NOTICE: This post references card features that have changed, expired, or are not currently available

There are many reasons that you may end up with lots of small denomination debit gift cards. OfficeMax frequently runs deals, such as “$15 off $300 or more in Visa gift cards.” And Staples frequently offers Easy Rebates where the $15 or so rebates come in the form of either Staples gift cards or a Visa gift cards. And there are Amex Offers which often make it possible to buy Visa or MasterCard gift cards for less than face value (see this recent post for examples). Then there are the new Five Back Visa cards that give you 5% back when used at certain stores. If you buy $500 Five Back Visa cards and use them fully at qualifying stores (CVS, for example), they’ll be reloaded with 5% of the value: $25. Now what do you do with them?

The Free-quent Flyer recently published a guide to “Liquidating tiny-denomination prepaid debit cards“. Check out his post for full details. He covers the following:

- Buy gift credit (e.g. load up your Amazon or Starbucks balance). We have a post about the former here: Bet You Didn’t Know: A Quicker Way to Finish Draining Prepaid Gift Cards at Amazon.

- Pay bills

- Liquidate as usual (e.g. use as debit card to buy money orders or pay bills)

- Pay Up (pay bills via Plastiq with a 2.5% fee)

The Free-quent Flyer offered good advice, but missed 3 of the 4 methods that I personally use most. I do sometimes buy gift credit, especially at Amazon, but I also do the following:

Use as intended

Carrying around small denomination gift cards and keeping track of their value can be a huge headache. So, I don’t usually do that. But, if I have a bunch of very small gift cards and I’m headed out to spend money (especially at a chain such as CVS, Target, etc.), I’ll bring along the gift cards to use when checking out. Most chain stores have registers that auto-drain gift cards. Let’s say, for example, that you have three $25 Visa gift cards, and you’re buying $100 worth of stuff. In many stores you can simply swipe the first gift card and the register will automatically take $25 from that card and then ask you for $75 more. Repeat until you’re out of gift cards, then pay for the balance with a credit card (or store gift card).

Do good, get your money later

Kiva is a nonprofit organization that facilitates micro-loans to enterprising individuals around the world so that they may earn their own way out of poverty. Kiva loans do not earn interest, but they can be paid for with a credit card or a bank gift card (Visa, MasterCard, etc.). Most loans pay out in installments over the life of the loan (typically 8 months or longer). Loan payouts can be withdrawn to your PayPal account and then deposited from there to your bank account.

My approach to using Kiva to drain small denomination debit gift cards is as follows:

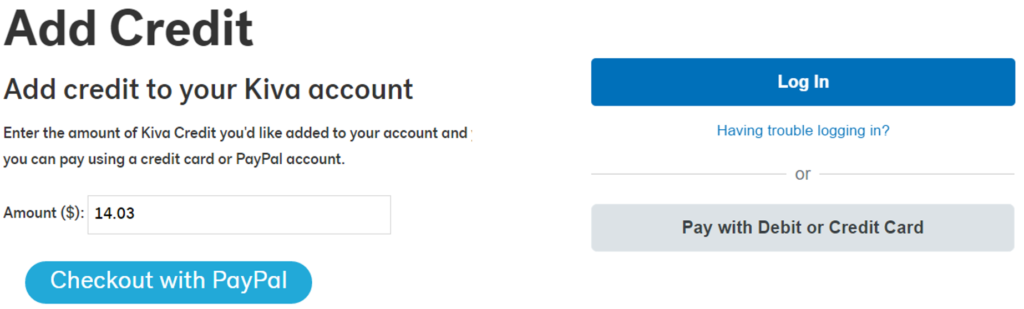

1. Add Credit. Log on to Kiva, go to Portfolio (click icon on top-right), then click “Add Credit”. Enter the amount you want to add (the current value of your gift card). When asked to log into PayPal, select instead to “Pay with Debit or Credit Card”. Then checkout as guest. While I’ve never used a gift card this small, it appears that you can fund as little as 1 cent! As an aside: this looks like it can also be a great way to meet the 20 or 30 charges per billing cycle bonus point requirements of the Amex EveryDay and Amex EveryDay Preferred cards.

2. Loan Credit. Credits cannot be withdrawn until loaned and paid back. The minimum loan amount is $25. I like to use a web app called Kivalens to filter to “safe” loans, loan only $25 per borrower (to spread risk), and sort by loans with the quickest payouts. Full details can be found here: Manufacture Spend (and do good) with Kiva and Kivalens.

3. Withdraw payouts. About once per month I look at my Kiva balance and decide if there’s enough there to be worth withdrawing. If so, I’ll request the withdrawal through the Kiva.org website.

Advantages

- Do good!

- Easy way to drain gift cards from home.

- Works with all forms of bank gift cards: Visa, MasterCard, Amex*, etc. Also works with virtual gift cards.

Disadvantages:

- Money inaccessible for many months.

- No guarantee of pay back. I’ve been loaning through Kiva for over 5 years and have slightly under a 1% default rate. Kiva currently reports that the average Kiva user’s default rate is 1.35%.

- Opportunity cost. Kiva loans can also be funded by credit card. I usually use my FlexPerks Visa which gives me 3X points for “charitable donations”. Even though Kiva loans aren’t donations, the loans still code as charity on credit card statements and therefore earn the bonus. So, when I fund loans with gift cards, I am losing out on 3X rewards from my FlexPerks card.

Personally, I love being able to easily drain gift cards from home so, for me, the advantages outweigh the disadvantages.

See also: Manufacture Spend (and do good) with Kiva and Kivalens.

Invest in KickFurther Consignment Opportunities

Kickfurther is a platform that lets companies seek funding from the Kickfurther community by offering a return on investment (such as 8% profit in 10 months, for example). Technically, these offers aren’t loans. When you invest in a Kickfurther offer, you are actually buying inventory that is then sold on consignment by the company seeking funds. With Kickfurther, you will earn a profit with each offer that you fund as long as the “borrower” pays out as promised. Importantly, Kickfurther allows funding by credit card (or bank gift card).

More complete info about Kickfurther can be found in these prior posts:

The process for liquidating gift cards through Kickfurther is very similar to Kiva:

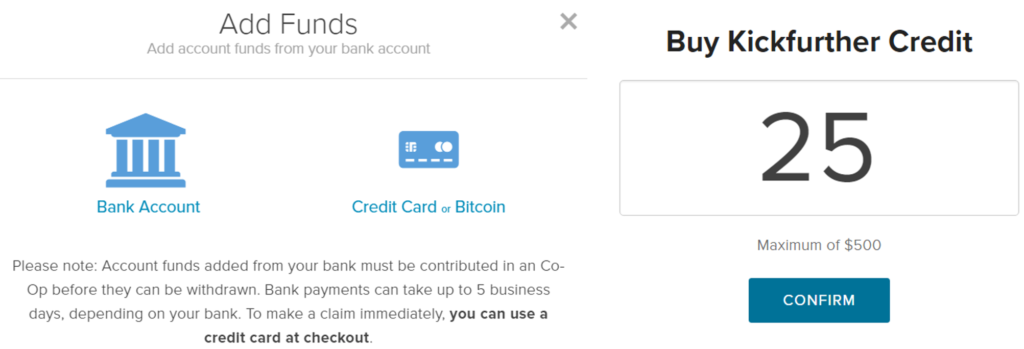

1. Add Funds. After logging into KickFurther, go to “My Account”, then select “Add Funds”. Select “Credit Card or Bitcoin”. Enter the amount to add. Unlike Kiva, Kickfurther requires whole dollar amounts when adding funds this way.

2. Fund a KickFurther Consignment. Funds cannot be withdrawn until they have been used to fund a consignment and then paid back.

3. Withdraw payouts. Once consignments pay out, you can withdraw funds to your bank account. Regardless of how you funded the original consignment, you will pay a 1.5% fee to withdraw your money. This effectively reduces your profit by slightly more than 1.5 percentage points (since the 1.5% fee is assessed against the entire balance, including your profit, not just the original investment). For example, if you invested $100 on a 10% profit consignment, then your final balance should show $110. When you withdraw, you’ll be assessed a 1.5% fee on $110 = $1.65. Your final profit in that example will be $8.35 (8.35%).

Advantages

- Potentially earn a nice profit.

- Very easy way to drain gift cards from home.

- Works with all forms of bank gift cards: Visa, MasterCard, Amex*, etc. Also works with virtual gift cards.

Disadvantages:

- Money inaccessible for many months.

- No guarantee of pay back. I hope to report on my results to-date soon. I think that I’m doing quite well, but KickFurther’s reporting features are abysmal, so it’s hard to know for sure (especially since most of my consignments are still in-progress).

- Opportunity cost. Kickfurther can also be funded by credit card. I usually use my Citi AT&T card which gives me 3X points for “online purchases,” including payments to Kickfurther. So, when I fund consignments with gift cards, I am losing out on 3X rewards from my Citi AT&T card.

As with Kiva, I love being able to easily drain gift cards from home so, for me, the advantages outweigh the disadvantages.

* In my experience, Amex gift cards don’t work as well as Visa or MasterCard gift cards when used with Kiva or Kickfurther. With Kiva, you may have to call Amex to register your name and address to the card in order to get the payment to go through. With both Kiva and Kickfurther, there will be a $1 hold on the card that prevents it from being fully drained (actually I saw two $1 holds when using Kickfurther).

Yo greg do you still have a kiva team? If so how do I join? I can’t find it

The Kiva team I belong to is called inside Flyer. If you sign up for Kiva here, I think you’ll automatically be part of the team: http://www.kiva.org/invitedto/milepoint/by/FrequentMiler.

Thanks!

Greg / Anyone – is there a list of stores that will auto drain gift cards as described in the article?

Not that I’m aware of. My impression is that more often than not, registers do auto-drain.

Do you know a list of stores that show the remaining balance on the receipt after using a Visa gc to pay?

DP: Auto drain previously worked at my local walmart but is no longer working as of this month.

I’d caution continuing to encourage readers to fund co-ops on Kickfurther. I also think I’ll be getting out with fairly decent returns (or at least not losing money), but there’s been a ton of serious issues with the company as of late. They’ve proven they don’t actually vet companies before allowing co-ops, and a lot of people have lost a lot of money on the site. In addition, it does seem like they’re running out of money to actually fund the business, so there is an actual risk of insolvency there as well.

A reddit group called KFTalk is a good spot to check out the true percentage of failed co-ops, and the real risk of losing money on the site.

Thanks for the cautions. I’ll have to think about how to write about KF (since I still use it) with enough warnings so as not to encourage others to do it without understanding the risk.

Thanks.

[…] How to liquidate small denomination debit gift cards. […]

FM, what do you do with the $500 gift cards you bought at sam’s club? regular spend or BB/Serve?

he didnt buy 500s at Sams

Yes I did

In this case I’ve mostly done Kiva, but could also use them to buy money orders at a local store that allows it.

I drain all my small balance gift cards through paying my Comcast bill. I feel good knowing that Comcast will have to pay a 30 cent fee on 50 cent to $2 payments I use to zero out the cards. Of course, I pay most of it on the Ink.

Why do you feel good screwing Comcast over? If they are so bad don’t use them.

yes dont use that monopoly

Exactly. Hoping Google fiber comes through, so we can stop using Commiecast. In many places, there are no other options for internet, but Comcast.

My point was that the person is a hypocrite. Would you go to dinner with someone you couldn’t stand? Also, not having cable is always an option.

Dumb post, because that is literally the ONLY internet in hundreds of cities in the US.

Any advice on how to drain $500 VGC’s? Got Amex Business, but have to spend 15K. Not too worried about 5K with regular spend, but the other 10K will have to be MS. I was using the POffice, but that is no longer an option. I have Blubird card that’s never been used (I know that died for most), Visa Buxx (that died too a little).

Be careful about MS on the Amex Plat cards…had my points frozen and revoked with only 1k of MS spend. Wouldn’t recommend it. Many others did as well…

I’m not concerned about MS on a public link offer, as I have heard many DP’s that it’s ok. Your offer (or that last offer) however, wasn’t exactly public, so I think that’s why Amex clawed back many people’s points. Of course, YMMV.

I would be concerned. Read up on it. Ppl were screwed public and non public links

Well, tell us how it goes when Amex’ new perk abuse team looks at your activities 🙂

You can use the ideas in this post for $500 cards too if you need to.

If you are an eBay seller, you can make one time credit card payments of any amount on your seller account. Can even pay more than the current balance due.

What happens to the credit balance?

It stays in your eBay seller account until you have more seller fees to pay. I don’t think there is a way to cash out the credit balance.