NOTICE: This post references card features that have changed, expired, or are not currently available

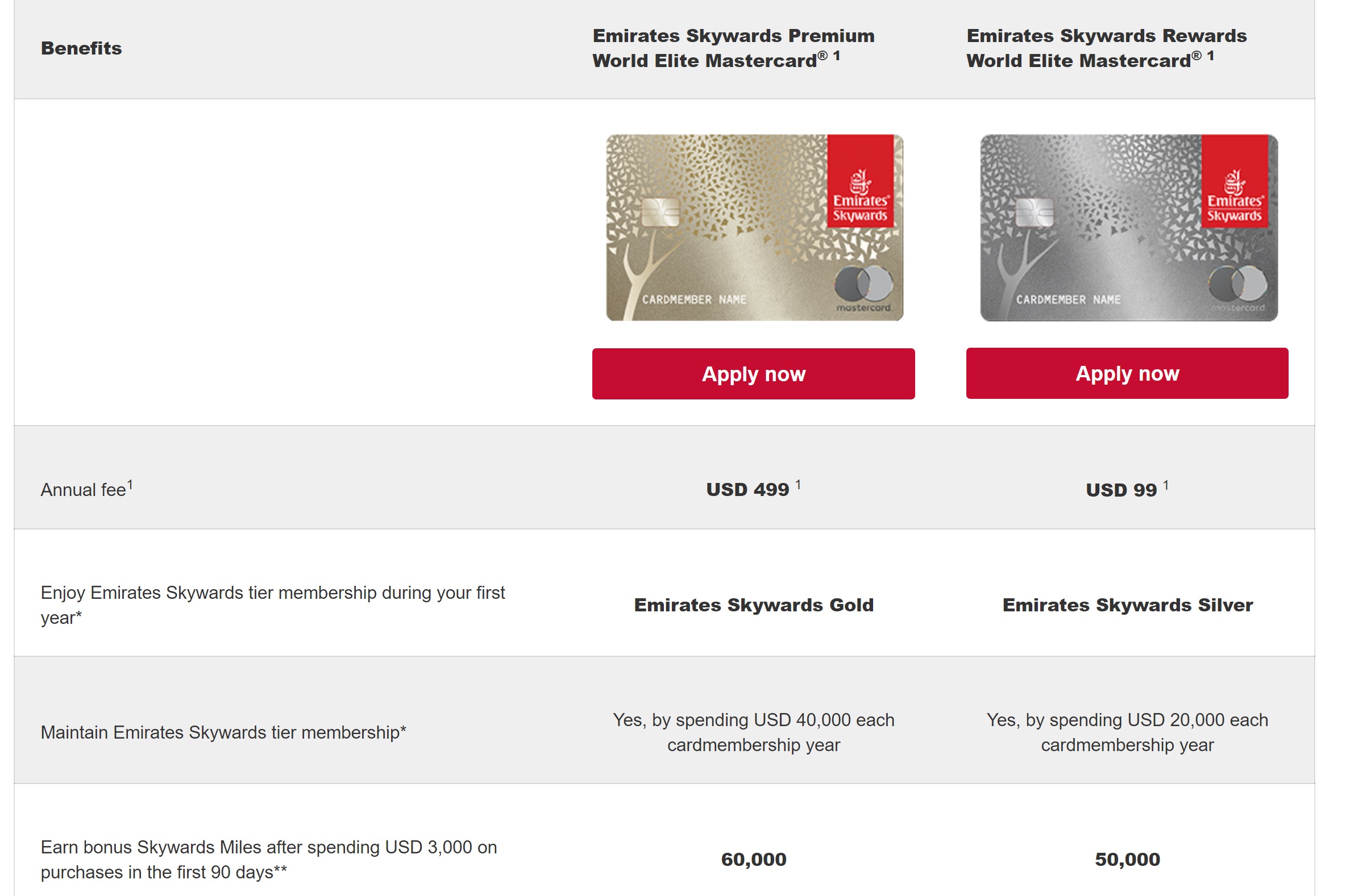

The Barclays Emirates Skywards credit cards are currently featuring increased offers of 50K or 60K miles after $3K in purchases in the first 3 months. While I still wouldn’t bother with the Premier card, the Rewards card that comes with Silver status and a $99 annual fee could certainly be worthwhile given the 50K bonus.

The Offers & Key Card Details

| Card Offer and Details |

|---|

ⓘ $303 1st Yr Value EstimateClick to learn about first year value estimates 40K Miles + 1 Year Silver status Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 40K after $3K spend in the first 90 days$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 3X Emirates ✦ 2X airfare, hotel, and car rentals ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Maintain Emirates Skywards Silver status with $20K spend per membership year (Silver status offers cardmember lounge access to Emirates Business Class lounges in Dubai only) Noteworthy perks: 25% discount when buying miles ✦ No foreign transaction fees |

| Card Offer and Details |

|---|

ⓘ $248 1st Yr Value EstimateClick to learn about first year value estimates 70K Miles + 1 Year Gold status Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 70K after $3K spend in the first 90 days$499 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 3X Emirates ✦ 2X airfare, hotel, and car rentals ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 10K bonus miles with $30K spend per membership year ✦ Maintain Emirates Skywards Gold status with $40K spend per membership year (Gold status offers cardmember and guest lounge access to Emirates Business Class lounges worldwide) Noteworthy perks: Priority Pass Select ✦ Global Entry Fee Credit ✦ 25% discount when buying miles ✦ No foreign transaction fees |

Quick Thoughts

I still wouldn’t imagine paying $499 a year for the Premium card, but the $99 card with 50K miles could make sense if you have a use for Emirates Skywards miles. Keep in mind that they quietly devalued some of their best partner awards recently, so which sours me on the idea of collecting their miles rather than a transferable currency like Membership Rewards points that could be transferred to Emirates when you’re ready to redeem, but I I’m sure there are some circumstances where these cards could make sense and the new offers are the best we’ve seen on them so far.

H/T: Doctor of Credit