NOTICE: This post references card features that have changed, expired, or are not currently available

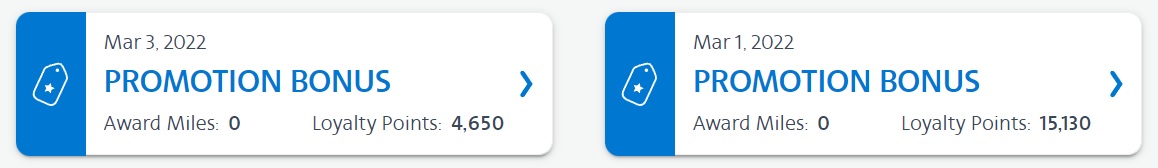

Woohoo! Wednesday morning I received notice from SimplyMiles that I had earned 4,650 AA miles for purchasing a Byte Impression Kit. Stack that with $100 back from Citi Merchant Offers (which showed up Tuesday!), and $45 from Top Cash Back, and this $100.70 purchase turned into a very nice windfall of points and cash! Unfortunately, that particular deal is no longer available, but it shows that the game’s afoot…

AA Loyalty Posts & Tools

As a reminder, if you’re interested in earning American Airlines elite status without flying (or wondering why others are interested), these posts will help:

- Introduction (What’s happening? How can you earn AA status without flying? Why should anyone care?): AA’s Loyalty Point Pursuit game: Earn status w/out flying

- Cheat sheet (what works, what doesn’t): How to earn American Airlines Loyalty Points without flying.

- Keep score: AA Loyalty Game Scorecard

Loyalty Points Posting

In January and February I kept track of Loyalty Points by seeing which AA miles post to my AA account as base miles rather than bonus miles. That was an imperfect way to track things since some things that aren’t expected to post as Loyalty Points show up as base miles and possibly vice-versa. Now that we’re into March, though, Loyalty Points have posted and, going forward, we’ll be able to directly see which AA mile earnings count as Loyalty Points.

Half-Reversed Claw-backs

A number of deals that we’ve posted on this blog have been disappointments because miles first appeared on our accounts and then were later clawed back. Interestingly, in my case and with everyone I’ve talked to, AA did not claw back Loyalty Points. For example, I had initially earned 1,200 miles when subscribing to Bespoke Post, but those miles were later reversed out without explanation. Despite not earning AA award miles for Bespoke Post, I did earn 1,200 Loyalty Points! I have no idea whether AA will “fix” this or not, but if it stays as-is, that will be a very nice but unexpected result.

Accounting for half-reversed claw-backs

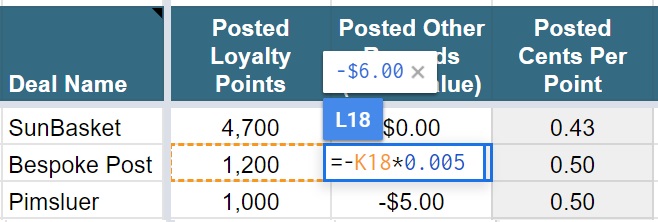

Those who use the AA Loyalty Game Scorecard Google Spreadsheet may wonder how to account for this situation. The spreadsheet wasn’t designed with the expectation of earning award miles and loyalty points at different rates. At some point I’ll build a version of the spreadsheet that corrects this, but for now, here’s how I handled this within the current structure of the sheet…

I had two deals clawed back: Bespoke Post and Pimsluer. For each, in the far right column labelled “Posted Loyalty Points” I put in the full number of Loyalty Points earned. But to account for the fact that I didn’t earn 1,200 award miles, I put in a negative number in the column labelled “Posted Other Rewards (Cash Value)”. Specifically, I’m personally valuing AA award miles at a half cent each and so I subtracted out $6 for the the 1,200 award miles not earned with Bespoke Post and $5 for the 1,000 award miles not earned with Pimsluer. The image above shows the formula I used. If you want to do something similar, do a similar formula, but make sure to change the number 18 to the correct row number and change the 0.005 to a different number if you value award miles differently than half a cent each. For example, if you value them at 1 cent each, you would change the number to 0.01.

This solution isn’t ideal because it creates a bit of weirdness such as a cents per point “cost” for Loyalty Points that were earned with zero out of pocket spend, but since I don’t think we’ll have this happen again going forward, I think it is a good enough fix for now.

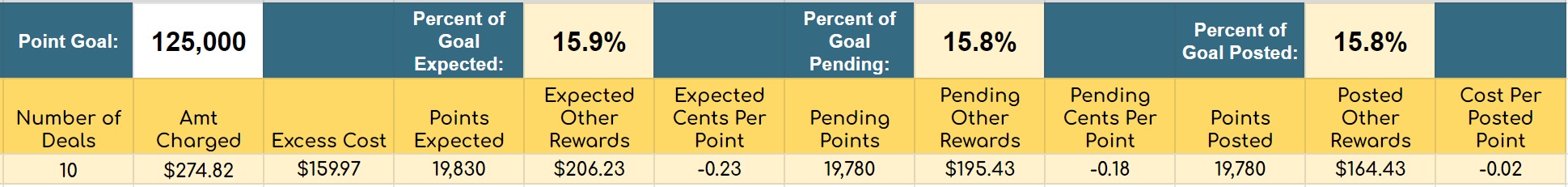

Greg’s Progress

As of March 3, 2022, I’ve earned 19,780 Loyalty Points. That means that I’m 15.8% of the way towards my goal of earning 125,000 AA Loyalty Points. Is that good enough progress? If I keep earning almost 8% of my target points per month, will I meet my goal? In the future we’ll have 12 months to earn enough points for our elite status goals, but this year January and February are extra and so we have 14 months. So, for this year (January through end of February 2023), we need to average just over 7% of our goal each month in order to achieve it. In normal years, we’ll have to average 8.33% of our goal per month. So, yes, I’m tracking pretty well towards my goal, but with very little room to spare. I feel like I need to kick it up a few notches going forward!

Another important metric is my Cost Per Point. I previously decided not to do any deals that cost more than 1 cent per point. And, in this area I’m doing really well because I’ve actually made a profit. My current average cost per point is negative .02. In other words, I’ve made a tiny profit on top of earning miles and loyalty points!

What Deals Worked?

All of deals that I took advantage of tracked appropriately and earned Loyalty Points, but two deals were clawed back and so I lost the award miles with those. Here’s a full list:

- Spot & Tango: 3,430 Loyalty Points (2,500 via AA eShopping; 930 via SimplyMiles)

- Byte: 4,650 Loyalty Points via Simply Miles

- 1800Flowers: 600 Loyalty Points via AA eShopping (this was a regular purchase, not a deal specifically for earning Loyalty Points)

- Hyatt stay: 1,000 Loyalty Points via a paid Hyatt stay (I didn’t receive any for award stays)

- Barron’s: 1,000 Loyalty Points via AA eShopping

- Blooom: 1,200 Loyalty Points via AA eShopping

- Marketwatch: 1,000 Loyalty Points via AA eShopping

- SunBasket: 4,700 Loyalty Points (3,700 via AA eShopping; 1,000 via SimplyMiles)

- Pimsluer: 1,000 Loyalty Points via AA eShopping [This was one of my two claw-backs where I earned Loyalty Points but not award miles]

- Bespoke Post: 1,200 Loyalty Points via AA eShopping [This was one of my two claw-backs where I earned Loyalty Points but not award miles]

You can find details about most of the above deals in our cheat sheet.

What’s next?

Going forward I’m going to try to earn at least 10,000 Loyalty Points per month. That will give me a little bit of cushion if I fall short in some months. Towards that end, I took a break from writing this section in order to place an order from Green Chef (see: 2200 AAdvantage Miles and 6 meals for $34 with Green Chef and Chase Offer). I’ll happily take 6 meals for $34 even without the Loyalty Points! Next, I plan to be more proactive. I started January strong by diving into a bunch of opportunities, but since then I’ve been lazy and have let deals pass by. Now I’m energized by the unexpected success of the Byte deal and ready to tackle more! Here we go…

When does this end. Which date in February.

Feb 28 is last day for earning 2023 elite status

TopCashBack rarely pays the cashback you earn.

I find TCB to be one of the most reliable portals. I’ve already received the $45 from the Byte deal

Was 3,700 for $15 for byte stacked with SM… At least last month.

I wouldn’t lose sleep over the accounting – those clawbacks are definitely going to turn into loyalty point clawbacks as well. I bought some stuff (shirts) using the AA portal in early January, returned some of them, and had the miles reversed pretty quickly (also in January). Yet those are still being counted as loyalty points, as if I never returned them. I would bet anything that they eventually figure it out and remove the loyalty points for these as well as the bigger fixed-point offers that were clawed back. Of course I hope I’m wrong though!

Are we to ignore that all the deals on the AA portal are also on the Chase UR portal? So you’re basically paying 1.5cents per mile and “loyalty” point.

They don’t usually have the same payout rates but it is something to consider. The way I think of it is that if I’m doing a deal only because I want to earn AA miles then I don’t look at opportunity cost because I wouldn’t have otherwise shopped through a portal. But if you are buying something anyway and have a choice of portals then yes, you should account for the opportunity cost based on the best alternate portal payout.

Don’t forget that you are getting the redeemable miles from AA too. The opportunity cost is only the difference in how your value an AA mile vs. an UR point. Assuming that the multiplier is the same between portals…

One good thing came out of the clawbacks and that will be a more measured approach to getting these. For example, the initial verizon deal that Nick posted was like “hey buy 20 of these and get most of your way to platinum status” or something of the sort. A bit overzealous and somewhat irresponsible.

@Greg: I think you have a bigger accounting issue with the clawed-back deals than just debiting the value of the redeemable miles. We don’t yet know whether the concept of claw-backs exists in the context of loyalty points or not, so you don’t really know whether those miles can be counted or not.

There’s a possibility that they’ve already been entered into a claw back system and will disappear in a month or two. But what I would be more worried about is that AAdvantage by choice or oversight did not implement a claw back mechanism but, over time, it will become a large enough problem (possibly when someone figures out how to exploit it deliberately and in larger volume) that they retrofit such a mechanism into the system and pull back a bunch of points later in the year.

I still have loyalty points for items that I purchased using the AA portal, subsequently returned, and had the (normal) miles reversed. There is not a chance in the world that these stick as loyalty points. This is going to be a mess for them as for many people they will make the difference between status levels.

If the loyalty points get clawed back, then the accounting will be really easy. We can then just zero out the Posted numbers.

I can’t seem to get any offers on Citi Premier card I got right before 80k ended. Any ideas? I have a balance transfer offer and a entertainment offer. What is the direct link for offers please?

Citi decides if you are worthy or not. I have 3 cards and none have offers as of yet.

Unfortunately, I have no idea why Citi turns on merchant offers for some people/cards but not others.

I’m currently at just shy of 24k, but should be over 346k and an easy, early Executive Platinum. However, the shopping portal is so frustrating. I put over $107k spend through the portal in four transactions with a single vendor at the end of January/beginning of February. They all tracked as purchases, but never moved over to pending or confirmed status. I complied with all terms and conditions. Previous purchases from this vendor had posted properly. But now I am stuck in “investigation” hell with customer service while they perhaps try to get the vendor to pony up the commission. You have to wait over 2 weeks to open the case and then the case can take 8 weeks to resolve. So…who knows when/if they will actually post. Obviously unfortunate with travel coming up, but I’m already Platinum Pro this year, so it isn’t the end of the world, but I remain worried that this is going to be a giant bait and switch and I will never see the miles or loyalty points. Again, so frustrating! And there is no clear escalation path with American if the portal doesn’t work as it should.

It’s a hot mess. It’s been over 3 months with simply miles (a couple of the 5x deals, Vinesse and Best Buy). I have filed multiple trouble tickets, escalated, etc. I follow up, they write back, we are working on it, Tech is on it. Very discouraging.

I’m at 40,977. Really wanted to hit Platinum by the end of March but I’m stalling out here!

My first two months I think I hit every possible Loyalty Points category: Credit Card Spend on my Citi Exec, Shell Gas, AAdvantage Dining, eShopping, Simply Miles and of course…. good old fashioned flying (a one-way and an RT). By far my biggest contributor was the credit card spend.

Anyway, looking forward to some easy points this month. I’m not seeing anything as good as the old Spot & Tango or Verizon deals though!

Same here John. I managed to get to 57k but not seeing any more easy wins. We need another round of great SimplyMiles deals. Did we get spoiled by the spree in December and January? I didn’t follow SimplyMiles before then so maybe those have been abnormal (obviously the Conservation International was!).

How did you get Blooom to work? I’ve been trying to click “Start” on my analysis, but the button doesn’t do anything.

I don’t remember the details, but I didn’t have any trouble with it.

Love the way you push the envelope.

OK, I have made about the same “points.” Admittedly, I am an AA “captive (DFW)”, and some it is actually (gasp) butt in seat points, but, I find a lot of the purchases through AA Shopping, or Simply Miles to be a bit of a head scratcher.

And, have found that “double dipping” is a lot more difficult with many merchants, as it seems you might get the Chase cashback, but the miles or points never materialize.

At ~33k, good enough for Gold so far. If putting zero value on any merchandise, Cost has been 0.74 cpm. Same enthusiasm swings so to speak—slowed down when things were not posting /clawed back, but now that miles are showing up, taking another look. It’s all so silly

Did you have to go back and cancel any subscriptions to Byte? We keep getting emails from them

I don’t know how to get off their email list.

I was able to extinguish the Byte emails by blocking each sender. After about 6-7 emails they stopped. Guess I got all employees blocked