Capital One Shopping, the often-misunderstood shopping portal that has nothing to do with Capital One apart from the name, has cooled considerably from the myriad of incredibly high cash back offers we saw during last year’s holiday shopping season. However, I have recently once again been getting some very good targeted offers via email that are actually moving the needle in terms of getting me to make purchases or double-check booking prices for upcoming travel. Not everyone will get these offers, but it’s worth keeping your eye on your email because we sometimes see these offers targeted to many people — and perhaps more importantly, they can get buried in an email with a seemingly irrelevant subject line.

Great targeted offers, poorly-drafted subject line

I wanted to write this post because of a situation today that reminded me of the importance of opening emails from Capital One Shopping.

An email popped in my inbox this morning with the following subject and preview. I saw it on my phone, where less than half of the preview here was visible.

![]()

If you can’t see that well, the subject line reads “Well deserved: You’ve got this offer from StubHub – Up to 20% back on your favorite brands . . . .”. That’s more than I could see in the subject line on my phone.

Having just recently purchased tickets to an event, I clicked on this email wondering whether I should kick myself for not having waited a few more days since 20% back via StubHub would have been fabulous.

However, I was reminded that the subject line and preview of a Capital One Shopping email is often misleading. The rate at StubHub was only 12% (which is still good, but less relevant to the subject line).

However, the reason I’m writing this post is because the body of the email was filled with offers that had nothing to do with StubHub and everything to do with travel.

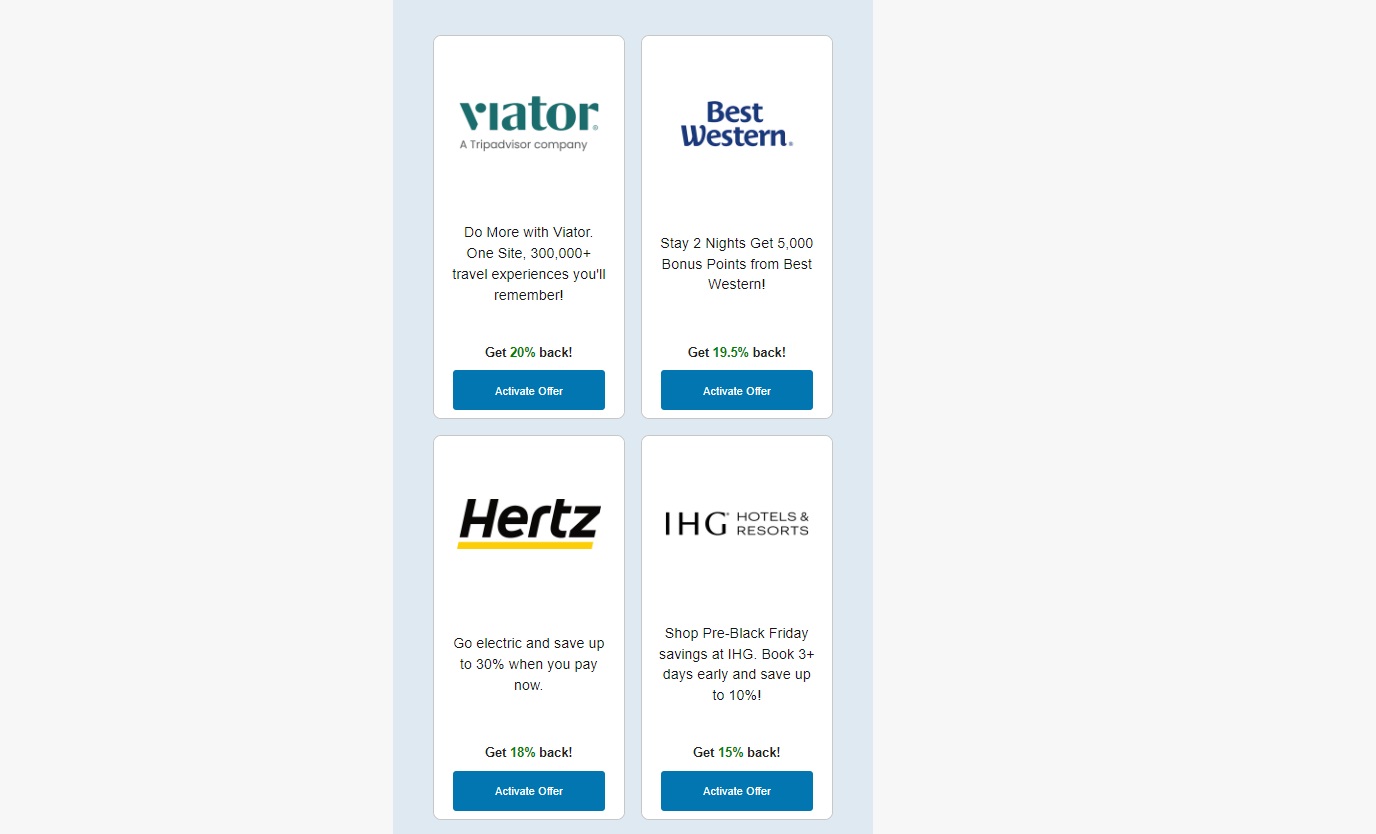

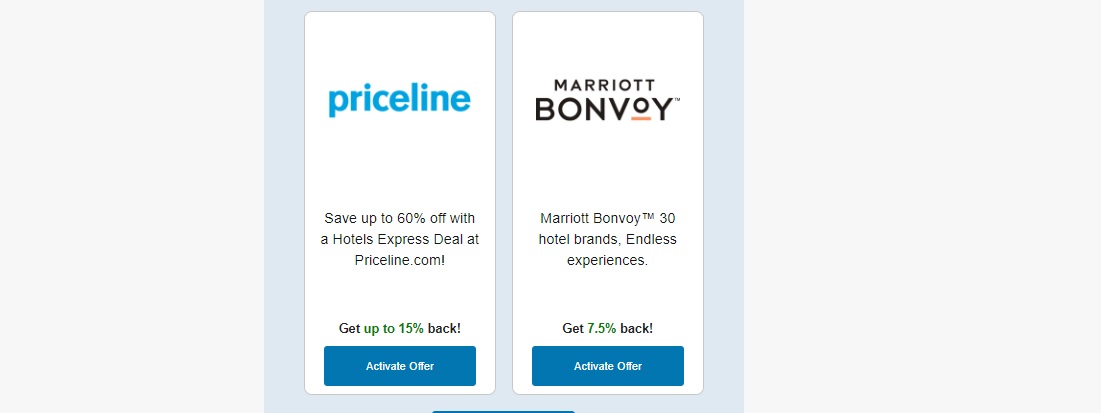

As you can see, I had offers including:

- 20% back at Viator

- 19.5% back at Best Western

- 18% back at Hertz

- 15% back at IHG

- 7.5% back at Marriott

- Up to 15% back at Priceline

Those rates are all excellent. Given that Capital One Shopping is just a portal, you can use this to click through and book the same postpaid rates that you ordinarily would and take advantage of elite benefits and get elite credits when booking.

Anyway, I thought it worth a shout out to actually click to open the emails they send. I could imagine a time when I wasn’t looking for tickets to anything when I may have ignored today’s email and missed the chance to save quite a bit on car rentals and hotels.

Note that if you click through the email where you have the Capital One Shopping extension installed, you should get a pop-up during checkout confirming the rate you saw from the email. That almost always works properly for me. I should add that I do not see these increased rates on the Capital One Shopping website or in the Capital One Shopping app, though it is always worth comparing because you will sometimes see different rates in those places.

How long does it typically take for rewards to post? I made my first purchase on 12/9 at giftcards.com and while it appears in the Rewards dashboard, it so far has remained in pending status. GC.com purchases seem to post rather quickly on Cartera shopping sites, but I think CapOne is using someone else to power their site?

I never expect rewards to be payable for at least a month — often it’s 2 or 3 months. Rakuten pays out once a quarter, so sometimes it is four or five months from purchase date until paid date with them. I have an order as far back as early October that is still pending. I’ve gotten paid out on plenty of previous orders without issue, so I don’t expect any trouble.

OK, so I got a Tripadvisor 21% off on activities. I booked a few activities on next trip and they show up on rewards and savings dashboard BUT they show up as INELIGIBLE. I assume this is due to the fact that they are not COMPLETED YET. Can anyone confirm? BTW, I cannot find an email for their help line.. I have time to rebook via another better site but took 21% over 10-15% on another site. Thanks.

These things sometimes have trouble tracking correctly. Do you really want to go 10 rounds with customer service? Buyer beware.

I’m currently in dispute with them because my order after clicking through the email doesn’t show up as a shopping trip. I have screenshots of the offer being active during my shopping trip.

These offers only come in the email and not listed as a targeted offer from their app. As generous as these offers are, I can’t recommend them or Capital One Shopping if they don’t credit me the proper amount when their product doesn’t work.

I thought on this portal, whenever they say x% or amount back, it is not the actual dollars back but funny “C1 cash”? I look at my C1 shopping account, and it had a huge number of “life time savings” as well as some accumulated C1 cash that you were supposed to redeem?

Hi Nick. So I’ve seen some really good offers lately. One that I jumped on was Verizon Business, get $165 cash back. Thing is, there was no minimum purchase amount or specific product specified. The T&C specifies “To earn the rebate you must make an eligible purchase at verizonbusiness.com. To earn the rebate, you must be a Capital One cardholder or bank account holder, and logged in to your account on capitalone.com or the Capital One Mobile app.”

When I called C1 CS and asked for more details, the rep confirmed the only requirement is to make a purchase from the website after clicking through capital one offers. I made a ~$175 purchase from the verizon business website and it’s not tracking after ~3 weeks. The T&C, as well as the C1 rep, state you will need to wait up to 90 days for the rebate. The return window is 30 days. Even with screenshots, I don’t have much confidence in getting this rebate without a lot of haggling? Curious what your thoughts are or what your experience has been dealing with situations like this. Thanks in advance!

Hi Nick – thanks for the post! So – when you click through the article and DON’T see the same rate, do you take a screenshot and haggle with CapOne later? About how are they averaging at honoring their rate?