| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

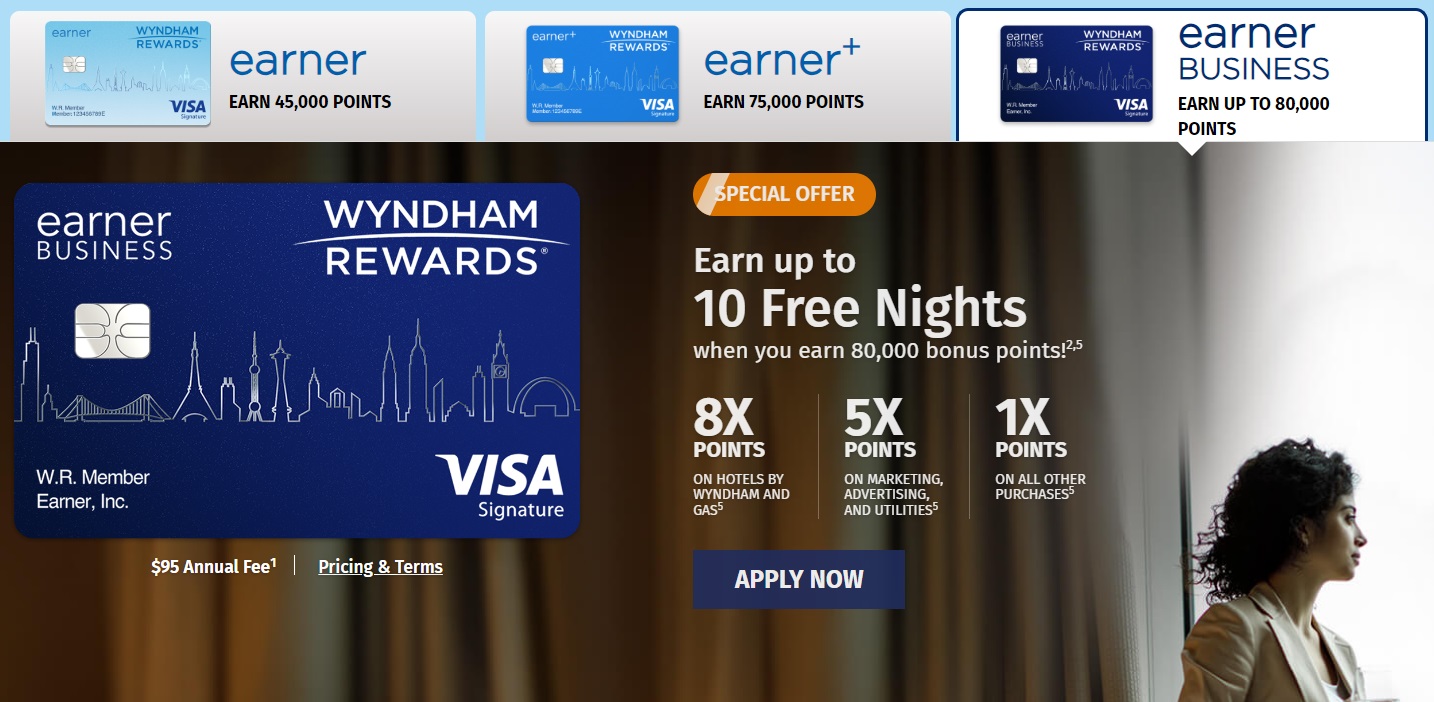

Barclays has increased the welcome offers available on all three Wyndham Rewards credit cards. Despite not being at all-time highs, they’re still decent bonuses that you can earn. The spending requirements to earn the full number of bonus points can be steep though if the Business card is the one you have your eye on.

The Offers & Key Card Details

Click the card names below to go to our card-specific pages for more information and to find a link to apply.

| Card Offer and Details |

|---|

ⓘ $186 1st Yr Value EstimateClick to learn about first year value estimates 30K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 30K points after $1K spend in first 90 daysNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/11/24: 75K after $2K in spend FM Mini Review: Sign up for the bonus. Keep for the 10% award discount. Earning rate: ✦ 5X Wyndham & gas ✦ 2X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 7,500 points each anniversary year after $15K spend Noteworthy perks: Priority Pass Select ✦ Global Entry Fee Credit ✦ 25% discount when buying miles |

| Card Offer and Details |

|---|

ⓘ $216 1st Yr Value EstimateClick to learn about first year value estimates 45K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 45K points after $1K spend in first 90 days$75 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/11/24: 100K after $2K in spend FM Mini Review: Not bad, but the business version is better. Earning rate: 6X Wyndham & gas ✦ 4X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 7,500 points each anniversary year ✦ Platinum status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays |

| Card Offer and Details |

|---|

ⓘ $148 1st Yr Value EstimateClick to learn about first year value estimates 45K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 45K points after $3K spend in first 90 days$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 7/11/24: 100K after $15K in spend FM Mini Review: Excellent earning rate at gas stations and Wyndham hotels. Diamond status plus 15K annual bonus makes this card a keeper. Earning rate: 8X Wyndham & gas ✦ 5X marketing, advertising, and utilities (telecommunications, cable, satellite, electric, gas, heating oil and water) ✦ 1X everywhere else Card Info: Visa Signature issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 15,000 points each anniversary year ✦ Diamond status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays |

Quick Thoughts

The highest offer here is for the Wyndham Rewards Earner Business card as that one provides the opportunity to earn up to 80,000 bonus points. You’ll earn 40,000 bonus points after spending $4,000 in the first 90 days, then an additional 40,000 bonus points after spending a total of $15,000 in the first 12 months. That’s a steep amount of spending considering you could – at the time of publishing this post – earn 175,000 Membership Rewards for the same amount of spend on an Amex Business Gold card instead.

The two personal Wyndham cards have much easier minimum spend requirements. The Earner Plus card is offering 75,000 bonus points on $2,000 spend in the first 180 days, while the no annual fee Earner card has a bonus of 45,000 bonus points on $2,000 spend in 180 days. Seeing as the spend requirements for the two personal cards are the same, applying for the Earner Plus card will make more sense for many people seeing as the $75 annual fee will be more than offset by the additional 30,000 points you’ll earn in the first year as part of the welcome offer, then at renewal you’ll earn 7,500 bonus points which offsets that annual fee (depending on how you value Wyndham points).

A great benefit on all three of these cards is that they provide a 10% discount when redeeming your points for award nights, including for Vacasa stays. Even though these welcome offers aren’t at all-time highs, if you anticipate redeeming a bunch of Wyndham points in the next few months it could be worth getting one of these cards now to save on those stays rather than waiting for an increased welcome offer at some point in the future. These new offers are due to be around until January 8, 2025, at which point I’d imagine it’s more likely that the bonuses would drop temporarily than go even higher. Either way, you’ll be waiting at least four months to see a different offer than these.

TRS Coral Costa Mujeres, an all inclusive in Cancun looks amazing for 27K points. Rooms go for like 600 bucks in the winter, so might have to grab one of these cards.

Has anyone figured out how to use any BUSINESS credit card to pay the 3 companies accepting IRS tax payments? Greg said PayPal is a “workaround” but PayPal charges 2.5% for using a credit card PLUS the almost 2% by the 3 IRS credit card processing companies. Paying 4.5% is not a viable workaround for most of us.

There’s no fee from PayPal. When using the payment processors website click to pay with PayPal. The total fee will be the same as paying directly by credit card.

Thanks Greg, Would that “total fee” be the 2.5% charged by PayPal or the approximately 1.9% charged by the 3 IRS sanctioned credit card processing companies?

The latter

Thanks Greg. Just to confirm: I give my business credit card number to PayPal but I enter the payment order with PayUSAtax.com and I’ll pay PayUSAtax.com their 1.85 % fee and PayPal won’t charge me their 2.9% fee?

Wasn’t there a 100k bonus for the Earner+ card (Not business card!) just a couple of months ago? I missed that opportunity and got this but will likely hold out for higher.

has anyone had any luck getting matched to the higher sign up bonus? i just got approved but with the 45k bonus so hoping to get matched.

Not with Wyndham cards, but a couple of years ago I asked Barclays to match a higher offer on a JetBlue card and was not successful.

Hopefully 100k (or better) Wyndham Biz card offer comes back next spring / summer.