NOTICE: This post references card features that have changed, expired, or are not currently available

My wife and I recently stayed three nights in New York City at the Kimpton Muse Hotel. For two of the nights we used IHG credit card free night certificates, and for the third night we used IHG points.

Our original plan was to use free night certificates for all three nights, but during the booking process we discovered that my wife no longer had an IHG card! Apparently Chase had shut it down at some point due to non-use when she applied for another Chase card and we didn’t realize that (or maybe we just forgot — I’m not sure). Anyway, we already had in-hand my wife’s free night certificate that was issued last year and we were expecting a second one to be issued this year. That didn’t happen due to the disappearance of the credit card. So we used points, instead, for the third night.

We originally booked the new Crowne Plaza HY36 (which gets incredible reviews on TripAdvisor), but just a few days before our stay it became possible to use IHG free nights or points to book Kimpton hotels. We’re Kimpton fans, so we switched the reservation. The first two nights cost the same (one free-night certificate per night), but the third night cost considerably more. I had booked the Crowne Plaza for 45,000 points (it has since gone up to 50,000), but the Kimpton charged an eye popping 70,000 points. Fortunately I’ll get 7,000 points back thanks to my IHG card which had not disappeared and which offers a 10% rebate on point awards. Booking the Kimpton was easily done through the IHG website.

Status Benefits?

IHG cardholders automatically get IHG Platinum status. Would that do anything for us at Kimpton hotels? According to the IHG Kimpton Karma website (found here), Platinum status should offer the following in-hotel benefits above those offered to base members: extended check-out, priority check-in, complimentary room upgrades, and “Raid the Bar.” All members get $30 in-room Spa Credit (which we didn’t use), and Dining Exclusives (I don’t even know what that is).

We didn’t have any need for extended check-out or priority check-in (there was no line), but a free room upgrade and raid the bar credit was welcome. More on these…

Complimentary Room Upgrade

I didn’t expect any upgrade at all, but when we checked into the Muse Hotel we were told that we were upgraded to a suite. Sweet!

Raid the Bar

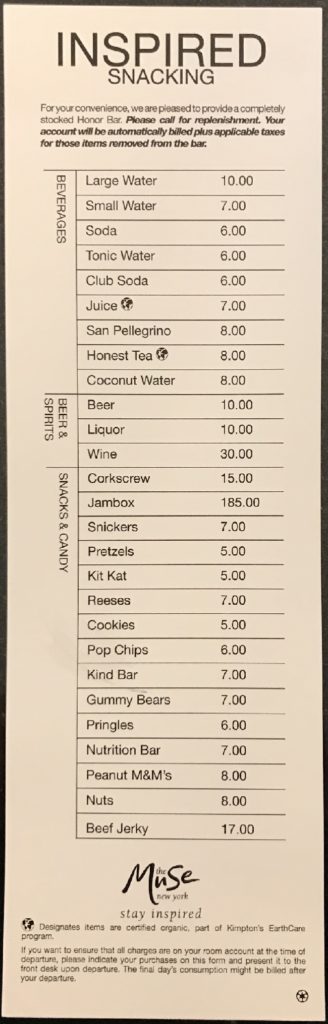

This benefit used to be available to all Kimpton members, but now it requires IHG Gold status or higher. At many properties, you get $10 in Raid the Bar credit, but at some properties (including the Muse) you get $15. This credit is per stay, not per night.

As you can see in the in-room bar menu below, $15 would be enough for (for example) a beer ($10) and a full sized Kit Kat ($5). It wouldn’t be enough for a JamBox ($185). Can anyone guess what that is? It took me a while to figure it out! Hint: Nothing in the min-bar looked anything like a box with jam.

We did not take anything from the mini-bar. The reason is that the Raid the Bar credit can be used for any food charged to the room. We ate breakfast a couple times at the in-hotel restaurant and charged it to our room. While we don’t have the final folio yet (see below), I expect that we’ll see that they took off $15 for those charges.

The Folio

When we checked out of the hotel I expected a receipt showing our breakfast charges (minus the $15 Raid the Bar credit), but the guy at the desk said that he couldn’t print a receipt because there were no charges at all. That would be really cool, but the truth was that charges appeared on my credit card a few days later for roughly the amount I expected (I should have kept track of how much we spent at breakfast, but I didn’t). That’s fair. On the IHG website, the stays are listed separately (since each was booked separately). The first two show no charges. The third currently says “Pending Stay * Thanks for staying with us. We’ll have your account updated to reflect your new balance within 3-5 business days of check-out. Stay tuned, and stay again!” I’ll update this section once the bill appears for that third night.

My assumption is that the weirdness of the bill is due to this being the early stages of integration between IHG and Kimpton. It seems that finalizing a stay currently takes them 3 to 5 business days to get right. That’s weird, but not a huge problem in my opinion.

Bottom Line

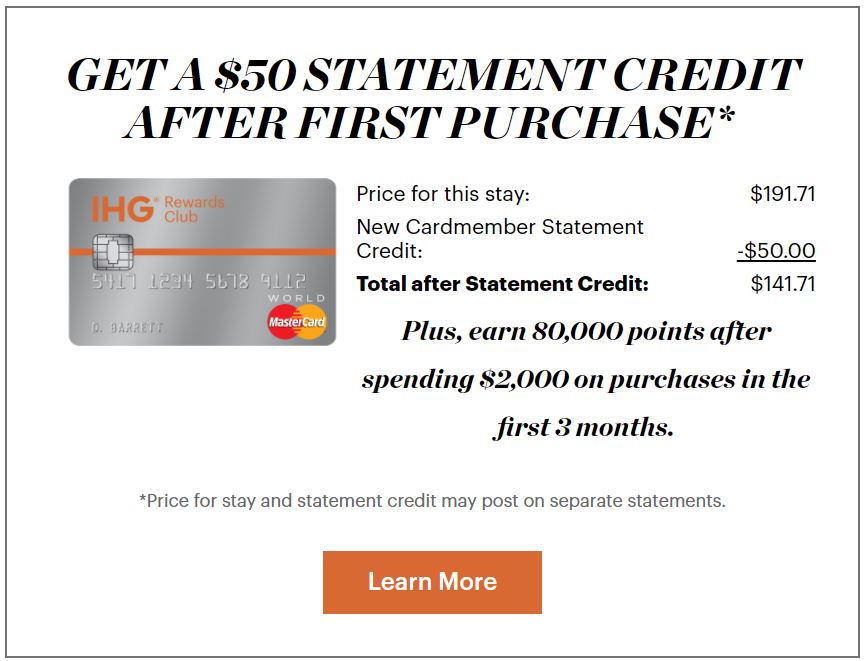

I wasn’t expecting to get any special benefits out of my credit card generated IHG Platinum status, but I was pleasantly surprised. Our stay at the Muse was excellent, and our suite upgrade made it even better. This just reinforces what I’ve written many times in the past: the $49 IHG credit card is one of the best deals in travel today. The addition of Kimpton properties makes the annual free night certificate more useful than ever before, and the card’s automatic Platinum status is worth having! When we realized that my wife no longer had the card we logged her into IHG (where she still has Platinum status leftover from the old card) and searched for a paid hotel night. This generated the expected 80K signup offer (+5K for adding an authorized user) with the addition of $50 credit:

She signed up. The application went pending, but the new card appeared in the mail about a week later. It has been more than 2 years since she received a signup offer for this card, so she’s qualified to get it again. This bonus will more than pay for that third 70K night!

[…] and we’ve not stayed at a Kimpton, whereas Greg didn’t receive it and he and his wife recently stayed at the Kimpton Muse Hotel in […]

So Chase shuts down a card that has an annual fee, because of non-use? That’s news. I had never heard Chase nor any other bank doing that.

Yeah I pay the annual fee religiously but never spend. Should I be concerned? Care to reach out to Chase for official policy here?

Yeah this is concerning. Not sure I agree with the “reach out to Chase” suggestion but care to elaborate on the circumstances? Had it been months or years with no use? Did they give you any warning? Or were there other reasons?

Actually, the exact same thing happened to me in the past. In my case it happened when I applied for a new Chase card. Just as they sometimes unilaterally decide to move credit from other cards in order to approve the new card, they apparently sometimes close accounts instead. In my case it was also the IHG card, just like what happened with my wife. I thought about calling to protest, but realized that I was better off applying new since the signup bonus is worth more than a free night.

Greg, please see my reply to Kalboz post.

Citi has done this to me and canceled a $10K no-annual fee credit card without notice for lack of use! This can affect out FICO – Shameless banks!

Greg and Kalboz, both of your cases are different from shutting down a card that has annual fee merely due to non-use.

In case of Greg, when applying for new credit some banks may decrease the credit limit of some existing cards and use that credit limit to approve the new credit request. It is natural to decrease the credit from a card that has been used the least (irrespective of whether or not it has an annual fee). So shutting down a card that has an annual fee but was rarely used occasionally happens when applying for new credit.

In case of Kalboz, a no annual fee card that has not been used for a long time is shut down because of inactivity which is different from no-use. Inactivity is a widely accepted reason for shutting down an account be it a credit card or even a checking account. A credit card that has an annual fee cannot be closed due to inactivity because it has at least two activities in year, once when the annual fee posts to the account, and another when the fee is paid.

So stvr and Larry’s questions still hold, and I appreciate if Greg can find and provide more information about this.

Sorry I wasn’t clear in the post. I’m pretty sure that my wife’s card was shut down when she applied for a new credit card sometime during the year.

If I currently have the ihg credit card and received the signup bonus over 2 years ago, can I cancel it right after the free room certificate posts in my account and reapply for it soon thereafter and get the bonus again?

Yes

I’m pretty loyal to SPG (surprise, surprise) because of the number of aspirational properties they have, but IHG has always been my backup. I had planned to abandon IHG this year, but hearing all these fabulous things about Kimpton makes me think I should give them a try.

This is good to know. I’m staying at a Kimpton in October and like you am using two free night certificates and one night on points. I’m hoping for the room upgrade as well but want a room with two beds and often suites only have one bed. Will have to wait and see.

I want to apply for this card, but the SW CP is dear to me. With Marriott Travel Packages no longer working to trigger it, I have to stick with the credit card path route and stay under 5/24.

I refer you to both cards

Kimpton has been our go to for 5 years with me being Inner Circle for 3 of them. Their customer service is top notch. Their social media team is also excellent. I have stayed at over a dozen of their properties and don’t expect this to change now that they are IHG.

We will use our 2 free nights in San Francisco in October for my husbands birthday and add on a points paid night. We also both have IHG cards and husband is Spire Elite.

Kimpton, simply, does it right!