NOTICE: This post references card features that have changed, expired, or are not currently available

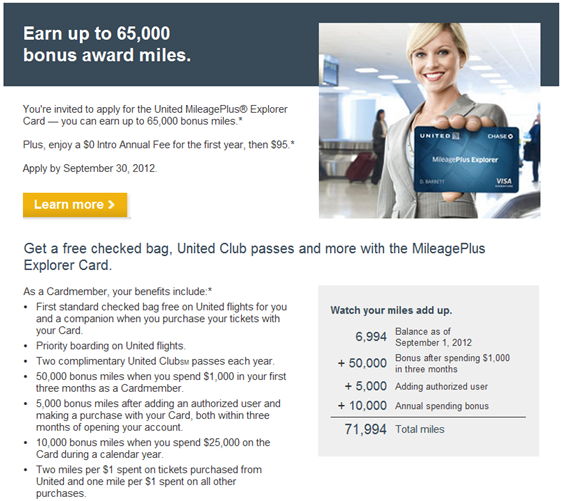

Every couple of weeks, I get an email like this one inviting me to earn up to 65K United Miles for signing up for the Chase MileagePlus Explorer card:

In reality, I see this as a 55K signup offer. You get 50K after spending $1000 and another 5K for adding an authorized user. The final 10K requires $25K in spend per year. That’s not really part of the signup offer – it’s really just the card’s standard big spend bonus. Still, 55K United miles is a great offer. If you haven’t received this offer (but want to), I recommend signing up for United’s MileagePlus loyalty program. Then, follow this advice by dabearz73 on Flyertalk:

Found a way to trick United to get the 60K bonus rather than 40K

First login to your United Mileage Plus account on united.com.

Most see an offer for 40K for signing up to the Mileage Plus Explorer card. Rather than clicking on that link, click on the link below.

https://www.theexplorercard.com/MPEl…NS9_XXD_110719

As long as you are logged in and have not previously clicked on the 40K link, the 60K offer will pop up in a new window. If you click on the 40K link you need to log out and log back in.

Even though dabearz73 describes the offer as a 60K bonus (which was the offer at the time), the trick above works for the 55K/65K offer.

There’s no question that this is a great sign-up offer, but is this card worth keeping after the first year? Let’s compare its perks to a few other popular airline cards:

|

Card |

Annual Fee |

Free Checked Bag(s) |

Priority Boarding |

Other Major Annual Perks |

| United MileagePlus Explorer | $95 | Yes | Yes | Two United Club passes per year, Primary car rental insurance |

| US Airways Dividend Miles | $89 | No | Yes | First class check-in; $99 companion ticket good for up to two guests; 10,000 bonus miles per year; 5000 mile discount on award redemptions. |

|

(Update: This offer has temporarily expired.) |

||||

| AAdvantage Select Visa or Amex | $95 | Yes | Yes | 10% rebate on awards |

Which ones are keepers?

- US Airways Dividend Miles: If you value Star Alliance miles, then this one is a no-brainer. For only $89 per year, you get 10,000 bonus miles. That’s like paying less than a penny per mile even if you do not use any of the card’s other perks. To me, the award discount and $99 companion ticket are just icing on the cake. I’d recommend to everyone interested in collecting miles that they get this card for the sign-up bonus and then keep it for the annual bonus regardless of whether the other perks get used.

Gold Delta SkyMiles: For anyone certain to use the companion pass each year, this card can easily pay for itself (although I would then recommend you move up to the Platinum Delta SkyMiles card). This is also a good card for people who fly Delta regularly, but not enough to earn elite status (since elite status also results in free checked bags and priority boarding).(Update: This offer has temporarily expired.)- AAdvantage Select Visa or Amex: If you fly American Airlines regularly, but not enough to earn elite status, then this card should be a keeper. Otherwise, I’d only recommend keeping this card if you plan to redeem AA miles. If so, the 10% rebate can easily be worth the $95 annual fee.

- United MileagePlus: I see this card as a keeper only if you fly United regularly, but not enough to earn elite status. Otherwise, it seems unlikely that the benefits of the free checked bags, 2 club passes, and primary car rental insurance will get used often enough to justify the $95 annual fee.

Summary

In general, if you fly a particular airline often, but not enough to earn elite status, then it makes sense to carry that airline’s branded credit card for priority boarding, fee checked bags, etc. Ironically, the one card that doesn’t offer free checked bags (the US Airways card) is the only one I’d recommend for everyone since its annual 10K mile bonus is alone worth the annual fee.

Recently I was asked what I thought about the United MileagePlus card. My response was that it’s a good card, but not as good as the competition. Since I don’t fly United often, I don’t see much reason for me to keep the card after the first year. I much prefer the annual perks of the US Airways card. And I think that Delta’s companion pass, and AAdvantage Select’s 10% award rebate are both good reasons to consider keeping those cards.

What about you? Do you think the United card is a keeper?

Glenn: Honestly, I’m not sure.

Glenn: Was your previous card slightly different than the current MileagePlus card? I know that they changed the card about a year ago — so if you had a previous product, then you can always get a new signup bonus for the new product.

I got the previous one 10/1/2011. It certainly looks identical to the new one. I guess you’re right there must have been a change. How can you know if there’s been a “qualifying” change to the card?

FYI I had the Chase United Signature VISA for a year and a half or so, canceled it in January 2013. Applied for another one in early May via the United login trick and just confirmed via SM with Chase that I will receive the 50K after $1,000 spend etc. Obviously this isn’t what they claim will happen as I’m a previous (recent) cardholder. Don’t know. Just lucky?

Thanks!

Rob P: That’s a good point!

Just learned from Dan of DansDeals and also at MileValue that SOMEHOW those who have the MileagePlus Explorer card have access to more award availability. That upgrades this card from good to great, especially for non-elites like me.

I tend to fly delta more but i dont earn enough quiet yet to get elite. So i might be bias toward the card but i think OPEN Savings can be a good reason to keep the card if you dont already have a card that include that. Especially with your 10X on everything article.

In my case, the search results page of a dummy booking had the 65k bonus plus $50 statement credit. I also had miles in my account, but I’m not sure if that makes a difference or not.

From the united.com website, free checked bags have to be paid with the card (unlike with Delta AMEX). I haven’t tried it yet, but I have an upcoming United flight that I booked before I received the card, so we’ll see. I also believe just holding the card gives you priority boarding, even if not used to book the flight.

http://www.united.com/web/en-US/content/travel/baggage/chasebag.aspx

How to do dummy booking?

pas: search for a flight on United.com and go through all of the steps to book it. Stop at the final confirmation screen.

By the way FM, I love the blog and follow it regularly. Appreciate all the info!

Interesting post as my United Explorer is coming up on a year in October, meaning I’ll have to pay the fee. We’re likely going to travel on United in December (don’t travel that much at the moment with a little one, but we like United for certain destinations) and I’ve found it beneficial in the past to have the Explorer card. We got upgraded to first class on both legs to/from Hawaii for example.

So I’m thinking I’d like to have a United Explorer card before we go.

I’m new to this whole churning thing, but it seems like the options I’ve got are:

– Apply for the United Explorer Business card BEFORE I cancel the personal one. Its about 3 months since my last churn anyway, and I can punt a British Airways card if need be to get approved since I’ve already hit the minimum spend. Then cancel the personal card before the charge hits. Yes of course negotiate and see if they’ll offer me anything.

– Cancel the Personal Card (assuming they don’t offer me something good) before the renewal date. Then before December rolls around, apply for the Business Explorer Card.

The only obvious advantage to the 2nd is that by allowing more time there might be a better offer for the business card, which at 25,000 miles (I’m probably not going to put $10,000 on the card) is somewhat low. Any chance Chase is going to goose this offer before the end of the year (meaning do they typically do that)?

What would you recommend?

99% sure that the United card gives you free bags regardless of how you pay

Furthermore if you book a flight for someone most all of your perks from the card and your status go with it

curtis: Thanks for the info!

Glenn: Honestly, you’re probably better off trying to get a retention bonus for the personal card you already have. That way you won’t use up a hard credit pull that can be used for more interesting offers. Call and say you’re thinking of cancelling and ask to speak with someone in the retention department. They’ll likely offer you something to keep the card.

weird !! Barclays could only giveme 25 % discount on fees ; what is that 10K yearly bonus? I thought you have to spend 10K to get that bonus

I cancelled it since I could hardly get a award ticket in a year after I got 40K and they refused to give me any retuention bonus outher than 35 % discount on fees. Plus they cite I had too many application activities away leading to the rejection of my Virgin America card approval. I did mean to treat the VA card as a work horse to collect VA miles when rebate is only 1 % and AMEX is NOT accepted.. WHen 1% and AMEX is accepted I pull my AMEX SPG card

Thanks FM. Now I have to sign up! Leaving for Hawaii in about a month using miles, so this is perfect timing!

Great post, FM.