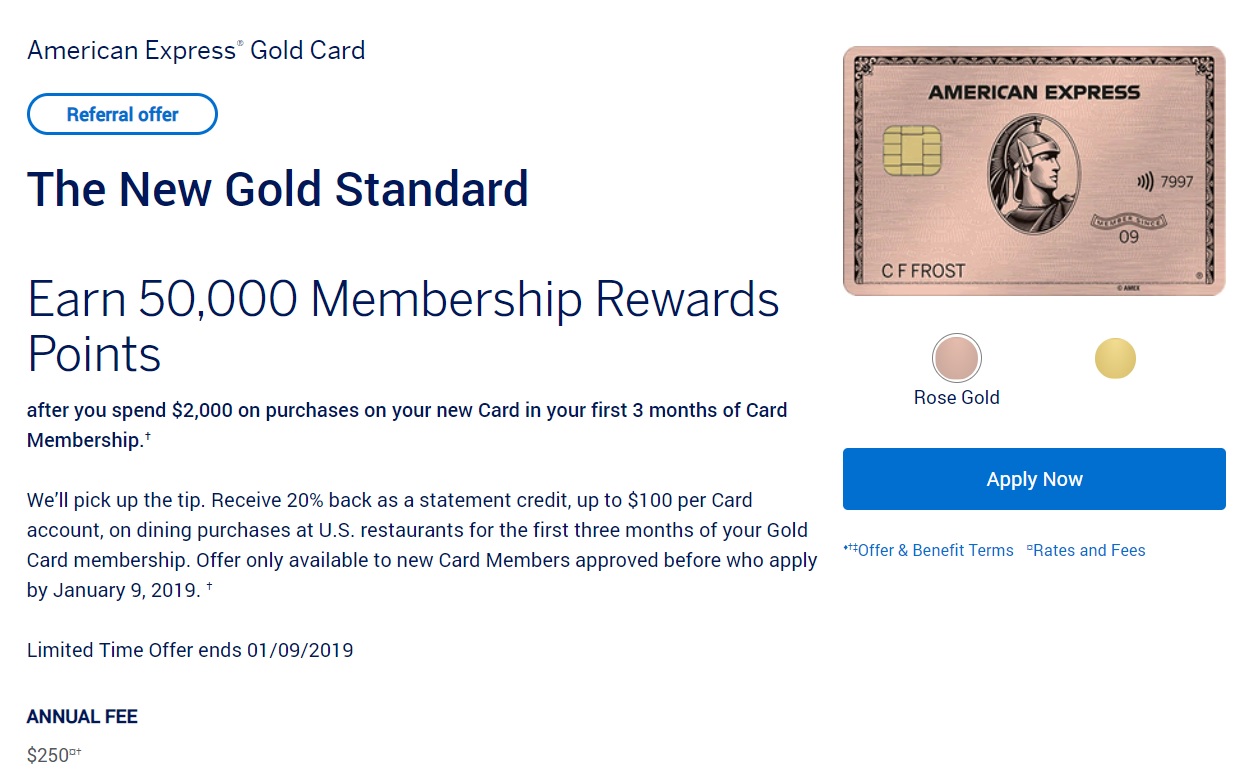

The Offer

- When referred by a friend for the new American Express Gold Card, you can earn 50,000 Membership Rewards points after $2,000 in purchases in the first 3 months plus get 20% back as a statement credit (up to $100) for dining purchases at US Restaurants in the first 3 months (Offer expires 1/9/19)

Key Card Details

- Annual fee of $250 is not waived

- Earn 4x at US Restaurants

- Earn 4x at US Supermarkets (on up to $25K per year, then 1x)

- Earn 3x flights booked directly with airlines or via amextravel.com

- $120 dining credit: $10 per month credit for spend at GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steakhouse, and Participating Shake Shack locations

- $100 Airline Fee Credit (unchanged benefit)

Quick Thoughts

The smart play was applying before today as the previous offer waived the annual fee for the first year. Even if we consider the restaurant statement credit at full face value, that makes this offer $150 more expensive. Furthermore, as Greg noted earlier, existing cardholders (i.e. those who opened the card before today) will keep 2x at gas stations through October 4, 2019 on top of the new benefits (See: Current Premier Rewards Gold cardholders keep 2X Gas and $195 into 2019). Those who opened the card before today are the clear winners.

However, if you share with me a nagging sense of regret and have not yet found a slick deal on a Delorean (O’Reily Auto Parts has you covered if you do find the car), you can take some solace in the referral offer if you have a friend who has the card. You’ll still be on the hook for the $250 annual fee as it still isn’t waived the first year, but you’ll qualify for up to a hundred bucks back from restaurants (20% back as a statement credit, up to $100 back, on dining purchases at US Restaurants in the first 3 months) and pick up 50K bonus points when you meet the spend. Coupled with 4x at US restaurants and 4x at US Supermarkets (on up to $25K per year, then 1x), and the monthly credits worth up to $10 for select dining merchants, it should ease the sting.

Like the public offer, the referral shows an expiration date of 1/9/19, so you do have some time to think it over and wait out a better offer if you’d like. If, on the other hand, you’re looking to make new friends, head over to the Frequent Miler Insiders Facebook group to find and share referral links with your good friends and fellow readers. Find the dedicated thread and read and follow the directions (links posted without following directions will be deleted). Please do not post your referral link here — it will get caught in the spam filter and will not post. Thanks for your understanding!

[…] points, but you can get 50,000 points if you use someone’s personal referral link (hat tip to FM post). Here is mine if you absolutely intend to apply right now. Thanks if you choose to use it! But as […]

Follow

Can I product change down from an Amex Platinum (ideally the MB version that I have) into this card? Realize I wouldn’t get the sign up bonus and would be on the hook for the $250 annual fee but I’m not eligible for the sign up bonus and would like to max out that 25k supermarket category with this card. Speaking of which, does the 25k reset every calendar year or card member year? Thanks!

usually cannot but can’t hurt to try.

But if I recall the MB plat is being converted to Vanilla plat so you would then likely be able to.

I am curious if 4X on dining will work in MPX app

I was a Premier Rewards Gold cardholder about 10 years ago, and the system still said I was ineligible for the welcome offer.

Join the discussion…at what point of application process does the message pop up? thx

Is this a business card or a personal card? I have the Amex god business card – will I be eligible to get a welcome offer on this one? Thanks!!

I have had a gold card for almost a year – is this a “new” product or am I banned for life?

Dining Credit? Hardly. I have never eaten in one of those and don’t ever expect to.

Seamless and Grubhub are sites from which you order from local restaurants.

You don’t eat in them.

Well, I would not be likely to use those services either … not my style of eating.

What do you mean by “not my style of eating”? Do you not eat at restaurants? Or just not eat in your home?

I get it if they aren’t available in your area, but if they are….you can basically choose any style you would without them and save yourself the trip out to the restaurant. Grubhub doesn’t exist where I live, so I won’t be able to use it all the time. I intended to use it last night because I’m visiting friends, but we did something different. Instead, I’ll use it to order Lou Malnati’s deep dish pizza when I’m at the Chicago Seminars later this month.

Will a referral from a Platinum holder work? Doctor of Credit had a recent article that any Hilton credit card referral would work for other Hilton credit cards.

I don’t think so, but have you tried to generate one?

New Amex referral links (possibly as of today?) seem to include all Amex cards, i.e. my BBP generated link shows all cards with referral offers at the very bottom, including this Gold 50k/2k.

Is it possible that those of us that previously received a Premier Reqards Gold sign-up bonus some years in the past might qualify again now that the card’s name and structure is different? i.e. it’s a different product so lifetime exclusion language doesn’t apply?

I definitely didn’t think this would be considered a new product (especially since the PRG holders were automatically converted to the new benefits). That said, I saw at least one commenter on Reddit who went through the application and didn’t get a pop-up saying he wasn’t eligible for the bonus. I’d say it’s an 85% chance that you are not eligible for the welcome bonus if you’ve had the PRG before, but we won’t now for sure until we get data points from people who have tried.

The language on the 25k offer says previous holders of PRG are not eligible, but of course their systems would have to enforce that correctly.