In a recent post (First steps towards rebuilding my point fortune: Bilt and AA) I reported that I had been approved for a Bilt credit card. Since then, I received the card, started using it, and have already accumulated 50,000 points and Gold status. Here are a few quick first impressions…

Instant credit card access

One really cool thing about the Bilt card is that the moment you are approved for the card, you can start using it. Within the Bilt Rewards app, you can view your full card number and add the card to your mobile wallet (Apple Pay, Google Pay, etc.). Unfortunately, the card’s welcome bonus (currently: 5x rewards for 5 days), doesn’t kick in until you get the card in the mail and activate it.

Quick card delivery

I received the physical Bilt card just 3 days after approval.

Wells Fargo’s systems are buggy

When you get the Bilt card, you can see your rewards within the Bilt app, but in order to manage your credit card, view pending transactions, and pay your bill, you have to log into your Wells Fargo account. When I tried to activate my online account, the system told me that I already had one. That was true. I used to have a Wells Fargo checking account, but no longer do. But, I do still have access to my Wells Fargo online account. Unfortunately, when I logged in, it said that I didn’t have any active bank accounts and so there was literally nothing I could see or do within the web site (or app, which I tried too). I then tried setting up a new Wells Fargo online account, but it told me that I already had an account and should log into that. Round and round it went. Luckily, all it took to fix this was a quick call to Wells Fargo. The phone agent apparently clicked the “make this account work correctly” button because within seconds I was able to log in and see my Bilt card information.

Bilt’s 5x for 5 days welcome bonus email never came

Bilt’s welcome offer for their card is now official: everyone who signs up can earn 5x rewards within the first 5 days upon the card arriving, with a cap of 50,000 bonus points (card details here) This offer is targeted to some cardholders. Since the 50K cap is on bonus points rather than base points, this means that a new cardholder can earn 5x on up to $12,500 of 1x spend. Until this offer became official, we only knew about it because readers kept reporting that they received an email with this offer after signing up for the Bilt card.

I never got that email. I had timed my application to correspond with some very large planned spend, and so I really wanted to earn 5x!

After a couple of days with the card, I messaged support, but even before getting a reply offering to reset the promo, I noticed that I had already earned 5x on the few purchases I had already made.

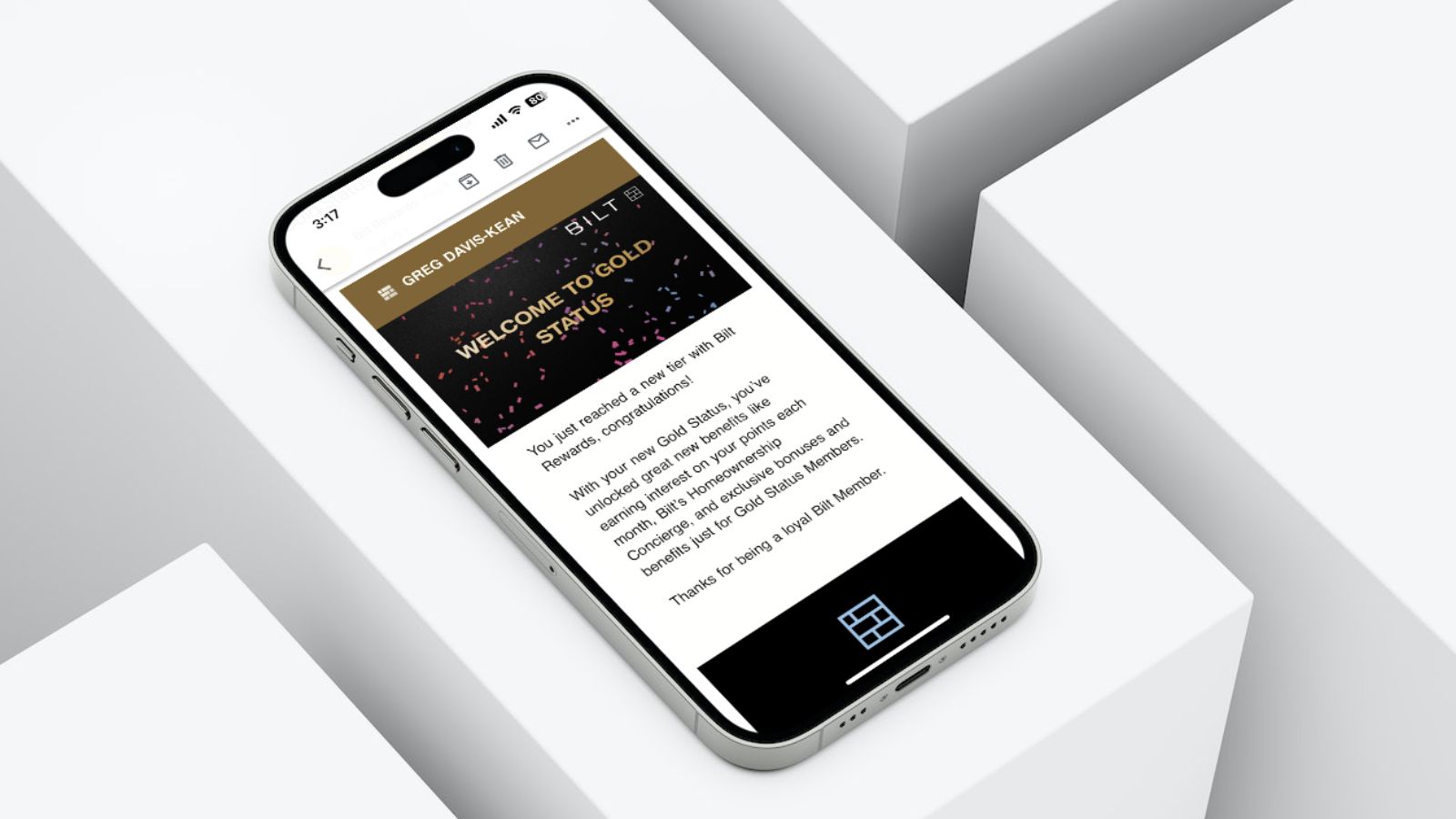

Bilt points post lightning fast

I completed a total of ~$10K of spend at 3:14PM on Monday. Tuesday morning at 8:01 AM, I received an email congratulating me for earning Gold status. You get Gold status once you’ve earned 50,000 Bilt points in a year. And, sure enough, when I logged into my Bilt account I saw that 50,000+ points were there! That’s amazing to me because with other credit cards it usually seems like charges stay pending for several days. Additionally, some other programs wait until your statement closes in order to make the rewards points available to you. I believe that Capital One is quick to dole out points like this as well, but they’re the only other issuer I can think of that does that. This is awesome. It means that if I’m short on the points needed for an award, and if I have spend that I can do quickly, I now know that I can get the needed points from that spend quickly.

Overall impression

While there were a few hiccups with signing up for the card, and setting up the card, I’m very happy with it now that it’s up and running. It’s absolutely awesome that points are awarded so quickly! So far, I’ve earned about 40,000 of the 50,000 bonus points allowed with the 5x promo. As I write this, I have one day left with the 5x promo and about $2,000 left to spend in 1x categories (or more in 2x or 3x categories). If I max out the promo in time, entirely within 1x categories, I’ll earn a total of 62,500 points on $12,500 spend. That’s excellent when considering how many great transfer partners Bilt has, and how they regularly offer incredible transfer bonuses during Rent days.

As usual, I am grateful and impressed with FM advice. I also got the 5x offer for first five days! Tell me, the miles and benefits seem too-good-to-be-true for a fee-free card, no??? So, when I read 6 hour delay travel insurance (wow!) up to $200pp/day…paint me skeptical. It goes on to read only if the entire fare was paid with card. Does that cover an airline award ticket where I charged ~$6 in taxes?

Just got the Bilt card and the 5x for 5 days bonus offer email. Can I make payments for bills through Plastiq and still get the 5x or is that not allowed?

I’d be very surprised if that wasn’t allowed. Can you make one small payment through Plastiq now and then wait a day or so to see if it earns 5x before doing more?

I just got the card. Was delivered yesterday. No email for 5x. Put a charge on it yesterday and was at 1x, put one today and currently pending

Reached out to support and got this email “The eligibility of a new Bilt MasterCard holder for the 5x promotion is determined randomly. Once a member has received the card but has not received the email for the promotion, we’re unable to override the system.

Additionally, please note that you’ll receive promotions via email every month, so be on the lookout.”

Any thoughts here?

I am in a similar situation too. I have seen quite a few data points of those who received the 5x offer even though they didn’t get the notification email. Did you manage to pursue the matter further with the rewards team?

1x earning on first 3 days of card. reached out again to rewards team

the rewards team told me that this is a targeted offer so it is not true that anyone who signs up will get it

Our Bilt contact is trying to get this resolved. The person that told you that gave you incorrect information

Update: Bilt has now ended the 5x promo as a standard feature (eg now some people get it but others do not). We’re trying to get guidance from Bilt about how to fix this for those who signed up while we showed the 5x offer as standard. We’ll post as soon as we know. In the meantime anyone who hasn’t reported the problem to Bilt support should do so ASAP.

Appreciate it. Reached out to them but haven’t heard back. Let us know if there’s any update!

I applied back in June and never got the offer and was told it was targeted in June. BILT is all over the place and I don’t trust them. This is what I received from them by email on June 23: “The 5X for the first 5 days promotion you might be referring to is given randomly to a few new cardholders after they activate the Bilt Mastercard. If you received an email from us letting you know of this promotion, send me a screenshot of it so we can take a closer look.”

If I open a new Bilt card to pay school tuition via check mode not credit card mode, will that count as 5x bonus?

No

In the Wallet tab of the Bilt app, I can see all my card transactions and pay my bill. But my welcome offer of 5x points on all transactions was simply that- 5x. It doesn’t take into account the base rate and allow 50K bonus like discussed on the latest podcast.

It doesn’t show you that complexity but it’s there

I am not seeing the 5x bonus anywhere on the page, so I’m hesitant. Am I missing something?

I read from somewhere else that you will get an email from Bilt after opening the account to “surprise” you with the 5x bonus. Bilt claims that they only send the email to some but not all. However, it looks like everyone is getting it now. But no one knows how long this will last.

Greg, I am still confused. At the end of the month I have expenses (home improvement $6,000 and cruise payment $6,000) to be paid. How many points will I earn, if I spend this much (in 5 days) when I sign up for Bilt? Or am I overspending?

I’m sorry for the very late reply. Here’s how it would work if those payments fell within your 5x promo:

Base earnings:

Bonus earnings:

Since the total bonus earnings are less than 50K, you would get all of the above points for a total of 60K

Sounds like with the referral, you won’t get the points if the person already has a Bilt account (but not the Bilt Mastercard) ? Unsure if I should wait to sign my P2 up for a Bilt account for the various rent day promotions/free points or wait until maybe she gets the Bilt CC to get the 2500 points.

[…] Update: This signup bonus of up to 50,000 points is now apparently official, as reported by FM. Some people are seeing it on the app when signing up, but I didn’t see it when I checked. […]

[…] page上写出来,但是大家在开卡之后会收到email说有这个开卡奖励。HT: DoC&FM。我们向Bilt官方确认了一下,他们的意思是他们想把这个作为surprise […]

I have two HOAs :-(. Someone told me you can only pay one HOA with Bilt. Is that true?

Yes that’s my understanding

[…] Greg Davis-Kean confirms that new cardmembers are still extended this offer, […]

Important also to note that you have to pay RENT instead of a mortgage for most of Bilt’s benefits to work. For the rest of us, the card has little value

Don’t forget to link to partners in the app. You get a bonus for this, too.

I’ve mentioned this briefly before but clearly their are huge differences in income with people in this community.

How does a regular Joe with a 9 to 5 job drop $12,500 in spend in 5 days? Not to mention all the big spend requirements on the oodles of business cards everyone seems to get.

Unless I hear some solid legal manufactured spend suggestions that aren’t loading up on zillions of dollars in gift cards at office supply stores for 5x and then doing ??? with them I’m not seeing how the average Joe does most of this stuff?

You have identified the dilemma correctly.

If Average Joe office worker makes $50K per year, even if he somehow manages to run 100% of his income through credit cards, that’s only what … 4 or 5 of the “big card” SUBS per year? (The AMEX business gold is $10K to get the SUB, the business platinum is $15K) And most folks can’t get that much through cards, when considering it’s usually not worth it for a mortgage, and you likely have 25% of your income going towards paycheck deductions (401K, insurance, taxes, etc).

So, as I see it, Average Joe has 3 options:

1) Be happy with a modest amount of points annually

2) Pay bills for other people (a player 2 can come into play here)

3) Do some manufactured spending

I’m about as average as it gets. 9-5 job, wife, 2 kids. Very little side income.

I do a combination of 2 and 3.

Not easy, but rewarding.

This card can help those that pay rent and have modest incomes. But the trick would be concentrating on cards that offer SUB’s with lower spend requirements. There are cards that award bonuses with just a single purchase. Turn every unexpected expense into a SUB. AC goes out, find a card with SUB and interest free period to pay for it. Anyone can find something to show ~business activity to be eligible for Biz Cards.

There are posts on this site and others about how to meet min spend requirements.

What Greg doesn’t mention here (but has alluded to in a few other post and the podcast) is that he has a method to manufacture spend at about a 2% loss. Obviously, the 5X points more than make up for this (as he’s probably using each point for greater than 2 cents per points with Hyatt and AA, meaning he probably is going to make back 10%+ on these purchases that he lost 2% on). He’s already said he won’t share his MS method as he doesn’t want to kill it.

If you’re not familiar with MS, FM has a whole post about the general concept, but the gist is that you “spend” money in some way, and then find a way to get that money back into your bank account. In your example, using gift cards, you’d generally buy money orders or find some kind of prepaid card you can load to return funds back to your bank account.

If you wanted a more above the board way to do this, you could use some of your savings to “time shift” your spend, such as paying / overpaying estimated taxes, prepaying utilities that accepts cards, or any pre-paying any other large, reoccurring payments that you have.

As you astutely pointed out, this is one of the only ways for middle class people to rack up big spend.

“He’s already said he won’t share his MS method as he doesn’t want to kill it.”

Worthless to me then. Not sure how I feel when a resource that is supposed to teach you how to do this holds back information on how to do this. 🙂

The 2% method died at the end of last year. I had promised not to share it and so I didn’t.

Did you promise not to share it posthumously too? It could be instructive.