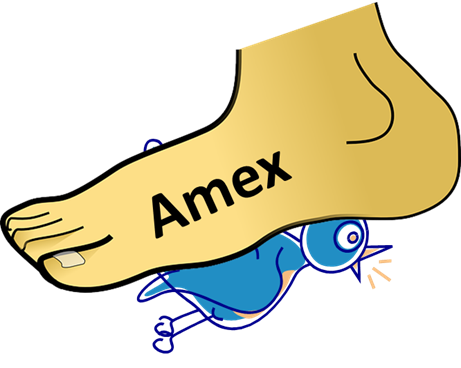

Amex seems to have swept through all Serve and Bluebird accounts to identify any that were being used to manufacture spend. Identified account holders received emails today as follows:

Dear [your name here],

We are writing to let you know that we have observed unusual usage patterns on your American Express Serve Account. Because of this, effective immediately, you will no longer be able to add money to your Account.1 We have made this change in accordance with Section 15.d of our Consumer User Agreement, which you can view here.

Please be aware that you continue to have full access to the funds on your Account and can withdraw them at any time. Any applicable monthly fees continue to apply.

Once your balance reaches $0, please close your Account online via your Profile page accessible here. Scroll down to the Close Account section and click “Close Account.”

If you have any questions or would like to inquire further about this issue, you may write to us at the following address:

American Express

C/O Customer Relations 02-04-40

4315 S 2700 W

Salt Lake City, UT 84184-0440

Another technique bites the dust. I guess yesterday’s post was prescient: Manufacturing Spend in 2016 and Beyond.

Is it possible to still use vanilla or other visa gift cards to load money to either Serve or BB?

It’s possible with Serve at some locations, but not at Walmart. At Walmart it may be possible with other Visa gift cards, but not with Vanilla. Not all Walmart stores allow it though

[…] accounts with “unusual usage patterns” (read: manufactured spend patterns) and froze them so that no more money could be loaded to them. Worse, once an individual had an account frozen, they found that they weren’t allowed to […]

[…] to switch to a 24-hour free cancellation policy instead of holds, it may have not been as fatal as the collapse of Bluebird and Serve or this week’s extension of the Chase 5/24 rule, but it was definitely another loss in a […]

[…] is the 3rd wave of Bluebird and Serve freezes. The first came on January 8th 2016 (see: Amex kills Bluebird and Serve for many). The second came exactly 9 weeks later, on March 4th (see: Amex lowers the boom on Bluebird […]

[…] 9 weeks ago, Amex lowered the boom on many Bluebird and Serve cardholders. While they didn’t outright shut down accounts, they did bar them from loading new funds. Most […]

[…] Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend […]

[…] attention and I saved this one for later. Unfortunately, as we all know, in the meantime a whole ton of Bluebird and Serve accounts were restricted and can no longer be […]

[…] announcement was quickly overshadowed when three days later Amex shocked the community by shutting down thousands of Bluebird and Serve cards for “unusual usage patterns.” Not unsurprisingly, it seemed the vast majority of those […]

[…] (Note: In January, 2016 many Bluebird/Serve accounts were shutdown for unusual activity. It is possible to load these cards at Walmart, however it may cause a shutdown if American Express deems your activity as unusual. For more info, see: Amex kills Bluebird and Serve for manufactured spend) […]

[…] the widespread shutdowns Amex inflicted on Bluebird and Serve cardholders, people are rushing to find alternatives. There are many manufactured spend opportunities that do […]

[…] Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend […]

[…] Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend […]

[…] Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend […]

[…] since Amex shut down many Bluebird and Serve accounts (see: Amex kills Bluebird and Serve for manufactured spend), many people have been scrambling to find the next best thing. If that’s you, a good starting […]

[…] though, my approach changes soon after I write about it. The latest big change, of course, was the wide shutdown of Bluebird and Serve cards on January 8th. On that day, all 6 of the Serve cards I managed were torpedoed at once. So, I’ve had to […]