As 2025 comes to a close, many points and miles enthusiasts are focused on buttoning up their end-of-year elite status runs. However, having already locked in everything I intend in 2025, I find myself looking forward to 2026 and wondering what elite stauts I’ll be chasing in the new year.

2026 Hotel Elite Status Plans

Marriott: Lifetime Platinum is coming

I am mere weeks away from earning Marriott Lifetime Platinum status, which will mean my exit (finally!) from the Marriott hamster wheel.

Marriott Platinum status ordinarily requires 50 elite nights per year. That level of status is useful for complimentary breakfast or lounge access at many (not all!) Marriott properties. Those who earn 50 elite qualifying nights also get a choice benefit (most choose “Nightly Upgrade Awards”). Alternatively, the easiest path to Marriott Platinum status is to get the Amex Marriott Bonvoy Brilliant card, which comes with complimentary Platinum status.

I have had the Brilliant card for the past year and a half, with the goal being to earn lifetime status.

Marriott awards lifetime Platinum status after 10 years of Platinum status or higher and 600 elite qualifying nights. I originally got the Brilliant card last year in part because I did not have Platinum status (I didn’t reach status in 2023), and I needed it for a specific trip. However, I also picked up the card because I have been closing in on Lifetime Platinum status.The Bonvoy Brilliant card would reduce my path, given that it awards complimentary Platinum status and 25 annual elite night credits.

I also have a Marriott Bonvoy Business credit card. Having a Marriott business credit card awards an additional 15 elite night credits each year that stack with consumer card elite nights. Note: elite night credits do not stack among multiple Marriott consumer credit cards, but it is possible to stack elite nights from one consumer card and one business card.

I will therefore start 2026 with Marriott Platinum status (courtesy of the Bonvoy Brilliant card), which will be my 10th year of Platinum status. And I’ll start 2026 with 40 elite night credits (25 from the Bonvoy Brilliant card + 15 from the Marriott Bonvoy Business card), which will bring me to a total of 602 lifetime elite night credits. As soon as the status and elite night credits post (which should happen within the first week or two of the year), I should unlock Marriott Lifetime Platinum status.

Once that happens, I will downgrade my Marriott Bonvoy Brilliant card to the $95 Amex Marriott card (Amex offers a prorated refund of the rest of the year’s annual fee when you downgrade a card, so I expect to get about half the Brilliant card’s annual fee back and to pay about half the $95 annual fee on the card to which I downgrade).

It is worth noting that my Lifetime Platinum status will not come with the 50-night choice benefits, nor will it reduce my path to earning Titanium. I don’t expect to reach for either of those things in the future. Since I will start 2026 with 40 elite nights, and I’ll have a few Marriott free night certificates to use from my credit cards, it is certainly possible that I’ll reach 50 elite nights in 2026, but it isn’t a priority (and in future years, it isn’t going to happen as I’ll start with fewer elite nights and I don’t value the 50-night choice benefits nearly enough to chase them).

I will be glad to have automatic Marriott “free breakfast” status for the rest of my life (or whenever Marriott decides to Bonvoy lifetime status) without having to think about qualifying or paying the steep annual fee for the Brilliant card.

Hyatt: Will I drop Globalist?

I am concerned about what will happen with my Hyatt elite status in 2026!

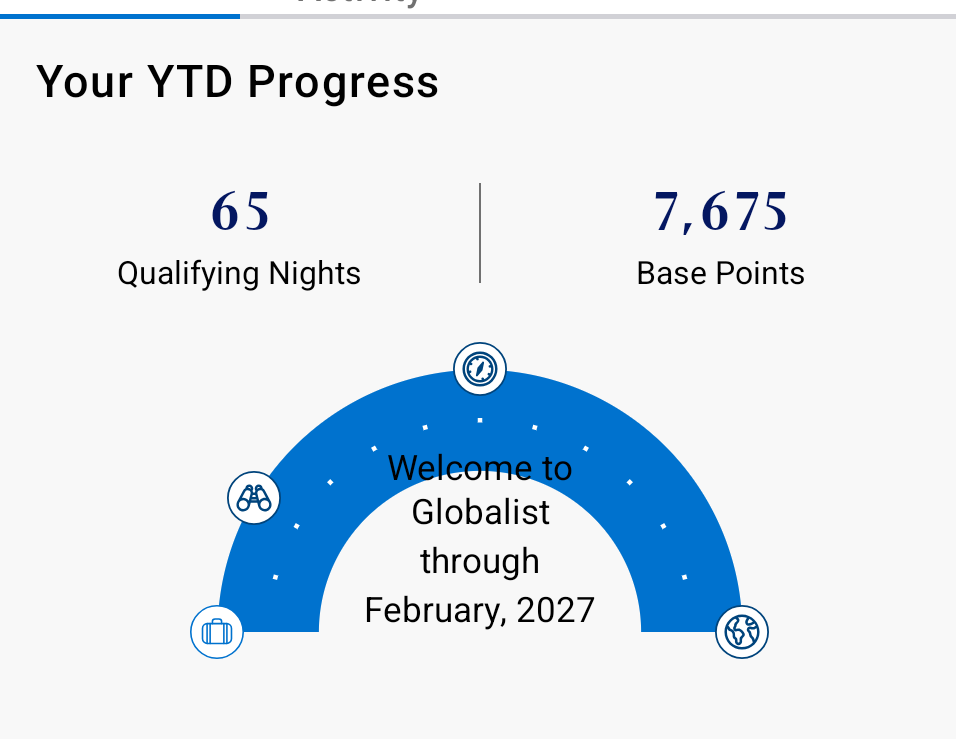

I am going to end 2025 with 66 elite qualifying nights, so I have secured Globalist status until February 2027.

Will I requalify for Globalist status in 2026?

I am heading into 2026 with 7 suite upgrade awards (only one of which expires in February 2026; the other six suite upgrades expire in February 2027), a Category 1-7 free night certificate, and three Category 1-4 free night certificates in my wife’s account (which she could gift to me). Combined, that would seem like a lot of reason to focus on Hyatt stays in 2026.

Despite that, I currently only have 1 night booked at a Hyatt in 2026.

That isn’t a function of disloyalty; rather, I don’t have many firm travel plans set for 2026. Once we do develop plans, I imagine that some of them will include Hyatt stays. However, I can’t help but wonder whether that will be enough to requalify for Globalist status.

As a World of Hyatt credit card holder, I’ll start the year with 5 elite night credits. Assuming that I spend $15K on my World of Hyatt credit card (to earn a Category 1-4 free night certificate on top of the points earned through spend), I’ll get 6 more elite nights (since that card offers 2 elite nights per $5K spent). And we’ll each be awarded Category 1-4 free night certificates later this year after credit card anniversaries (my wife could gift me hers). If we assume using all of our free night certificates, I should earn:

- 5 elite nights by virtue of being a World of Hyatt credit card holder

- 6 elite nights after $15K spend on that card (which also unlocks a free night certificate)

- 4 elite nights by using Cat 1-4 free night certificates (3 from my wife’s account + 1 from my credit card spend)

- 1 elite night by using my Category 1-7 free night certificate

- 2 elite nights by using the 2026 credit card anniversary free night certificates that my wife and I get by being World of Hyatt credit card holders.

- 2 elite nights from gifting my current two Guest of Honor awards (which usually go to my wife for stays where we need two rooms)

- 1 elite night from the one night I currently have booked in 2026

That’s 21 elite nights in 2026. There is some shakiness there as the plan above includes eight nights with free night certificates that aren’t yet booked, but I am confident that we’ll put those eight nights to use.

At 39 nights short of Globalist status based on the plans above, it is hard to imagine accidentally requalifying. I imagine that I’ll spend more nights in Hyatt properties next year than those booked with free night certificates, but how many?

With so many suite upgrade awards to use, I am hopeful that we’ll get in at least another 10-15 nights in a suite or two somewhere. At the high end of my hopes, that would land us at 36 elite nights for the year. If that is indeed where we end up, I will surely look to mattress run or spend my way to 40 elite nights in order to earn a Guest of Honor award for 2027.

However, if I’m being honest, even that feels like a stretch goal. I highly value Hyatt Globalist status, but at this point, it doesn’t look like my 2026 travel plans will support requalifying for Hyatt Globalist status. Things may change: at the outset of 2025, I didn’t anticipate that I’d spend the month of August 2025 traveling around the east coast on JetBlue, which ultimately yielded some of my progress toward Hyatt elite status. Maybe some other promotion will change things for me in 2026. But as things stand, it doesn’t look like I’ll requalify for Hyatt Globalist. That disappoints me if true!

Hilton, Wyndham, and IHG

Hilton, Wyndham, and IHG all make slite status easy just by holding a credit card. I don’t have any plans to chase anything interesting in those programs since I’ve already got status locked up thanks to holding the right credit cards.

My 2026 airline elite status plans

JetBlue: Coasting with Mosaic status

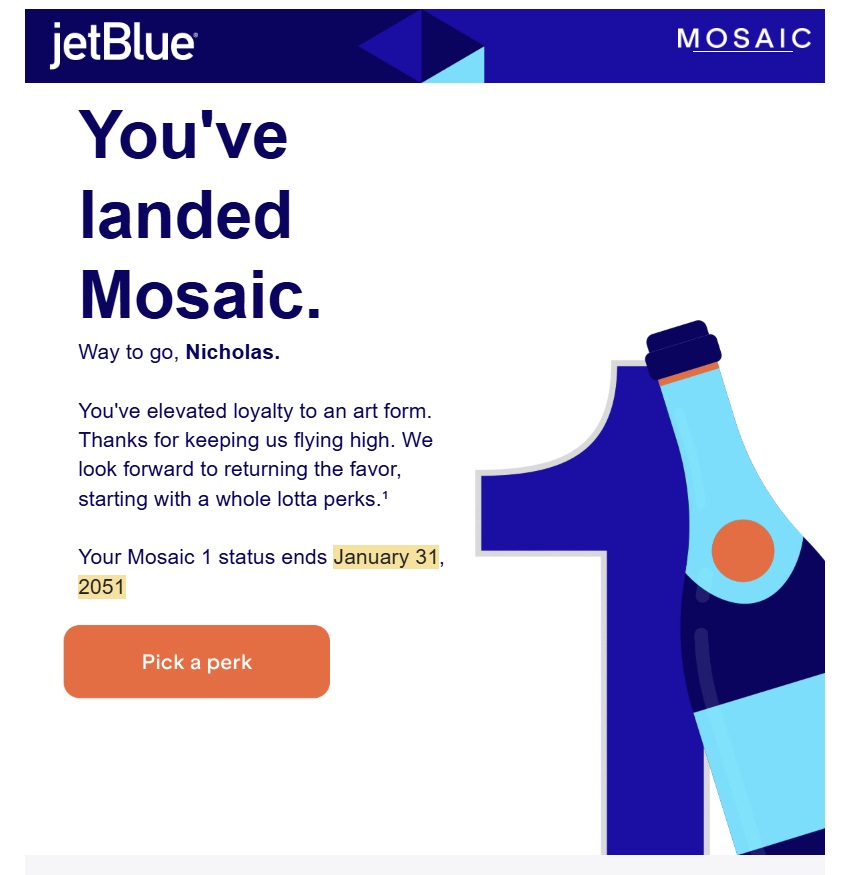

Thanks to JetBlue’s 25 for 25 promotion, I have locked up Mosaic 1 status until January 31, 2051 (yes, my account reflects a 2051 expiration date!). The rest of my family will pick up their 25th destination this weekend and should have Mosaic 1 status by this time next week with the same January 31, 2051 expiration. That will make for some easy coasting here.

I am particularly looking forward to the expansion of JetBlue’s BlueSky partnership with United. Starting in early 2026, we expect to see reciprocal elite benefits. I’m looking forward to being able to fly United with things like a free checked bag (I haven’t had a United credit card in years) and preferred or extra legroom seating.

JetBlue offers a “Perk You Pick” at Mosaic 1 status. The three choices I am considering are whether to take 15,000 points or 20 bonus tiles or 20 tiles to gift.

On a recent podcast episode, Greg and I discussed whether I should select 20 bonus tiles for my Mosaic 1 pickable perk and then have the rest of my family chose the 20-tile gifts and give them to me. As I have already earned more than 20 tiles this year (thanks to all the flying for 25 for 25), if I choose 20 tiles and my family members each give me 20 tiles, I’d reach Mosaic 2 status (which requires 100 total tiles). The incremental perks of Mosaic 2 are not plentiful, so taking this path doesn’t make a lot of sense on paper. Our alternative is to each select 15,000 points. With our points already pooled, that would mean 60,000 additional points among the 4 of us. Based on our Reasonable Redemption Value of 1.3c per point, that’s about $780 worth of points. Does it make sense to trade away $780 worth of points for Mosaic 2 status (when we all already have Mosaic 1 locked up)? It probably doesn’t. Nonetheless, I think that’s what I’m going to do.

The reason I think I’m going to trade away $780 worth of JetBlue points for Mosaic 2 status is primarily to see if Mosaic 2 morphs into something more valuable than Mosaic 2. Here’s what I mean: there has been widespread speculation that United might buy JetBlue. If they do, having a higher level of JetBlue status might mean getting a higher level of United status. Star Alliance Gold would be nice! There’s also the matter of matching: maybe an airline will offer a really attractive status match in 2026. Having Mosaic 2 status might position me for a better match. Those are admittedly very wishy-washy reasons. It is certainly possible that I’ll end up with far less than $780 worth of value if I take this path. However, given that we’ll soon have more than 1.4 million JetBlue points, I don’t necessarily value the additional 60,000 points quite as much as the first 1.4 million. Even if I did really want another 60,000 JetBlue points, I could easily reel in 60,000 JetBlue points with a new credit card offer. I can not otherwise easily reel in Mosaic 2 status, so I think I’ll go for it.

Alaska Atmos: Silver secured for 2026. Now what?

Based mostly on award flights (and a little bit of spend on my Hawaiian Airlines credit cards), I have eached Alaska Atmos Silver status for 2026. That really isn’t much.

However, I may reach higher in 2026. I’m eyeing the Alaska Atmos Summit card and its 100K companion certificate after $60K in purchases. Since that card offers 1 status point per $2 spent, I would earn 30,000 status points with that level of spend. I currently have a speculative trip booked using Alaska Atmos points that would have me flying almost 9,500 miles. If I were to spend $60K and take that trip, I would end up about 500 status points short of Atmos Gold (oneworld Sapphire) status in 2026.

I can’t yet be sure of this plan since I do not yet have the Alaska Summit card, and I’m not sure if it will make sense to pursue (see the American Airlines section next). However, if I do open the Summit card in early 2026, I think it is very likely that I will chase Gold status with Alaska.

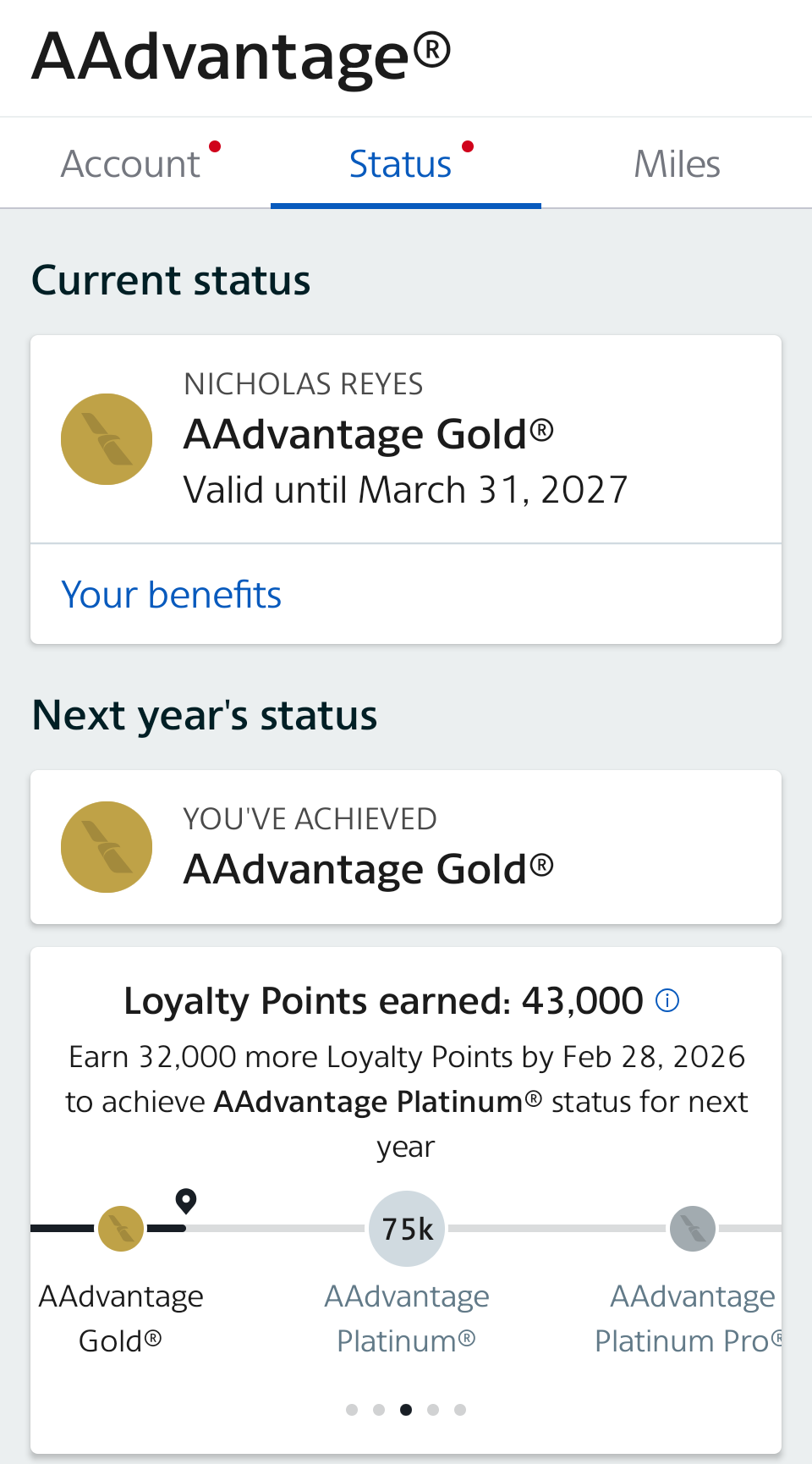

American Airlines AAdvantage: Gold secured. Now what?

American’s status year runs from March 1st to the end of February, so the current year’s qualificaiton period doesn’t end for a few more months (and the new qualification period doesn’t begin until March 1st).

I have already earned American Airlines Gold status for the current qualification year. I sit at exactly 43,000 Loyalty Points, mostly earned through a combination of credit card spend and shopping portal use. My AAdvantage Gold (oneworld Ruby) status is entirely redundant with my Alaska Atmos Silver status. I’d have about the same perks with either airline even if I only had status with one of them.

I am about $6,500 short of the $40K spend threshold on my Aviator Silver card in order to unlock the next 5K bonus Loyalty Points. In other words, if I spend an additional $6,500 on the card, I’ll earn 11,500 total Loyalty Points. That would put me at 54,500 Loyalty Points. An additional $10K spend beyond that would unlock another 5K bonus Loyalty Points for a total of 15K more Loyalty Points, which would put me at 69,500 Loyalty Points. That’s awfully close to AAdvantage Platinum status (oneworld Sapphire), which requires 75,000 Loyalty Points. I could surely earn the difference through some shopping portal offers. With tax time approaching, does it make more sense for me to spend $16,500 on my Aviator Silver card and set aside thoughts of the Alaska Atmos Summit card?

I guess that it probably does make more sense to pursue AAdvantage Platinum status. Will I actually do it? Honestly, I hadn’t considered it until I sat down to write this post, but it does feel relatively easy to reach, and that $16.5K spend would go toward achieving the card’s annual Companion Certificate (which I’ll earn after $20K spend and worked out well for me this year), so the spend achieves a double purpose here.

Will I finally go for a second household Southwest Companion Pass?

I am finally under 5/24 and have been trying to take a breath and contain my enthusiasm.

My family has primarily flown Southwest for domestic travel for the past couple of decades (dating back to long before my wife and I were married). She appreciates the predictable nature of always flying a 737 (no small planes that make her feel more claustrophobic) and we have had a Companion Pass in our household for more than a decade.

Since we have two kids, it would be really nice to have two Companion Passes. My wife already has hers secured through December 31st of next year. I could finally qualify for a new Southwest credit card or two now.

My timing stinks being that I’ve missed the recent elevated offers on Southwest cards, but I could nonetheless consider opening the Southwest Performance Business credit card sometime soon. Completing the minimum spend on that card would yield 85,000 total points in early 2026, and I would get the automatic cardholder boost (10,000 Companion Pass qualifying points). If I also open the Southwest debit card, I could both earn the 2,500 point welcome offer on that card and get the 7,500 qualfying points offered by that card annually. That would put me at a total of 105,000 Companion Pass Qualifying Points — just 30,000 points short of a Companion Pass. That’s close enough that I think I could bridge the gap with a referral or two or other ways of earning points without needing a second card.

However, is that worth more than going for a different Chase card now that I’m under 5/24? With a litany of cards now available to me, a Southwest card doesn’t feel like the strongest option available. At the same time, I will likely have opportunities to pick up referral bonuses in the future with a Southwest credit card, which could put the Companion Pass in reach again in future years. Having a two household Companion Passes would probably be pretty valuable for us in the long-term. I think it is very likely that I’ll apply for the Performance Business card and the Southwest debit card before this year ends.

Other airlines?

I don’t have any elite status with Delta, nor do I regularly fly Delta (in fact, I think I’ve only flown Delta 3 or 4 times total in the last decade). I won’t be pursuing anything with Delta even though they are the easiest airline with which to secure status via credit cards.

I don’t have United elite status, but with my family set to have Jetblue Mosaic status for 25 years, I hope to enjoy benefits on United for years to come without worrying about United status.

It would be nice to achieve airline elite status with a foreign airline as that might unlock lounge opportunities within the US. However, with my wife’s Strata Elite card offering some Admirals Club entries each year and the low frequency with which we’re traveling somewhere without any lounge access, it isn’t a priority to me. If a good status match pops up, I’ll certainly be looking to take advantage of it, but I don’t plan to pursue any other airline elite status.

Bottom Line

In 2026, I’ll finally give up on chasing Marriott elite status. I’m very much unsure as to whether I’ll requalify for Hyatt status (will I have to settle for Explorist?). I will probably hunt down American Airlines Platinum status now that I’ve written out my plans, and I think the time is finally right for me to go after our second household Companion Pass. I’ll be coasting with JetBlue, but I’ll hope that Moasic 2 might prove to be worth more than the points I’ll echew to get it. Here’s hoping for some unexpected Hyatt stays to come.

For whatever it’s worth, I can’t really properly express how much I appreciate your team’s graphics work. It’s honest to god so nice that y’all aren’t using AI slop graphics like other blogs. Please, please, please keep using these lovingly created, janky photoshops and please, please, please continue to avoid the ugly slop graphics found elsewhere.

@Nick Reyes or @ Greg from your recent On the Air podcast/post

“Changing names on reservations/workarounds for using the Fine Hotels and Resorts the Hotel Collection benefit”

Also when did THC start offering free Brekkie for two for two days (some properties) and $100~$125 Amentiy credit?

For kicks and curiosity we have an upcoming trip to Chicago- so I checked THC listongs in Chicago for two night bookings ( also thinking about the annual 10 EQN for true Bonvoy Platinum we need) – getting an AU Companion Platinum AU card to book FHC to earn EQN/nights points on our primary Loyalty accounts normally mine) with P2s Plats.

I was supprised to see some Loyalty chains (Hyatt, Bonvoy and Accor but not IHG/Hilton) offering Free breakfast for two for two days and $100~$125 (Lotte L7) Amentiy credit instead of the $50 (again its been two years since I booked THC) so perhaps I missed the change.

“The Hotel Collection:

$100 Credit: A complimentary credit valued at $100 to use towards eligible charges, such as food and beverage, spa, or other on-property charges

Complimentary breakfast for two people each day of your stay

This year we did have to do a 1N local mattress run for our 50th (10th EQN) for five night upgrade selection (we have gotten outsized value from them). As well as our initial FHR/Renowned Hotel booking in 2025 would have had earn our 50th but we changed the bookings to Chicago in 2026.

Typical we get to 50 EQN from FNC and cash or FHR stays during the year. But this is an intresting option with three platinum cards = 12 EQN with THC for Hyatt/Accor/Bonvoy.

It sounds like you spent $33K on your aa card and you’re thinking about spending $60K on the alaska card next year.

Why not instead put $90K on the Hyatt Business card, earn 45 nights and go all in Hyatt to get to 100 nights and get AA platinum?

Given the partnership with Alaska, that’s equivalent to Alaska Gold. Although you have to jump through some hoops to get that to apply to Alaska award travel.

Right, I think it makes sense to concentrate only one-AA or AS. I hit Alaska Gold this year only through 6 months of award flights on American and credit card spend (including Bilt rent with the Summit) and Lyft. See no reason to pursue AA simultaneously.

Next year between award flights, Bilt Rent on the Summit, Lyft EQMs and the 10k Summit annual bonus I should be able to hit Alaska Platinum, OW Emerald, which will give me a better AA experience and upgrade chances than AA Platinum members. The only reason I’d concentrate on AA is if I thought I could hit ExPlat, but I absolutely cannot without dramatic spend.

Reciprocal benefits between AA and Alaska are so strong the only reason to really force one over the other at a cost is if you really need the greatest shot at an upgrade. But the first class cabins are so full these days prior to any upgrades I feel like unless you’re going to the top in a program the juice may not be worth the squeeze for upgrades.

Nick, given what you’ve written here about your Hyatt plans, I’m curious if you regret choosing to get all those Suite Upgrade Awards?

I remember last year you had written about possibly being willing to mattress run what seemed like an insane number of nights mostly because your marginal value of each of those awards was like 15k points even after having a bunch of them. Now it seems like you are maybe unsure that you will even use them all (or will be booking some stays just to use them before they go to waste). And even in your “hopeful” scenario, you will be using most of them for only 1 or 2 night stays (10-15 nights over the 7 awards). So do you regret not choosing the points for some of those milestone benefits, or even some of the mattress runs that may have gotten you to those milestones?

Personally, I don’t travel with a family and about 2/3 of my Hyatt nights are in Places/Houses, so I often end up having trouble finding “good” uses for even the 2 SUAs that come with Globalist. I generally end up taking the points for every milestone even though it can be painful knowing the SUA can in theory be worth so much more.

Excellent read, Nick. I have LT Plat on AA and Lifetime Titanium on Marriott, which gives me Silver status on Air Canada and United (i.e., not much), but I am wondering about a few things about your post:

1. How much do you value that 85K certificate from Bonvoy Brilliant? Using the $300 per year annually on restaurants is very easy, so in essence I am paying $350 for that cert. I have used that cert for a $1925 room at the Ritz Central Park and a $1500 room at the Ritz NoMad, and have plans to use one at Essex House, which always seems to run over $1000. You are close to NYC. Is that cert not worth it to you for $350?

2. Like you, I have a tough year coming up for Hyatt Globalist, primarily because I have pretty much been to every aspirational Hyatt that is on my list (except Zanzibar–I loved Tim’s review and hope to get there while I am still Globalist). Are you having the same issue? I currently have 35 nights accounted for in 2026 (including $15K on credit card), but it doesn’t seem to make sense to make a run for Globalist at that level unless I could figure out how to realistically use those benefits going forward. Thoughts?

3. To me, Aspire is a no-brainer if you can use the benefits, which I have been able to do. Where do you stand with Hilton Diamond?

4. You mentioned above that you just fell below 5/24. It looks like under any scenario, if you want to keep a Bilt card, it will burn a spot. Does that affect your views about staying with Bilt? FWIW, I spent on the card (primarily on rent day) to be able to convert Rakuten points into Bilt for 2026, but didn’t think the transition would be handled this badly.

Thanks. Long comment, but as always, appreciate your thoughts.

All good points, as always. My responses:

1) Q: How much do you value that 85K certificate from Bonvoy Brilliant?

A: A lot more than the $300 annually in restaurant credits. I hate that I have to remember to load my Starbucks account once a month, and I don’t really want to spend $25 a month at Starbucks. I’m definitely not carrying it in my wallet. It’s already taking up more brain space than I want it to just to remember to use it every month. And I have two Ritz cards, and my wife has one. I’m much happier to spend $450 to get a $300 travel credit that I can use in one shot and the 85K cert (and one of my Ritz cards is grandfathered at a $395 AF). I would probably take another Ritz card if I could get it (I can’t), but I’m not interested in $650 for the 85K cert + dining credits that I need to remember to use monthly (we were traveling for most of November and all of August and I think we forgot to use it at least one of those months). Also, I was in NYC last weekend and several other times this year. None of the times I’ve been looking for a hotel in NYC were any of the properties you listed available for less than 100K points (this just came up in discussion amongst the team two days ago — I was literally just using those properties and a few others as examples of the places I’d like to be able to stay with my 85K cert, but haven’t been able to for any of the trips where I’ve wanted to). Don’t get me wrong, I do think the 85K certs are nice, just not nice enough to continue spending $650 on the Brilliant card. Also, while all of those places regularly sell for more than $1,000 per night, I wouldn’t be paying $1,000 per night. When I was young and broke, I used to drive to NYC, walk around all day, go to dinner and a comedy club, and drive 3 hours home at midnight rather than spend the money to stay in the city. Maybe it wouldn’t be at midnight, but I’d be driving home same day rather than paying $1,000+ to stay, so while I very much appreciate and do value the convenience of being able to stay so we could make a relaxing weekend out of going to the Christmas shops and seeing the window displays and whatnot last weekend, I don’t value it enough to pay the sticker price for the CC.

2) No, I haven’t been to all of the Hyatts at which I’d like to stay (by a longshot), and that’s just measuring the hotels. There are plenty of places I’d like to see where Hyatt would be a good option even if not a hotel that necessarily excites me. Actually, in my case, we just don’t have a ton of travel planned for 2026 yet. It’s possible that I’ll end up far closer to Globalist than I anticipate at this point.

3) Yes, Aspire is still a no-brainer, though that is not primarily because of status but rather because of the combination of the value of the cert + card benefits. Status is a nice byproduct. Not sure I’d assign much value to Diamond over Gold, but the card overall has plenty to justify its fee.

4) I don’t have the Bilt card. My wife does. She hasn’t been spending toward status on it, but now that they have the partnership with Rakuten, I’m very interested to see what the new cards hold in store. If there is an accelerated path toward status, I might go after one of the new cards. We primarily earn Rakuten rewards in my account (mostly because I manage things, and so getting the points in my Amex account made sense when we were earning Amex points). I may well be willing to spend toward status both to keep the 1:1 ratio with Rakuten and because applying those big transfer bonuses to rewards I’m earning through Rakuten becomes a more compelling case for me to want status.

I agree that the transition from WF to Cardless (like the one from Evolve to WF) makes me unhappy. It probably doesn’t matter for a large segment of their customers, but it does for folks like you and I, and I’m not thrilled, either.

Thanks–I always appreciate your thoughts. One idea may work for you at home–it definitely does work for me. Once a month, I spend $50 on Uber Eats. That uses up my $15 AMEX Plat credit, my $10 AMEX Gold credit and my $25 AMEX Bonvoy credit, all in one shot. Often, I use the pick-up option and save virtually all those fees.

As far as those fancy Marriotts and Ritzs in NYC, it takes some work but there are usually a few days a year where the points total is less than 100K (including top-up). I would never pay that amount, but then again, I have been in this hobby since 1988. AMEX had a triple miles promotion with Delta that year that got us to Australia and New Zealand, including World Expo in Brisbane (in case you are curious, Gary wrote an article about it years later in 2016). This little hobby lets me do things that I would never be willing to pay for myself but others obviously would and do. And thanks again for having the best blog in the business!

As @1990 knows, I believe one of the biggest perks of status these days is extra legroom economy.

Mosaic 2 is valuable because you get extra legroom at booking for you + 2 companions. So you get 3 extra legroom seats for free, and you can always either pay for the fourth or just put the fourth person in the aisle in the row behind and switch off with P2. Still 32″ in regular economy… for now…

As for AA… look, I don’t value any hotel status at all (although I never tried for Globalist which admittedly has some value) – I’d rather stay in boutique hotels, AirBNBs, etc. half the time. That said, literally one AA Hotels stay could get you 15k miles/LPs (and if you hit the – still in existence for now – 20% bonus once you hit 60k LPs, 18k LPs, although you don’t really need that to get from 60 to 75kLPs). And Platinum gets you extra legroom MCE for you plus up to 8 companions on the same booking at the time of booking. It’s a real sweet spot in AA’s program and, given that you are already at gold, can be achieved without spending $16.5k over 2.5 months.

I actually like regional jets versus 737s sometimes, but that’s just me perhaps.

Just my $0.02! Happy status earning and travels.

If I have 4 passengers on a single PNR, will the system let me pick EvenMore Space at booking for only 3 of the passengers? Or will I need separate PNRs? That would be a key difference for me. We’re also at more than 85 or 90% success in getting Even More Space at check-in. Getting the extra space at booking is obviously nicer, but it would only make enough difference to me if I knew that I could get it at booking for 3 of us without splitting onto two PNRs.

When you mention one AA Hotels Stay getting 15Kmiles/LPs, is there a promo I don’t know about, or are you just saying that if I spent enough on the right hotel in the right situation, it would yield 15K points? Most of my paid hotel stays are single-night ~$150 stays (and even then, there are usually only a handful of them each year). I’m rarely ever paying more than $200 for a cash stay. That could be why I’m not seeing returns like that through AA Hotels. I like staying at hotels that cost far more, but I’m using points when I do that, not paying cash. And even at the lower end, I rarely feel like AAHotels is my best option. I just ran a search for tomorrow night because I’ll need an airport hotel. I can book a Hyatt Place through Hyatt for about $100 or 5,000 Hyatt points or I could pay $121 to stay at a Wyndham (that only gets 3.3 stars on the Wyndham website) and earn 2,500 AA miles/LPs. I could choose AAHotels in situations like that, but it’s rarely my preference and typically small returns like that.

But you’re right that MCE for up to 8 companions is nice. I had Platinum at some point a couple of years ago, and that was nice.

It’s a good question on Mosaic! I don’t know for sure – so someone else with actual knowledge should answer – but I don’t see why you couldn’t pick 3 EvenMore seats and 1 regular seat, even if you had to chat with an agent to adjust (although I would hope the seatmap system should be good enough to just not charge you for 3 EvenMore seat selections). I don’t think it’s a situation where you’d need separate PNRs (like on AA where you have to split into separate PNRs for complimentary upgrade purposes if your companions don’t also have status and you are looking for an upgrade for only 2 people on the PNR, etc.). T&Cs just say you get EvenMore at booking for you and two companions. Great that you are doing well at check-in, but as B6 goes to 30″ legroom in economy with the Mini Mint introduction, folks may be “buying up” to EvenMore, well, even more. So the “at booking” benefit may start to matter a whole lot more. Sounds like you are going for Mosaic 2 anyway – so you’ll try it out!

Offers with AA Hotels miles/LPs cap out at 10k for one night stays or 15k for two night stays (and you have to be an AA credit card holder and an AA status member to get the best offers – so make sure you are logged in when searching). Yes you’re not usually going to get amazing offers at the $100 airport hotels. But let’s say you were at 60k LPs and in the 20% bonus – suddenly you’re getting 3k LPs (2,500 * 1.2) for a $121 stay. I picked up 6,700 miles/LP once at a ~$200 DFW airport hotel, for instance.

And if you pay with the AA Exec Card it’s another 10x miles on the spend – 1 base / 9 bonus – so you’d end up in that example with 3,121 LPs and 3,710 AA miles. Of course with the AA Executive Card you’d also get a bonus 10k LPs at 50k just for having the card. So instead of spending $16.5k, could spend $595 for the card (the coupons are not great of course – $120 with Avis and $10 a month with Grubhub, so you’re actually paying $ for it), get to 50k LPs quickly, get another 10k LPs immediately with the card and get to the 60k LPs and pick up the 20% bonus, and string together a couple of AA Hotels stays (or do some simplymiles offers or AA eshopping portal purchases and also get a 20% LP bonus) – it really shouldn’t take that much to get to 75k LPs if you want to chase it.

YMMV of course. For instance, I’ve got a 2 night stay coming up in London – $700 total for 10,700 miles/LPs and in the 30% bonus using the AA Exec Card. So for that stay I’ll get 14,610 LP (10,700 * 1.3 + 700) plus 17,700 miles (700 * 10 + 10,700) total. So yes you’ll do better in the $300 a night range, usually. But the value is also there as well – if you value AA points at 1.5c, that’s $265 of value to offset the $700 total. Even if you value at 1.3c it’s $230. Enough of those stays and the AA Exec Card pays for itself, in my view.

That all makes sense. I can count on three fingers the number of times this year I’ve spent $700 on a single hotel stay :-). And in one of those cases, I did it for ~30% back via Capital One Shopping, which gives me an interesting question to consider: would I rather have 17,700 mi, which can only be used for flights, or $210 that can only be redeemed for gift cards, but can be redeemed for a wide range of gift cards to buy lots of different things? Good question.

All good stuff though

Cash is king! Points are fun though.

True dat! “All hail the cash king!” *bows*

And @Peter’s not wrong. Extra legroom in economy is ideal for a family of 3 (or 4), looking for a row (and an aisle) to themselves. It’s not practical to get 4+ people up-front, either by paying outright, or expecting/hoping for a complimentary upgrade for everyone (or getting split-up, which may not work well for most marriages or for the youngins).

As far as B6 is concerned, I’ve enjoyed the status-matches to them (especially Mosaic 3 for the Move to Mint certificates). Otherwise, I’m fine with their Barclays ‘Plus’ card, unless and until they open more lounges (looking forward to reviews on the new JFK one!)

As to regionals, yessir, I’m a huge fan of a220 and E175+ because of the 2-3 and 2-2 in Economy (less middles). However, I’m so over the CRJs with their tiny overhead bins, lack of IFE or reliable WiFi.

Yup. Have I booked the family in business on points before? Yes. Is it really hard to do especially when traveling during peak school vacation weeks? Also yes. If I can get business one way on a reasonable points redemption for the 4 of us, it’s a real win. Have one of those coming up in a few months across the pond on AA for 65k/pp – booked far in advance. MCE on the way back and lounge hopping the business lounges at T3 with 1xOWE and 1xOWS. Those MCE seats on TATL are not cheap to select and are a nice benefit of status. Can’t complain too much? (Well…)

Always root for B6. Enjoyed a great ride with the family in Mint earlier this year. Terrific option on board. Less terrific at JFK T5. There was a small lounge at T5 years and years ago – is that where the new BlueHouse is? Just looks small, and with cold prepackaged food… eh… just matches the standard that T5 sets I guess (not high).

A220 when you can find one is great, but yeah, an E175+ is a great aircraft. First row of economy is always good in a 2-2 with the B seat having unlimited legroom.

Excellent redemption, especially TATL J at 65K/pp, like, wow. Also, huge fan of Mint, whenever and wherever it’s operated. Have enjoyed it to the Caribbean and Costa Rica as well. As much as some knock on B6, I think they’re actually really good at the passenger experience at least. Flying on their a220 soon, too (only B6 and DL for now in the US.)

It’s the $5.60 each in fees on the outbound that makes it great. Sure could pay 57.5k with BA… if you want to pay $750 in fees or whatever. Fees make or break so much especially TATL. Booked it 10 months in advance of travel date.

Economy on the way back for 19k each but can’t avoid those fees. But paid like $600 in fees total. Getting just over 2cpp – not bad. And of course sitting MCE, as if you had to ask.

B6 flies Mint to some wonderful non-standard places. If they would like to upgrade the route I am looking at for next Xmas to a mint plane that would be ideal as it is a red eye… but will likely book with B6 anyway versus Avianca or Latam.

Unrelated here, but Qantas chose recliners for the XLRs.

Thanks for the update, Nick! I’m not sure that this is in your plans, but if you explore ‘fast tracks’ to Atmos Status other than flying and CC spend, I’d love to see a post. Any great regular shopping portal deals through Atmos? Anything I’m forgetting?

I signed up for the Summit card when it first came out, and I really wish the 10k status points would drop Jan. 1 instead of needing to wait until August or whenever my anniversary is.

Was scrolling the convo to see if someone mentioned this, but in reality nick only needs to spend ~$40k instead of $60k to get to Alaska gold because of the nearly 10k miles flown and the summit card 10k bonus.

Also I’ll add that next year Alaska hotels and Lyft are all $1 for 1 sp, so I’m going to use that. Not like I’m going to spend $10k on Lyft but natural spend certainly helps and it’s not all reliant on pure cc spend.

To all you hotel elite programs, my offer is this: nothing. I’m done. Free credit card status and that’s it. I’m a free agent next year.

https://youtu.be/wPmTp9up26w?si=U0k7KqgJgknm7Avx

Question for newbies: Airline tier status offers what benefits that a premium cabin ticket doesn’t otherwise provide?

Note to Nick regarding Marriott: There have been reports that Marriott is “testing” alternative breakfast benefits.

Oh God like what? Lifetime Plat recently unlocked for me

One non-US property excluded breakfast as a tier benefit — it had been disclosed as a “test.” At a limited number of other properties, a dollar-specific breakfast credit was being “tested.” This had been reported upon in the past year or so. Not too much attention was paid to it. I have lifetime status as well and such reports can give a person an uneasy feeling.

Interesting post, Nick! I remember you mentioning you were at least mildly interested in IHG Diamond. Curious if you got targeted for (and opted to purchase) it for 2026? Seems like it was more limited this year.

I did get targeted. As you’ll hear on this weekend’s podcast if you listen to it, I don’t think I will do it. Here’s my rationale: despite numerous annual opportunities to buy 120K points for $600, I haven’t bought IHG points. So I obviously don’t value 120K points highly enough to have bothered spending $600 on them in numerous previous opportunities. Would I buy at $500? Still probably no since I rarely stay at IHG properties. At $400? Maybe. Then Diamond status is “costing” me $400. Am I going to get $400 in value from IHG Diamond? Probably not — I don’t stay at IHG properties very often. So I don’t think I’m going to do it.

For someone who regularly stays at higher-end IHG properties, I could totally see it being worthwhile, but it isn’t a good fit for me.

Interesting. I narrowly opted to go for it based on some stays I have planned, but it’s not as easy a call as last year.

I will definitely listen – can’t do my Saturday chores without you and Greg! Thanks, Nick!

We were also targeted – while we have had more stay at IHG this last year – two of my award booking past & future- the 120K we were more valuable than the $800 – but were book far in Advance.

I did use a my IHG FNC +7K vs $450 cash for a room at an IC – definitely an outlier.

That said even with 7 IHG nights booked for Jan/Feb 2026 the free breakfast and the 120K just didn’t pencil – but PCing my Surpass to 4th Aspire (P1/P2) for $550 actually makes more sense.

We’re thinking a trip to Tahiti with the Aspires FNCs but the way the flights (for us) shake out its typically 7 days in Tahiti with one being spent near PPT airport becaue of flying/ferry to BOB. So I have noticed reasonable close in cash/awards at IHGs in Tahiti.

I really enjoy forecasts like yours, Nick. Thank you for preparing and sharing with us.

It’s epic that you (and others) actually completed and received the 25 for 25 promotion with jetBlue. Well done!

I did ‘LOL’ at the Marriott Bonvoy ‘Lifetime’ Platinum goal, since it hardly does much for us these days, other than maybe ‘complimentary breakfast’ at ‘participating properties.’ I’m keeping my Brilliant card regardless, because I still find ways to use the 85K certificate (even though it’s probably worth closer to $425 at best), and although it’s a chore, the $20/mo dining credit is relatively easy to use.

Personally, I strive to re-earn SkyTeam Elite Plus (via Delta), One World Emerald (via American), and Star Alliance Gold (via United) each year for their respective benefits. I earn each mostly thanks to crediting partner flights (especially AF/KL to DL and QR/JL to AA) and spend on their various cards (thanks PQPs and MQD ‘Headstart’).

I am so over worrying about the higher-end statuses, though. Sure, DL Platinum and Diamond are nice for the RUCs and GUCs, but I’m settling on Platinum for 2026, and probably will drop further to Gold thereafter, based on my forecasted travel/spend. Likewise, United and American each burned me in the past with PlusPoints and systemwide upgrades that never cleared (it blows to earn the status, receive those benefits, and not be able to use, die on the Waitlist.)

For 2026, specifically, I am most curious as to what will happen to BILT once WF exits. I understand you and the other bloggers receive commissions, so I respect your biases, but, I’m concerned that the ‘good times’ are soon over with that product, which would be a loss to us all (who rent and like earning tens of thousands of ‘free’ points each year).

Are you the same 1990 that posts sometimes hilarious and sometimes negativity on omaat? If so, I’m 50/50 on my agreement/endorsement frankly commenters like you make the comments worth reading for me. Entertainment mainly. LOL. But it’s spilled over and I now read comments here too where before I never did.

Yes, same guy here, DoC, OMAAT, LALF, VFTW, etc. Honestly, I’m only here (and there) because I enjoy it, too, and because I am obsessed with cards, banks, points, miles, status, airlines, hotels, etc. (That said, beware, there is a guy at OMAAT who is impersonating a few of the regulars there, which is sorta not-cool.) Anyway, thanks for those kind words. Hope you’re reaching your ‘goals,’ and are also inspired/entertained by others on these sites like I am.

What’s LALF?

Ah, sorry for the all the acronyms. By LALF, I meant Live and Let’s Fly, another blog with the Boarding Area network, lead by Matthew Klint and occasionally with posts authored by contributor Kyle Stewart.

Thanks Been following the others for over a decade. Never noticed that one, though to be fair, I never come in via the boarding area main page

Live And Let’s Fly

I may well go for Bilt elite status in 2026 once we know more about the new credit cards. Ironically, I didn’t even mention that specifically because I know that some small segment of readers will assume that I have some ulterior motive in writing about it (I don’t, I just like the idea of potentially doubling all of my Rakuten earnings during Rent Day bonuses).

I think that it is natural that credit card enthusiasts focus on the credit card and assume that the credit card matters for Bilt. I truly think that they would be in business regardless of whether or not they had a credit card. We’ll see what the future holds.

Nick, I remain skeptical, but I will try to keep an open mind. You’re correct that everything about 2.0 is mere speculation, until we officially learn more. That said, I’ve only ever ‘earned’ Gold status with them, and other than a few bonus transfers, it really hasn’t ‘done it’ for me. Perhaps, those who attain ‘Platinum’ see more ‘bang for their buck,’ like the Blade transfer that Gary over at VFTW posted on earlier this year. I don’t hold the sponsorships, advertisers, and coordinating in the industry against you or him or anyone. It’s still a relatively free market, and I appreciate competition, collaboration, etc. I’ll read your (and their) takes regularly, until I find something better to do. Bah!

I did not use Bilt until the Rakuten 1:1 transfers opened up. I now have a small stash of almost 40k points from the 11/15 transfer and I should get another 40k or so at the 2/15 transfer. We will see about the 5/15 transfer depending on what they roll out in February with respect to cards / mortgages. But worst case scenario, will get the 2/15 transfer in, transfer all the points out (to Atmos or Hyatt most likely, unless there’s a really good “Rent Day” transfer bonus for non-status members somewhere else, although that too may be Bilt credit card dependent), and move on. I don’t think there’s a Mesa-like risk with Bilt in the next 6-12 months, but, who knows.

And, @Peter, as much as I have been doomsaying, I doubt it’ll happen like Day 1 in February… I do honestly want the program to continue, because I benefit from it directly and personally every month that I pay absurd rent and get 1 point per dollar on that… it’s like getting $700 back each year, and spending it mostly on Hyatt. LOL.

My guess is it will go to 0.5 points per dollar for rent unless you have the new credit card.

I’m not an employee at FM, but I personally think the good times are just getting started with Bilt. I don’t think they make much from the credit card, but rather make most of their money from travel bookings, the landlord payment portal, and their “neighborhood” program (where local businesses pay them to be advertised within the neighborhood. I think that we are probably the exception and the loss leader for them as a lot of people are dumb and use their Bilt points for terrible redemptions (like Amazon shopping, gift cards, Lyft pay with points, rent credits, home down payments, or bad transfers to Hilton, Marriott, or IHG). Most people don’t do the math and have no idea that they can get 2 CPP on Bilt points for Hyatt or by using to book for business class tickets. According to what Richard Kerr has said, I think its fair to estimate that they hope most people make these poor redemptions and that the awesome deals they offer on Rent Day generate free publicity so that more people use their ecosystem.

Its important to realize that most users are not us. The average Bilt user is probably the same person who thinks that taking advantage of a transfer bonus to IHG is a good deal.

Bilt earns its money more like Rakuten than like Mesa.

Megan, I sure hope so, and in that case whether it’s Wells Fargo, or everyone else, that is subsidizing my Hyatt transfers, I’m fine with that, so long as the gravy train keeps runnin’

Thanks for the interesting post Nick.

I appreciate that you pointed out how it may make sense to concentrate on AA or Atmos status, but perhaps not both. The two programs are tightly integrated enough so that getting status on one really helps with the other. Since we’re based at an AA hub (CLT), we’re watching this very closely.

I’d add two things here. First, the Summit card–terrific for status chasing, among other reasons–is not easy to get. Both P2 and myself were flat denied, and I’ve heard many other similar reports from people with excellent credit profiles.

Second, the Citi Business AA card just extended for another year its double-dip benefit for loyalty points. That is, if you spend on an AU card, both the AU and the primary cardholder enjoy 1 LP per dollar for that spend. This offers an unusually easy path to ginning up status, especially since the Citi Business cards don’t seem overly concerned about cycling the card.

Just a quick update. While P2 was told she was denied for Atmost Summit, the letter just asked her to call in. Once that was done (thank you honey, lol!), she was approved.

So our plan for 2026 will be I’ll re-up MS on AA, and she’ll do it for AS. On AS award flights together, she’ll pull me up; on AA flights I can do the same for her.

Pursuing Marriott platinum or Marriott lifetime platinum over Hyatt globalist is foolish. I’ve seen the Hyatt Place in Page, Arizona, for as low as $70. Maybe you could do a mattress run.

39 nights at $70 a night = $2,730. That’s way too much for me to consider mattress running. Globalist status isn’t worth that much to me.

I’m not choosing Marriott Platinum over Hyatt. I’ll have reached Lifetime Platinum without choosing Marriott over Hyatt (on the contrary, I’ve earned Hyatt Globalist status for several years during the time when I’ve had Marriott Platinum). There are naturally enough situations where there is no Hyatt property, but there is a Marriott property that I’ve naturally made it to Marriott Platinum without sacrificing Hyatt. I just don’t have enough 2026 travel plans to get me to Globalist again as things stand.

Sure, but what you could do is add an extra night onto every Hyatt stay if there’s a cheap cash or points rate. Or put a bunch of spending on the card to get the 2 nights with every $5,000 spent.

One week’s vacation at a Hyatt resort with no parking fees and no resort fees is at least $700 saved by virtue of globalist status. If you do two weeks per year, that’s potentially $1,400 right there. A week of free breakfasts (say $30 pp) is $420 or $840 for two weeks per year. So $1,400 + $840 = is $2,240 in savings.

If you have no parking fee, it means you’re booking an award stay. If you’re booking an award stay, you’ll pay no resort fee on award stays even if you don’t have any Hyatt status whatsoever.

With free breakfast, it’s lovely to have but I’d never pay $420 for a week’s worth of breakfast for two of us. We’d get breakfast out somewhere or sleep in and have and have lunch somewhere, so although free breakfast would save us money, it wouldn’t be anything close to $420 for the week.

It’s hard to find a breakfast for less than $30 with tip and tax.

I guess it depends where you’re having breakfast. I think it’ll have been a very rare occasion where we’ve paid $30 per person for breakfast, even including tax and tip. That’s obviously not going to be the case for everyone, but we don’t have expensive tastes. If nothing else, we’d sooner get stuff for breakfast from a grocery store than pay $420 for a week’s worth of breakfasts.

I love you posts!! I just got into points and miles in March and am officially addicted because of you and the FM team. I’m going to try and get Globalist for the first time in my life in 2026 and can’t wait!!! (I have a trip in February, let me know if you need to offload you suite upgrade, I’ve never stayed in a a suite but would love to) 🙂 I have Atmos Gold and I’m curious about matching to Delta and then using that try to Match to American because I heard American does targeted offers for status challenge from American to Hyatt globalist… is that a thing? I’m I crazy for thinking I could try for that!?!?!

It’s not crazy at all. BUT, consider how much effort, time and money you’ll spend chasing an elite status. And when you get it, are you going to get real value (higher than the costs to get it) out of the status.

If the numbers are in your favor, then go for it!