Capital One Shopping is once again offering $66 cashback when taking out a 5 year AARP membership. That’s a great deal seeing as that membership is available for only $45, plus it can be stacked with $8 back from an AARP Chase Offer. Both these offers are targeted, but it hopefully won’t be hard to get targeted for the $66 cashback at least.

The Deal

- Get $66 cashback from Capital One Shopping when buying a 5 year AARP membership.

Key Terms

- Expiry date unknown.

Quick Thoughts

AARP memberships are cheap and you can be any age to subscribe – you don’t have to be 55+. It comes with all kinds of benefits including 10% off British Airways flights, discounts of up to 30% on gift cards, discounts at large restaurant chains, savings on gas, discounts at Walgreens (which presumably stacks with the new Bilt partnership) and lots more. Check out this post for a list of benefits you might not have known about.

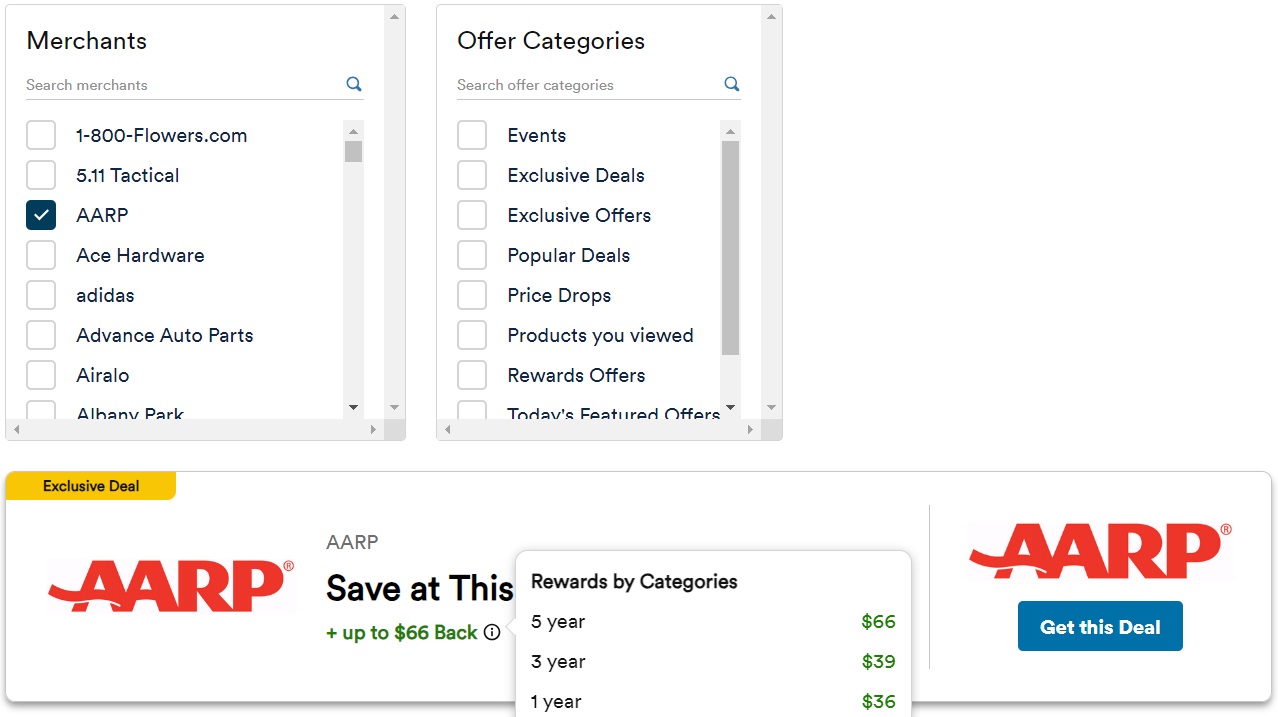

To see if you’re targeted for the $66 cashback on a 5 year membership, go to Capital One Shopping on desktop and click the ‘Filters’ button. That’ll display a couple of boxes where you can filter for Merchants and Offer Categories. In the Merchants box, select AARP if it’s there and scroll down the page. Hovering over the exclamation mark displays the cashback available depending on your subscription period:

A five year membership subscription costs $45, so the cashback from Capital One Shopping would make you an easy a $21 profit.

If that increased cashback rate doesn’t show for you, try clicking through to AARP with the Capital One Shopping browser extension installed and give it a day or two. Capital One Shopping frequently offers targeted increased cashback offers, so there’s a good chance you’ll see the $66 rate in a few days (but no guarantee).

Be sure to also check your Chase Offers because there’s often an AARP membership offer giving an $8 statement credit. There was one showing as expiring yesterday or today, so hopefully that gets renewed and more people get targeted.

Can anyone confirm whether it works on renewals?

My C1 offer was for $104 (!?!)

DP for $103.50 via targeted C1 email.

The 5-year membership is $63 now. Is it common for the price dropped back to $45?

Was only seeing $22 so clicked through and closed the page. A couple of hours later got targeted for the $66. Signed up, but it isn’t showing up as pending in my portal. Any DPs on the timeline here or if I’m out of luck? I almost never use C1 portal because I find their tracking sucks and I hate the gift card cashout requirement. Would literally prefer a cashout option at 80%.

Update: It is now pending. Took around 20 hours.

My capital one shopping portal doesn’t even have AARP listed.

There’s a way to make more cashback with AARP, using a different path. Right now extrabux is giving only $10 back, but for a long time it was $15. It will probably return to $15 at some point. Then you can get a 1-year membership for $12 and get back $15 + $8 from Chase. Rinse and repeat. You can only prepay your membership for about 2 years, but over 5 years I expect to get more cashback than with the 5-year deal.

Will it work on a renewal?

You don’t need to use a Capital One card to trigger the cashback through the Capital One Shopping portal? You can use a Chase card and still get Capital One Shopping cashback?

Yes – Capital One Shopping is just a regular shopping portal and so you can use it even if you don’t have any Capital One cards.

I had a $26.50 discount in the Cap One app. Extension was $22.00. Since my $8.00 Chase offer expires today, I took advantage of the stack. $45.00 – $26.50 – $8.00 = $10.50 for five years.

I had AARP for a year and never used a single discount, although admittedly I wasn’t in the market for British Airways flights. Just be aware that they might be the single most obnoxious organization on the planet, and they will fill you mailbox with an endless stream of junk mail. Unfortunately even if you cancel they continue to send junk on a regular basis. I cancelled a few years ago and I still get stuff from them regularly.

AAA I’m pretty sure is sending me stuff like 2-3 times a month still.

Oop, I just joined AAA. I hope I don’t regret it.

At the worst AARP was sending me something probably 2-3 each week. It was just ridiculous.

Agree. AARP is a scam preying on the elderly.

Not too happy with Cap1 Shopping, either, though – the alleged $200 referral at the end of last year was never honored for me, my partner, or our kid.

For what it’s worth I’ve found AAA discounts to be more prevalent, AARP was more hit or miss such that I didn’t renew it. Almost everywhere offering an AARP discount also gave the same or better rates for AAA but the reverse was not true. Marriott for example has a Senior Discount that is age based but nothing for AARP, while they do offer AAA rates.

AAA has helped with a couple pretty sizable paid hotel stay discounts at Hyatt and Marriott (Hilton AAA offers usually just match typical HHonors Member rates). Scored something close to 25% off at Grand Hyatt Seattle last year for one of their large corner rooms which was like a suite (long hallway with no door) without having to pay suite pricing – great for traveling with a kid. With Marriott the AAA Hot Deals are usually 15%+ and they sometimes offer special inclusions like free parking. It can sometimes be a way to get cancellable bookings when normal rates have a longer 14 or 30 day prior to travel cancellation window.

I always take “discounts” with a grain of salt, as they are commonly the same prices you can find in a dozen places. My cap one shopping only shows $24 so I showed some interest in it, and I’ll see if I get targeted. I rarely use the capital one portal though and can’t remember the last time I did.

Only $24 on mine too