Back in 2022, Marriott added a discounted rate category for its business credit cardholders that gives ~7% discount from the normal member rate. Somewhat oddly, that discount only applies to business credit cards; there was nothing added for personal cardholders, even those that have the $650/year Amex Bonvoy Brilliant card.

Earlier this week, Marriott announced that it was adding a (for now) limited-time special rate category for people who walked down that Brilliant, $650 road with them year after year. However, as opposed to being a discount, it’s more akin the Amex’s Fine Hotels and Resorts or Chase’s The Edit, providing on-property credit, bonus points and a welcome amenity.

What’s Happened

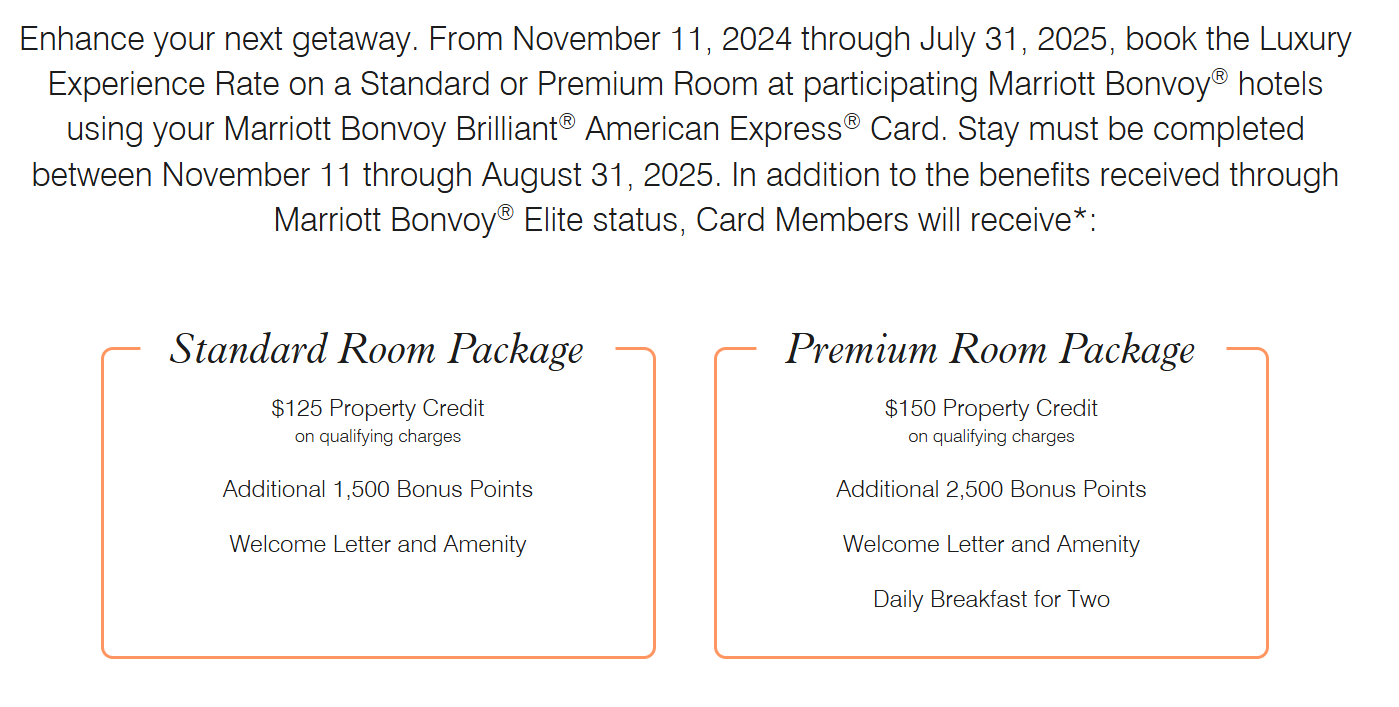

- Marriott has given Amex Bonvoy Brilliant cardholders access to a “Luxury Experience Rate” at participating properties:

- The standard room package offers a $125 property credit, 1,500 bonus points and a welcome amenity per stay

- The premium room package offers a $150 property credit per stay, 2,500 bonus points, a welcome amenity per stay, as well as daily breakfast for 2

- No registration required

- Valid for reservations booked by July 31, 2025 and completed by August 31, 2025.

Click here for a full list of participating properties

Quick Thoughts

This seems to be a trial run for this “Luxury Experience Rate,” with eyes on whether or not to make it an ongoing benefit. These sorts of added-value packages are common throughout the industry…Amex, Capital One and Chase all have them. The unique aspect here is that it’s not being offered through a bank’s own transferable currency cards, this one is Marriott-specific.

Similar to all of those other programs, this is most valuable on short stays vs lengthier ones, as you’re effectively paying extra for on-property credit and ~$10 worth of Marriott points when you get the standard room package.

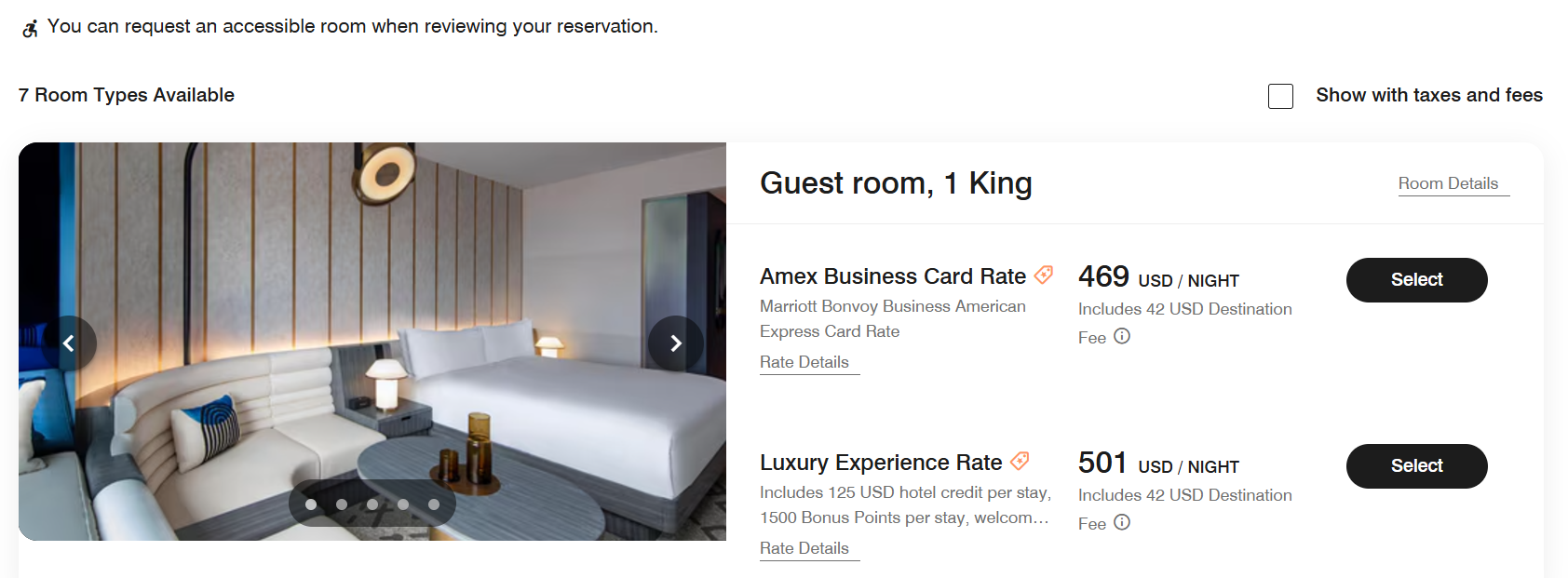

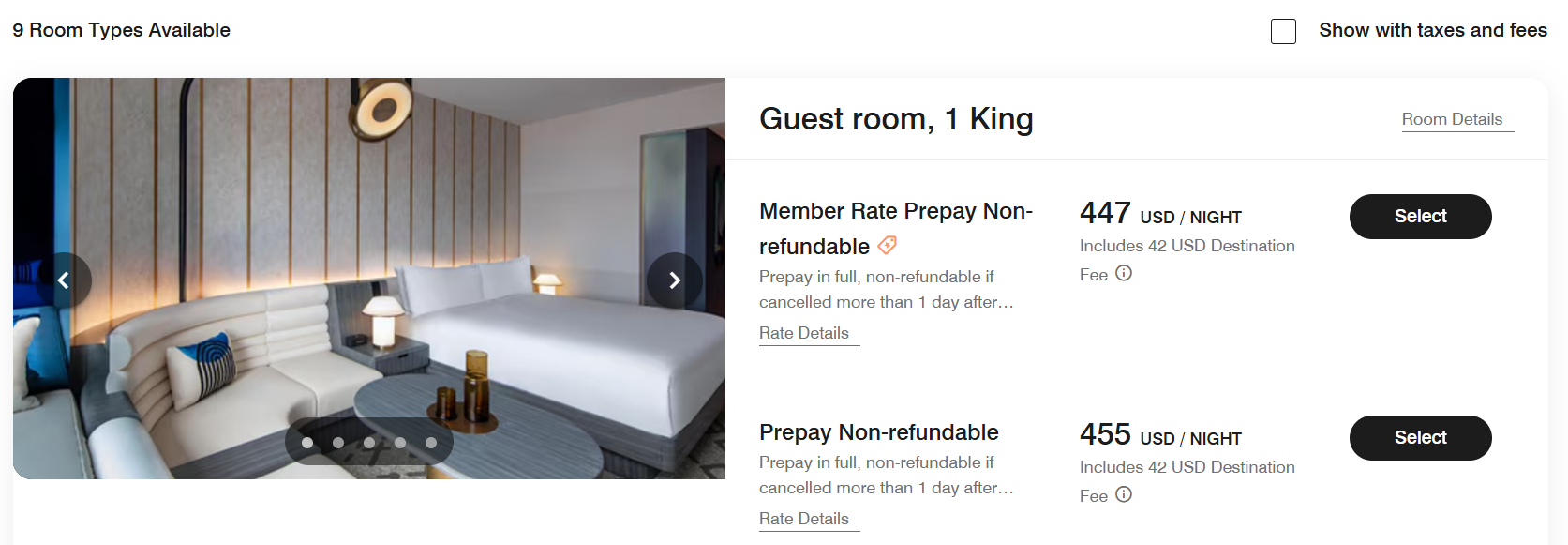

I checked out a few properties on the list and they all had a similar format: the cardholder rate was ~$40-50 more than the cheapest non-refundable and ~$30-$40 more than the business card rate. For example, here’s the W Hollywood for random date in June:

Note that the Luxury Experience rate has a one-day cancellation policy, much better than the non-refundable rates. So, effectively, you’re paying somewhere around $30-50 extra for $125 in property credit and $10 worth of points…once per stay. That could be a great deal for one night, but if you’re paying that higher rate for 2+ nights, in begins to lose its luster quickly.

It’s worth noting that Brilliant cardholders already have Marriott Platinum status, which gives them free breakfast at many Marriott properties. In those cases, the credit would have to be used for drinks, dining or spa activities. At properties where there’s only a $10 credit (or nothing), that $125 could come in handy once brekkie rolls around.

Can this rate somehow be combined with the 2 night minimum $100 Property Luxury Card Rate that already comes with the Brilliant?

Stayed at JW Marriott Parq in Vancouver booked with this Luxury rate. We had dinner at night and charged to our room. To my surprise, the hotel denied the credit, claiming it could only be used for in-room dining. Restaurants inside the hotel didn’t count. I’ve never heard of hotel credit with such restriction.

[…] Marriott has given Amex Bonvoy Sensible cardholders entry to a “Luxurious Expertise Price” at collaborating properties. The usual room package deal affords a $125 property credit score, 1,500 bonus factors and a welcome amenity per keep. The premium room package deal affords a $150 property credit score per keep, 2,500 bonus factors, a welcome amenity per keep, in addition to every day breakfast for two. ➡️ Learn extra […]

[…] Marriott has given Amex Bonvoy Brilliant cardholders access to a “Luxury Experience Rate” at participating properties. The standard room package offers a $125 property credit, 1,500 bonus points and a welcome amenity per stay. The premium room package offers a $150 property credit per stay, 2,500 bonus points, a welcome amenity per stay, as well as daily breakfast for 2. ➡️ Read more […]

Marriott is the Delta of the hotel space. The goal seems to be to leverage loyalty for increasing wallet share without providing a significant benefit. The last couple of Marriott stays I’ve booked, portal rates have been much better than the exclusive member pricing. Some of those portals come with the ability to earn either significant cash back or significant amounts of transfer points. I’m happy to trade Marriott points for bank points or big cash back rates.

Nick made a similar observation re: Accor properties when on the SAS challenge. C1 Shopping was offering a better rebate than the one offered by the program (with more flexibility to use the rebate). It is clear that some of these programs are offering the illusion of value to their loyal members.

Imagine being asked to pay $650 to get a $300 restaurant rebate, maybe some breakfast (subject to the whims of the property), and the occasional upgrade. Then, the value add perk “exclusive to you” is being able to pay an inflated rate to get a little bit of property credit. Yeah, there are use cases, but man, it is not all that compelling of a value proposition. You have to do a lot of 1 night stays at luxury properties. I’m not sure of the demographic for that. It is clear Marriott is hoping to rope people into 3-4 night stays where people pay more for less, but they get to feel special doing so.

Would love the option for a prorated (or free…) parking fee built into the booking price.

Many of the non-resort properties that charge junk fees for self-parking have special parking included rates. You just need to look at the packages tab or whatever it’s called. Sometimes it’s cheaper and other times it’s a lousy deal.

Nothing says “Luxury Experience” like a Welcome letter and 1500 Bonvoy points. 🙂

At a supposed 5-star hotel like a Ritz-Carlton or St. Regis, you expect a welcome letter as it is.

Right?

Nice to see Bonvoy trying new things. And I’m not even being sarcastic!

The problem is, as I said below, it’s a small number of properties at a limited number of brands.

I looked at the list. The list of participating properties seems limited to Marriott-managed properties within the JW Marriott, W, Luxury Collection, Ritz-Carlton and St. Regis brands. No franchisees and no Sheraton, Marriott, Autograph Collection, Renaissance or Westin* properties.

(There was one Westin on the list.)

I always check the special rate packages tab. About 40% of the time you find something that’s valuable. I had a property last week that included self-parking ($20) and a $50 F&B credit for only $40 over and above the lowest non-prepaid rate. At the same time, I had another property, a Courtyard, that had a rate that specified daily breakfast. But they wanted to only give me the standard $10 platinum and higher F&B credit, which obviously was unacceptable. A large coffee with two made-to-order eggs was $21. So, $10 was absurd. In my experience, you have to definitely screenshot rate packages and be prepared to stand your ground. A couple years ago, I booked a package that included a “bottle of champagne.” They gave me a $3 bottle of Andre sparkling wine. That’s obviously not champagne.

Marriott believes their Platinum, Titanium, and Ambassador elite members only deserve the finest Sham-pagne 🙂

Don’t forget about the corp rate, AAA rate there…

More times than not, if available, the AAA rate will likely be the better choice. The Brilliant’s cousin . . . the Ritz Carlton card . . . offers Club Lounge upgrades, but the AAA rate will likely be the better choice . . . making the upgrade benefit valueless. Also, the Business card’s discount is only on a property’s base room category — no enhanced rooms. Again, the AAA rate will likely be the better choice.

And always, always search the best rate against rates on Expedia, etc. Marriott has a decent best rate guarantee.

AAA rate is extremely useful for Marriott properties, the package rates are only rarely a better option (usually when bundling parking or waiving resort fees). I’ve had one time that AMEX business card rate was better because all the AAA rates were nonrefundable. 90% of the time AAA rate wins out.