NOTICE: This post references card features that have changed, expired, or are not currently available

Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

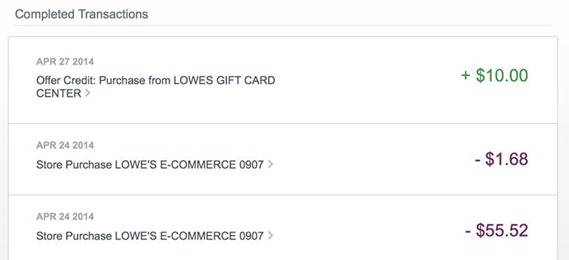

American Express Sync offers can be a fantastic way to save a lot of money. The exact offers available change regularly, but there is often a gem or two that can be used to save money almost anywhere. For a few recent examples, please see “20% off Lowe’s, Zappos, Crate & Barrel, and more” and “Amex Sync Offer: $20 off $100 at Staples!”

Let’s take the current Lowe’s offer, for example. Once you signup your Amex card for the offer (which can be done by syncing your card to Twitter and then tweeting: #AmexLowes), you’ll get $10 back automatically when you spend $50 or more at Lowes. And, Lowes sells many types of gift cards in-store (see “Gift cards at Lowes”). With most Sync offers, including this one, you can only get the cash back once per card. So, the trick to maximizing savings is to sign up many Amex cards. For tips on how to sign up a number of Amex cards at once, please see:

How to get a lot of Amex cards

Sign up for credit cards

One obvious way to get a lot of Amex cards is to sign up for a lot of cards. There are, of course, limits to how many Amex will let you open though. In fact, Amex limits most people to 4 total credit cards where they are the primary account holder (charge cards and prepaid cards are not counted towards that limit). And, since many cards have annual fees, this is probably not the best way to scale up for Sync offers.

Add authorized users

For each credit card or charge card account you have, you can add authorized users, often for free. In most cases you will have to provide a valid SSN for that user. Those extra cards can be used for Amex Sync offers.

Sign up for Serve

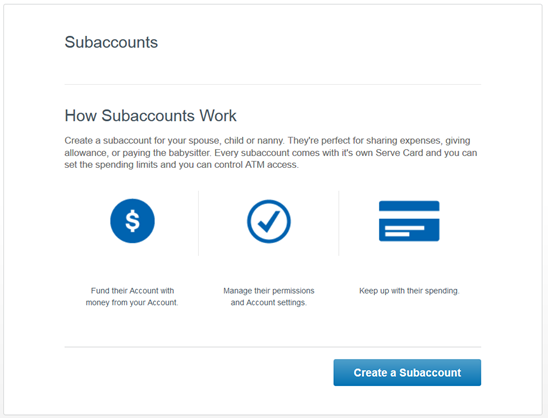

Serve is a prepaid card very similar to Bluebird (and you can only have one or the other). One big difference between the cards is that Serve cards are eligible for Amex Sync offers. Bluebird cards are not. Each person can have only one Serve card, but each Serve account can also have up to 4 subaccounts…

Serve Subaccounts

A reader named Haley Bach sent me a message last month regarding Serve: “…my guess is subaccounts can add sync deals.” She offered to give it a try and sure enough she was able to register for the Lowes promotion with a subaccount and she received the cash back after fulfilling the terms of the deal!

Not only did Haley prove that subaccounts work, but she found that Amex officially supports it. Here is a quote from this online document:

Can my Subaccounts participate in American Express Offers?

Your Subaccount(s) are eligible to participate in the program. They can connect their American Express Serve Card with their Facebook, Twitter, or Foursquare accounts.

Creating Subaccounts

Creating Serve subaccounts is very easy. While it requires a unique email address and valid phone number, it does not require a social security number.

Getting the most out of Sync offers

The first step towards getting a lot out of Sync offers is to get a lot of Amex cards as outline above. For the rest of the story, please review these posts:

- Maximizing Amex Sync offers. Part 1: sync multiple cards

- Maximizing Amex Sync offers. Part 2: extreme savings

- Maximizing Amex Sync offers. Part 3: shopping elsewhere

- Maximizing Amex Sync offers. Part 4: forget shopping, get points and cash for free

- Create an Amex Sync Machine

- SyncAssist: Making AmEx Sync easy

![[EXPIRED] Serve One VIP to be discontinued Switch REDbird to Serve](https://frequentmiler.com/wp-content/uploads/2015/09/SwithRedbirdToServe.png)

My question: cab a sub account add their own money to the card they get? …walk into a CVS and add 30 bucks to their card. Or does the money always have to come from the main account holder?

The money always has to load first to the primary account holder.

Anybody know if Serve account limits (deposit withdraw etc) apply to subaccounts separately from the parent account? Or is the parent account limit enforced on subaccounts

Yes, I expect that withdrawals are limited by the parent account. I haven’t tried though.

[…] and all Amex Serve cards. This includes authorized user cards and Serve Subaccounts (see: More free cash from Amex via Serve subaccounts). For details showing how to sync multiple cards, please read: Maximizing Amex Sync offers. […]

[…] that Serve subaccounts are a great way to sign up additional cards with Amex Sync Offers (see “More free cash from Amex via Serve subaccounts”). While the Small Business Saturday terms and conditions are quiet about subaccounts, I would […]

[…] Unlike other prepaid cards, Serve users can actually enroll in Amex Sync Offers. To learn more about Sync offers and to maximize your Serve capabilities, read this post. […]

Warning – I would tread very carefully here. For anybody who does not receive automatic credit they are going to have a nightmare getting credit as serve customer service is based in phillipines and those people dont have a clue about amex offers. First you will wait 20 min to connect to a rep then another half an hour to connect to a supervisor and still get nowhere except a ticket which nobody will respond

Anybody have any easier way to deal with serve ?

Any idea what the ATM limits are for Serve subaccounts? having 4 cards means you can withdraw all the monthly $2000 in one day? or perhaps now you can get $8000?

I don’t know, but I’m not sure why that would be helpful. You can simply transfer money directly from Serve to your bank account instead.

For all those who did offers via Amex on their serve cards (primary +subaccounts) did you get the amex credit immediately in few days like the amex credit cards

I have been waiting for few weeks and no credit although i did everything right and also got confirmation emails of doing the offer and getting credit

Need to know the experience out there

#amexlows 1 account took 4-5 days the other account next day primary accounts not subaccounts

One more reason to close Bluebird and shift to Serve…….

“Those extra cards can be used for Amex Sync offers.” is a perfectly VALID statement.

It’s possible that the most offers appear under the primary account holders card when you go to the online statement page of your account. So,

1) you have to register all primary and secondary cards on your online amex account(s).

2) you then have to take out either a Facebook a/c or a Twitter a/c for each of your cards and then “force” the application of the Amex Sync offer to each outstanding card.

I have 5 Amex card accounts and a total of 12 cards under my and family members names. I’m enjoying 12x the recent staples and Lowes syn offers. Last Xmas was a bonanza!

“Those extra cards can be used for Amex Sync offers.”

This is not the case for me this year. They only give the cashback for account holder only. One AE account only can have one promotion cashback.

Make sure to sync both cards to separate Twitter accounts and enroll both cards separately with each offer.

I have Serve; my wife has Bluebird. Can I add my wife as a sub-account holder, or will her Bluebird prohibit that?

Yes, that should be fine

Up until last week I had a Bluebird and my Spouse had a Serve account with me as one of the sub accounts. No problem at all with that set up, and also no problem when I switched myself over to Serve. I had other problems (30 day wait) but was able to get CSR to push it through, ymmv on that one.

All subaccounts can use the same phone number and I’m 99% sure I used the same email address for two of them.

I wasn’t able to add myself to my wife’s sub-account by using the same phone number that’s associated with my personal Serve account.

Used one wrong digit on the phone number, but not sure what to expect when I receive the card (if they verify by phone or what, I don’t know).

just a data point.

Yesterday I was able to load $1000 in Bluebird at Walmart money center using visa gift card bought from Simon mall.

Hi,

Does anyone knows what this means?

This week I’ve been getting a “debit transaction not authorized” with code = 75 when I use visa gift cards to load my bluebird. I tried over a few days with different amounts and even changed my PIN to see if it was that.

I’ve never had issues in the past with the cards. I did call in to Visa gift card and they said it was rejected because I was “trying to use an atm.”

I’m wondering if this is a sign of things to come or was it a one time fluke? In the meantime, I’m going to try another Wal-Mart and see if that works.

It may be a sign of things to come. Yesterday when I tried to load the 2nd $500 onto my Serve at a WM Money Center, the cashier wanted to see if I was using a vanilla card. I actually had a OneVanilla debit card. Regardless, the cashier said “I know what you’re trying to do, and we’re no longer allowed to do such transactions”.

I had to go to one of the checkout cashiers and finished with no further issues, but it sure was a nuisance.

If Amex Sync works with the Amex Serve card, has anyone tried Amex Sync with Amex Bluebird, Amex Target and Amex Prepaid cards?

@Ken I tried amex target got a massage this account is not eligible for amex sync

The only prepaid card that works with these offers and with small business saturday is Serve