This morning Amex delivered bad news to huge numbers of Bluebird and Serve account holders. They shut down accounts due to “unusual usage patterns on your American Express Serve Account.” I reported the news here: Amex kills Bluebird and Serve for manufactured spend.

Since Bluebird and Serve used to provide a great way to liquidate gift cards, many people are asking “what now?” In a sense, I answered that already in my post “Manufacturing Spend in 2016 and Beyond.” The only long-term sustainable forms of manufactured spend involve fees or risk.

While people work on sorting out their long term objectives, many have an immediate problem: pockets full of Visa/MasterCard gift cards. What to do?

Liquidate Visa and MasterCard gift cards:

1) Use for everyday spend instead of cash or credit card

This one should be obvious, but it had to be said. If you want to use the cards online, you may have to register your name and address with the gift card first.

2) Pay bills

Many service providers accept credit or debit cards for payment. If so, it’s likely that they’ll accept Visa and MasterCard gift cards as well. You may have to first register your name and address with your gift card, though, before making an online bill payment. For monthly charges, it is often possible to pay more than your current month’s bill and the overage will be deducted from the next month’s bill. Check with your utility, cable, phone companies to see if they accept credit or debit payments.

3) Pay mortgage, rent, or other bills that can’t normally be paid with a credit card

Services like Plastiq and ChargeSmart allow you to pay bills, including mortgage and other loan payments, by credit or debit card. Plastiq has a fixed 2.5% fee. ChargeSmart’s rates vary by the size of your payment, but tend to range from 2% to 3%. Some bills that ChargeSmart doesn’t allow to be paid by credit card can be paid by debit card, so gift card payments should be possible.

For rent payments, try out RadPad. See: Doctor of Credit: Complete List Of Options For Paying Your Rent With A Debit Or Credit Card.

4) Pay Federal Taxes

Estimated taxes are due January 15th. You can also prepay your end of year taxes. If you overpay, you’ll eventually get a check back for the difference. You can find payment processors that allow credit and debit payments, on this IRS page: Pay your Taxes by Debit or Credit Card.

Debit card fees are quite low, but you can only make 2 payments per service for each type of tax payment. Since there are three services, you can make a total of 6 Q4 estimated tax payments, and another 6 end of year payments. Here are the current debit card rates:

- OfficialPayments.com/fed: $2.50 flat debit card fee for payments of $1000 or less

- Pay1040.com: $2.59 flat debit card fee

- PayUSAtax.com: $2.69 flat debit card fee

5) Buy money orders

Some stores will let you buy money orders and pay with a debit card. The particular stores that allow this vary by location.

Warning: banks have been known to shut down customers who regularly deposit money orders in large quantities.

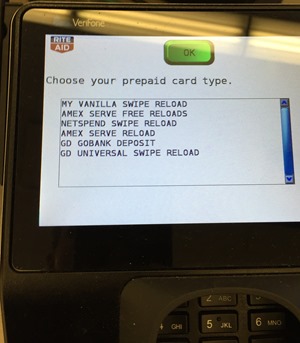

6) Try other prepaid cards

With the end of Bluebird and Serve, and the effective end of Buxx cards, there aren’t many good options left. Plus, I’m pretty sure that the clock is ticking on any remaining options. Still, if you know of a card that can be loaded with a debit card and easily liquidated, then go for it.

7) Make loans via Kiva

You won’t get your money back for quite a while, but if you filter to “safe” loans you have a good chance of getting most or all of your money back eventually. See: Kiva: loans, points, and miles.

[…] starters, when I read Frequent Miler’s post on how to liquidate some Visa or MasterCard gift cards you may have been stuck with when your Bluebird died, I couldn’t help but think that many of […]

My Local Grocery store has $500 MC’s issued by U.S. Bank. They accept apple pay. Once i buy them, where can these Mastercard GC’s issued by US Bank be liquidated? Any Idea? I am trying to utilize CF Q1 5% CB Bonus.

It all depends on where you live. Many grocery stores sell money orders…

Hi Greg,

Have you found out any way to liquidate MC gift cards? They don’t work at WM.

Thanks!

[…] Opportunities come and go all the time. If you’ve found one way to liquidate gift cards that’s good, but it’s not enough. I recommend finding at least 2 distinct options before investing heavily in gift cards. If you get stuck with a bunch of gift cards anyway, please check out this post for ideas: Bluebird Serve Birdpocalypse: How to liquidate remaining gift cards. […]

[…] Bluebird Serve Birdpocalypse: How to liquidate remaining gift cards […]

How do i use my unused visa Giftcards to buy MO? Where do i buy them? Best place? And any fee associated to buy the MO?

And can MO be deposited to my bank account?

It’s hard to answer where since the answer depends on where you live. Many stores sell money orders. Some of those allow you to pay for the money orders with debit cards. Some of those allow you to use Visa gift cards as debit cards to pay. Try the Walmart in your area, for example. Fees vary but are usually less than $2 for up to $500 or up to $1000.

Yes you can deposit MOs in your bank account, but if you regularly do many thousands of dollars worth, your bank may shut down your account for suspicious activity. You can also use MOs to pay bills that can’t otherwise be paid by credit card.

[…] Bluebird Serve Birdpocalypse: How to liquidate remaining gift cards […]

Also I have recently had to send in documents to paypal for swiping some of my cards that,way. They say that they where labeled “a gift for you” I have a business paypal and had to wait 2 days for them to lift my hold. But I have a serious question. If I register my gift cards will it still be labeled “a gift for you”? If it han f ed that label afyer registering maybe I can continue to swipe into my paypal and they see its a person’s card and not a gift card.

I don’t know

The “a gift for you” is encoded on the magnetic stripe so whenever it is swiped it will always say that.

So what do I do with my us bank issued visa and master cards I am sitting on from kroger. If yall are saying Walmart will allow us to buy money orders why can’t yall just open a business bank account and minimize the risks of the bank shutting it down due to money order deposits. And is bluebird and serve the same. This probably a dumb question but I have bluebird. Will I be able to swipe my gift cards to reload my bluebird?

Many people do buy money orders instead of reloading prepaid cards. Yes, at Walmart, you can reload Bluebird with debit cards.

[…] listed additional options for liquidating gift cards here: Bluebird Serve Birdpocalypse: How to liquidate remaining gift cards. While many people gravitate towards buying money orders due to their very low fees, I don’t […]

I didn’t receive that email. I bought 2 VGCs to try to load to my BB last night. I don’t have a close WM KATE so I used POS. After I confirmed the amount to load, cashier told me this card can’t be loaded. I haven’t tried to load with other “real” debit cards or cash. But that’s end of my BB game…. too bad.

Unload these 1000 VGCs? I am thinking to wait until Costco accept them this APR.

I never got big into the MS game — but, of course, I bought $1200 in GCs a few days before this shutdown. I actually didn’t even have a Serve acct yet (haven’t closed my never-used Redbird yet).

I have a dumb question though. For the past couple of years, I’ve liquidated rebate GCs via Square reader. I’m talking $300 here, $400 there four or five times a year. I also have a PayPal reader and have used that on occasion….Square is just quicker (next day deposit). Yes, there is a 3% fee. Is there any other problem using Square to liquidate? In other words, do they ban people for this?

That’s not a dumb question. Lots of people use Square and similar services to liquidate gift cards. The problem is, yes, they do shut down accounts. My Square account was shut down years ago 🙂

The only common pattern that I see is that somehow all the bloggers where safe from the account shutdown ……

[…] If you’re in to manufactured spend and got stuck with a bunch of gift cards when Bluebird got shut down, Frequent Miler has suggestions for liquidating. […]

One door closes (Serve) and one door opens (Venmo). Thank you AMEX for turning me on to Venmo.

Just googled Venmo. It’s part of Paypal, which is far from MS friendly. I suspect Venmo isn’t going to work for liquidating VGCs.

Can’t use Vanilla Visa cards with Venmo. MetaBank cards from Staples work, but a 3% fee applies. Not really a cost-effective option.

At the time I wrote that (January 2016), I was able to unload US Bank VGC’s fee free (about $1,000 worth). Unfortunately, I quickly found out that there was a limit to the number of cards one could add per year so I dumped that option and moved on. I did research all of the online person-to-person payment options and none of them really worked very well for MS.

Overall, I’ve been in this game less than a year and I’m on my fourth iteration of unloading VGC’s. One has to stay agile in order to keep playing the game. Also, I’ve found various forums that do a great job of keeping me up to speed on the latest news. My comments from two months ago are basically a lifetime in the MS world.