For a long time, I said that I saw the target market for whom the Bilt card made sense, but that it wasn’t for me. Then, Bilt started running insane transfer bonuses last year that seemed too good to be true. Then they opened 2024 with another of those bonuses. When they announced last week that the February 1st Rent Day would be a 75-150% transfer bonus to Air Canada Aeroplan, I couldn’t continue to sit on the sidelines. I love Aeroplan and the stars aligned so I could see an opportunity to build a Bilt bonus that I couldn’t refuse.

Making a move and taking a gamble

When the coming transfer bonus to Air Canada Aeroplan was announced, I felt like we had to make our move in our household. I referred my wife and she opened the Bilt card the day that the Aeroplan bonus was announced (last Friday, January 26th). I immediately picked up a referral bonus of 2,500 points when she was approved.

We had about $7K in tax payments that we needed to make for a family member (we pay to earn miles and they pay us back). Those payments were split over four payees. I use Plastiq for those types of payments because I still have a lot of fee-free dollars from the old days of their referral promotions, so it only costs me the $1.49 fee that Plastiq charges to pay by check.

I knew that Bilt would issue an immediate card number in the app and we had access to that number right away since my wife was instantly approved. Note that the instant card number does not get access to the full credit line, but it had access to enough credit for our immediate needs.

Bilt has no official welcome bonus, which has been the sticking point for a lot of people (and you certainly don’t need to convince me that big welcome bonuses are the fastest path to points & miles riches — look no farther than our Best Offers page for plenty of opportunities to snag welcome bonuses!). However, some (many?) people get targeted for an initial bonus of 5x everywhere for the first 5 days up to 50,000 bonus points (which works out to the 1 point you ordinarily get + 4 bonus points, so it’s essentially 5x on up to $12,500 in spend). People who get that offer usually report that they receive it via email after receiving and activating their physical card.

Now and then, I’ve heard a report or two of someone who started receiving 5x before receiving or before activating their physical card. I didn’t expect that would be the case from the moment of approval, but since we needed to make the tax payment that day anyway, I decided to gamble and hope that we magically got 5x. (Spoiler alert: We didn’t.)

I checked the Bilt app the next morning because I remember from Greg’s experience that Bilt points tend to post very quickly. My wife didn’t yet have any points from the tax payments, which surprised me a little bit. I checked again several times that day and the next day: still no points. Then I dug into her Bilt account on desktop and I found that the card spend had registered in her account, but without points — and that’s when I saw what I was missing: it said to be sure to make 5 transactions this billing cycle to earn points. Duh! I knew that you needed five transactions, but I hadn’t even thought about the fact that we’d only done four. We immediately went to Amazon and bought something small that we needed.

Sure enough, the next morning, the 7,000+ points posted to her Bilt account. I was of course slightly disappointed that she didn’t get the 5x, but not at all surprised since she hadn’t received any email offer for that yet.

The next step was sweating the card arrival. When the card shipped, the tracking information initially showed an expected delivery date of February 1st. That would be too late! Others who have been targeted for 5x for 5 days usually report getting the email about that deal the same day they received and activated the physical card, so I was hoping to receive the physical card by January 31st in the hopes that we’d be able to use the card and earn points that would post on the first of the month and then transfer those points to Aeroplan.

Getting targeted for Bilt’s build-your-own bonus and stacking it with a big transfer bonus

As fate would have it, a day later the tracking information updated with an expected delivery date of January 31st! Sure enough, the card arrived yesterday. Sometime after the tracking showed delivered but before we’d even gotten it from the mailbox and activated it, the email came in from Bilt with the offer to earn 5x for 5 days, starting 1/31!

I should repeat that this offer is not guaranteed — many people get targeted for this, but not everyone. There was some element of gambling on this offer. I was very happy to see it come in.

The further good news is that it’s tax time! Greg and I talked about the joy of paying taxes on the podcast over the weekend. I was happy for her to get targeted for 5x for 5 days and make a large tax payment. I don’t yet have all of our tax forms, so I’m not exactly sure how much we’ll owe in taxes, but I know that if we overpay, the IRS will send us a refund, so I’m not too worried about that.

I should note that for those targeted, the 5x for 5 days bonus offers the chance to earn up to 50,000 bonus points. That’s counted as 4 additional points per dollar on spend that would otherwise earn 1x (or 2 points per dollar on spend that would otherwise earn 3x, etc). In other words, if the spend is put entirely on unbonused purchases, it would take $12,500 in spend to max out the offer. Unfortunately, my wife’s credit line wasn’t quite enough to max out the $12.5K in spend on top of the $7K+ that we’d already put on the card.

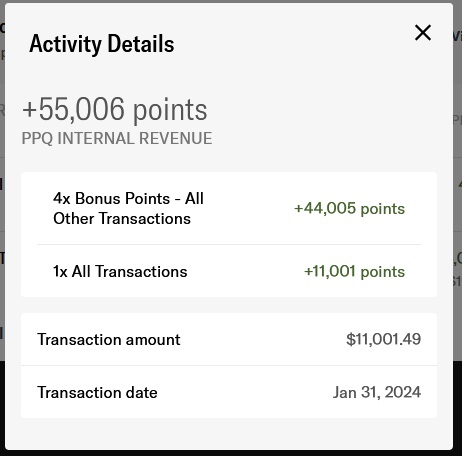

Nonetheless, I figured that we could comfortably make an $11K payment and leave a little room for some other ordinary purchases. The hope was that we’d earn 5x on an $11K tax payment and since Bilt points post quickly, we were further hopeful that by making that payment on January 31st, we would be setting ourselves up to have those 55,000 points post on February 1st, just in time for the Bilt Rent Day transfer bonus to Air Canada Aeroplan.

Since the tax payment alone would put my wife north of $10,000 in spend on the card, I also expected that my wife would get Bilt Silver status. That would bump her up from earning a 75% transfer bonus to a 100% transfer bonus on Rent Day. Sure enough, that’s exactly what happened — overnight last night, her status bumped up to Silver and 55,000 points posted to her account from that tax payment!

Let’s for a moment ignore the 7K points earned at 1x since we knew that was a gamble. The $11K tax payment yielded 55,000 Bilt points. My wife will certainly transfer those to Air Canada Aeroplan today and take advantage of the 100% transfer bonus with her newly-minted Bilt Silver status. After that 100% transfer bonus to Air Canada Aeroplan, she expects to end up with 110,000 Air Canada Aeroplan points, which sure feels like a respectable initial spend bonus that will have made it well worth picking up a Bilt card. I will furthermore transfer the 2,500 points I earned from referring my wife (along with all of my other Bilt points) during this Rent Day and that referral bonus will become 4,375 points after a 75% transfer bonus for my account.

Interestingly, the end result for my wife (110,000 miles on $11K spend once she transfers to Aeroplan thanks to this transfer bonus) isn’t far off from the welcome bonuses you can earn with some popular cards like the Amex Business Platinum card (currently 150K on $15K spend via targeted referral, which we keep on our Best Offers page so that you get the best offer, but the offer listed by most sites is 120K after $15K spend). I can think of another popular business card that offers 100K points after $15K spend. Capital One right now requires $20K spend for the initial 150K bonus on a couple of their business cards. Those are business cards rather than a consumer card and flexible transferable points like Amex Membership Rewards points or Capital One miles are worth more than points that are now locked into Aeroplan. I’m not arguing that the Bilt “bonus” I built is worth more or is better than those other card options — it isn’t. Rather, my point is that the end result here isn’t miles away (pun intended!) from what I would gladly accept with other cards.

And the full end result here if we include the points she initially earned at 1x that will become 2x with a 100% transfer bonus, she’ll end up today with a grand total of more than 124,000 Aeroplan points on about $18K spend. That’s certainly not an amazing bonus (one could hit 3 or 4 new card card welcome bonuses with that much spend), but it certainly doesn’t make me feel bad about picking up the Bilt card. There are plenty of ways I can imagine using those points to terrific value – see Best uses of Air Canada Aeroplan points (ways to maximize that 75%-150% Bilt transfer bonus).

Moving forward, we’ll probably use the Bilt card for estimated tax payments on Rent Day and dining on the 1st of the month since ordinary earnings in those categories would double on Rent Day. In fact, we might consider ditching our Gold cards for 3x dining on this card and use the Citi Premier for 3x grocery. The Bilt card is not a card we’ll use much at 1x outside the first of the month, but I could see seeking out other unbounded spend for the first of the month.

My enthusiasm is in part because after putting $18K in purchases on the card pretty quickly, my wife will be within easy striking distance of Gold status, which requires $25K in card spend in a calendar year. That Gold status level would have gotten us a 125% transfer bonus this Rent Day. I don’t know for sure that these big transfer bonuses will continue, but if they do, I’ll be pretty excited for my wife to pick up an even bigger bonus the next time around.

Am I concerned that the next transfer bonus will be even more awesome?

In short, no.

In the comments of my post last week about Best uses of Air Canada Aeroplan points, a reader asked me, “What if BILT comes with a similar AA bonus in future? Would you risk waiting for that or transfer now to AC?”. Here was my response:

A) Highly, highly, highly, highly, highly x infinity unlikely that we’ll ever see one of these huge transfer bonuses to the US based programs. You have to understand that the US-based programs have their own well-established US-based credit card programs with a captive audience to whom they can market them. I imagine they can more or less charge a transfer program what they want with no incentive to cut a deal since they’re going to sell tens of millions of dollars worth of miles (in AA’s case to Citi and Barclays). It is well-established that American Airlines earns more money selling miles to banks than they do from flying passengers (in fact, they lose money flying).

Foreign airlines are in an entirely different place: they desperately want to tap into the lucrative business of selling miles to banks, but they don’t have Americans captive on their planes all the time. Partnering up with transferable currencies gives them a chance to sell miles that they otherwise wouldn’t. And selling them cheaply enough that a currency can offer a transfer bonus makes sense to get that currency top of mind and get customers engaging with their program (so that hopefully they will transfer again in the future). I know that Aeroplan actually has a US-based credit card, but they obviously don’t have the native customer base for it that AA or United or Delta does.

It is just logical that foreign programs have more desire to get people engaged and therefore will be more motivated to cut the type of deal that makes something like this possible.

Bilt has made a lot of things that seem impossible happen, but I think there is a greater chance that I will win the lottery tonight than that we’ll ever see a 150% transfer bonus to AA, UA, or Hyatt (and I don’t even have a ticket for the lottery as of yet and didn’t have plans to buy one).

I wouldn’t be surprised if we saw one of these bonuses to Avianca LifeMiles or maybe to Avios and Bilt has continued to add partners, so I wouldn’t be surprised to see something like Hilton get added with a big bonus since they sell the points cheaply anyway, but I wouldn’t at all expect AA.

B) Nonetheless, no, I won’t be mad. I like AA miles, but the redemptions I can make with Aeroplan are more exciting to me. My real “fear” if we can call it that is missing a similar bonus to Turkish, though I don’t think that Turkish is as likely to put any effort into making themselves appealing, so while I wouldn’t be shocked if it happens, I don’t expect Turkish to have one of these 150% bonuses.

I stand by that answer. In fact, during our Ask Us Anything Live last night, I posed a question to Greg about this. I know that Greg shares my expectation that Bilt is almost surely never going to offer one of these huge bonuses to American Airlines, United Airlines, or Hyatt. So I asked him that if we accept that those three programs won’t get a huge transfer bonus, which partner would have to offer a 150% transfer bonus for him to regret speculatively transferring all of his points to Aeroplan with today’s bonus? He couldn’t name one. Neither could I. The Aeroplan bonus is that good in my opinion.

Don’t get me wrong, if Bilt offers up to a 150% bonus to Avianca LifeMiles or Turkish Miles & Smiles next month, I’ll be disappointed that we won’t have enough points to make a meaningful transfer. However, I’m not more excited about what I can do with points in those programs than I am with Aeroplan. At the very least, the points my wife earned could buy a round trip in business class from New York to Frankfurt or points west. More interestingly, we could do a multi-segment trip to Asia or Australia with a stopover on the way in Europe or the Middle East. I don’t imagine that even a 100% or 125% bonus to Turkish would make me feel regretful about having speculatively transferred today. A little disappointed? Perhaps. Regretful? No.

Bottom line

The Bilt Mastercard does not offer a public official welcome bonus, but when today’s huge Rent Day transfer bonus to Aeroplan (available 2/1/24 only) was announced, my wife and I decided to gamble and take a shot at building our own Bilt bonus thanks to a targeted offer we hoped to receive, the speed with which we expected Bilt points to post, and today’s big transfer bonus. At the end of the day, we’ll have turned around a valuable amount of earn on this card in just a few days of card membership. Moving forward, I’ll be happy for us to put some spend on the Bilt card because I don’t imagine that they are done surprising us.

Great article! It convinced me to get a Bilt card. One question: I have a quarterly tax due September 15 of $16000. Based on your article, for the 5×5 initial bonus, spending $12500 will max out the 50,000 bonus points. So if I put the $16000 tax payment on Bilt, is it better to do it on Rent Day so I can at least get 2x points for rest of the payment after $12500? Or my bonus points stopped at 50,000? The reason I’m asking is I don’t have much time to get approved for new card to have it arrive by the Rent day of September 1. If I don’t get 2x points for the rest of my tax, then I can take my time to get the card. Just need it by September 15 to pay quarterly. Thank you for your input.

Also, any referral link?

I think its too late to participate in the Sep 1 Rent Day (I believe that you have to have the card 5 days beforehand or something like that).

Also keep in mind a few things that might change your mind about doing this:

Great article! Do you have a referral link? I want to sign up for Bilt and I’d love to support yall

I don’t understand how one needs to spend $12,500 to get the 50,000 bonus points. Isn’t 5 X $10,000 = 50,000 points? This is important because I just got the Bilt card and got this offer, and I need to know if I need to spend $10,000 or $12,500 in 5 days (3 days left now), especially since I have a $7,500 credit line so I need to pay it off and have available credit a second time to max out the bonus. Thank you.

It’s up to 50,000 *bonus* points. You already get 1 point per dollar on unbonused spend, so 5x gives you 4 *bonus* points per dollar spent – hence $12,500 spend gets you the full 50K bonus points (62,500 total points with the 1x you ordinarily get on unbonused spend) assuming you’re spending on unbonused purchases. If you were spending on dining, you’re only getting 2 bonus points per dollar spent since dining earns 3x – so you’d actually need $25K in dining spend if you did only dining spend since you’d be earning 2 extra points per dollar spent.

Does that make it easier to follow?

OK, thanks a lot.

Do you happen to know if I can get a second 50,000 for spending a second $12,500 on my wife’s card? I added her as an authorized user and got a second email about 5x for 5 days from the time she got her card. Thanks again!

It appears that I have proven the claim that this is targetted. No email 24 hours after confirming physical card.

[…] and 1x everywhere else didn’t excite me. That was until I read Frequent Miler’s post: How Nick built his own Bilt bonus. I finally understood that I could use the Bilt Credit Card without paying rent and still get […]

This might have already been answered somewhere else but the Bilt Rent Day bonus is capped at 10,000 bonus points – does anyone know if that’s a monthly or yearly cap?

I’m confused…. You made your own SUB…by using the SUB that Bilt actually provides(to some people).

If Bilt *hadn’t* given you the 5x/5 days SUB(which they are not required to do), you would have very little to show for it.

Didn’t you just get lucky that they gave you the SUB that they (sometimes) offer?

I get the impression that they offer it pretty regularly. They are adamant that it is targeted, but everyone I know personally who has opened the card has received the offer. Some people must not, but it’s pretty common.

I think the bigger point of the piece here is that it was an example of striking while the iron was hot. I knew there was a transfer bonus that I could take good advantage of, I knew that Bilt points post quickly enough to be able to strike while the iron was hot, and I knew that it’s tax time, so it was very easy to max out the offer.

Is it still possible to do something like this now that the Q4 estimated tax deadline has passed?

i.e. if I file my 2023 taxes and owe $500, can I actually pay $11k and then receive a refund of $10.5k in a reasonable timeframe?

I know at this point I would be counting on a future transfer bonus(or transferring 1-1), but am not sure if the tax angle is still possible.

Yes, you can make a 2023 payment (as opposed to a quarterly estimated payment) at any time — and if you pay too much, it gets refunded. Keep in mind that every now and then, the IRS gets a backlog of returns and while most people get their refund within a few weeks of filing, every now and then it takes someone months and months to get it. The good news is that the IRS pays interest if they take too long to refund you, but the moral of the story is that you need to be ready to float the cash if it doesn’t come back quickly.

Thank you Nick!

Obviously talk to your tax person and report any payments you’ve made on your return.

Hey Nick, so of the 2 Bilt cards you got, you got the 5x spend for 5 days offer on just one of the cards? We have a large purchase for appliances for a new home build I’m hoping to use the 5x offer on the our 2nd Bilt card we just got approved for. I received and used the 5x offer on my first Bilt card over a year ago and hoping to repeat our luck. I originally got the Bilt card for rent. We won’t be renting anymore soon but it will still be an excellent point earner for us by timing large purchases on the first of the month. I got rid of our AMEX Gold card. With 6x dining gift cards on the 1st, and always getting 5x groceries via Citi Custom Cash, no need to pay for the Amex Gold.

We only got one Bilt card (I had some existing Bilt points from referrals). My wife got the credit card. The 5x for 5 days is targeted, but everyone I know personally has gotten that offer. I’m sure there must be some readers who haven’t because Bilt is adamant that it is targeted, but the offer is pretty common.

That’s encouraging to hear the 5x offer looks to be more common than not. Here’s hoping American becomes the next crazy good Bilt transfer deal! A man can dream, can’t he 🙂

Just want to pop up with a data point: I used my Bilt card to put down a large purchase (close to $1K) at Adidas.com at 10:10pm Pacific time on Feb 1st hoping to earn 2x on Bilt rewards, but it did not get processed by Adidas until the next day…. so just 1x on Bilt…..Place your order early on Rent Day to make sure it captures the timestamp

Good safety tip that goes far beyond Bilt: Most retailers don’t process your card until they ship your order and many retailers don’t ship until the day after you buy (especially if you’re buying late at night), so the same situation applies if you’re buying from Dell on the last day to use a Dell credit or you’re buying something on the last day of an Amex Offer, etc. Purchases made for physical stuff often end up with a transaction date that matches the shipping date. Retailers usually just put a hold on the funds initially and don’t finalize until they ship.

Hey Nick, this a great post that is very convincing to me (not a renter), to get the card for the 5x for the first 5 days.

Assuming your wife transferred all of her Bilt points to Air Canada, her Bilt balance is probably less than 1,000 points now.

Is your plan to use this card only for 2x points on the first of the month and build up the points balance over several months until the next “can’t pass up” Bilt transfer bonus comes along?

Like I said in the post, will use it for 2x on the first of the month but also probably as a main dining card. I’ll probably also pop up too the local restaurant where we get takeout at least one time a month and buy a gift card on the first of each month for 6x. Might also do some prepaid travel on the 1st of the month at 4x!

Gotcha, so on Rent Day, you will earn 6x for restaurants and 4x for travel. Then on the other days of the month, you would get 3x at restaurants.

But since you have Bilt Silver status, you get a 100% bonus on points transfers. And once you get up to Bilt Gold status, you will get 125% bonus on point transfers.

Wow, I think I got it all straight. Assuming you stay at Bilt Silver status, you are essentially earning 6x at restaurants all month long, and then 12x restaurants and 8x travel on Rent Day.

Did I get all that correct?

Yep, that’s exactly correct. And my wife will probably reach gold status within a couple of months and pump that all up by another 25% if these bonuses continue.

Awesome, next time I have $10K -$12K in spend to do in a short period, I will definitely consider the Bilt Credit Card 🙂

Just curious – in what situations do you have $10-$12k in credit card spend in a short period? That seems to be the key to creating any sort of “welcome bonus” from the Bilt card like Nick did, but it seems extremely rare that many people (including in the points/miles world) are able to generate $10-$12k/spend in 5 days. I get that some business owners/self-employed people might pay that quarterly and are OK with the 2% fee, that just seems like a far more limited crowd than those able to spend ~$3-$10k in 3 months. But maybe I’m missing something!

No secrets here, just federal income taxes, car insurance, home insurance, car maintenance, etc.

Well of course it has to be more limited than the crowd who can spend $3K-$10K in 3 months, but I can imagine a lot of very typical situations where someone might spend that much:

-Kitchen / bathroom remodel

-Big vacation spend (many people spend that much on things like a cruise, safari lodge, etc. Others buy cash business class tickets. Not everyone uses points for every trip).

-Buying a car (I put $25K on a card on my last car. The car before the dealership was willing to take up to $20K, Many/most dealerships accept at least $2-5K).

-Having a wedding / company holiday party / etc

-Medical expenses (the bill for the delivery for my first son was $10K — and yes, we had insurance. Still had to pay the $10K deductible).

-Property taxes

-Income taxes

-College tuition (we’ve heard from some readers whose colleges accept a CC with no fee, others charge a fee of course)

-Private school tuition for younger kids

-Daycare (many of my friends in larger cities pay in the range of $2500/mo on daycare (and I think there was a national news story this week about that cost being fairly normal) so if you could prepay for a couple months of that it could be a significant chunk of spend)

-Other large purchases (I live in the countryside — a lot of people have four wheelers, snowmobiles, boats, etc)

-Other major home maintenance / home improvement (a new roof could easily run in that range; if you put in something like a pool or hot tub or built-in firepit, there are plenty of other major expenses like those in the world that could easily add up to more than $10K).

Mix and match things from above and there are a host of ways you might spend $10K or $12K in a few days. Maybe none of those are applicable to you, but the notion that it is “extremely rare” to spend that much within a few days seems to ignore lots of ways that people spend money all the time. Again, I’m not saying that everybody is spending $10K every 5 days, just that I can think of a host of reasons Grant might have occasion to spend $10K or $12K right off the top of my head — and that’s surely not an exhaustive list.

Thanks, Nick, helpful as always – that’s why I asked! (I was striking out asking myself “How could I make a big Bilt “welcome bonus” happen”) Fortunately, almost none of those apply to me in the foreseeable future, but I’ll try to etch “consider opening Bilt card next time I have big spend come up” in my mind. A list like this might make a good supplement to the Big Spend Bonus guide for those of us who tend to focus on the Big Spend and forget about the Big Bonus potential.

As you’ve said, every strategy/card/bonus is not for everyone, and I’m happy for your outcome and for others in the comments who have racked lots of Bilt points (I’m trying to learn from you all!). But I think some of the Bilt head-scratching in the (non-renter) points and miles world continues to be driven by the hoops to jump through/star-alignment needed to get a potential bonus like this (this basically fails without the unpublished/non-guaranteed 5x bonus, not to mention the uncommon big spend ability, 1-day-only transfer bonus, etc.). Put another way, imagine Chase rolled out a welcome bonus on their Aeroplan card:

-Spend $11k in the first 5 days of the card

-Earn 22k Aeroplan miles (BUT data points suggest it might be 5x that, but 5x isn’t guaranteed or mentioned by Chase)

-Offer is only good for the next ~5 days, after that, it drops to 11k Aeroplan miles (BUT data points suggest it might be 5x that, but 5x isn’t guaranteed or mentioned by Chase) OR increases again to 22k IF you can limit your 5 days of $11k spend to just the first of the month

That offer would barely exist long enough to make it from podcast recording to release, and few would seriously consider it. Obviously, this isn’t a perfect comparison by any stretch (Bilt points are widely transferable, so you wouldn’t have to transfer to Aeroplan for the 75% bonus), but I think it demonstrates how well Bilt has avoided making their points “easily” gameable. And good for them – as you’ve said before, Bilt is focused on building a long-term profitable model, which does not include big sign-up bonuses. So hopefully they’re able to continue to do that.

Thanks again to you and Grant for the helpful replies!

And yet the Citi Double Cash and Amex Blue Business Plus have both existed for years and years and years with no welcome bonus at all or a very tiny welcome bonus that is not better than 5x for 5 days with even modest spend and return that does not match the Bilt card on travel and dining (even before transfer bonuses or rent day bonuses ) and transfer partners that are arguably weaker and nobody has questioned why those cards exist or who should apply for or use them. If perplexes me that the Bilt card use case perplexes some. I get that it’s not for everyone, but given the fact that advice to have a 2x everywhere card for unbonused purchases has long been standard in this hobby, I find this card pretty clear cut. It takes that and adds the element that you need to do that spend on the first of the month and / or catch a good transfer bonus.

The Citi Double Cash is a reasonable comparison point as a no annual fee card. It often features no welcome bonus at all. When it does, it’s usually $100 / 10,000 points. All it would take is more than $2,000 in unbonused purchases at the 5x for 5 days to exceed the return on that card. And if you got a 75% transfer bonus on top, it would take even less spend. And whereas the Double Cash card by itself does not give you the ability to transfer points to partners, the Bilt card does and the transfer partners are better. Throw on top 3x Dining all month long that can transfer to American Airlines or Hyatt and 6X on the first of the month – and the chance that those multipliers might really become more like 5.25x / 10.5x and it just seems like It shouldn’t be surprising that this fits into strategy for many people.

For the record, I don’t think big purchases are as rare as you suggest. After all, your local hot tub / pool shop, home contractor, etc. wouldn’t exist if those purchases were rare. You wouldn’t see the huge appliance sections at Home Depot and Lowe’s if people rarely had to buy those things. Car dealerships wouldn’t be in business if people didn’t frequently buy cars. Surely plenty of people into credit card rewards own legitimate small businesses that owe at least $10K in taxes every year (and maybe others over pay their taxes and get a refund). No, these aren’t purchases that you’ll have every day or every month or even every year, but plenty of people do have occasion to make a big purchase yearly at least. No, it’s not going to be $10,000 every time for everyone, but neither do I think it exists in a tiny vacuum. Now are you going to go after the Bilt card instead of the Business Gold card or some other card for those large purchases? I don’t know. But any time I have a major purchase to make and almost every year a tax time, I open a new card for a new bonus.

And yet the Citi Double Cash and Amex Blue Business Plus haven’t gotten 2 Podcast Main Events (“Bilt IS all that” and the most recent “Game changing transfer bonuses…”) in the last year plus a third if you count the Deal of the Year. The Citi and Amex ecosystems have definitely been Main Event features, but that’s the point – those two cards you mentioned have only been mentioned in the context of those ecosystems with multiple points-earning cards having regular guaranteed welcome bonuses that are easier to obtain than Bilt’s non-guaranteed 5-day welcome bonus. Ongoing spend cards (like the Double Cash and BBP) are always mentioned well after SUBs in the “this is how you obtain a lot of points in this ecosystem” discussion. A “Best cards for ongoing spend” Main Event which mentioned the Bilt card, Double Cash, and BBP would make a ton of sense. It might even be named the “Best” card for ongoing spend in such a discussion, but the context is different.

I think a lot of the “context” issue results from Bilt’s newness. We don’t see a post, let alone a Podcast Main Event every time Tim opens a new NLL Amex Biz Platinum 150k or a team member opens a new Ink card (it took Greg opening 3! to get a post). And you’re totally right that Bilt is newsworthy, having set up the best group of transfer partners in short order with exciting bonuses and uniquely valuable points-earning ability for rent. So a disclaimer early in posts or podcasts along the lines of “Remember, SUBs are still the easiest ways to accumulate lots of points, this doesn’t officially have one, and Bilt requires more hoops to jump to accumulate a bunch of points than Chase/Amex” might clear up some head scratching. This is not a perfect comparison, but the “What’s in XYZ’s Wallet” posts had that spirit of clear/early disclaimer, where paragraph 2 starts:

“To be clear: Just as Greg said yesterday, this post is not meant to tell you what I think “should” be in anyone’s wallet…”

Reader Matt’s comment on the Podcast post today illustrates this lost context, as he overlooked/didn’t hear the “SUBs are still probably best” message near the end of the Main Event.

And by the way, the “Wallet” series and “XYZ’s 2024 Elite Status Plans” series are fantastic for “this is what I actually plan to do/have done big-picture across multiple points/miles strategies”. I had no idea Tim was such a wizard with Alaska mile! I’d love to see more content about how Bilt will actually/did actually fit into a team-member’s earning strategy. In other words “How/Where XYZ team member earned most points 2023/Plans to earn most points 2024”. I’m not a West Coast resident, so I can’t copy Tim’s Alaska strategy, but I’m sure I’ll learn something from every team member who would make a similar post or Podcast guest appearance (similar to how I learned from every team member in the Wallet series). I doubt Bilt points will make a large portion of Greg’s/Nick’s 2024 earned points, but if they do, I’d love to read about it.

As for big purchases, you’re right of course but I think they depend far more on debt (that’s often not payable easily with a CC) and other transactions not easily payable on CC than on consumers paying in full on a credit card. IE car dealers make more money financing cars (not easy to pay a loan or lease with a CC) and servicing cars (where they do accept CC, but hard to time a big spend – IE car breaks down – with the 1st of the month or new Bilt card arrival) than selling cars. And we just did a large remodel, but the small business contractor we used only accepted checks. There’s wide diversity in the points and miles world and surely a lot of us have high spend (small business taxes are a great example you gave), but a lot of us collect points and miles because we don’t like spending money. If I were super comfortable paying cash for business class tickets or a $4,000 cruise, I wouldn’t collect transferrable points or play the casino cruise status match game.

Lastly, I again want to say how great you guys are and how much I appreciate the content, and how I don’t doubt your motives at all here. While I’ve surely spent too much time on this topic, perhaps FM’s greatest strength is the community and interaction with readers. So thanks, and keep it up!

PS – I hope you’ll consider an FM to Go relaunch so we can continue the conversation in-person (and talk about more important topics too)!

Great as always Nick! I’m going to feel rather ill if the transfer bonuses stop as soon as I get the card and start using it in a similar fashion.

Very well played my friend!

Nice moves but why do you refer to yourself in the 3rd person (“How Nick Built…”)

So that when it it shared on social media and says “Frequent Miler”, people don’t assume that Greg the Frequent Miler wrote it. You’ll notice that we don’t usually use “I” in the titles so that it isn’t ambiguous. Not everyone pays attention to the name on the “by” line.

Got it. Is this a new thing? I can’t say I remember every post but I certainly remember “How I drove away with half a million miles”

Not really. Once in a while all of us probably forgets, but we’ve been doing it that way overall for years. See the “What’s in Tim’s wallet”, “What’s in Stephen’s wallet”, etc. Or the “Nick’s elite plans for 2024”, etc. Or “Greg’s predictions”…and so on. Or Cellars-Hohenort Hotel Cape Town South Africa: Now Greg’s favorite points-bookable hotel. Or Greg’s point earning strategy. Or Disney mistakes: Nick’s newbie errors. (really, just pop any of our first names into the search box and you’ll find dozens if not hundreds of posts published with our names in them that way).

Nick – since you an expert, could you please give us a very high level summary of the pros and cons of the main features and redemptions Aeroplan vs. Turkish including for domestic United redemptions. I suspect Turkish may be a future transfer bonus and want to decide whether to save for that or transfer to Aeroplan today. I am based in the NYC area, have never used the Aeroplan program and used Turkish a couple of times for last minute domestic UA redemptions. Thanks

Nick, I hate you (in the most loving way). 110k AC miles in 5 days??? I’ve had the Bilt card for almost 2 years and just transferred a measly 11k Bilt > 19k AC.

Some amazing nuggets in here. Alone the idea of referring P2 to immediately max out the 5x sign-up bonus on taxes to get you within reach of Bilt Gold is, well, gold.