Marriott Bonvoy loyalists may be happy to learn that there are some new benefits that will be launching on the Marriott Bonvoy business credit cards: these cards will soon offer complimentary Gold elite status (rather than Silver) and a 7% discount on room rates. Additionally, they will now earn 4x at restaurants worldwide. We already noticed the room rate discount and reported it a few days ago, but it’s great to see this spelled out as a concrete benefit of the card. That said, Gold status isn’t particularly meaningful and whether or not the cardmember discount is your best available deal will likely vary considerably.

Note that these new benefits apply to both the Marriott Bonvoy Business Card from American Express and the Marriott Bonvoy Premier Plus Business Credit Card from Chase (note that the Chase card is no longer available for new applicants).

Key Card Details

The below card details relate to the Marriott Bonvoy Business Card from American Express. For more information about this card, click the card name below to go to our dedicated card page.

| Card Offer and Details |

|---|

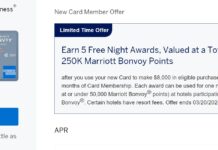

Earn 3 Free Night Awards - Valued at up to 50K points each, up to 150K points total. ⓘ Affiliate Earn three 50k free night certificates after $6K spend in the first 6 months. Redemption level up to 50,000 Marriott Bonvoy(R) points for each bonus Free Night Award, at hotels participating in Marriott Bonvoy(R). Certain hotels have resort fees. Terms apply. (Rates & Fees)$125 Annual Fee Recent better offer: 5x50K free night certificates after $8K in spend (expired 3/20/24) Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn an additional 35k free night certificate (can be topped-up with up to 15k additional points, subject to resort fees) after you spend $60K on purchases in a calendar year Noteworthy perks: Complimentary Marriott Gold elite status ✦ 15 Elite Night Credits each calendar year ✦ 35k Free Night Award every year after card renewal (subject to resort fees) ✦ Complimentary premium Internet access at Marriott properties ✦ Terms Apply (Rates & Fees) See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

A Marriott business card is certainly worth having for its annual 15 nights of elite credit toward status — especially since it is possible to stack those 15 nights from this business card with 15 nights from a consumer card if you have one of each (note that elite night credits from multiple consumer cards do not stack — you get a maximum of 15 total elite night credits from having one or more consumer cards and 15 elite night credits from having one or more business cards). Having one Marriott Bonvoy business credit card and one Marriott Bonvoy consumer credit cards puts you more than halfway to Platinum status, which comes with free breakfast at most brands and lounge access at most brands. More detail about elite benefits can be found in our Marriott Bonvoy Complete Guide.

Gold elite status doesn’t come with much in terms of concrete benefits. You’ll get 2pm late checkout and more points per dollar spent. While it’s nice that the card will now convey that status automatically, anyone could get Gold status by either having one Marriott business credit card and one consumer credit card (Gold status requires 25 elite nights and you would get 30 total with one business and one consumer card) or by having an Amex Platinum card (which also offers complimentary Marriott Gold Elite status).

The room rate discount could certainly be nice if you don’t otherwise have access to useful room rate discounts. It’s certainly a tool worth having in your bag and a reason to log in before searching, though I suspect that other widely-available discounts like AAA will be as good if not better in many cases. We’ll see.

The restaurant bonus category now expands to restaurants worldwide. That’s better than being limited to U.S. restaurants, though a return of 4 Marriott points per dollar spent wouldn’t be enough to get me using a Marriott card rather than the Amex Gold card (which also earns 4x points that are transferable to Marriott on a 1:1 basis).

Keep in mind that there are is a weird set of rules as to whether or not you qualify for a Marriott credit card welcome bonus. Whereas rules like that usually only apply to a single issuer, this is the exception where those rules apply across issuers between Amex and Chase. See this section of our Marriott Bonvoy Complete Guide to determine whether or not you are eligible for the Amex business card.

Overall, the enhancements here certainly don’t hurt, but they will likely do less to move the needle than a strong welcome offer. In that regard, the new offer here is certainly valuable enough, particularly if you prefer points (which can easily be kept alive with activity and which offer greater flexibility than free night certificates).

Should I get the Marriott Business card?

I planned on it to put me over 50 nights and renew platinum status in 2023. Now that my Brilliant comes with platinum, I’d only get the business card for the SNA I’d receive plus signup bonus.

How much value should I put on SNA? Everyone complained about them this year. Will the travel boom continue to make them impossible to use? Should I value them at $0? Since I’m not short on points right now, I’m tempted to hold out and apply in 2023 when I expect Amex/MR will have to offer an even bigger sign-up bonus due to the 2023 points devaluation.

Yeah, don’t assign much value to them. There’s a chance that they’ll work out well, but only a very small chance.

If it doesn’t add free breakfast, it doesn’t add value.

Its definitely nice to have over silver, even if only marginally. Thought it was just a mistake at first

The 7 percent applies to the public standard rate not the member rate, which really means 5 percent. It doesn’t apply to package rates either. And, it certainly doesn’t apply to the cash portion of an award stay. Limited application and limited value but better than a sharp stick in the eye.

Thanks for the heads-up. While I never regretted retaining my Premier Plus Business Credit Card from Chase, now I’m extra glad I did!

Do you have to pay with the card to get the 7%? Or just have the card?

I just checked the fine print. Yes, you must and do so via marriott.com, the Bonvoy app, via Marriott Customer Service or at the hotel.