Last week I wrote about my wife’s “last, great Delta mileage run.” She is fairly close to achieving Delta’s 2 Million Miler status and that will mean lifetime Platinum Medallion status. And, critically, this year (2023) is the last time that credit card spend can move her closer to Million Miler status, and so we’re going all-out with massive credit card spend (primarily through Manufactured Spending techniques where we’ll get most of our money back) in order to get her within easy striking distance of 2 Million Miler. To me, that decision was easy. With one last mighty push, she’ll get top-tier Diamond status for 7 years plus near-top-tier Platinum status for life (or until Delta changes that program). My own situation is not so clear. I’m too far from 2 Million Miler status to make a meaningful dent in the gap this year. Instead, my decision is solely about whether to earn Diamond status for several years with one last credit card based mileage run of my own…

Background

When Delta first announced draconian changes to their elite program for 2024 and beyond (which they later walked back), I was ready to give up chasing Delta elite status for good. To be clear, I would still fly Delta. I think they’re the best domestic carrier, and since I live near a Delta hub (Detroit), they offer the best route network for me, by far. But, I figured that I was better off simply paying more to sit in the front of the plane when that’s important to me rather than wasting time, effort, and cash towards earning elite status.

Delta’s revisions to their 2024 plans changed things a bit. My plan not to chase Delta elite status in the future remains, but I now have an opportunity to keep elite status earned this year for several years into the future. Delta’s revised revision offers the option to extend the elite status earned this year for 2024 by one year for each 100,000 MQMs (Medallion Qualifying Miles) rolled over at the end of this year.

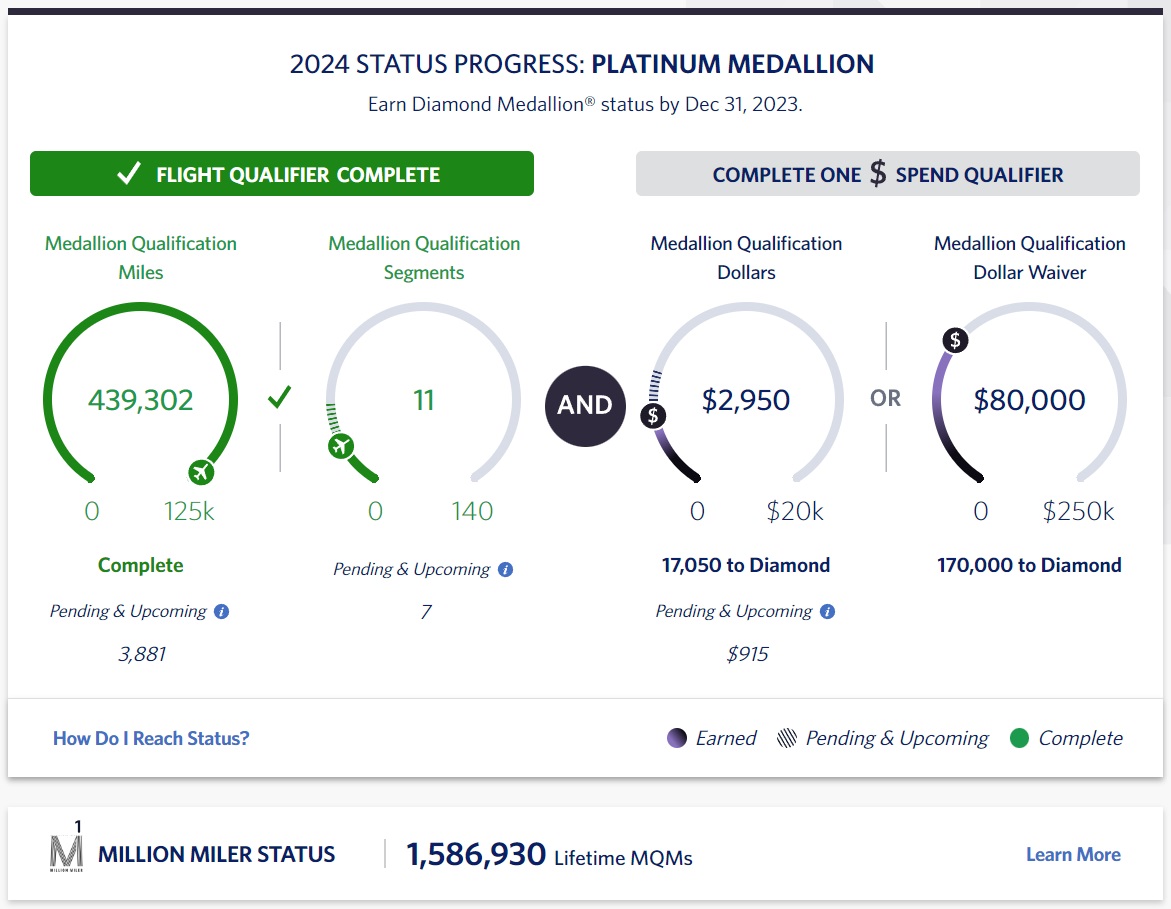

I currently have Platinum status for 2024 and about 440,000 MQMs. If I don’t do anything more with Delta this year, I’ll roll over ~365,000 MQMs (440K minus 75K for achieving Platinum status). With that haul, I could convert 300,000 of those MQMs into 3 extra years of Platinum Medallion status. After those years are up, my 1 Million Miler status will “soft land” me to Gold Medallion status for life.

Background Summary:

- I have already secured Platinum Medallion status for 2024.

- I have enough MQMs rolling over to extend Platinum status for 3 additional years

- I have 1 Million Miler status, but I’m too far from 2 Million Miler to get significantly closer

Why is 2 Million Miler out of reach?

I currently have 1,586,930 lifetime MQMs and need 2 million to get to the next level of Million Miler status. This year, all MQMs earned will get me closer. Starting next year, though, only butt-in-seat miles flown will count towards Million Miler status.

Delta’s new program offers Gold Medallion status to 1 Million Milers and Platinum Medallion status to 2 Million Milers. In my opinion, Platinum is a big leap over Gold status, but can I get there?

With a tremendous amount of spend, it’s currently possible to earn 160,000 MQMs in a year (that changes completely next year when Delta will stop counting MQMs at all). I’ve already earned 35K MQMs that way, so I really only have 125K more that can easily be earned. Yes, it’s possible to get friends in on the action with spend on their Delta Reserve cards where they would then gift the bonus MQMs to me, but that doesn’t seem practical at the moment. So, with a lot of spend, I could get 125K MQMs closer to 2 Million Miler status and that would still leave me 288,000 miles short. And starting next year, there won’t be any way to spend my way to lifetime status with credit cards. So, let’s imagine that I fly 25,000 miles per year on Delta and its partners. In that case, it will still take me 12 more years to get to 2 Million Miler status. And, what if that estimate is high? At 15K miles flown per year it would take me 19 years to get there. Those are very long timeframes with or without a big push this year, and so I don’t see any reason to put time and effort now into this particular effort.

2 Million Miler Summary: Regardless of what I do this year, I’ll still be many, many years away from 2 Million Miler status so it’s not worth pursuing right now.

Should I push for another year of Platinum status?

As things stand right now, I have earned Platinum status for 2024 and I’ll have ~365,000 MQMs rolling over. Since each 100K MQMs of rollover can mean another year of extended status, the question is whether I should try to earn 35,000 more MQMs before the end of the year since that would be enough for another year of extended status.

I have an upcoming trip where I expect to earn around 5000 MQMs, so I’ll be 30,000 MQMs short of another year of Platinum status. I could get there with $60,000 spend on a Delta Reserve card. Until next year when all of this changes, Delta Reserve cards offer 15K MQM boosts with each $30K of calendar year spend, up to $120K spend. With my worst case cost of easy manufactured spend at 3%, we see that $60K spend could cost me up to $1,800. And, in fact, since I’ll be using up better techniques to get my wife to 2 Million Miler status through spend, I think that 3% is the right cost for me to use for this analysis.

Since I’ve already secured Gold Medallion status for life, the question now is whether Platinum status is worth $1,800 for a single extra year? In my post, What is Delta elite status worth? I conservatively estimated the incremental value of Platinum over Gold status at $500. Easy answer: No, I shouldn’t spend $1,800 to earn another year of Platinum status which I value at about $500.

Here’s a summary of advantages of Platinum status over Gold:

- Free Upgrades to First Class Beginning 120 Hours Before Departure

- Free Upgrades to Comfort+ Shortly After Ticketing

- Dedicated Higher Priority Phone Line

- Hertz President’s Circle Elite Status

- Earn 9 miles per dollar on paid flights (1X more than Gold)

- Waived award change/cancel fees (Delta offers free award changes and cancellations to everyone for flights from North America. Platinum elites, though, get free award changes and cancellations for all awards regardless of the flight departure point)

- Choice Benefits: 4 regional upgrade certs, for example

Additional Platinum Year Summary: The cost to earn another year of Platinum status rollover is too high compared to the relative value of Platinum status over Gold status (which I’ll have anyway).

Should I push for Diamond?

In my post, What is Delta elite status worth? I conservatively estimated the value of Diamond status at $1,600 above Platinum status.

Now, let’s assume that a push to Diamond status would achieve two things: 1) Diamond elite status for 2024; and 2) 400K MQMs rolled over. If both happen, then this final push would give me Diamond status for 5 years. That’s a value of $8,000 ($1,600 x 5) over Platinum status and even more value over Gold status.

Here’s a summary of advantages of Diamond status over Platinum:

- Free Upgrades to First Class Beginning 120 Hours Before Departure

- Free CLEAR Membership

- Board first, even when seated in economy

- Dedicated VIP Phone Line

- Earn 11 miles per dollar on paid flights (2X more than Platinum)

- 3 Diamond Choice Benefits: Global Upgrade certs, $500 credit card fee waiver, 35K redeemable miles, etc.

The Diamond benefits I value the most are the dedicated phone line and the Choice Benefits, the latter of which have real material value.

For me to achieve Diamond status this year, I’ll need to complete $250,000 spend on Delta credit cards to get a Diamond MQD waiver. I’ve already spent $80K, so I would need $170K additional spend before the end of this year. If we use that 3% cost of spend number discussed above, $170K of spend would cost me $5,100. That’s significantly less than the estimated $8,000 value of 5 years of Diamond status. But would I really get that many years of status? Will I have enough MQMs rolling over?

If I achieve $170K of spend via $120K of spend on a Delta Reserve card and $50K of spend on a Delta Platinum card, I’ll also earn MQMs from that spend, as follows:

- Delta Reserve $120K spend: Earn 60K MQMs

- Delta Platinum $50K spend: Earn 20K MQMs

I currently have ~440K MQMs and expect to earn at least 5K more from flying. Then, with the 80K earned through card spend, I would end with up to 525K MQMs. 125K of those MQMs would be subtracted for my 2024 Diamond Medallion status and 400K MQMs would roll over. So, yep, I would be able to use those 400K rolled over MQMs to extend Diamond status for 4 additional years for a total of 5 years of Diamond status altogether.

Overall, the benefits do appear to outweigh the cost here. I’m still a little on the fence about this though since I’ve committed to even more credit card spend for my wife to achieve 7 years of Diamond status plus a lifetime of Platinum status.

Diamond Push Summary: It would cost me about $5,000 to get to Diamond status and to earn enough MQMs to rollover 4 extra years of Diamond status (for a total of 5 years of Diamond). Compared to the conservative value of Diamond status over Platinum status for 5 years ($8,000), this is a good choice. That said, I don’t know that I have the bandwidth to do this spend and the spend I’ve committed to do for my wife.

Bottom Line

I have an opportunity to earn 5 years of Delta Medallion Diamond Elite status with big, big credit card manufactured spend. It will cost me about $5,000 in fees to generate the spend and get the money back to pay my credit card bill. In return, I estimate getting over $8,000 in incremental value from that Diamond status.

Despite the math working out in favor, I haven’t yet fully committed to this approach. I’m currently extremely focused on my wife’s path toward 7 years of Diamond status plus a lifetime of Platinum status. And, to the extent that my wife and I will be travelling together, the incremental value of me also having Diamond status is lower since Diamond benefits apply to up to 1 travel companion.

On the other hand, this is it. 2023 is probably the last time where it will be possible to earn multiple years of top tier status with a single big effort. A similar thing happened years ago when Marriott bought SPG and announced that they would no longer offer lifetime Titanium Elite status past the current year. It was possible back then to earn lifetime status through a combination of tricks which I don’t even remember today. I was tempted, but I didn’t do it. And, to some degree, I’ve regretted it since. I could imagine this being similar, or worse. For example, I could imagine Delta adding more valuable new perks for Diamond Elites in the coming years. And, if so, maybe I’ll kick myself for passing on this opportunity. On the other hand, it could go completely the other way with elite devaluations. Only time will tell which path is better.

There are some other factors at play that I didn’t discuss in the post, above. For example, writing and talking about this stuff is my full time career. Going for Diamond status and trying to get full value from Diamond status can lead to valuable blog and podcast content. Additionally, having Diamond status could qualify me for valuable status matches and challenges with other airlines. I doubt we’ll see anything as generous as the Alaska and JetBlue status matches again, but you never know.

Overall, I’m leaning towards doing it. What do you think? Please comment below.

Think about the environment, dude. Is elite status really worth spending all that time and money and CO2? And elite status will just make you fly more and spend more money on that airline..

lol…

Do it because back then Finnair had a promotion whereby you could buy 200k Finnair points and they will give you bonus 200k Finnair points plus gold status and it also comes with an option of upgrading to platinum (one world emerald) for almost 2 years and 2 months. It was a gamble back in 2021 because the world was pretty much closed but i am glad that i did it because one world emerald from my part of the world is so difficult to attain via flying and we do not have American Airlines loyalty points program/ simply miles so to speak with.

You left out opportunity costs. What else could you do with that time and energy to earn more money or buy and/or manufacture more useful points to get the flights/trips you want instead? — Regardless of which airline you fly. Sure you get a few interesting posts for the blog but that is very short term. I would lay out a rough estimated travel destination plan for the next five years and then decide if the status will truly matter. I bet not overall. And since DL prices awards based on revenue costs the RDMs will have a fairly fixed and likely declining value. There are scenarios where this could make sense but they are few and quite specific.

“I could imagine Delta adding more valuable new perks for Diamond Elites in the coming years.”

You have a really good imagination!

– Delta CEO, probably

I would like to see this blog write an analysis of how much time is invested per each 10k of MS. That will also give us a better understanding of what is possible for us who have jobs and how much we can actually afford in MS. Some of us can’t dedicate 8 hours a day trying to MS 50k.

Given the fees involved, I am pretty sure it’s a method that does not involve much time commitment

I went into September thinking that I would have enough rollover miles to have Delta Platinum for almost three more years (combined with enough CC spending to hit the waiver each year). I left September thinking that those rollover miles would be worth one year of Silver. Now leaving October, it sounds like the rollover miles will convert to Platinum for two years and I have absolutely no trust in Delta or this program. The fact that you are even thinking about this means that you have a lot more faith in Delta than I do. Given Ed’s comments (it’s very clear he’s not sorry, he’s sorry he got caught), I really can’t imagine incurring major out-of-pocket costs (or time cost) to earn another year of status many years out. We know that Delta won’t stand by the current program; we just don’t know how bad the changes will be.

The biggest surprise to me in all of this has been how little you seem to fly Delta! Presumably that’s because you are using points to fly other airlines on most of your trips. But if you are only flying 25k miles per year on Delta (and it’s partners) and your wife is only doing 15k, then I don’t see at all how any of this could be worth it.

Exactly. The benefits only happen when you spend a lot on Delta flights. You can be a lifetime diamond but if you only fly from LGA-ORD spending an average of $150 per flight, is this all worth it? Upgrade on a flight that they barely give you one drink because of the flight time? It just doesn’t make any sense.

I noticed the same. That is revenue tickets, though, and some of the benefits are applicable to awards, too, right? (I am not a Delta flyer). Still, it’s questionable to me that all this is worth it compared to buying what you want if your lower status doesn’t suffice.

How are you able to reasonably manufacture this much spend + the spend for your wife in such a short period of time? What tricks am I missing even at a 3% loss?

The question is how much time this will consume. Unless this is becoming your full-time job, it is not worth it.

Our brains play tricks with us, yours will probably bother you a little over the next 62 days if you don’t go for this. BUT in the end it seems like it does not make sense for you. The kicker is that your wife will have high status so when you travel with her, you’ll have all these perks. So I think your brain would punish you if you go for this and reward you if you don’t. Imagine: 5-6 years of not using the perks, not getting upgrades, thinking how much crap you went through to get that status. And imagine, further, each time you get that upgrade via your wife, you’ll smile and think, and I didn’t have to spend 400k.

I get that you would get content for the blog trying to spend 400K in 60 days, but it seems a lot of hassle and cost. But you’ll get most of the benefit of that by spending for your wife – add in much more content and the rest of us will be bored. Also, as someone pointed out, there would be at least some opportunity cost in terms of interest forgone, which I don’t think has factored into your calculations.

Go for it. It’s not going to be easy, it will consume almost every Q4 travel/spend thought, but so what? I’m still occasionally smarting that I didn’t buy, for $2k, lifetime Plat Status at Fairmont Hotels back when in 2011 when Living Social offered it. Lifetime of annual free nights, lifetime of (5) annual free suite upgrades. Live and learn.

No seriously, the best option is to get her to DM by waiver, stop at 1.9MM

Spend 50k on 2 platinum cards for her 1.847+20+20=1.887; add a 15k

That will give her DM + 5 more years of DM with rollover

You need to gift all her MQM to yourself 30+60 = 90

Then add 135 from all your spend = 225 more for you

1.586+0.225 is 1.811 for you

You can both make 2MM in the foreseeable future

your MQM 439+225 = 664 -625 is 39 left over

you can afford to give her 30k MQM if it makes sense to her rollover

And, swing a dead chicken over your head for good measure.

Um… NO.

Maybe you have so much money that your household can front-load spending by $400,000+ in two months, but egads! Also, with savings account interests being 5%, this endeavor will cost at minimum $10,000 from lost interest by not having this money in a savings account for 3 months. That’s assuming you’ll get all the pre-spent money within 3 months, which seems unlikely if you’ll be paying income taxes upfront.

Chasing Delta status will likely cost over $20,000 when all done. This “hobby” is supposed to help people travel at great values, but maybe status and luxuries have gotten too important that it’ll cost serious amount of money. But, let’s assume you want this because you fly Delta every week and really want those perks. Unlike the Marriott/SPG thing, Delta isn’t even a lifetime offer – it’s only for 7 years.

I think you’re missing some of the nuances of Greg’s process. In MSing, you’re not committing $400k for months. You’re using $20k in a cash cycle that takes about a week and then you do the cycle 20 times. So, the lost interest is truly only on the $20k used in the cash cycle. Regarding taxes, Greg likely pays quarterly estimated taxes. As this is a non-discretionary expense, the real question is: what is the opportunity cost relative to the best alternative card? I could go on but I’ll leave it there.

I am an ardent ***opponent*** of tier status. Some of the things people do to obtain or retain tier status are nonsensical. You and I will agree on this point. But, Greg has a very unique situation right now. For a little bit of heavy lifting, Greg will move from Platinum to Diamond for X years. The key is that the status during those X years is deemed “earned” status and the Annual Choice Benefits attach. And, if I know Greg, he’ll choose the upgrade certificates . . . for X years. Greg is shooting for substantial value and it makes sense. For someone else’s situation, perhaps not.

In comments to prior articles on Delta’s changes, I said that Delta was trying to protect its highest value customers. Because of swollen elite ranks, those highest value customers were not seeing upgrades but they were seeing crowded lounges. So, Delta implement changes. And, while the changes were an overreach, we needed to understand 1) the “why” and 2) there would be a v2.0 to the changes just as AA released v2.0 on its Loyalty Points scheme. Now, with Delta’s quickly released v2.0, its most valuable customers are loving it.

What is the MS technique for cycling $20k in a week? That still requires 20 weeks, and Greg and his wife only have 16 full weeks to do that. (8 weeks left in 2023, X2.)

I assumed the bulk would be used on paying taxes since spending $400k in gift cards is outrageous, unless he’s giving away $200 gift cards as holiday bonuses/gifts to 2000 people or similar.

That doesn’t make sense, you can’t cash out taxes repeatedly and no one will let you carry a 400k balance on your card for a few months.

If Greg pays his taxes ahead, he can charge a big payment, pay that off, then make another big payment to pay off, etc. But, it’ll take quite a while for the tax agencies to refund the money.

But, I don’t know where you can charge $20k every week, then get it back that quickly. I’d do that with any credit card because it’d be over a million miles in a year with a 1x card!

Even if Greg has enormous limits, I suspect he’ll still have to cycle his credit for the next 8.5 weeks and then overpay his taxes (or make another similar payment) near the end of December. Depending on when his statement closes, he could get float for up to 55 days. Also, by my calculations, 5% interest for 3 months on $400k is closer to $5k, not $10k. Suppose the end of year balloon payment is $200k and is fully recovered in 90 days. With 45 days of float, the interest is closer to $1.25k. Not insignificant, but also not $10k.

Oops, my bad about the interest. You’re correct that 3 months is “only” $5000. But, for a 45-day float, isn’t that $2500? I.e., half of 3 months? If not, I don’t understand what float means…

I never have $400k sitting around to pay credit card bills though and may not understand such a scale, hah.

I assume Greg doesn’t have $400k sitting around in cash either. It’s not the scale but the timing of payments that’s key here.

Float is the time between when cash flows out of and eventually back in to an account. On average with Amex, the consumer should get 40 days of float. An average of 15 days before the statement closes and another 25 day until payment is due.

This example is a little unrealistic, but suppose Greg is buying unlimited Visa gift cards fee free from Staples, then buying money orders, and finally depositing the money orders in his bank account all on the same day. He has costs associated with buying the money order, getting to the physical location, his time, opportunity cost of using a sub-optimal DL Amex, and risk of shutdown. But his cash outlay will only be the purchase cost of the money order, which he won’t have to pay for and average of 40 days. His cash flow will be positive during that time, and he’ll actually earn a little bit of interest.

I used the $200k figure assuming that Greg can cycle half his $400k target prior to the end of the year in a manner similar to the example above. Also assume that near the end of the year, he over pays his taxes for the remaining $200k. It wouldn’t surprise me if Greg has requested late closing dates for his monthly statements for precisely this purpose. So if his statement closes on 25-Dec and he makes his IRS payment on 26-Dec, his payment to Amex isn’t due until 19-Feb, which is a month after the IRS starts processing returns. Early returns are usually processed in 6-8 weeks.

There is risk involved, because the IRS might not pay a large refund right away (they like their float too). Or Greg could be audited. Or Amex shuts him down. But Greg is not planning to be out $400k for 3 months.

Given the massive understaffing, the IRS seems to take longer to process refunds.

That’d a lot of money orders to buy. With a dollar limit on the money order’s amount (e.g. $1000), I have trouble believing there are people who’d cash in 50 money orders every week or even half of that amount. I’d also be concerned about my banks suspecting me of money-laundering.

Basically, this doesn’t seem practical even for the most extreme points players while Mrs. FM chases higher Delta status which is a very tall task itself, especially with Amex’s propensity for clawing back or shutting down accounts.

Those being said, maybe you can create another “business” to pay, then pay yourself from that business without flagging the credit card/bank overlords.

Come on Greg

If you don’t do it then who will?

Mixed feelings. The irony is you suggested at FTU that I should go for LT Titanium and I’m glad I did (a “conference” consisting of my wife and I sitting in a room for 20 minutes rented for $135.10 got me 10 elite nights and pushed me over the top). On the other hand, what I value from “The Hobby” is a nice suite (Marriott suite upgrades are not uncommon overseas), even better if confirmable at booking (hello Hyatt Globalist) and a seat in J on a long flight. Delta gives me none of that. I try not to make mistakes but my biggest one was I actually put money on AMEX Delta cards to earn status. I end up just canceling each reservation when I can get a better seat on United or American. If I want to fly E, Delta is fine, but anything above that is just an absurd amount of miles compared with competing programs. All this from a former Delta fanboy Royal Medallion who lived and worked in Atlanta for 10 years.

As Elmer says, you need to value your time and hassle/stress as well. Don’t do it and you’ll have that much less crap clogging your brain and causing you worry. Just live, man, and relax a little.