Melio is a service intended to simplify paying business bills. Melio lets you pay bills with a credit or debit card for a 2.9% fee, or for free with bank-to-bank ACH transfers. Melio users can pay vendors through whichever means they prefer (i.e. ACH for free up to 5 times per month, or credit card with a 2.9% fee).

Melio also has subscription plans for those who are interested. Fortunately, they continue to offer a free plan (Melio Go) with unlimited 2.9% credit card payments. Those who want to add multiple users, or make more than 5 ACH payments per month, or have other advanced needs may want to consider the Melio Core or Melio Boost plans. Plan pricing and details can be found here.

It can make sense to pay the 2.9% fee if you want to increase spend in order to earn a large welcome offer or a big-spend bonus (for example, some credit cards offer free hotel nights or elite status with big spend). Unfortunately, you cannot pay personal bills with Melio.

If you’re interested in trying Melio, you’ll find a welcome offer below for $200.

Why use Melio?

Here are some reasons you may find Melio compelling for paying business bills that can’t usually be paid by credit card:

- Earn credit card rewards. This can be especially compelling when you need to increase spend to earn a large welcome offer or to earn a big-spend bonus (for example, some credit cards offer free hotel nights or elite status with big spend).

- Keep your cash for up to 45 extra days. With a service like Melio, you can pay your vendors immediately, but wait until your credit card statement is due to pay off your credit card bill.

Melio Welcome Bonus: $200

Sign up for Melio with Frequent Miler’s unique link, and then you’ll earn $200 back via bank deposit after your first completed payment of at least $500 using any payment method.

We have an affiliate relationship with Melio in which we’ll earn a commission after you complete the terms for earning your own bonus (as long as you click through our link to sign up). We negotiated a special offer with Melio to increase your welcome bonus (most sites offer a bonus of only $100).

How to earn $200:

- Sign up for Melio here: Frequent Miler’s Melio link.

- Upload a bill or an invoice.

- Make a first completed payment of $500 or more using any payment method

- Ensure you add your routing and bank account details as your receiving method within your Melio account (not just the payment method).

That’s it, Melio should then deposit the $200 cashback to the bank account you provided.

Welcome Offer Terms: For a user to be eligible to receive the one-time $200 cashback, a user must be a new user of Melio who successfully created a Melio account through this page and whose first completed payment is $500 or higher using any payment method offered by Melio. Eligible users will receive the cashback by bank deposit. Melio reserves the right to end the promotion ahead of time or to make changes or additions to this promotion for any reason at any time. Melio reserves the right to withhold the cashback in case of fraud or abuse and subject to its Terms and Conditions. This promotion is not available to accountants’ clients and/or businesses added and/or managed by accounting firms on the Melio platform.

Melio Pricing

Melio charges 2.9% to pay with a credit or debit card. Additionally, Melio charges $1.50 per check after the first 2 free checks each month.

Frequently Asked Questions

Who can use Melio?

Almost any U.S. based business, including sole proprietor businesses, can use Melio to pay business bills.

Businesses cannot use Melio if they are involved with any of the following:

- Gambling and related activity

- Multi-level marketing firms or any agents that represent them

- Sales of tobacco, marijuana, hemp, pharmaceuticals, supplements, nutraceuticals, or paraphernalia.

- Pornography, obscene materials, or any sexual/adult services

- Weapons, ammunition, gunpowder, fireworks, and any other explosives

- Toxic, flammable, or any radioactive material

- Gold, silver, diamonds

- Other goods and services subject to government regulation.

What types of payments are allowed with Melio?

Melio offers the following examples of payments that are allowed:

-

Rent (when your landlord is a business not an individual)

-

Taxes

-

Utilities

-

SaaS & app-based expenses

-

Franchising and operating expenses

-

Legal expenses

-

Accounting & bookkeeping expenses

-

Freelancers/contractors

-

Inventory, raw materials, and supplies

-

Professional services

-

Maintenance services

-

Donations

-

Employee reimbursements

-

Credit card debt (not with a credit card)

-

Loan payments (not with a credit card)

-

Mortgage payments (not with a credit card)

-

Pre-payments (only with ACH bank transfer)

Which credit cards can I pay with?

- American Express: Limited to certain industries

- Visa business cards

- Mastercard

- Discover

What types of payments are allowed with Amex cards?

The use of American Express cards is only supported in the following industries:

- Education

- Government

- Rent

- Utilities

- Membership Clubs

- Professional Services

- Business Services

- Inventory/Wholesale

- Construction/Logistics

Can I make payments with Visa/Mastercard/Amex gift cards?

No. Melio does not allow payments from prepaid cards.

Can I use Melio to pay a 1099 Contractor?

Yes. And your contractor can select how they want to receive payment: check or ACH.

Note that Melio typically asks for one of the following for verification purposes: Trade License / Business Registration, Doing Business As (DBA) Registration, Previous Schedule C filing, Most recent sales tax filing, Business utility bill under sole proprietor or DBA name, Sole proprietor bank statement.

What types of payments are not allowed with Melio?

Melio prohibits all of the following uses:

- Personal payments (i.e. payments for a non-business entity)

- Card network specific restrictions

- Payments from prepaid cards

- Balance transfers (paying a credit card balance with a different credit card)

- Cash advances: payments from a credit card to a business owner; to the business from its owner; to another entity in which the cardholder controls or has interests). This is also extended to household members and relations.

- Payroll transactions (though freelancers and contractors are supported).

- Pharmaceuticals, including for animals

- Flammables

- Explosives

More examples of payments that are not allowed can be found here.

Can I earn multiple welcome bonuses if I have multiple businesses?

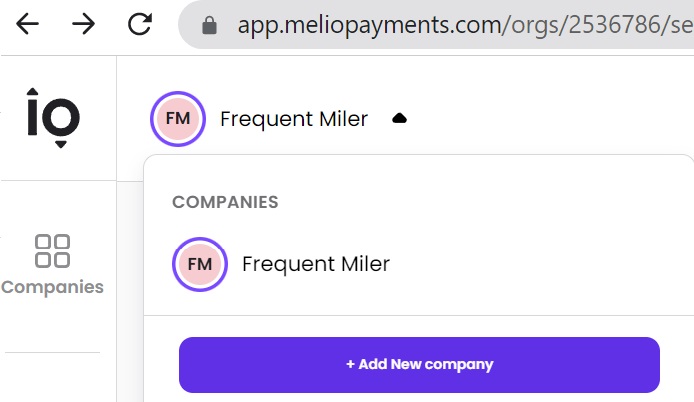

Yes. Plus, a cool thing about Melio is that you can add additional companies from a single log-in. Simply click your company name at the top, left of your browser and you should see an option to “Add New company”.

I signed up with the link but no where do I see I have the bonus. Really don’t like these “trust” bonuses. So I went on to chat with CSRs – – they said they don’t have that information and instead I had to email a specific individual in charges of affiliates. What? So I did and no response yet. Im not sure im ready to trust the bonus at this point. Very non-customer friendly setup thus far and not sure I would use them again unless I had a SUB emergency.

Hello, Do you know what Melio codes as on the Amex side. I can earn 1.5 x points on my bus plat for construction materials but not sure if it will code as what the Invoice is for or something Generic for Melio? Thank you!

To use Mastercard gift cards with Melio, you can set up an Affirm account then get a virtual card from Affirm and use that with Melio. Affirm only accepts MC gift cards and not Visa

Thanks for sharing the option with us, Greg. So, does Melio pay or does not pay the promised bonus? A lot of negative data points below.

Most people get paid the bonus without any problem.

seems there’s a higher bonus if you use the app instead to sign up?

or was that an accidental thing

Where did you find that? There used to be a deal for $250 by signing up through the app, but that’s no longer available.

Ahh I see, i just did a google search and that was the first item that poped up; if it pulls the same results:

https://www.google.com/search?client=firefox-b-1-d&q=Melio++cash+back

I see. I’ll let them know that they need to take down that page ASAP unless they plan to bring back that deal

Last time Melio had $200 offer – I never got it from them despite meeting the qualifications

Be careful

Hi Greg, if you’d prefer not to post my comment publicly, please feel free to respond by email.

Weird. I completed the terms of the promotion and chatted with Melio to confirm. Their response was puzzling, to say the least:

“At this time, we do not have a way to track the status of the payout. However, please reach out to https://frequentmiler.com/melio-pay-business-bills-by-credit-card/ and they will be able to share an update. I hope this informaiton is helpful and I apologize for this inconvenience and delay here.”

So, Greg, I guess they want me to check with you? Do you have any update on their situation?

Wow, that’s wacky. If you email me the email address that you used with Melio, I can see whether it tracked that you signed up through my link. And I can see if you were paid. That’s the extent of the info I have.

Thanks Greg, I really appreciate that. I’ll email mailbag@Greg The Frequent Miler.net. And for what it’s worth, my user experience at Melio (aside from the bonus) has been really good. I’ve shifted about 75% of my business payments over to their ACH service, and plan to stick with it.

[…] Read the full article… […]

I had a terrible experience with Melio. For a while I was paying my car lease payments with it and went through fine. A few months later they blocked it since they say you cannot pay off a loan with a credit card. Fine. What they didn’t say was you had to proactively cancel the payments. Since they never said that and I had scheduled automatic monthly payments, the system kept charging and blocked it every month. After a month or so Melio sent a very nasty email accusing me of repeatedly committing a fraudulent activity and shut my account down. I emailed them twice that since the payments were blocked, I just assumed there were no transactions made and never thought i had to cancel all the payments proactively, which they failed to mention if they deem the payments didn’t comply. They still wouldn’t reinstste my account. On Plastiq if the payments are not supported they’ll simply block it and won’t penalize you. Melio’s rude service and lack of good customer support made me go back to using Plastiq. I have a legitimate business and to be accused of fraud by Melio and their lack of communication put a bad taste in my mouth. I’m back with Plastiq which charges the same 2.9% fee and also accepts Amex with much better customer support.

I had used Melio for years. Only the absolute best to say about them. Super, super customer service. Willing to listen to recommended feature changes.

I just did this last week and used the link. Today, I got an email from the “manager” at Melio confirming I’ve met the requirements and that I used the Frequent Miler link and all he needs to finalize the payout is my bank’s routing number and account and a confirmation that my email is correct. That doesn’t seem right, as they already have that information on my account. I don’t feel comfortable sending him my bank info, but I will confirm my email.

It’s what they always ask for, because you can have the bonus deposited anywhere (personal checking, etc). It’s the same info on every random check you’ve ever written anyone.

Ah ok, that’s good to know. The way it was worded seemed like it was possibly a scam. thank you for confirming.

Opened a 2nd Melio account with my other business using EIN, paid a bill, got my $250 iPhone bonus – all automatic, all in a few weeks start to finish. Went faster than my previous $200 Melio bonus. So I recommend doing this if you have an actual business and actual business expenses to pay – they do pay.

Another person who has yet to be paid despite meeting the requirements for the $200 sign up bonus in April. I’ve chatted with their online support twice who said that it would be fixed and was just told that I need to email partners@melio.com

Same here!

I accidentally signed up before clicking the link. Am I able to open a new account for the same business using a different email address? (EIN the same of course)